Ethereum has been the leader of the market’s altcoins for a long time now, with the cryptocurrency marking out its own route for the season with its own rallies. However, while it did follow a similar trend as Bitcoin, it also managed to report greater growth, with traders supporting its high price on the charts. Alas, off-late, ETH has been noting a degree of selling pressure in the market while a huge Options contract expiry is scheduled to take place on 28 August.

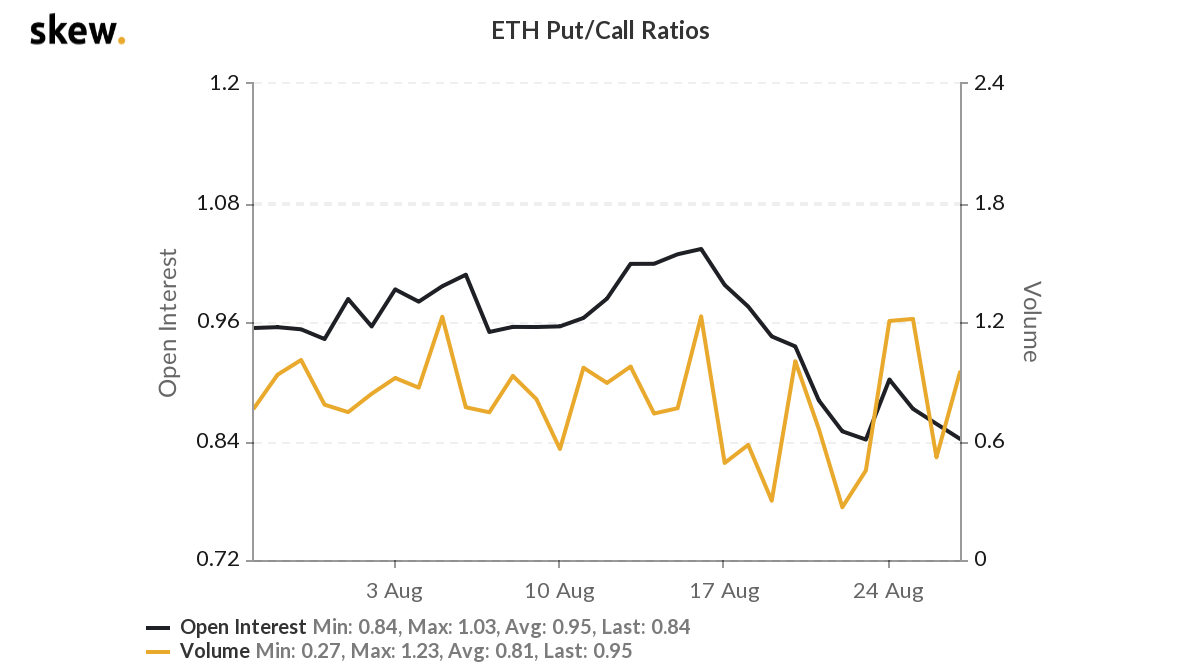

According to the press time outlook of the Ethereum Options market, traders were buying more puts than calls. This was highlighted by the high Put/Call ratio which, at the same time, was touching 0.84. The same was a sign of rising bearish pressure in the market, with many investors speculating that the market may move lower or hedge, in case of a sell-off.

Source: Skew

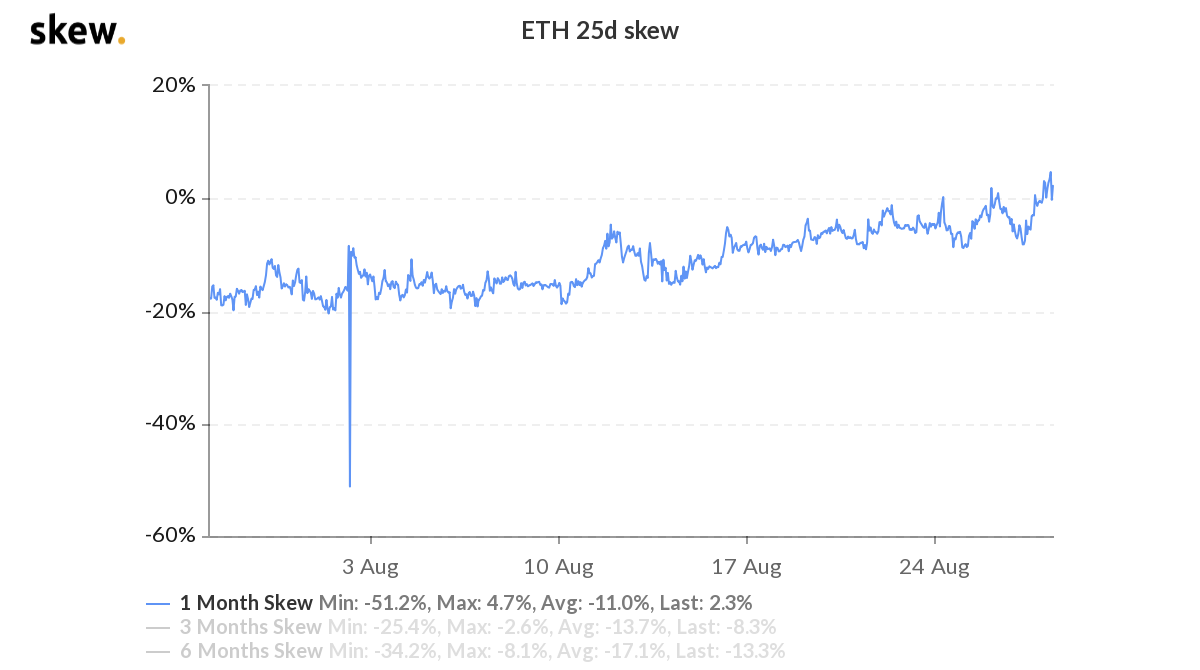

In fact, Ethereum’s 25d skew was also painting a bearish picture. The skew indicator moves towards the negative zone when call [neutral/bullish] options are more costly than equivalent puts. It generally oscillates between -20% and +20%, reflecting the current market, regardless of the previous day’s activity.

Source: Skew

A negative value on the metric implied that the cost of protection for bullish movements was costlier than for downside price swings. However, the attached chart underlined the price of puts rising, relative to calls. Put together, it can be argued that traders in the market are getting cautious by the day.

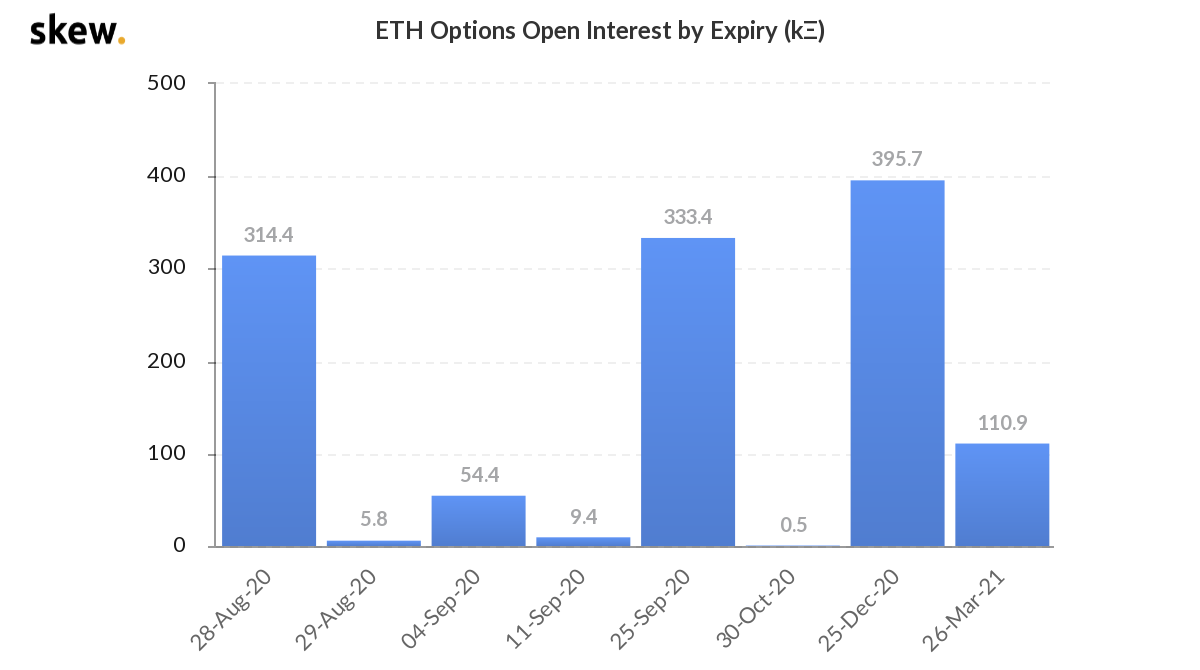

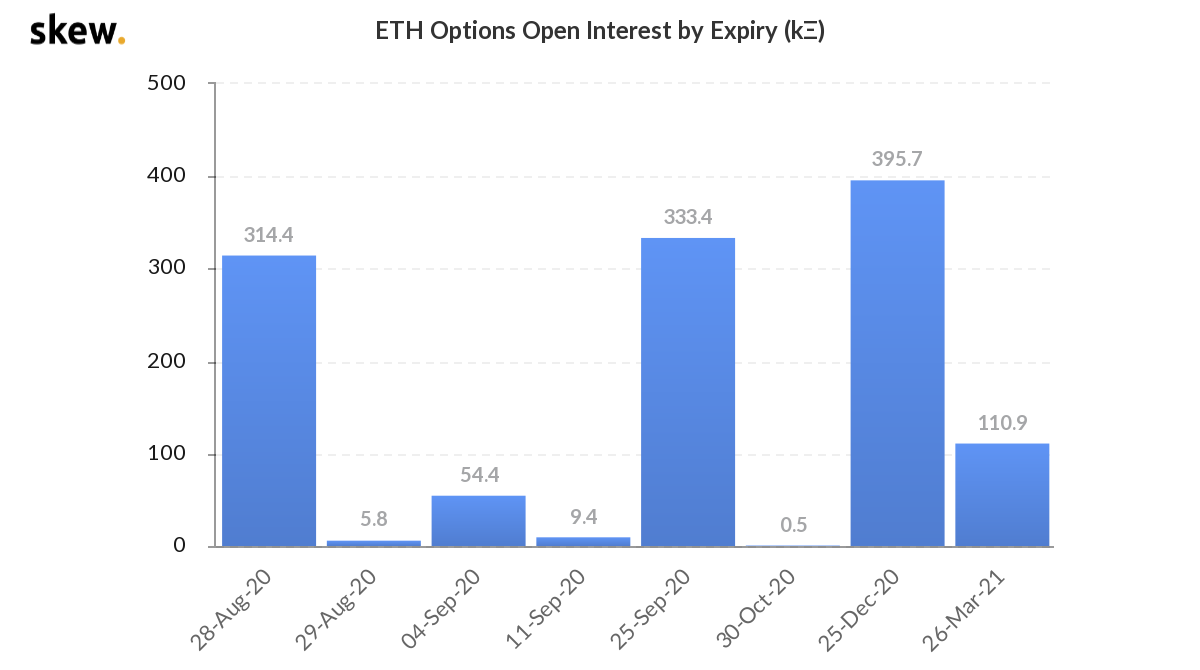

This caution could be due to the huge expiry of 314.4k ETH Options Open Interest on 28 August.

Source: Skew

The expiration of these ETH Options contracts could pivot the market in any direction.

At the time of writing, there were 104.8k ETH Options with a $400 strike, although this included all calendar expiries until March 2021. The latest expiry will act as a good indicator for traders to gauge the true sentiment in the market. Till then, caution is key.

The post appeared first on AMBCrypto