- Ethereum saw a small price drop today as the coin falls to $316.

- This comes after ETH managed to increase by a total of around 30% this week.

- Against Bitcoin, Ethereum reached as high as 0.0317 BTC but has since dropped to 0.0288 BTC.

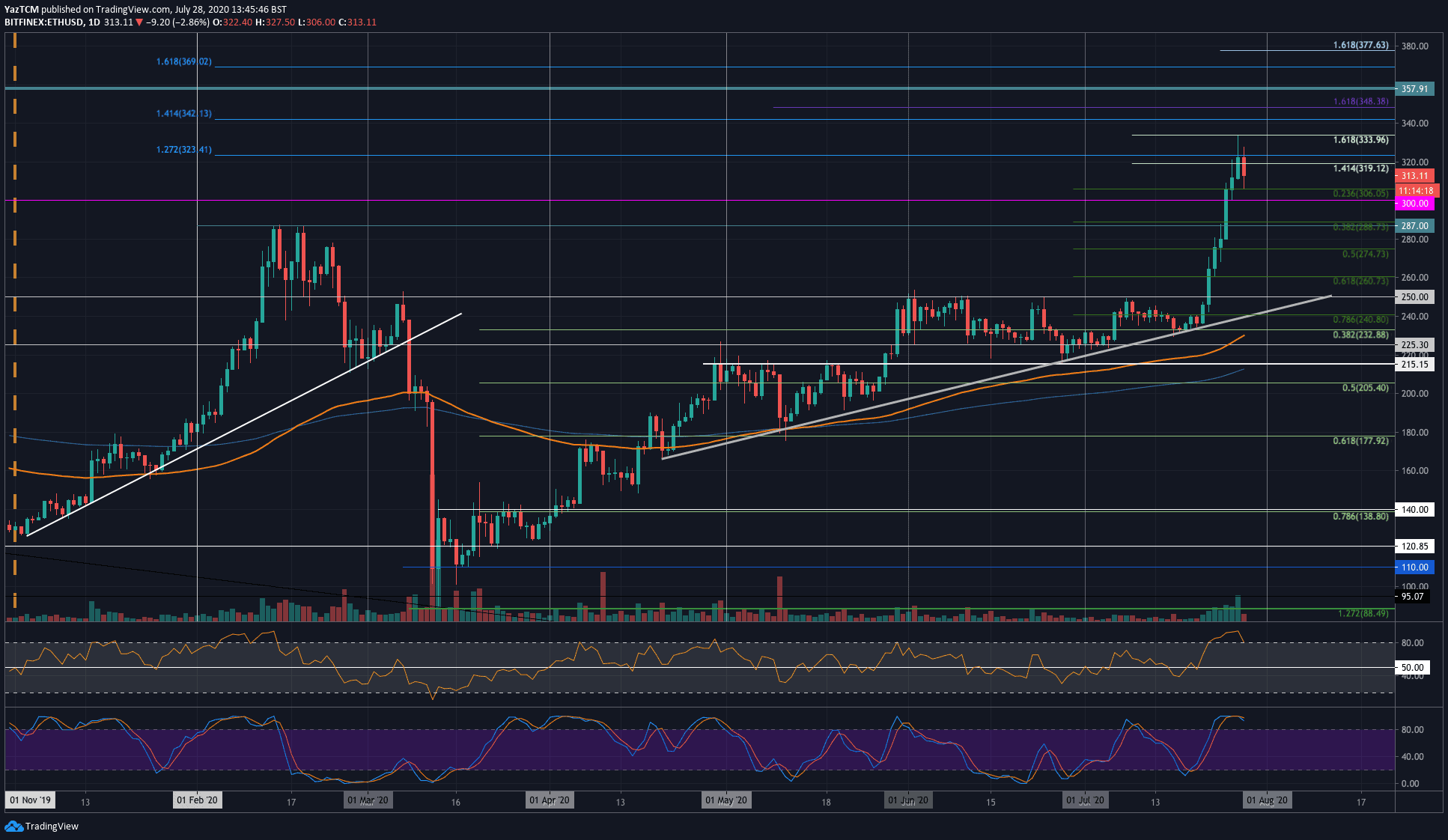

ETH/USD: Bullish Push Stalls At $323

Key Support Levels: $306, $300, $288

Key Resistance Levels: $323, $333, $342.

Ethereum went on a rampage over the past week after breaking the previous consolidation phase at $250. The coin continued higher as it broke above $300 to reach the resistance at $323 (1.272 Fib Extension). ETH did spike higher into $334 (1.618 Fib Extension) but was unable to close above $323.

The coin has since dropped into the support at $306 (.236 Fib Retracement).

ETH-USD Short Term Price Prediction

Looking ahead, if the bulls continue to push higher and break $323, the first level of resistance is at $333. This is followed by added resistance at $342 (1.414 Fib Extension) and $350.

On the other side, the first level of strong support lies at $306 (.236 Fib Retracement). This is followed by added support at $300, $288 (.382 Fib Retracement), and $275 (.5 Fib Retracement).

The RSI has dipped lower from extremely overbought conditions. Likewise, the Stochastic RSI has produced a bearish crossover signal. These two signals indicate that a potential retracement is imminent.

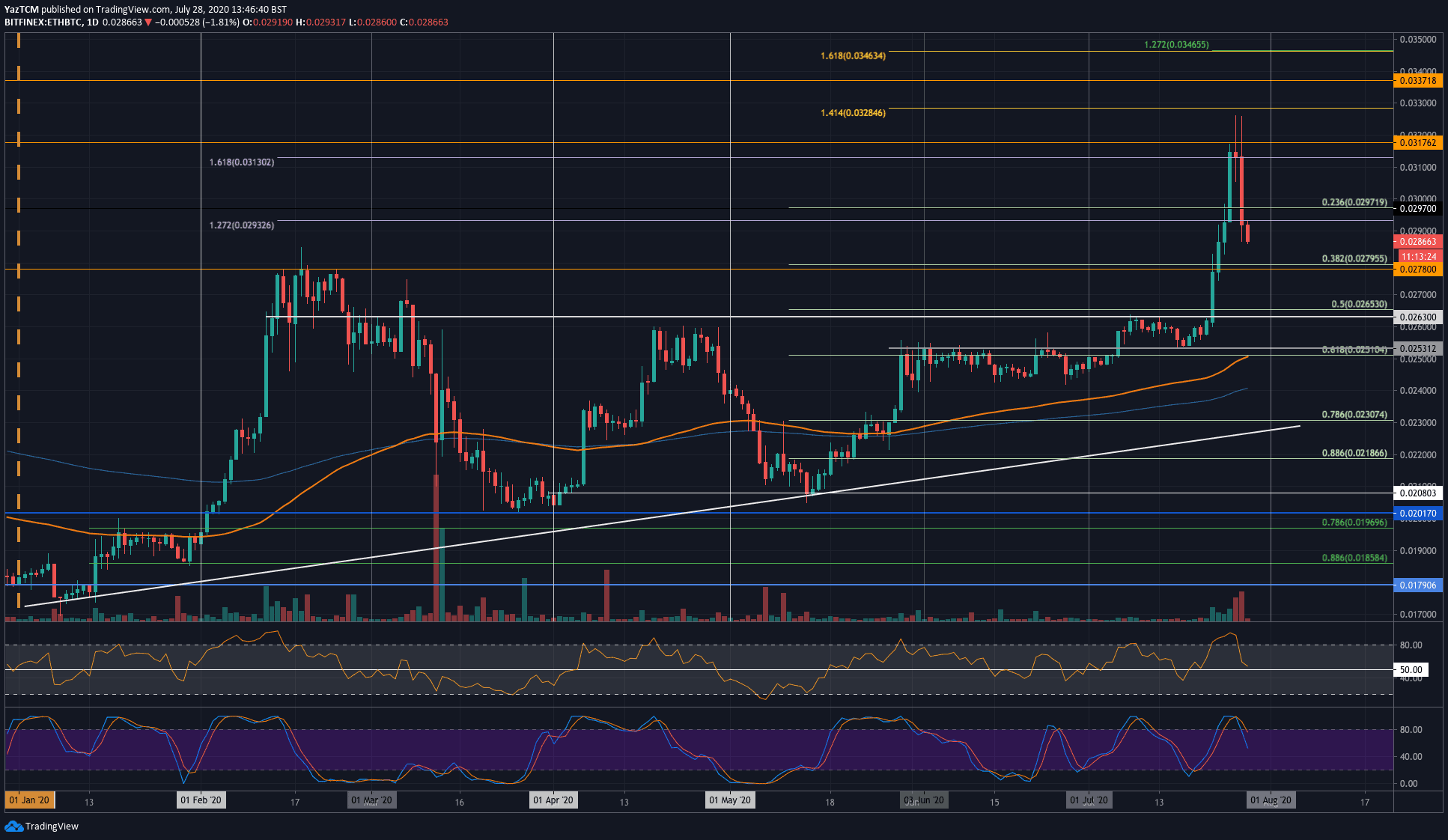

ETH/BTC – Ethereum Bulls Created Fresh Highs 0.0371 BTC

Key Support Levels: 0.0279 BTC, 0.0278 BTC, 0.0263 BTC.

Key Resistance Levels: 0.03 BTC, 0.0317 BTC, 0.032 BTC.

Against Bitcoin, ETH has also pushed much higher as it bounced from 0.0253 BTC earlier last week to push to 0.0317 BTC a few days ago. The coin has since dropped beneath 0.03 BTC again as it trades at 0.0286 BTC.

This retracement is expected after such a parabolic push higher. Despite this recent pullback, ETH still remains bullish and will remain bullish if it can stay above 0.0278 BTC.

ETH-BTC Short Term Price Prediction

Looking ahead, if the sellers continue to drive ETH lower, the first level of support lies at 0.0279 BTC (.5 Fib Retracement). This is followed by added support at 0.0278 BTC, 0.0263 BTC (.5 Fib Retracement), and 0.025 BTC (200-days EMA).

On the other side, if the buyers regroup and push higher, the first level of resistance lies at 0.03 BTC. This is followed by added resistance at 0.0317 BTC, 0.032 BTC, 0.0328 BTC, and 0.0337 BTC.

The RSI has dropped from overbought conditions toward the 50 line to indicate indecision within the market. If the RSI drops beneath 50, ETH can be expected to head further beneath 0.0278 BTC.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited – first 200 sign-ups & exclusive to CryptoPotato).

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato