DeFi ecosystem offers users bank like options including lending and borrowing platforms, payment platforms, derivatives platforms among several others. While most of the DeFi applications are built on the Ethereum blockchain, Ethereum seems to be making headway in the same.

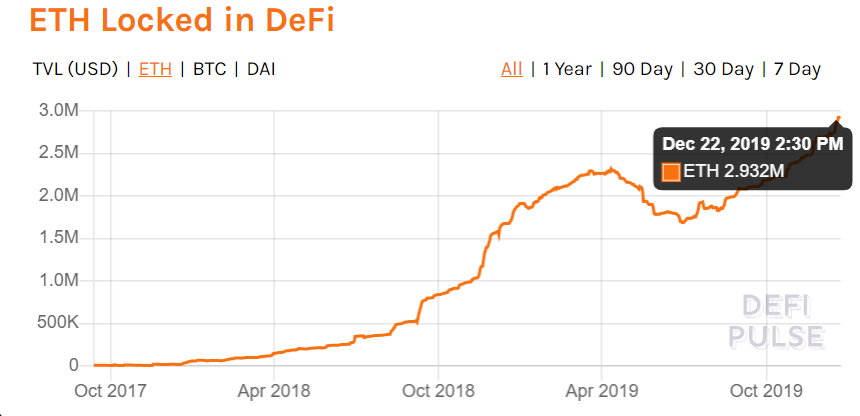

Ethereum not only seems to be taking a lead with regard to the applications in the DeFi ecosystem but also in terms of the value locked in DeFi as the charts on DeFi Pulse reflect the same. As per the latest data, the total ETH locked in DeFi hit an all-time high with 2.932 million.

Source – DeFi Pulse

After witnessing a steep fall from April 2019 to the beginning of July 2019, ETH locked in DeFi has evidently gone uphill and has been encountering new ATHs almost every other day. Out of the 2.9 million ETH locked in DeFi, Maker accounts for 49.82 percent of the ETH, more specifically, Maker alone has locked 2.3 million ETH. This is followed by another prominent lending platform Compound which has about 357.3 K ETH locked in DeFi.

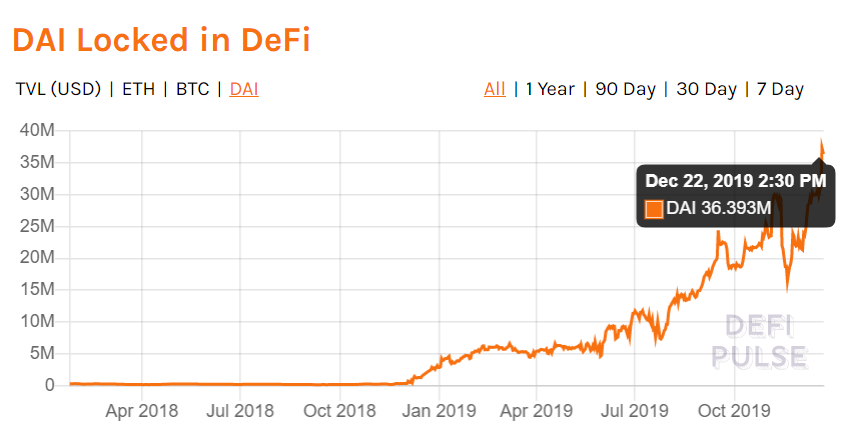

While there is comparatively scarcer BTC locked in DeFi, Maker’s stablecoin DAI locked in DeFi hit an ATH just yesterday. The total DAI locked in DeFi went up to a high of 37.355 million, however, in just a day’s time, it fell down to 36.393 million.

Source – DeFi Pulse

Again, Maker was seen dominating the space as it locked 25.1 million while Compound locked about 6.6 million followed by another lending platform dYdX locking 1.7 million.

The post appeared first on AMBCrypto