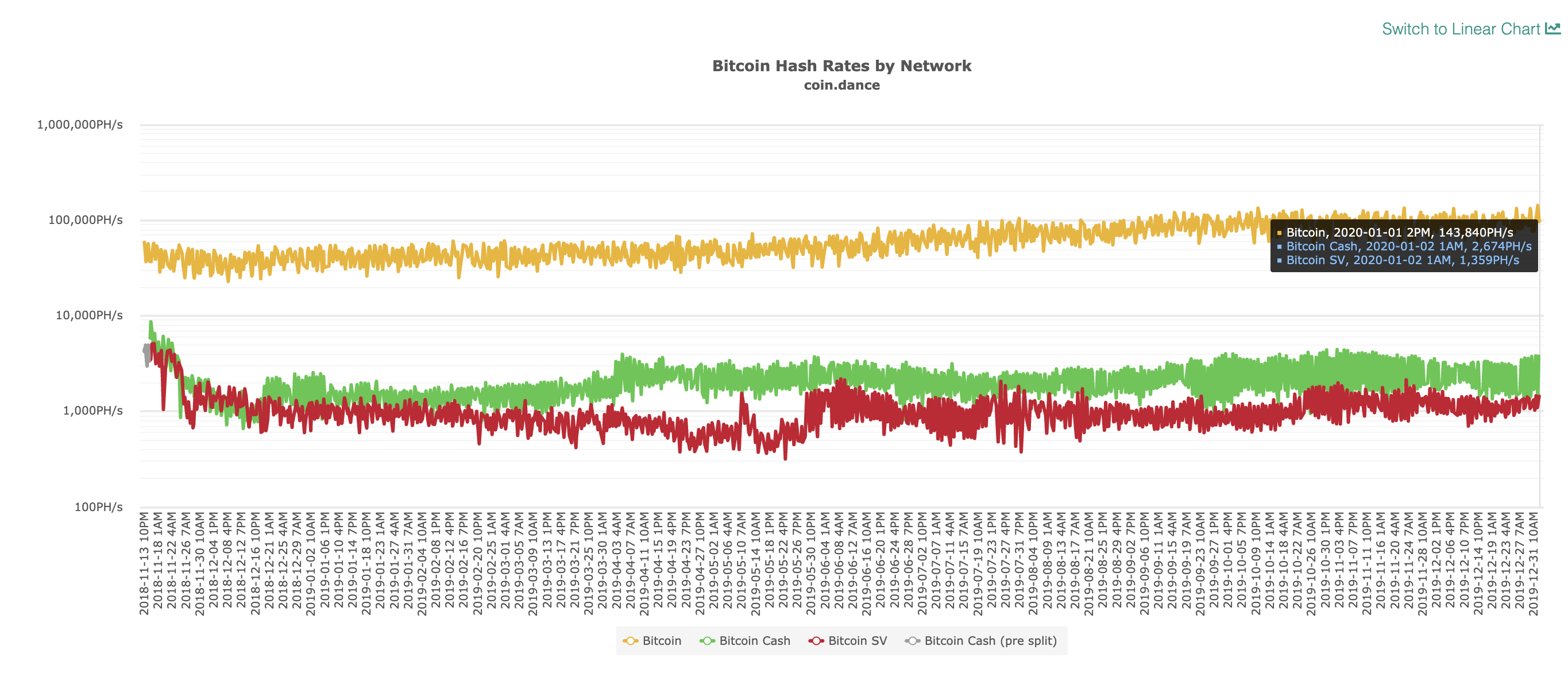

The Bitcoin ledger is completing a decade on the 3rd and while it is only 2 days into 2020, the ledger is already setting new records. Bitcoin’s hashrate breached its previous high and was recorded to be 119 million TH/s, according to the data monitoring site, Blockchain. Bitcoin’s hashrate has been spiking over the past few months and according to a recent report by Coin Metrics, its hashrate has grown by 130% in 2019. On the other hand, its fork, Bitcoin Cash, reported a hash rate of 3.5 million TH/s, while BSV recorded 11.3 million TH/s.

Source: Coin Dance

A similar pattern of rising hash rate was observed when Litecoin [LTC] was approaching halving. However, it fell right after.

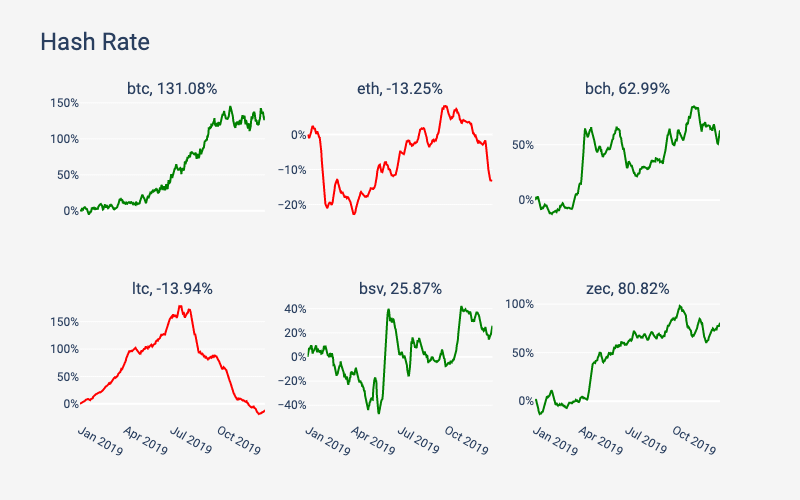

Source: Coin Metrics

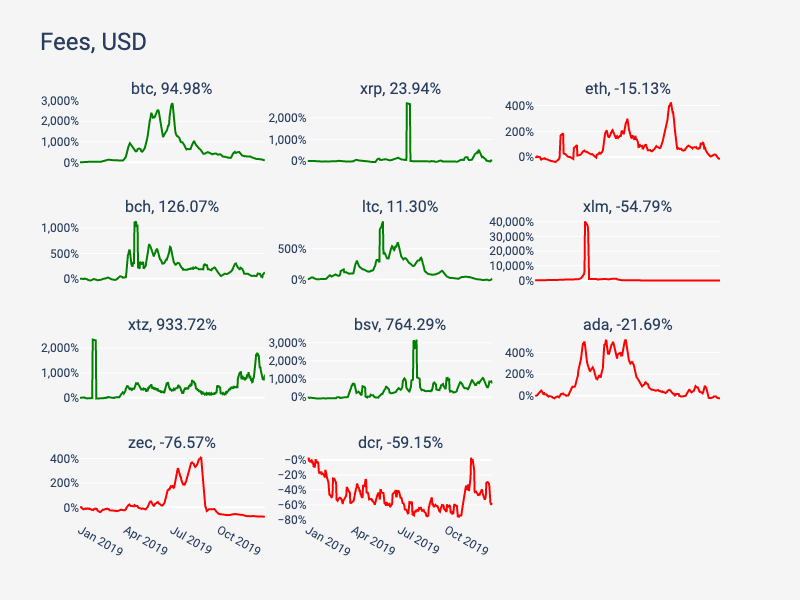

The report compared the daily fees of major coins and noted that Bitcoin and Ethereum had a lead over all other crypto-assets in terms of daily fees. The annual average of BTC was $427k, while Etheruem’s was $95k. None of the other crypto-assets had more than $1,200 in daily total fees on average over the year.

Source: Coin Metrics

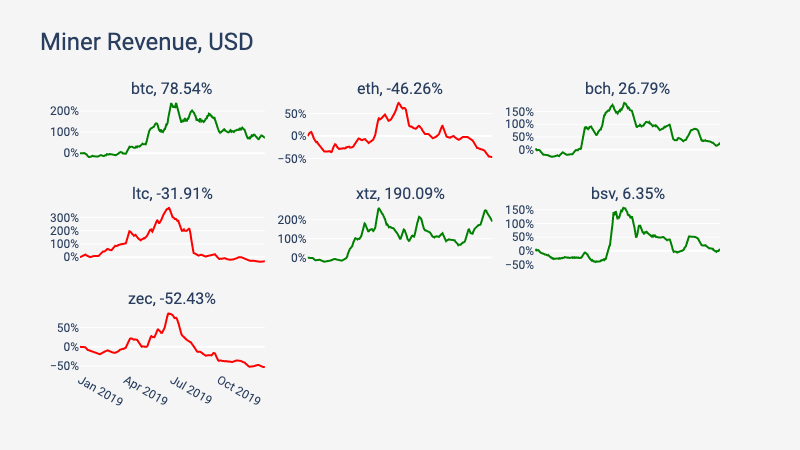

Miner Revenue

Miner revenue represents the incentives pool for miners of a blockchain and the higher the revenue, the more money miners can potentially earn. Thus, miner revenue has played an important role in determining the overall health and security of a protocol. BTC alone generated $14.2 million in revenue per day for miners, whereas Ethereum generated $2.6 million on an average, according to the report by Coin Metrics. Apart from the top 2 cryptocurrencies, no other crypto-asset managed to generate more than $900k per day on an average.

Source: Coin Metrics

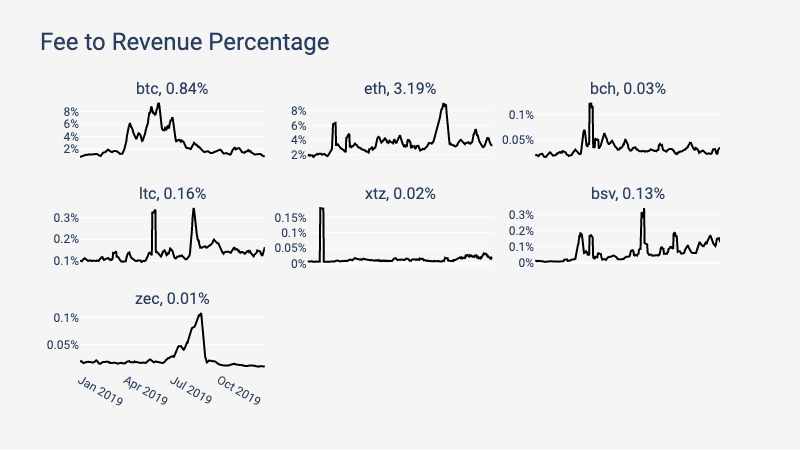

The block rewards will fall towards zero due to the scheduled block reward halvings, a development that will lead to the fees becoming a larger percentage of overall mining revenue. Despite a meaningful amount of fees, ETH raced ahead of Bitcoin in terms of the proportion of miner revenue earned by fees as it ended 2019 at 3.2%, as opposed to 0.8% for BTC.

Source: Coin Metrics

The post appeared first on AMBCrypto