Bitcoin witnessed a turbulent 2019 and in spite of high volatility in the market, the king coin registered an impressive growth north of 90 percent.

In Coinmetrics’ recent State of the Network report, Bitcoin’s performance with regard to various factors and other assets was evaluated, including fundamental properties and other adoption parameters.

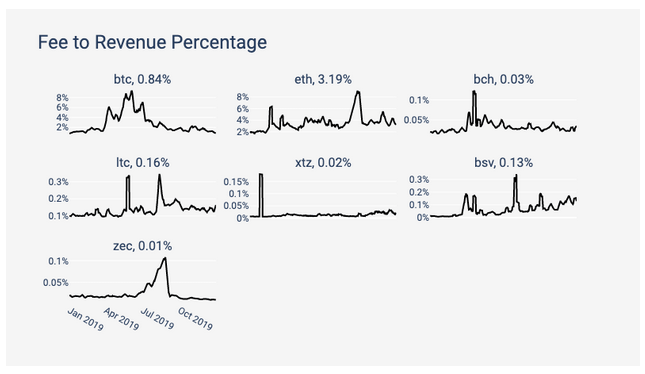

A section covered in the report, one based on network security, compared the fee to the revenue percentage metric of Bitcoin and other major cryptos.

The fee to revenue percentage is basically the percentage of miner revenue allocated from transaction fees. It is understood that in the long run, block rewards would eventually stem down to a minimum amount or fall down due to periodic block reward halving. Hence, it is imperative that transaction fees become a major portion of the mining revenue over the next few years as it will determine the sustainability and security of a chain’s long-term future.

Source: Coinmetrics

In 2019, it was observed that Bitcoin and Ethereum registered higher conversion of a transaction fee to mining revenue, suggesting larger growth in terms of security and health from other crypto-assets. Although BTC and ETH reigned above all the other cryptos, ETH was further ahead of Bitcoin, registering a conversion of over 3.2% to Bitcoin’s 0.8%.

The chart caught the attention of Ryan Sean Adams, Founder of Mythos Capital, with Adam highlighting that this particular metric has more importance than it is given credit for.

According to Adams, the higher the fee that is converted to miner revenue, the security of the network would directly increase. Transaction fees allow a lower issuance, while maintaining significant protection, he added.

However, the statement under observation from the community was that Store-of-Value is directly related to the highest fee revenue as well.

Bitcoin’s narrative as a Store-of-Value sky-rocketed in 2019, but according to Sean Adam, Ethereum is a better SoV since it registered a higher fee to revenue percentage.

Despite the SoV observation, Ethereum registered a growth of -2.09 in 2019, a figure which is contrary to the aforementioned SoV credentials.

The post appeared first on AMBCrypto