There is no element of certainty in the crypto-market, whether it is a price trend or a position. The same was recently proven by Ethereum’s Vitalik Buterin after he appeared to change his opinion on Tezos. During a recent Twitter exchange, Buterin commented,

“I hope Tezos does well. It has genuinely interesting and well-thought-out tech and governance philosophy, even if I don’t personally agree with some of the latter.”

The governance philosophy in question that Buterin has drawn criticism towards in the past concerns Tezos’s on-chain governance model that allows ‘bakers’ to stake their tokens and vote for proposed changes, without implementing a hard fork.

To be clear: eliminate the need yes, the possibility, no. Hard-forks are valuable failsafes and you make a great case for it.

— Tezos (@tezos) July 10, 2017

Vitalik’s present comments were in response to a post by Evan Van Ness who cited an academic paper to identify Tezos as a “ghost chain.”

According to Van Ness, September was reportedly the first time in months that Tezos noted ‘non zero transaction blocks,’ despite the fact that it continues to record millions in market capitalization. The aforementioned paper had observed that while 95% of EOS transactions came from an airdrop of valueless tokens, 82% of Tezos’s throughput was used just for baking.

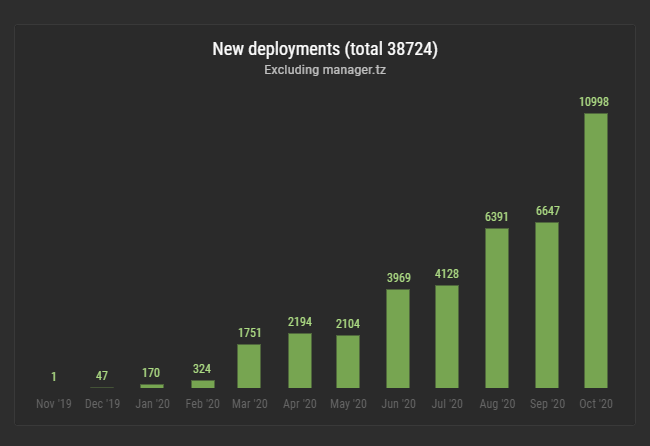

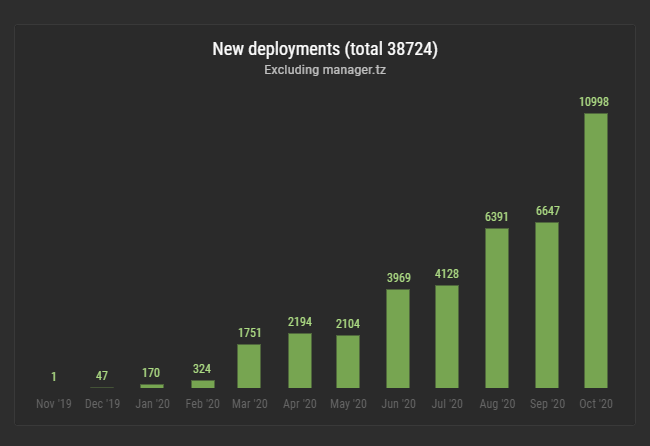

Many like Van Ness have used these findings to suggest that “self-amending” blockchains like Tezos see no real use and are instead, “ghost chains.” However, it is important to note that while yes, XTZ is down by more than 65% against ETH since mid-July, developments in the space have been plenty. The pace of these developments might suggest that Tezos is making a comeback.

In fact, October reported over 10,000 smart contract deployments on the Carthage Testnet.

Source: Twitter

Despite the seemingly negative narrative around it, there were some who saw the bright side, with one user commenting,

“EOS is doing 60-100 times more transactions than ETH. So if 95% is spam, the 5% is still very close to Ethereum. Definitely not a ghost chain.”

The post appeared first on AMBCrypto