- No sign of bearish sentiment for Ethereum as the ETH price continues to surge.

- Ethereum rose to $226 after gaining 25% in a week against the US Dollar.

- If ETH faces rejection at the current traded level, the market may correct to near support, which will be healthy.

ETH/USD: Ethereum Hits $226, But Targeting 6-Month High

Key Resistance Levels: $238, $279, $300

Key Support Levels: $200, $180, $160

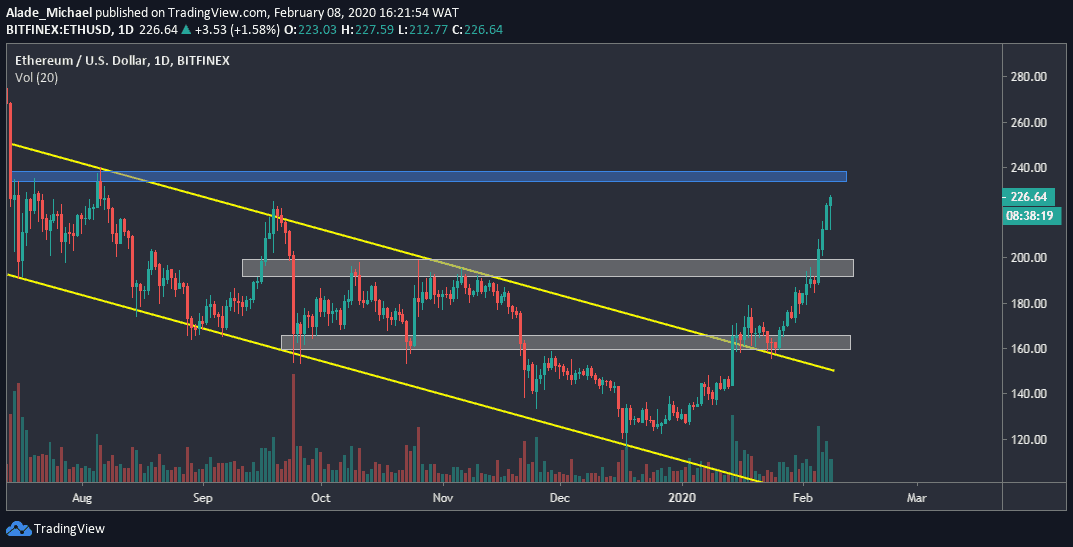

Since our previous analysis, Ethereum’s price has advanced higher and has continued to surge towards a key resistance area at $238. After initiating February at the price of $180, Ethereum has shown a lot of strength following a massive 25% growth in just eight days.

This impressive performance has made the second-largest cryptocurrency to reach a price of $226. Ethereum is up by 1.5% over the last 24-hours of trading. Looking at the daily price actions, the buyers are still eyeing the blue marked resistance zone, although we may soon see a rejection once the target is met (if met). As of now, Ether is strongly bullish on the daily chart.

Ethereum-USD Price Prediction

Since Ethereun bounced back from $156 on January 24, the price has consistently advanced higher; breaking through the $200 benchmark and now almost reaching the August 2019 high of $238, which is a five-month high. A break above this resistance could propel long-term buy to $300 in no time, but there’s a tough resistance at $279.

If Ethereum pulls back, the imminent support is supposed to be at $200 (resistance turned support), right in the grey demand area. A drive beneath this area could send ETH to the next support at $180, followed by $160 – which is located in the grey area.

We can see that ETH volume was quite significant since the price broke out of the five-month descending channel. More should be expected as long as the bullish bias remains dominant.

ETH/BTC: Etherum Continues To Soar Against Bitcoin

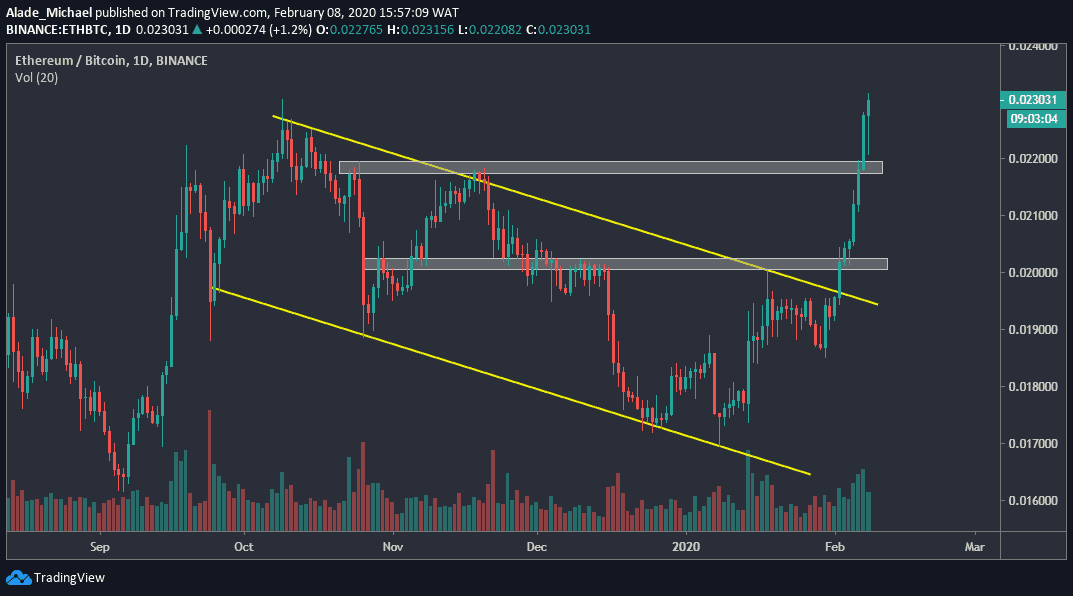

Well, there’s no doubt most pairs are now correlating in terms of patterns and trends. Against Bitcoin, Ethereum has decided to follow the same bullish scenario with its counterpart. As a result of this, ETH reached the price zone of 0.023 SAT level with 1% gains over the last 24-hours.

At the time of writing this analysis, the market is correcting as Bitcoin making its paves towards the $10,000 mark. Meanwhile, the February 2 bullish flag breakout (at 0.0195 SAT level) has brought a 30% price move for Etheruem. As it appeared now, the buyers are still aiming higher.

Ethereum-Bitcoin Price Prediction

Ethereum is currently trading at a key resistance area of 0.025 – 0.023 SAT level after surging consistently for a week. This bullish rally was pinned at 0.017 SAT support level, followed by 0.0185 SAT level before Ethereum broke out from the 4-month descending channel earlier this month.

If ETH continues to surge, the next resistance to watch is 0.024 SAT and 0.025 SAT levels. Meanwhile, the market is relying on a grey support area of 0.022 SAT over the last 24-hours. If Ethereum’s price gets rejected at the current trading level, we may see a retest at the immediate grey support area.

A drop below this area could allow further correction at 0.020 SAT level, where the second grey support area lies on the daily chart. For now, there’s no sign of bearishness as bullish sentiment remains strong. We can expect that when the buyers run out of momentum in the market.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato