- Ethereum dropped by a small 2.28% over the past 24 hours as the cryptocurrency rolls over at $230 and drops to $223.

- The cryptocurrency failed to make ground above 0.023 BTC against Bitcoin and fell to 0.0224 BTC.

- This latest price fall can largely be attributed to Bitcoin dropping back beneath $10,000 briefly.

Key Support & Resistance Levels

Support: $212, $206, $201.

Resistance: $230, $235, $240.

Support: 0.0218 BTC, 0.0211 BTC, 0.0207 BTC.

Resistance: 0.023 BTC, 0.0232 BTC, 0.0239 BTC .

ETH/USD: Ethereum Reaches September 2019 Highs and Rolls Over

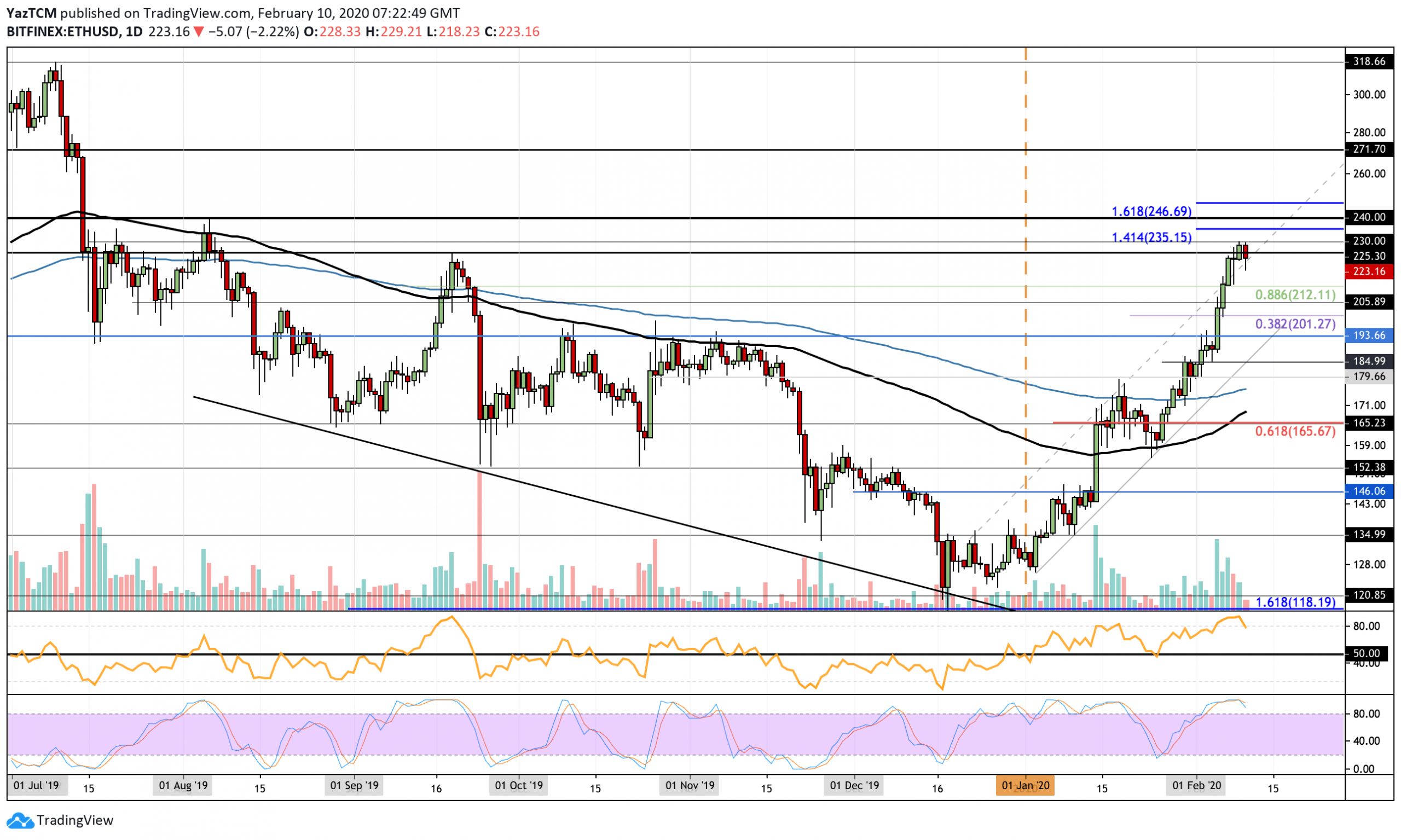

Since our last analysis, Ethereum continued to drive past the resistance at $212 and climbed above the September highs at $225, as expected. It went further to reach $230 before stalling.

Ethereum is still up by a total of 17.7% over the past week of trading with a further 55% price surge over the past 30 days.

ETH has since rolled over at $230 and dropped toward the $223 level. It is currently using the upper boundary of the previous ascending price channel as support.

Despite the small price decline, Ethereum still remains bullish until it drops back beneath $194 at which point it would be considered as neutral.

ETH/USD. Source: TradingView

Ethereum Short Term Price Prediction

If the sellers continue to drive beneath $220, support lies at $212, $206, and $201. If the bears continue to bring Ethereum beneath $200, additional support can be found at $194, $185, and $176 (200-days EMA).

Alternatively, if the bulls can defend $220 and push higher, the first level of resistance lies at $230. Above this, higher resistance lies at $235 (1.414 Fib Extension), $240 and $247 (1.618 Fib Extension). Beyond this, higher resistance lies at $260 and $271.

The RSI has dropped slightly from extremely overbought conditions which can be considered as a good sign as it allows the buyers to return to a natural level of momentum to continue higher. Similarly, the Stochastic RSI produced a bearish crossover signal in overbought conditions which signal the start of the retracement.

ETH/BTC: ETH Reaches 0.023 BTC and Also Rolls Over

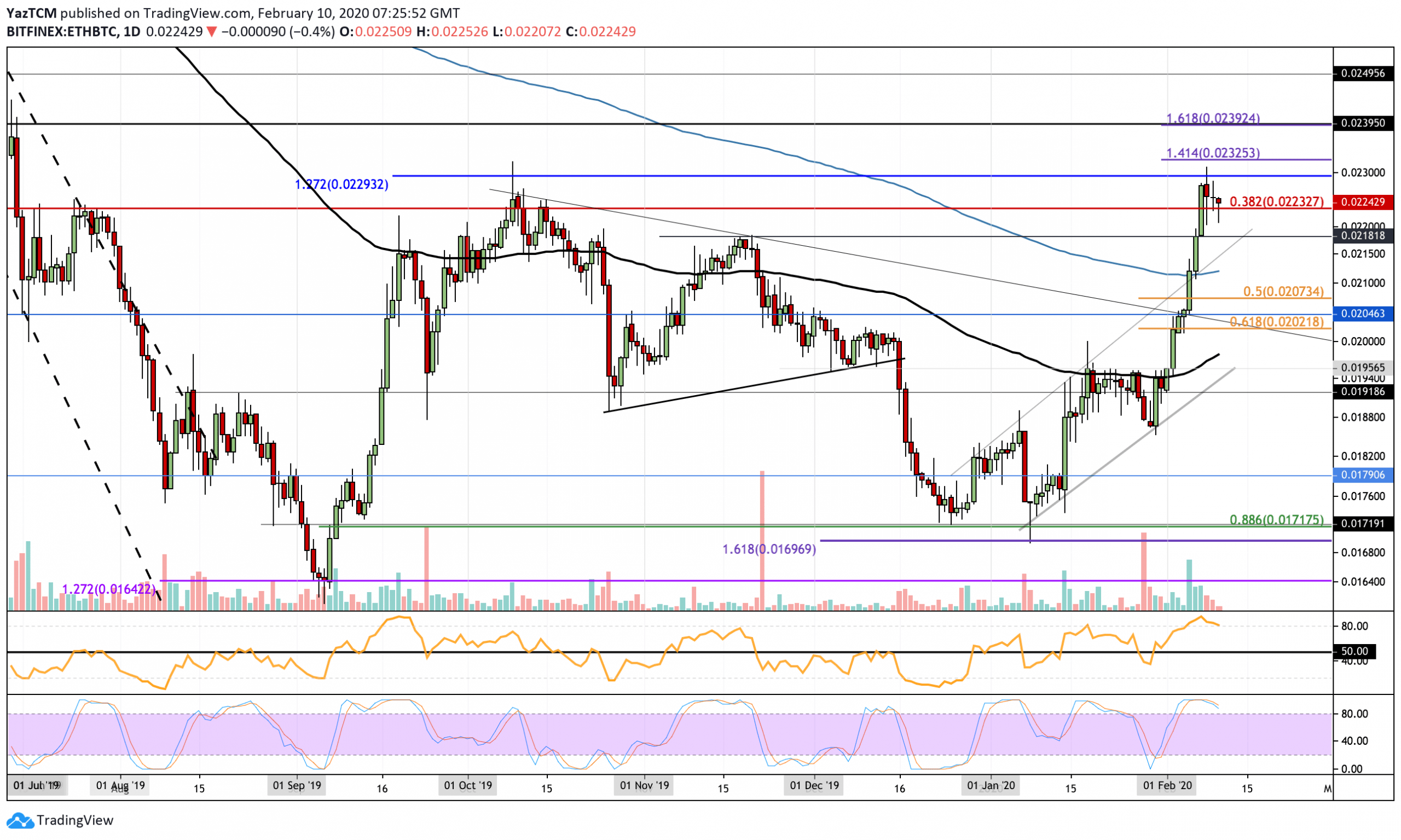

Against Bitcoin, Ethereum continued to penetrate above the resistance at 0.0218 BTC to continue higher into the 0.023 BTC level. It was unable to make ground above here and, instead, rolled over and started to drop to the current price of 0.0225 BTC.

The market remains bullish, however, a drop beneath 0.021 BTC (200-days EMA) would turn the market neutral. It would need to drop beneath the 100-days EMA at 0.0196 BTC to turn bearish.

ETH/BTC. Source: TradingView

Ethereum Short Term Price Prediction

Looking ahead, if the sellers continue to push beneath 0.0225 BTC, support is expected at 0.0218 BTC. Beneath this, additional support lies at 0.0211 BTC, 0.0207 BTC (.5 Fib Retracement), and 0.02 BTC (.618 Fib Retracement).

On the other hand, if the bulls defend 0.0225 BTC and push higher, the first level of resistance lies at 0.023 BTC. Above this, resistance lies at 0.0232 BTC (1.414 Fib Extension) and 0.0239 BTC. If the bulls continue above 0.024 BTCc, additional resistance can be found at 0.025 BTC.

The Stochastic RSI has also produced a bearish crossover signal here as the pullback starts. Additionally, the RSI has also dropped slightly from overbought conditions as the bullish momentum starts to show signs of fading.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato