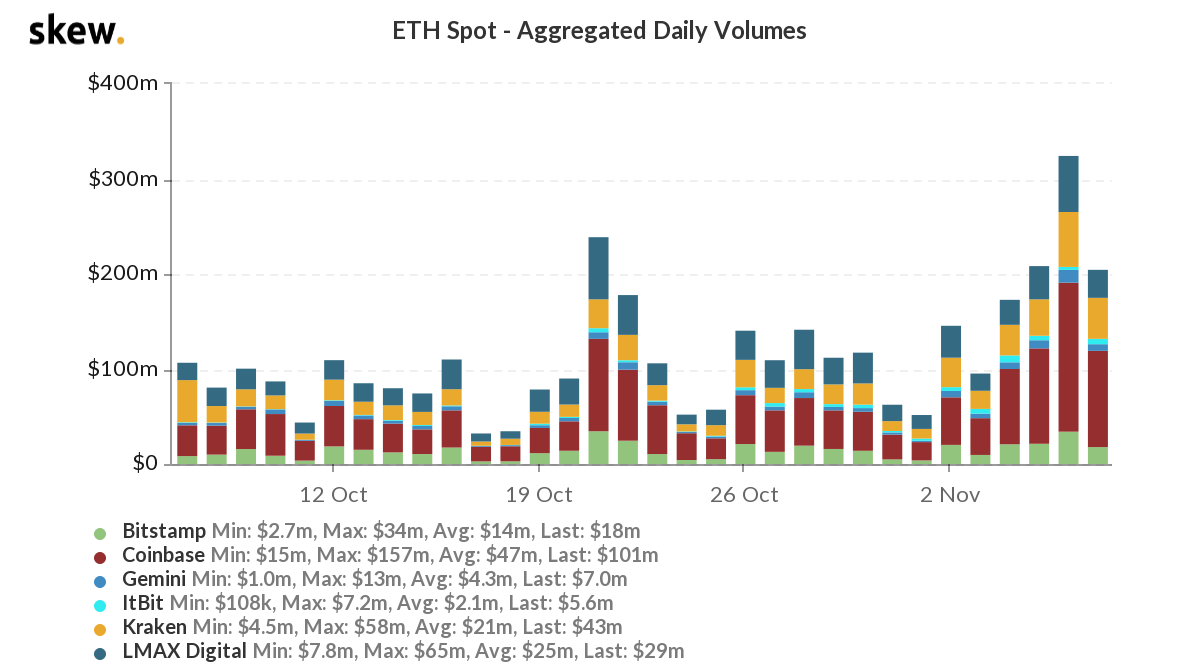

Ethereum’s price is up 13.21% in one week. What does this reveal? Well, the said price rally suggests that more retail and institutional traders would trade on spot and derivatives exchanges. However, the trade volume on spot exchanges is still oscillating around its mid-October levels. In fact, while the trade volume did climb above $300M on 4 November 2020, despite the current price rally, the trade volume was still shy of hitting its monthly ATH by nearly $100M.

Further, based on data from Skew, the aggregate daily volume for ETH hit $500M in September 2020 and nearly $600M in August 2020. Both these volume levels were triggered by a price rally on Ethereum’s charts. However, the present rally has not had a massive impact on the trade volume just yet.

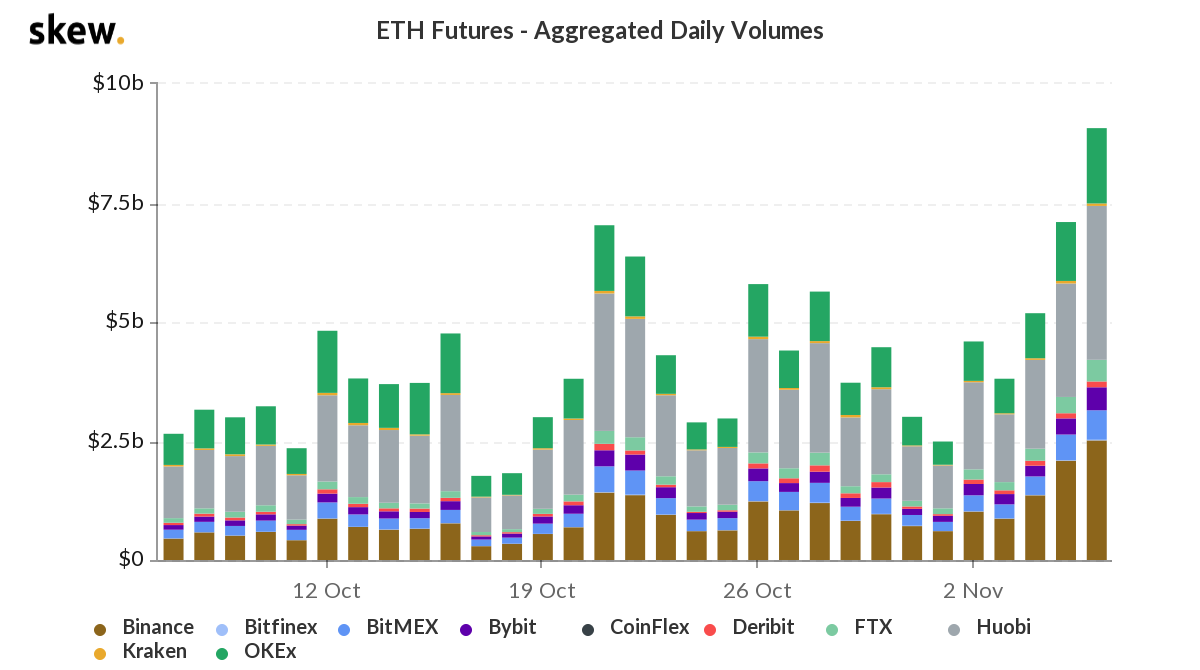

On derivatives exchanges, the trade volume was nearly $6.5 Billion. Akin to spot exchanges, on derivatives exchanges, the volume was average throughout October, until 7 November 2020.

In the first week of September 2020, the trade volume was twice the current level. At the time of writing, ETH was valued at $435, with the cryptocurrency’s price in a range last seen back in July 2020. It should be noted, however, that the July 2020 price rally was shortlived.

In response to the ETH’s rally, DeFi’s TVL recorded an increase from $9.58B in September 2020 to $12.12B, based on data from DeFiPulse. During July 2020’s rally, DeFi’s bull run pushed transactions on the ETH network, thus possibly driving ETH price north. In fact, the current increase in TVL is low relative to the July 2020 rally.

Apart from DeFi, the other driving factor for Ethereum’s price is the ETHBTC realized correlation. It has dropped to 75% from 90% 3 months ago, and prices of both BTC and ETH are rallying.

ETHBTC realized correlation || Source: Skew

Based on data from Skew, with the implied volatility spread of BTC and ETH dropping, ETH’s price is behaving more like BTC in the short-run. The dropping ETH and BTC reserves may be another reason why Ethereum’s price is following Bitcoin’s trend.

The dropping spread in volatility, combined with the trade volume that is below the monthly high, signaled an upcoming change in trend. The upcoming change could be a price hike or a drop based on the volatility and trade volume above $435.

The post appeared first on AMBCrypto