Ethereum has been pretty stable over this past week increasing by a total of 1%, bringing its current price to $187.57. It found support at a long term rising trend line and has remained above here since mid-August. If the bulls can hold this support, we may see a rebound.

Ethereum remains the second-largest cryptocurrency with a market cap of $20.17 billion.

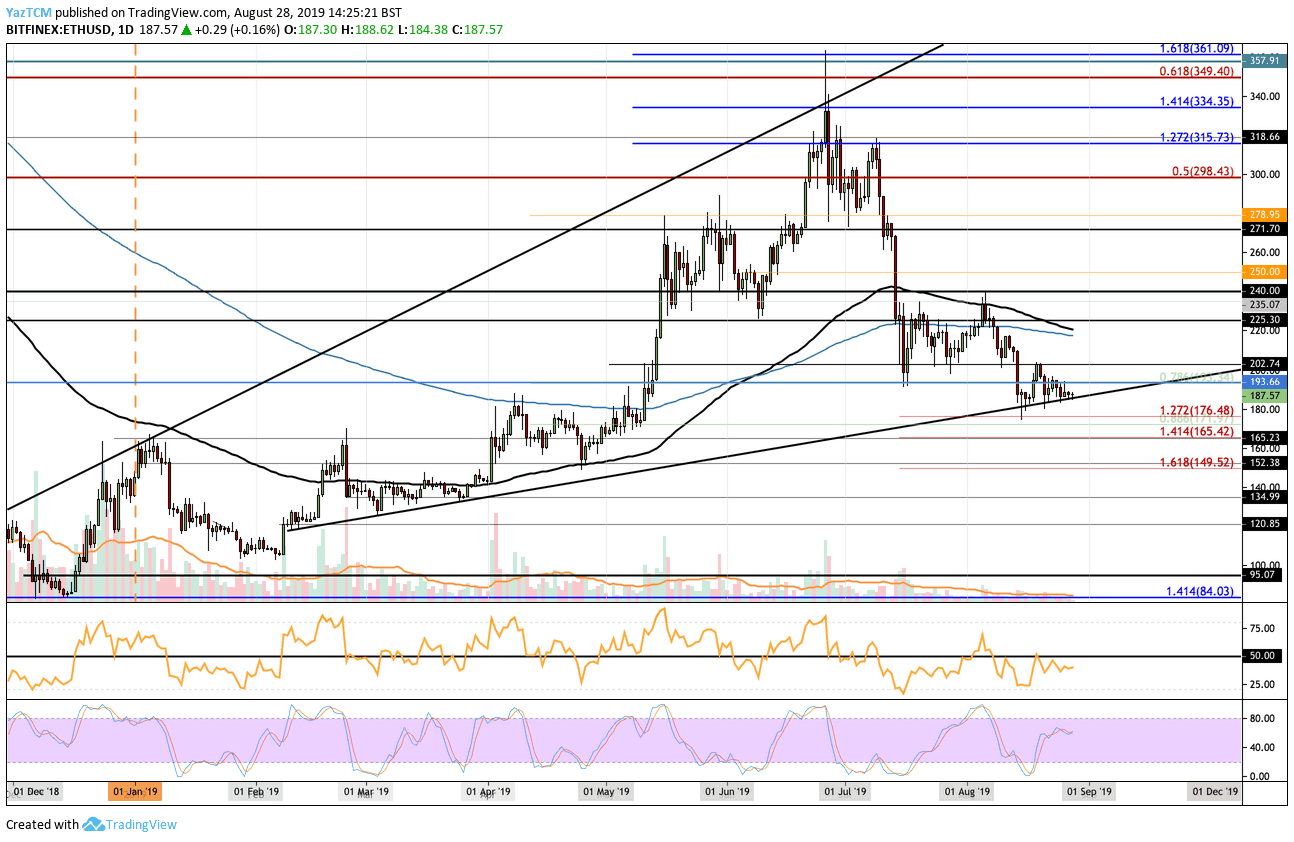

Looking at the ETH/USD 1-day chart:

- Since our previous ETH/USD analysis, ETH continued to trade along the contour of the rising support line which dates back to February 2019. This support line had managed to prevent it from falling lower during August 2019.

- From above: The nearest level of resistance lies at $193 and $202. Higher resistance lies at $217 and $220 which contain both the 100-days EMA and 200-days EMA and, therefore, will require significant momentum to overcome. Beyond $220, resistance lies at $225, $240 and $250.

- From below: If the sellers break beneath the rising support line, immediate support lies at $176 (downside 1.272 Fib Extension), $171, and $165 (downside 1.414 Fib Extension). Beneath $165 lies support at $160 and $150.

- The trading volume is starting to pick up as it remains around the average level.

- The RSI remains beneath 50 but is showing signs that it is grinding higher which suggests that the sellers might be losing some pressure. If the RSI can break above 50, the rebound at the rising support line is likely to occur.

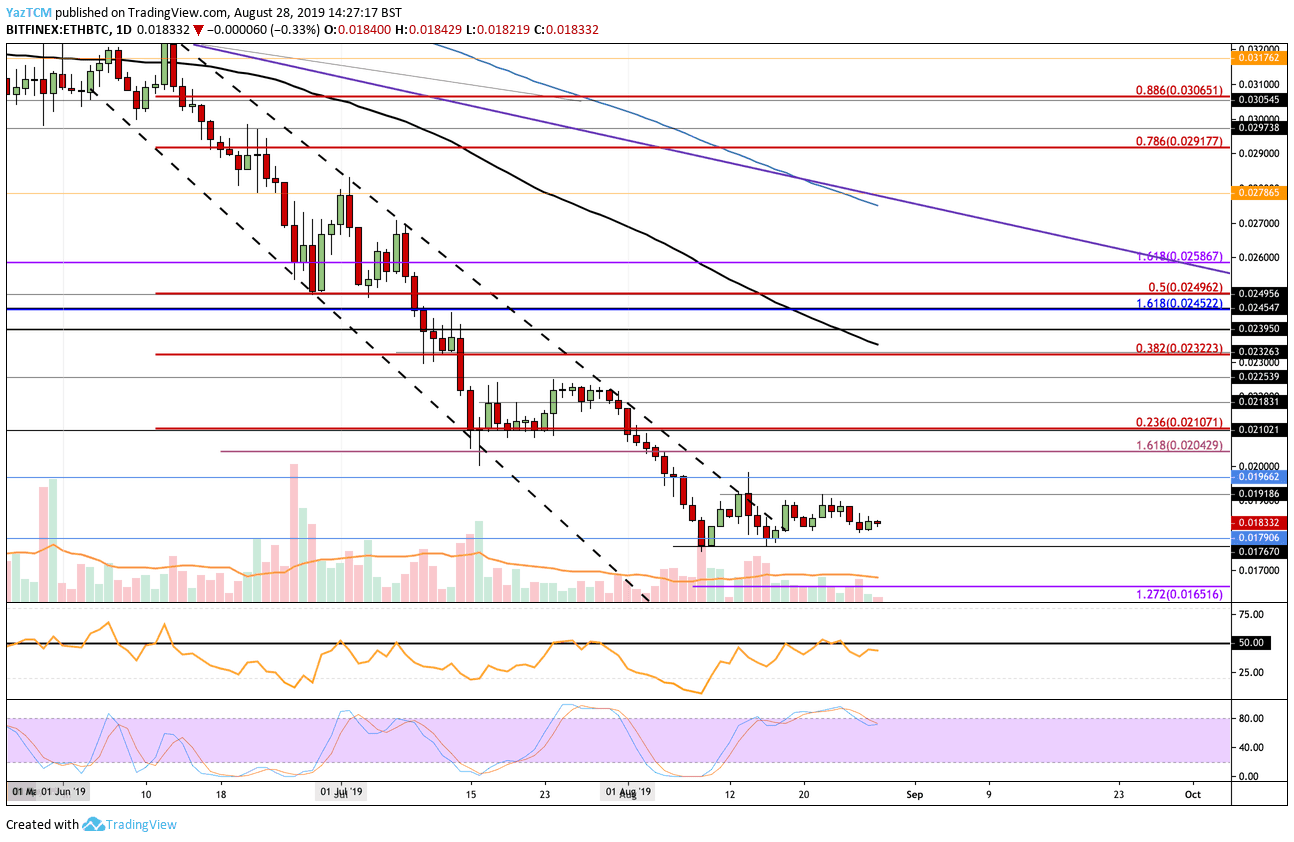

Looking at the ETH/BTC 1-day chart:

- Ethereum continued to trade sideways after breaking out of the previous 2-month-old falling price channel. ETH has now created a trading range between 0.01918 BTC and 0.01767 BTC.

- From above: The nearest level of resistance lies at the upper boundary of the range at 0.01918 BTC. Higher resistance is found at 0.01966 BTC, 0.02 BTC, 0.0204 BTC, and 0.021 BTC.

- From below: The nearest level of support lies at 0.01790 BTC. Lower support can be found at 0.0176 BTC, 0.017 BTC, and 0.0165 BTC.

- The trading volume still remains very low and beneath the average level.

- The RSI is trading very close to the 50 level which is a representation of market indecision – hence the trading range. If we would like to see a recovery, we will need to see the RSI break well above the 50 level to show that the bulls have control over the market momentum.

Be the first to know about our price analysis, crypto news and trading tips: Follow us on Telegram or subscribe to our weekly newsletter.

More news for you:

The post appeared first on CryptoPotato