It is a great time to speculate prices in the digital asset industry with the apparent presence of bulls in the market.

January 2020 catalyzed the dormant markets, and the curiosity of various analysts was piqued, on whether the current momentum would persevere over the next few weeks.

Ethereum’s valuation surged past $160 mark on 14th January. The 2nd largest asset has been able to consolidate over the past 8 days, marking a positive period for the asset. The bullish sentiment has been acknowledged by popular traders as well.

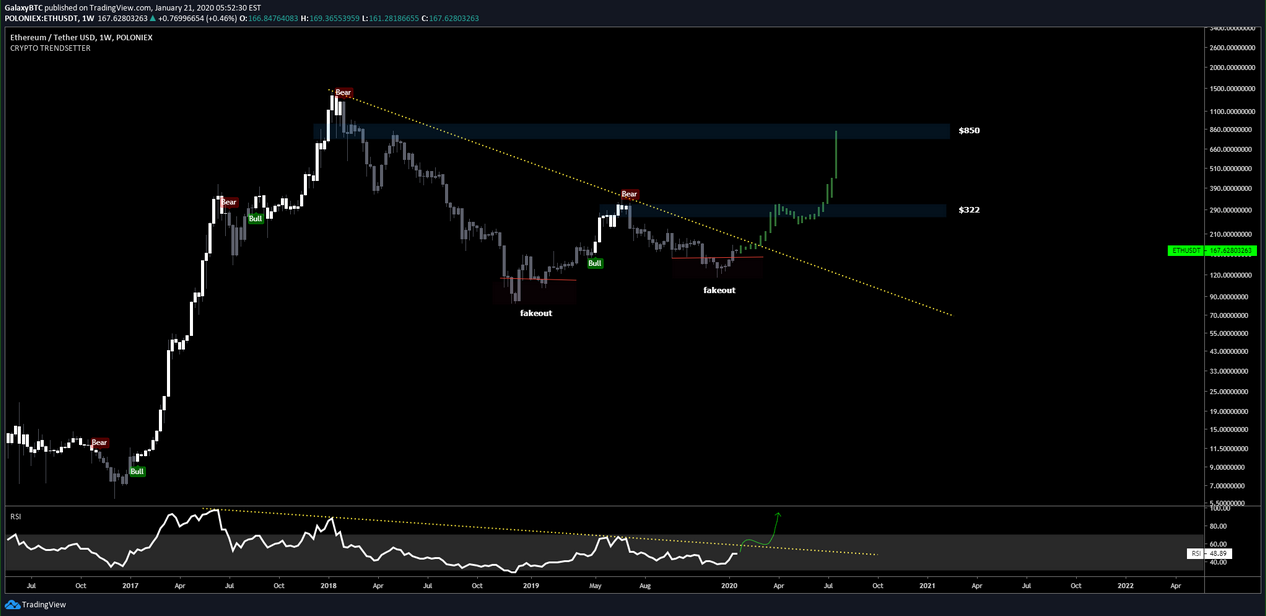

GalaxyBTC, a popular analyst, recently spoke about the parabolic trend followed by Bitcoin and he suggested that Ethereum could follow the same path as well.

Source: Twitter

The trader suggested that Ethereum is weeks away from breaching a long-term downtrend that may have bullish implications on its price. The trader indicated that if the trend is overturned, Ethereum may attain a $200 valuation by the end of February and if it continues to march above, there is a possibility of reaching $850 by August or September.

A similar trajectory was projected by SatoshiFlipper as well. The altcoin trader believed that Ethereum would mirror a similar hike of 2019 and the price would reach $335 by the summer.

The above analysis is constructive but a lot would depend on Bitcoin’s performance as well. Ethereum and Bitcoin have shown a strong correlation index since 2018, which is not likely to change in the current market.

Ethereum’s consolidation can prove imperative

ETH/USD on Trading View

Ethereum’s hike on 14th January recorded an 18.88 percent rise, which was followed by a consolidation period of 8 days. Last year, a similar spike of 21 percent was seen on 18th February, following which the market consolidated again.

Since the market is usually susceptible to an earlier trend path, the price-performance of ETH from hereon can most probably undergo another spike due to the healthy consolidation at the moment.

The post appeared first on AMBCrypto