The cryptocurrency market has been witnessing a rise in the price of most crypto-assets. Led by Bitcoin, most major cryptos were a part of this bullish wave. Ethereum, the world’s second-largest coin reported YTD gains of around 57%, outperforming BTC’s gains of 35%. With the price of digital assets climbing, DeFi also managed to mark a new milestone.

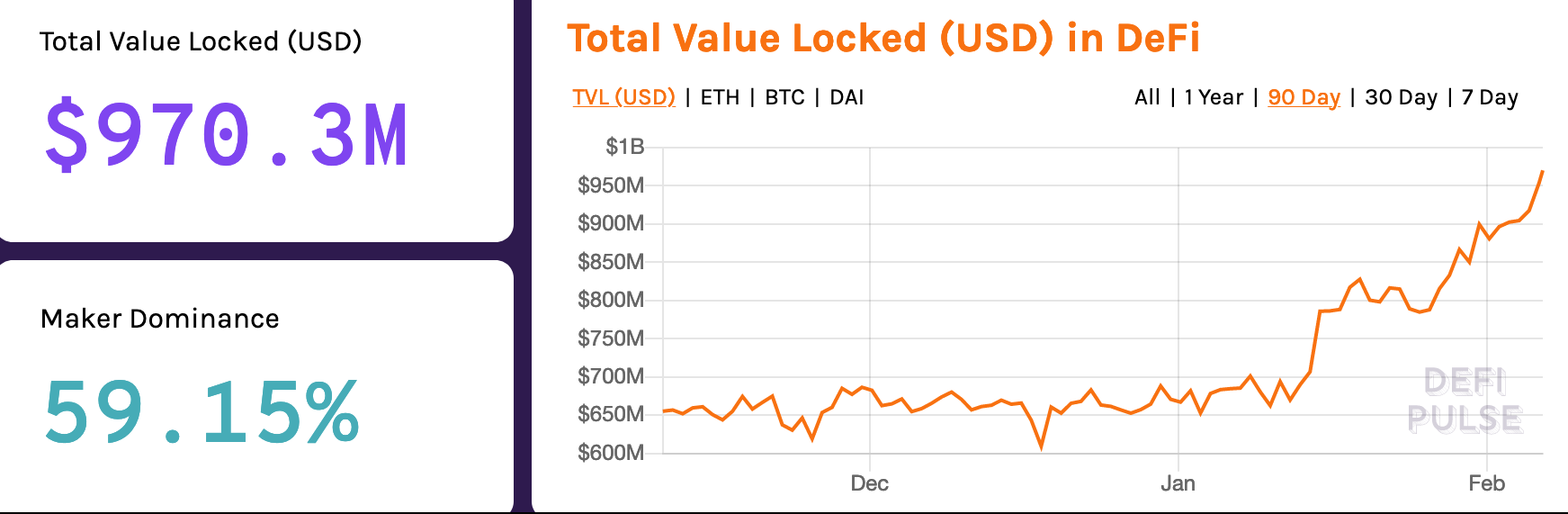

According to data provided by DeFi Pulse, the total value locked [USD] in DeFi was reported to be $970.3 million.

Source: DeFi Pulse

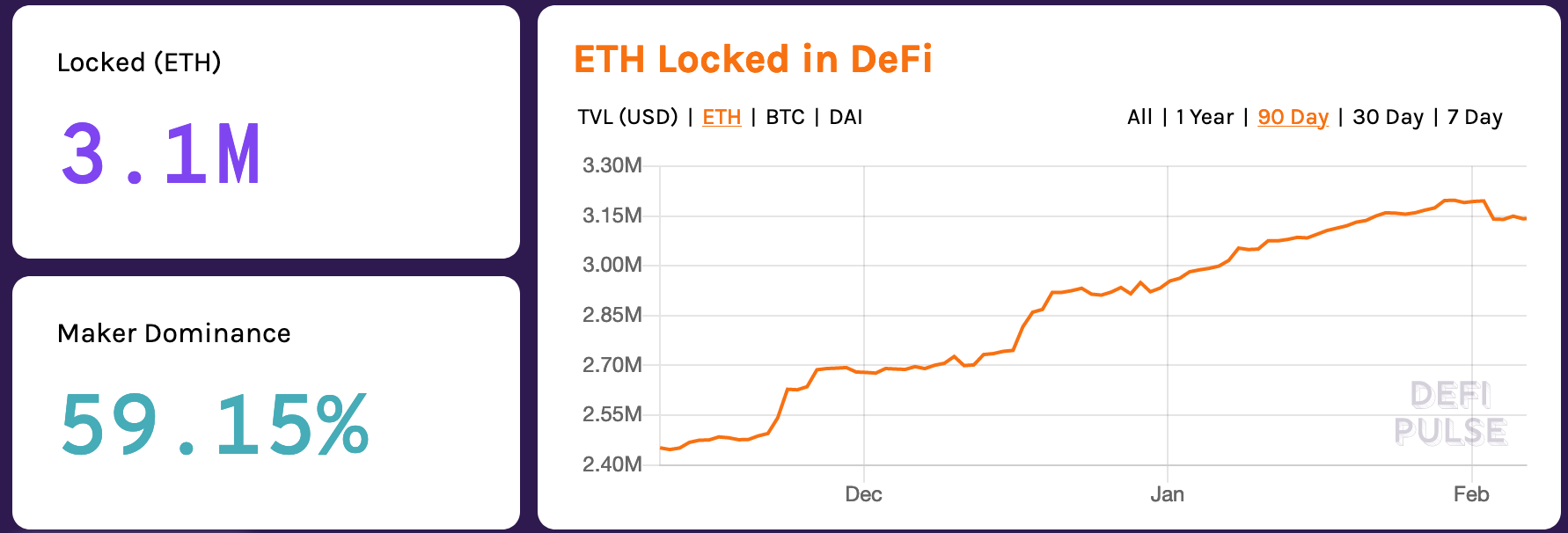

Whereas, Ethereum locked in DeFi noted a decline in February.

Source: DeFi Pulse

Maker dominated lending with the value locked-in reaching as high as $573.6 million, recording a 7% rise over the day. Compound took the number two position due to the vast difference in the locked-in value but reported an 8% surge in a day. Despite the tremendous growth of DeFi, Udi Wertheimer, an independent developer and coder, remains a skeptic as he believes that DeFi applications do not offer an advantage over traditional Bitcoin exchanges.

Wertheimer was a guest on ‘The Blockchain Debate’ podcast wherein he debated for the motion ‘DeFi is DeFicient.’ Wertheimer pointed out the vagueness in defining DeFi or decentralized Finance, with the coder highlighting that by the current understanding of DeFi, Bitcoin could be a DeFi in itself. He added,

“If it is, then what about USDT/Tether? Is that also DeFi? Is USDC also DeFi? So it’s hard to tell.”

In a tweet thread, Wertheimer had asserted that the Bitcoin exchanges offered “services like lending, leverage, synthetics, etc. with identical security properties” and that there is no upside to using DeFi instead. Despite existing arbitrage opportunities on DeFi, the volume has been low and according to the coder, it may not be able to go far.

The post appeared first on AMBCrypto