With the spooky month coming to an ending, the spookiest thing you can expect is Ethereum outperforming bitcoin. Well, Ethereum outperforming bitcoin isn’t spooky per se, but there are other aspects to this that suggest otherwise.

Outperformance here is comprised of solid price data and then the sentiment around each coin.

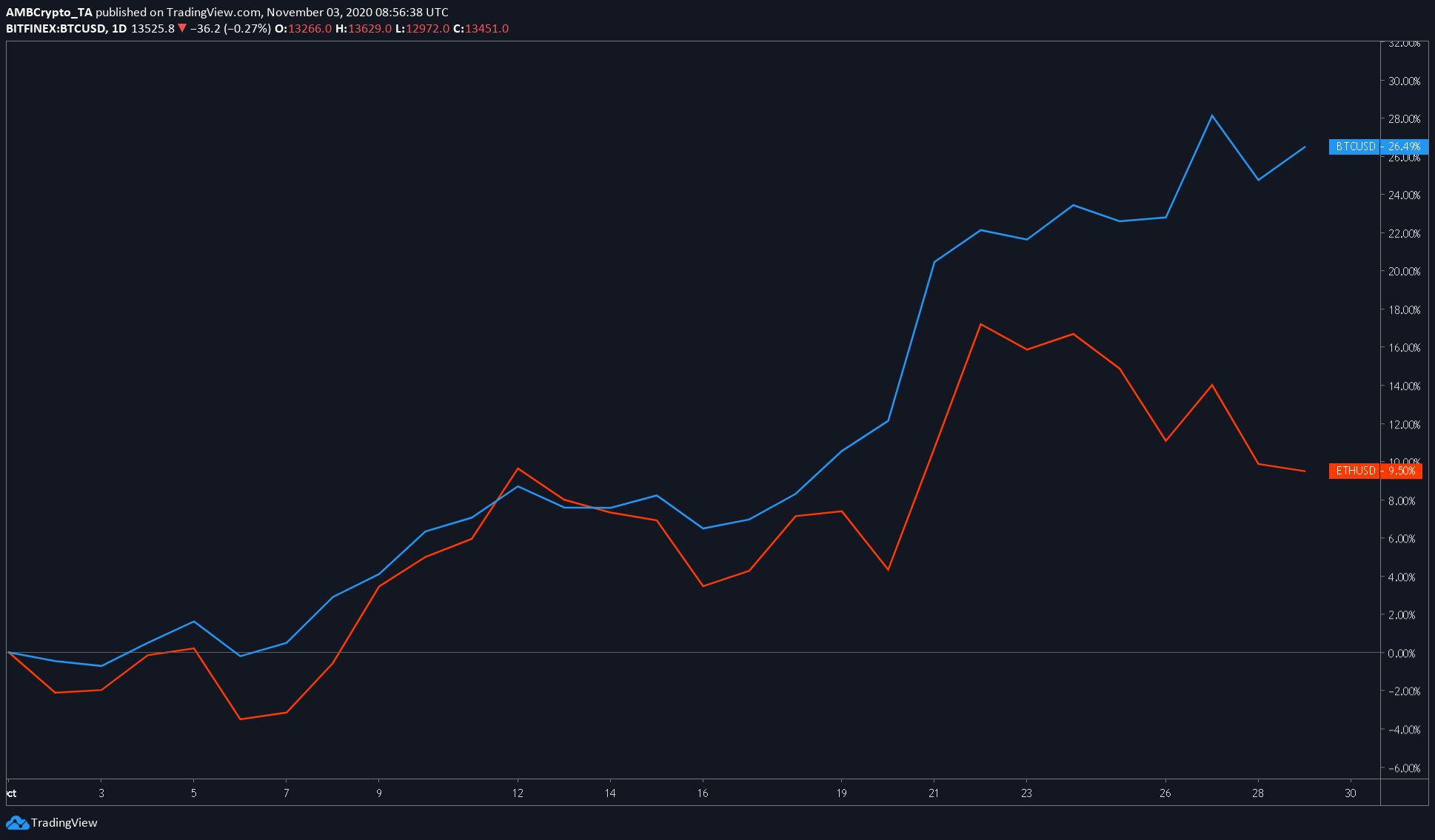

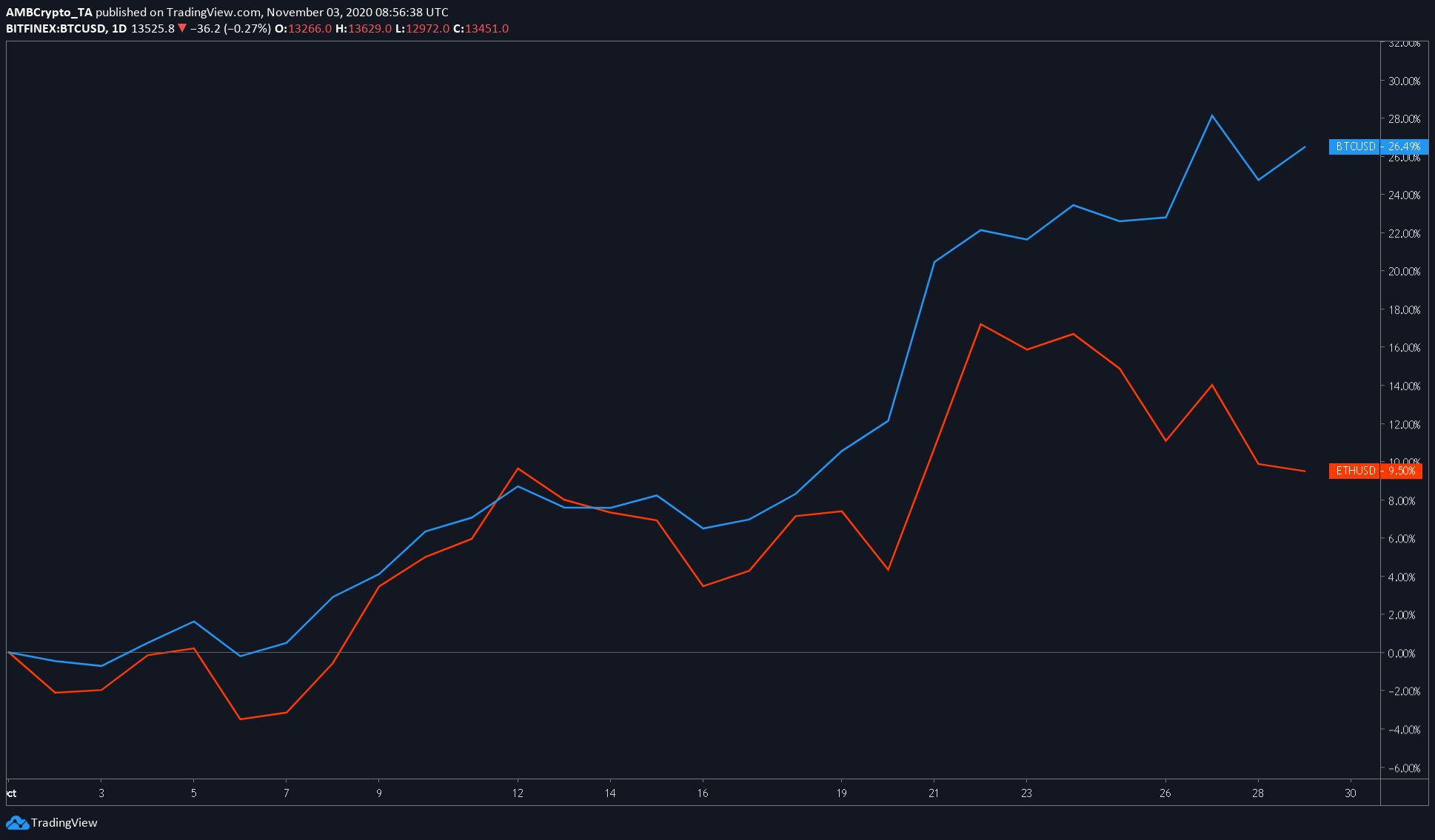

Bitcoin v. Ethereum Price

Source: TradingView

The daily price chart for October shows the performance of BTC and ETH. Clearly, BTC’s return is one-third of ETH over the last month. In and of itself, this isn’t surprising, shocking, or spooky. However, despite the DeFi bear market, Ethereum has managed to outperform bitcoin. But this is only applicable in the domain of price; sentiment is a whole other thing.

Other Aspects

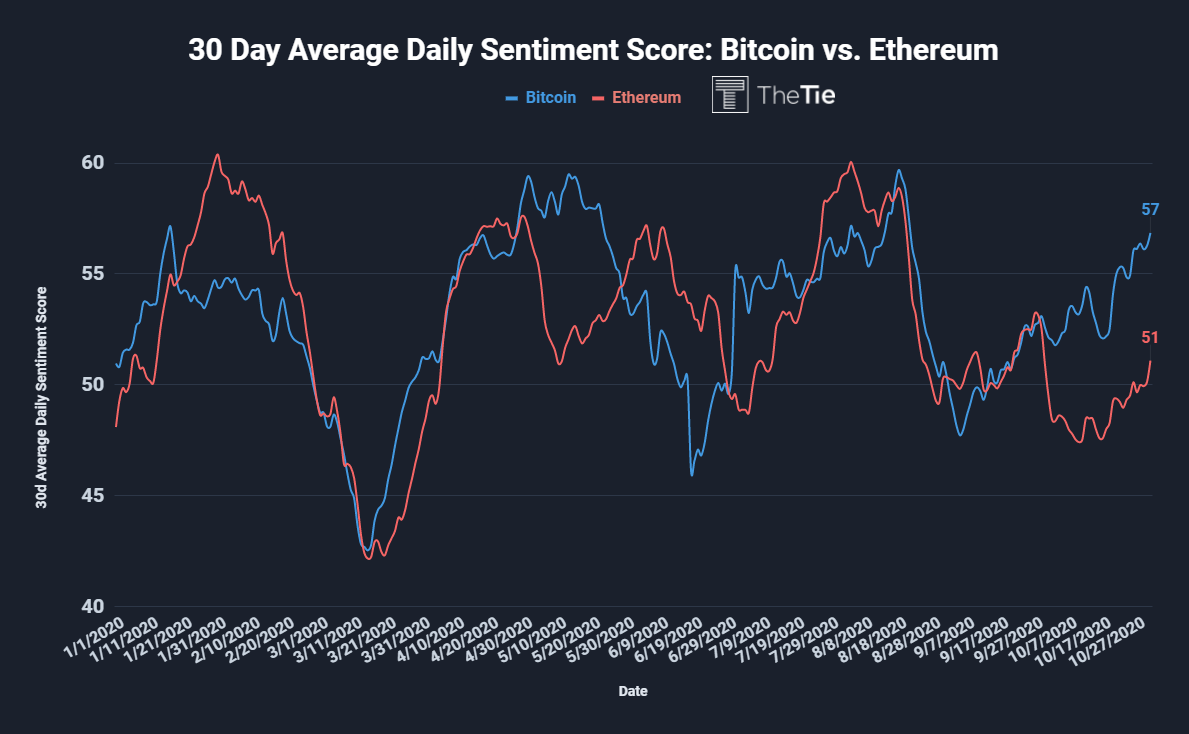

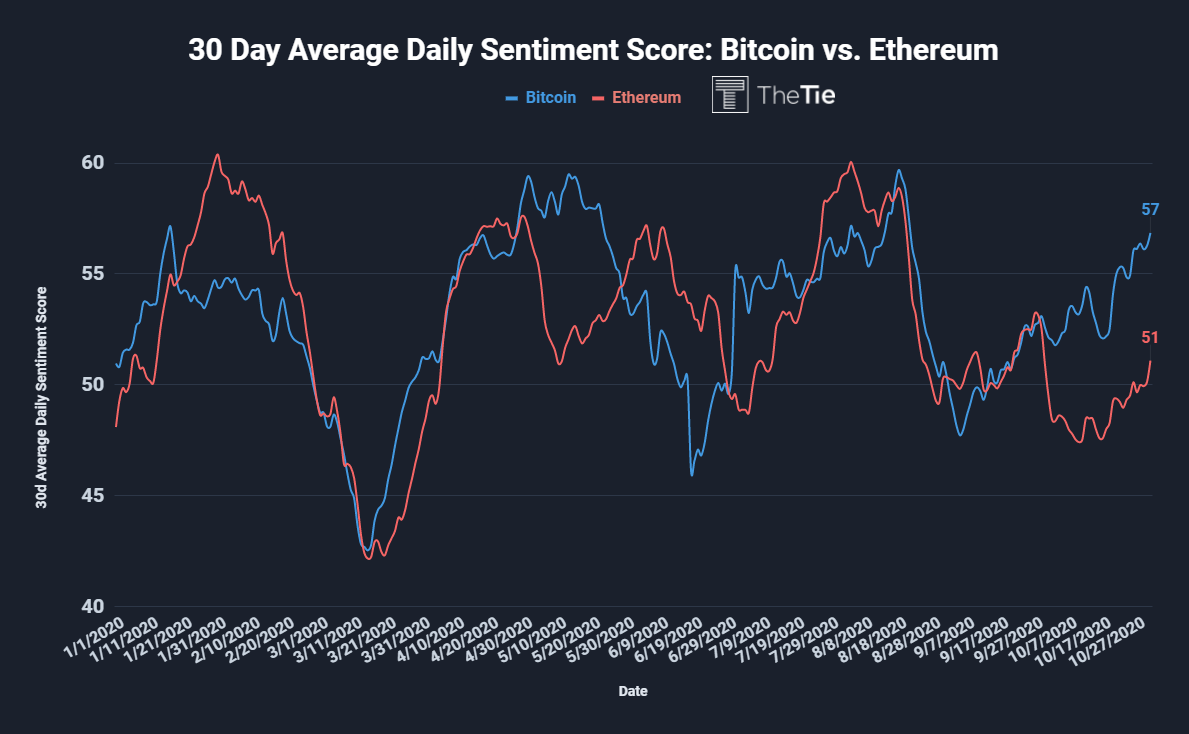

Average Sentiment Score

Source: The Tie

The 30-day average sentiment score showed bitcoin taking a lead with 57 points while ETH slacked off with 51 points.

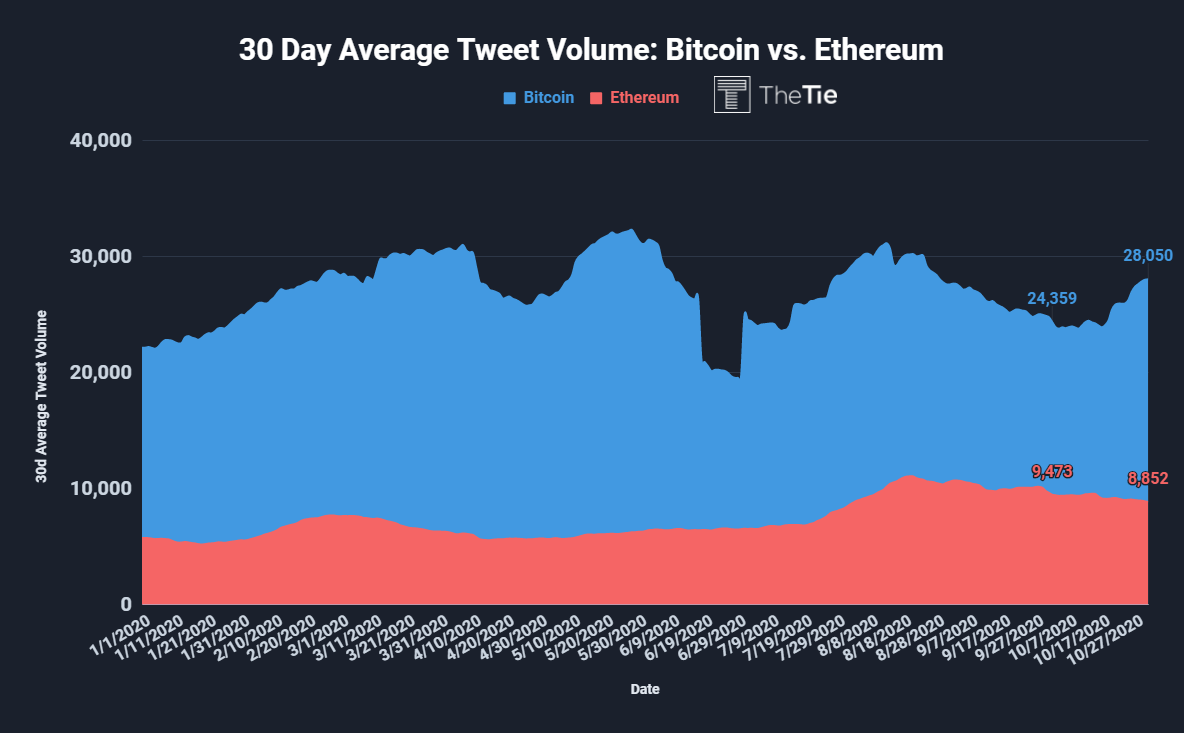

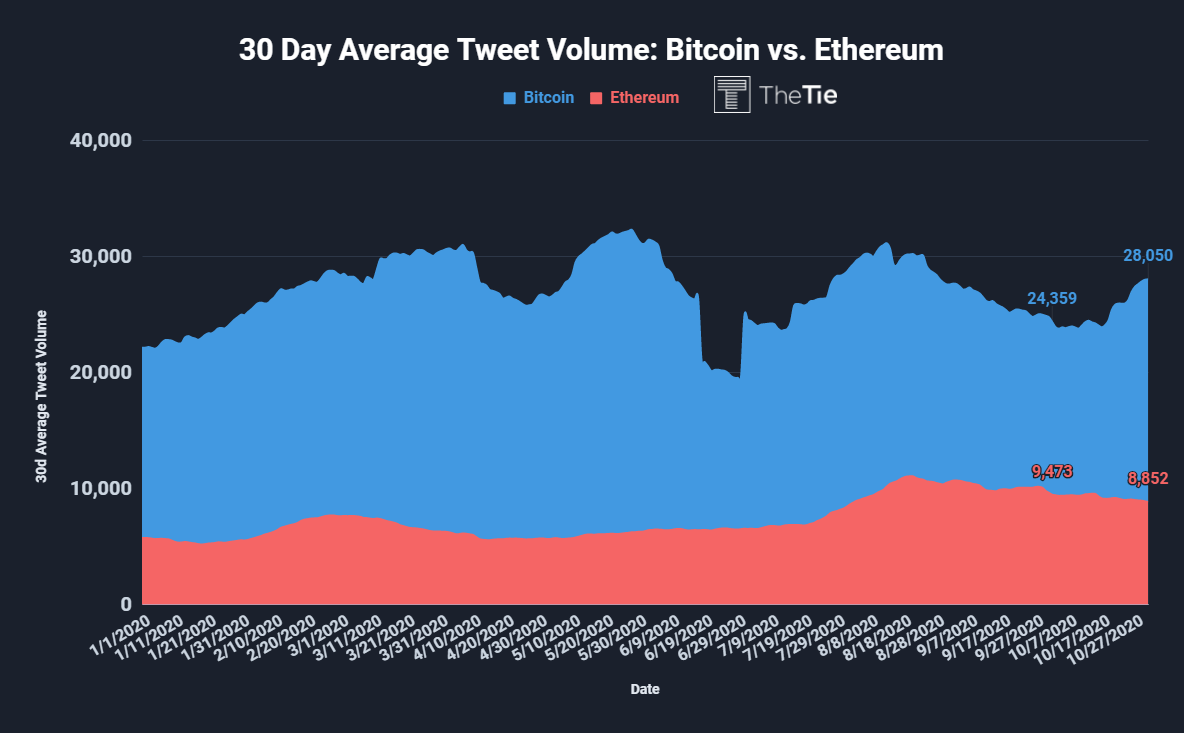

Tweet Volume

Source: The Tie

Tweet volume was another area where bitcoin dominated. This isn’t surprising considering the MS, CA, PayPal, etc news that has hit the market. Moreover, Ethereum’s tweet volume decrease can also be due to the defi bear market.

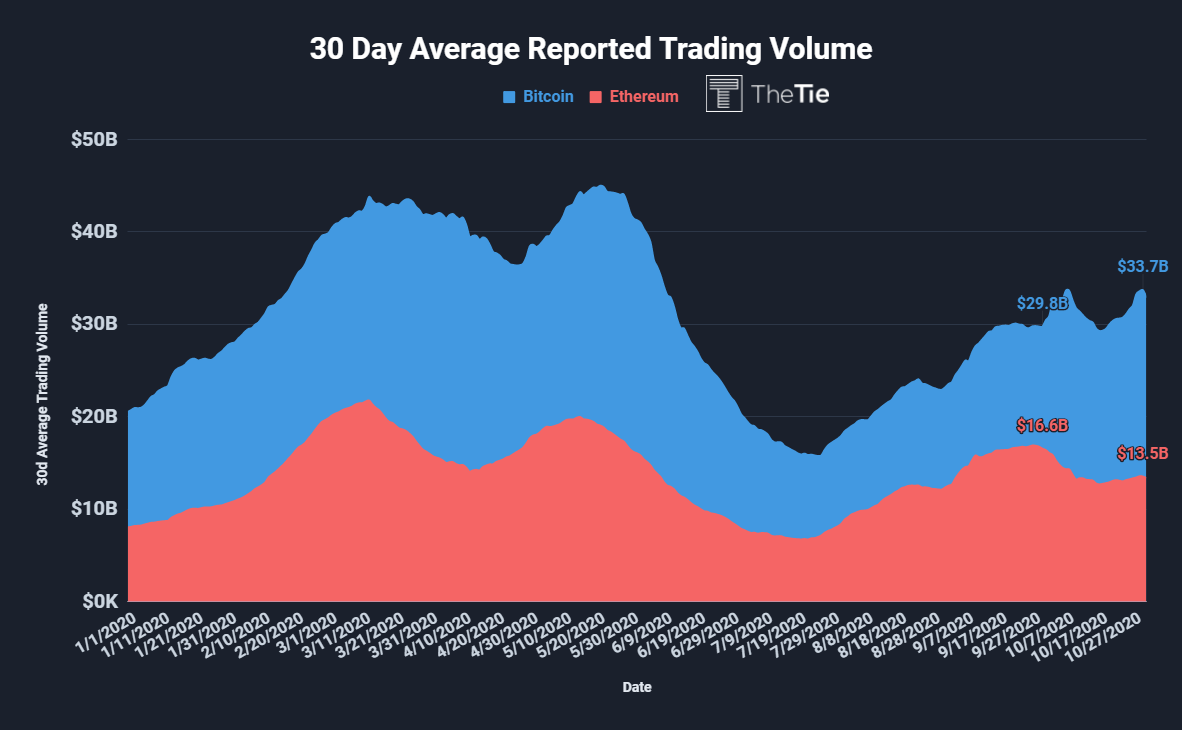

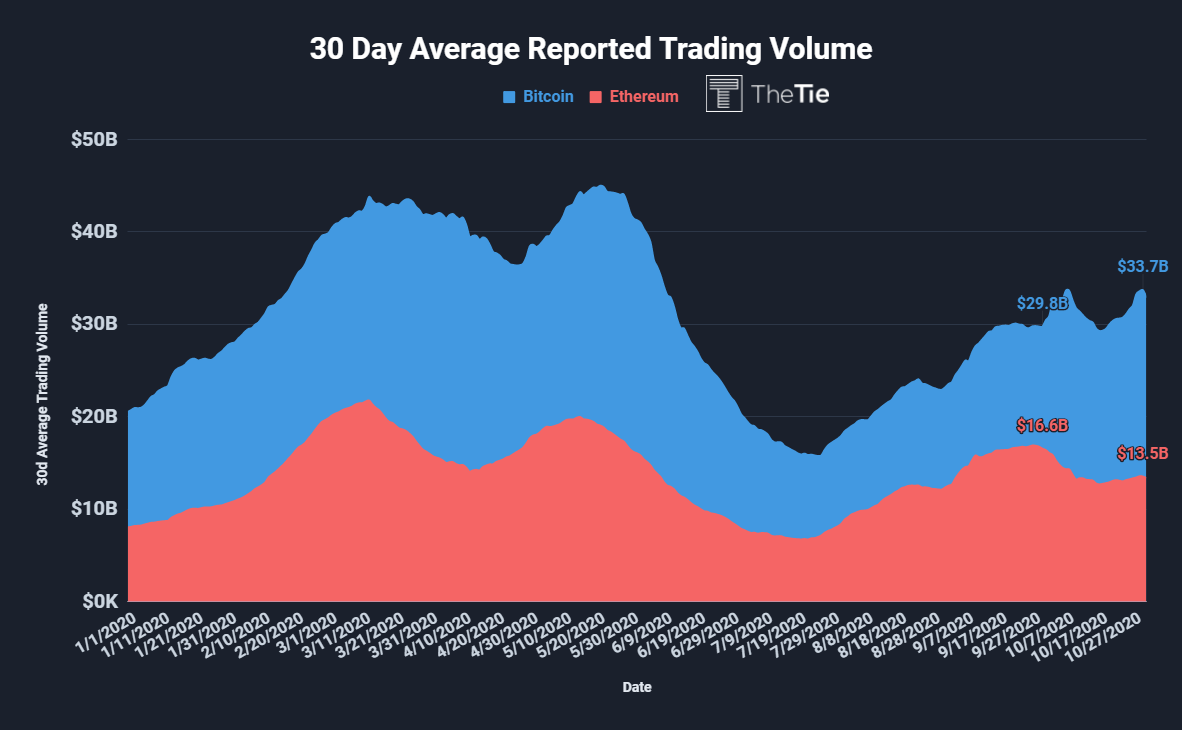

Trading Volume

Source: The Tie

The trading volume of bitcoin was almost 2.5 times that of Ethereum, which clearly showed who is the king of cryptos. Perhaps the end of defi hype could be substituted with the ETH 2.0 conversations which might arise in the coming weeks.

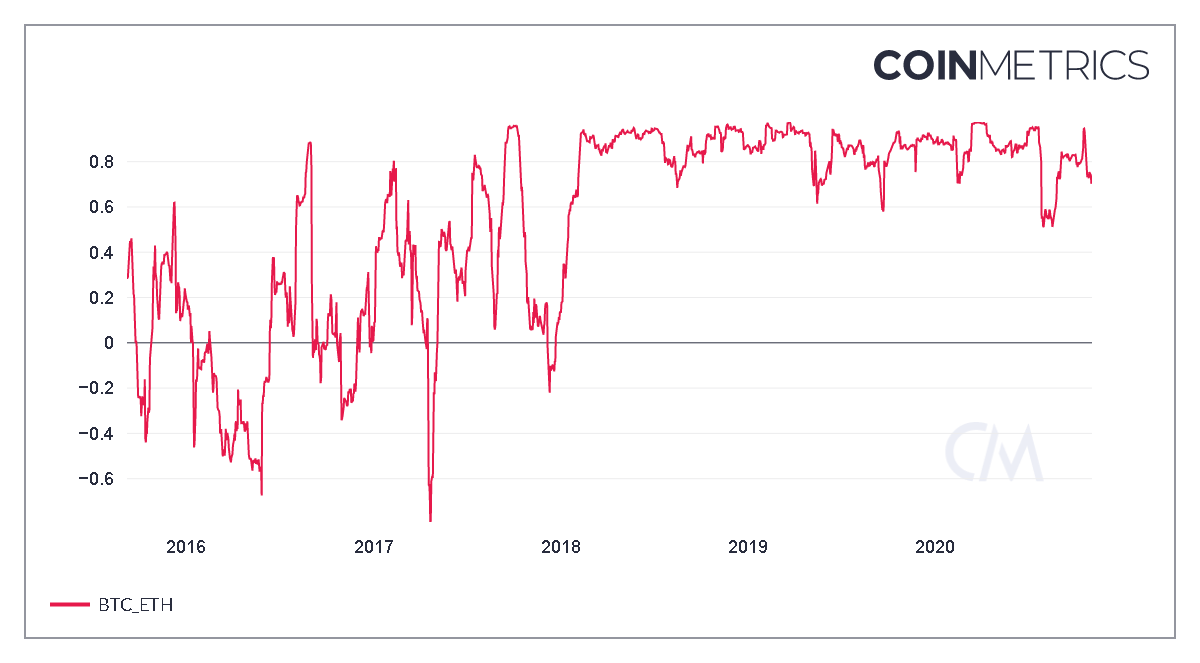

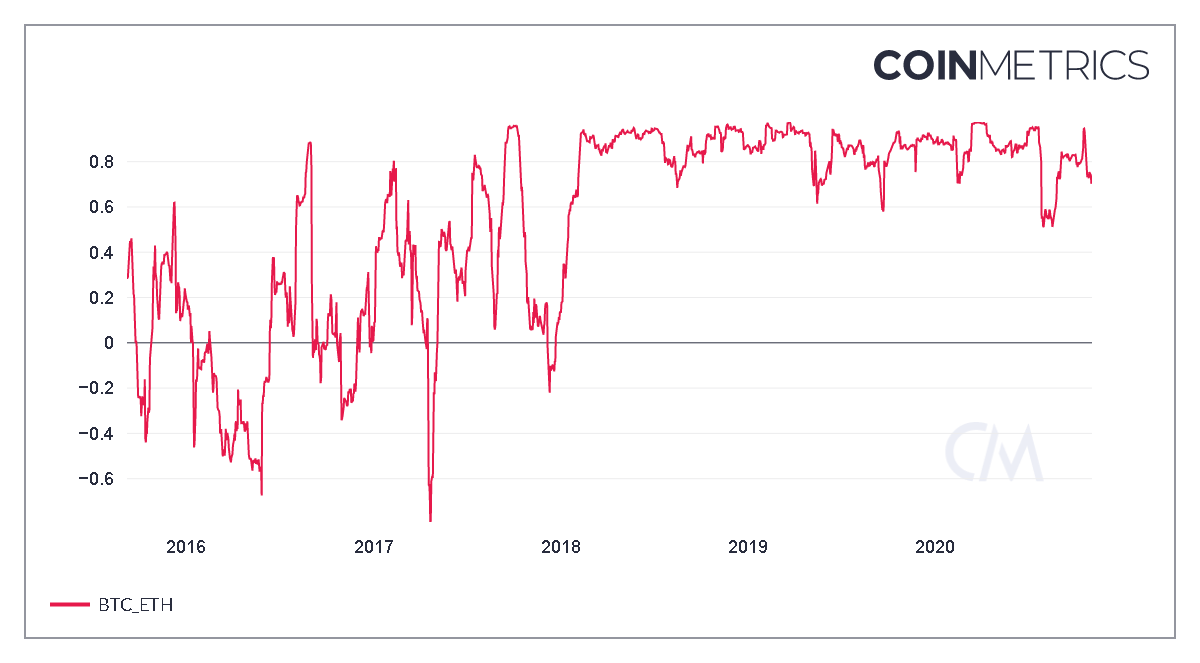

Source: coinmetrics

For now, both ETH and BTC look fragile, especially since the latter hit $14,000 and is showing signs of exhaustion. Hence, should bitcoin drop or consolidate, we might see altcoin king or other alts to rally as well. This can be explained by the drop in the 30-day rolling correlation between BTC and ETH.

It will be interesting to see how things will evolve after ETH 2.0.

The post appeared first on AMBCrypto