Bitcoin’s investment thesis as a long-term asset has been fairly well-received over the past few years. In fact, with more and more institutional investors, Bitcoin seems to be emerging as the go-to asset. While 2020 was pitted to be a key year for the cryptocurrency owing to its third block reward halving, the year hasn’t really turned out as planned, with a pandemic and growing uncertainty in global economies thrown into the mix.

That being said, over the past few years, Bitcoin’s dominance has grown substantially and while the price hasn’t gone past its 2017-levels, there are other metrics that point to quite a promising future for the king coin.

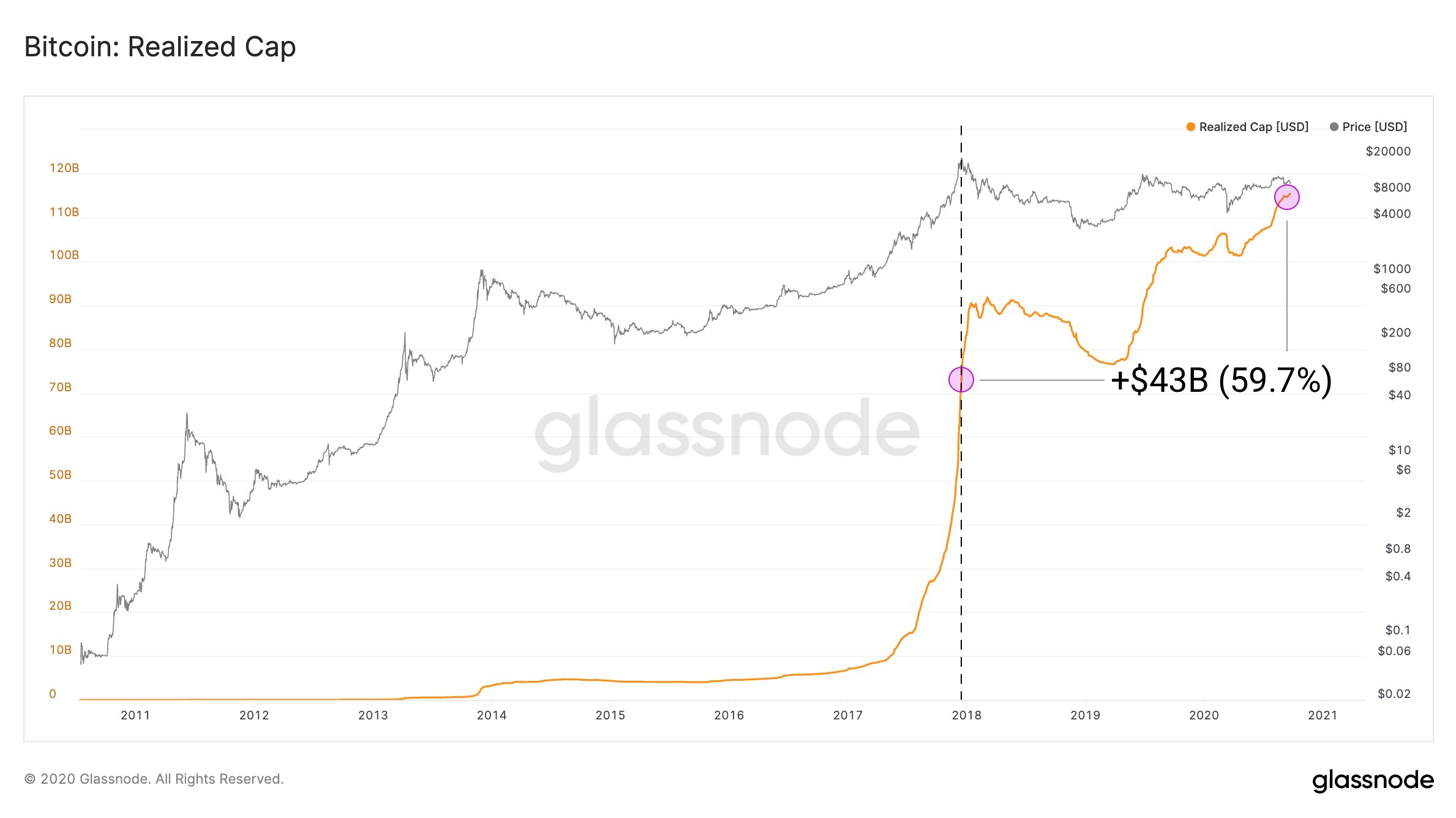

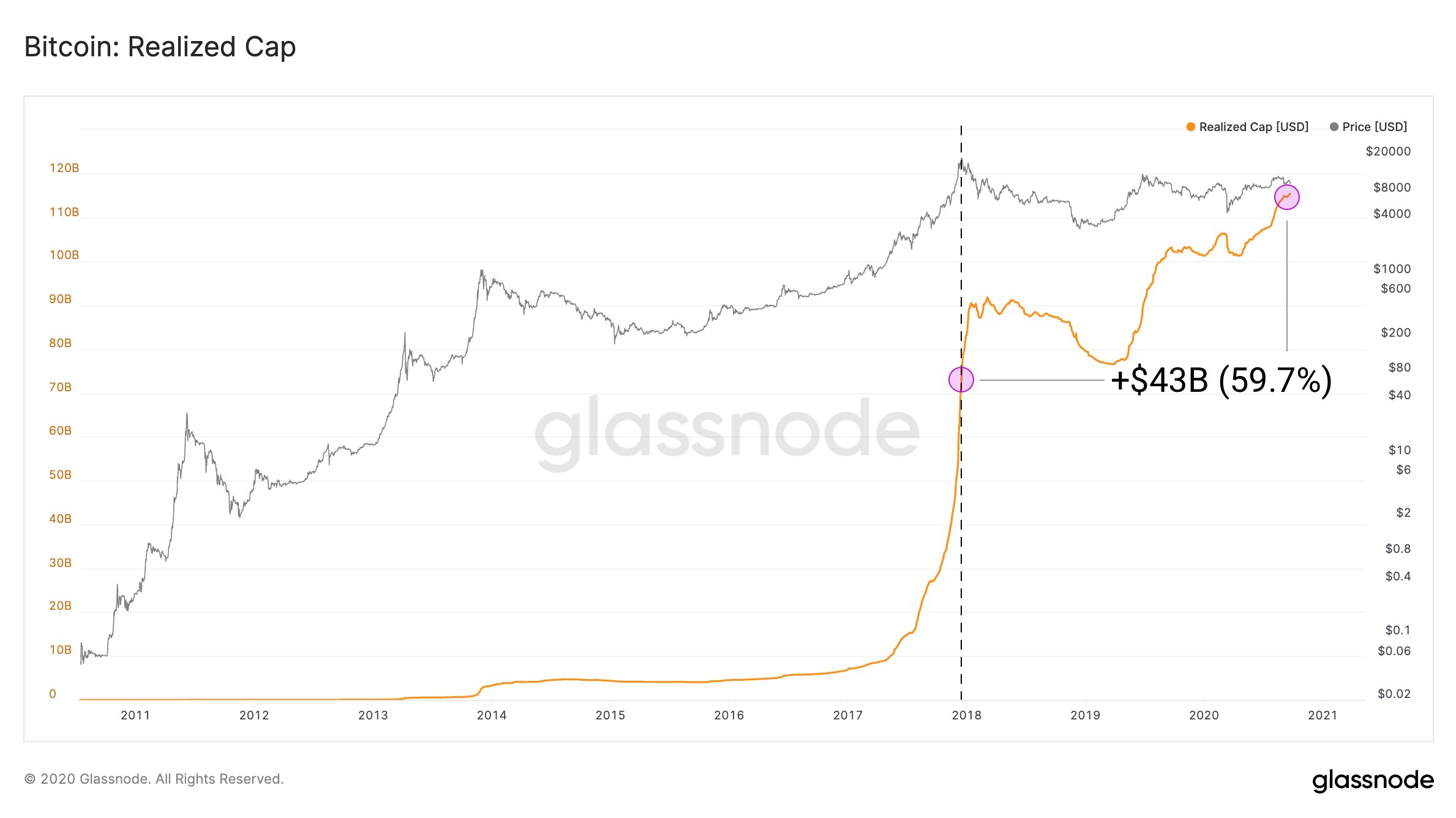

Source: Glassnode

The realized cap of Bitcoin, according to data provided by Glassnode, hit yet another high recently, after it noted an increase of almost 60 percent since Bitcoin’s trading price hit $20k at the end of 2017. The realized cap of Bitcoin takes into account the total number of Bitcoin present in the market and in its assessment, the values are based on the price of BTC when the funds were last moved.

However, what’s interesting here is that the previous high for the metric this year was followed by the now infamous Black Thursday, a price crash event that took down the price of BTC by over $4000 in a matter of hours.

One of the key takeaways from the rise in Bitcoin’s realized cap is that new investors are entering the market. The previous year, and notably, the past few months, have made it clear that there is significant interest from institutional investors, especially with regard to Bitcoin’s store of value status.

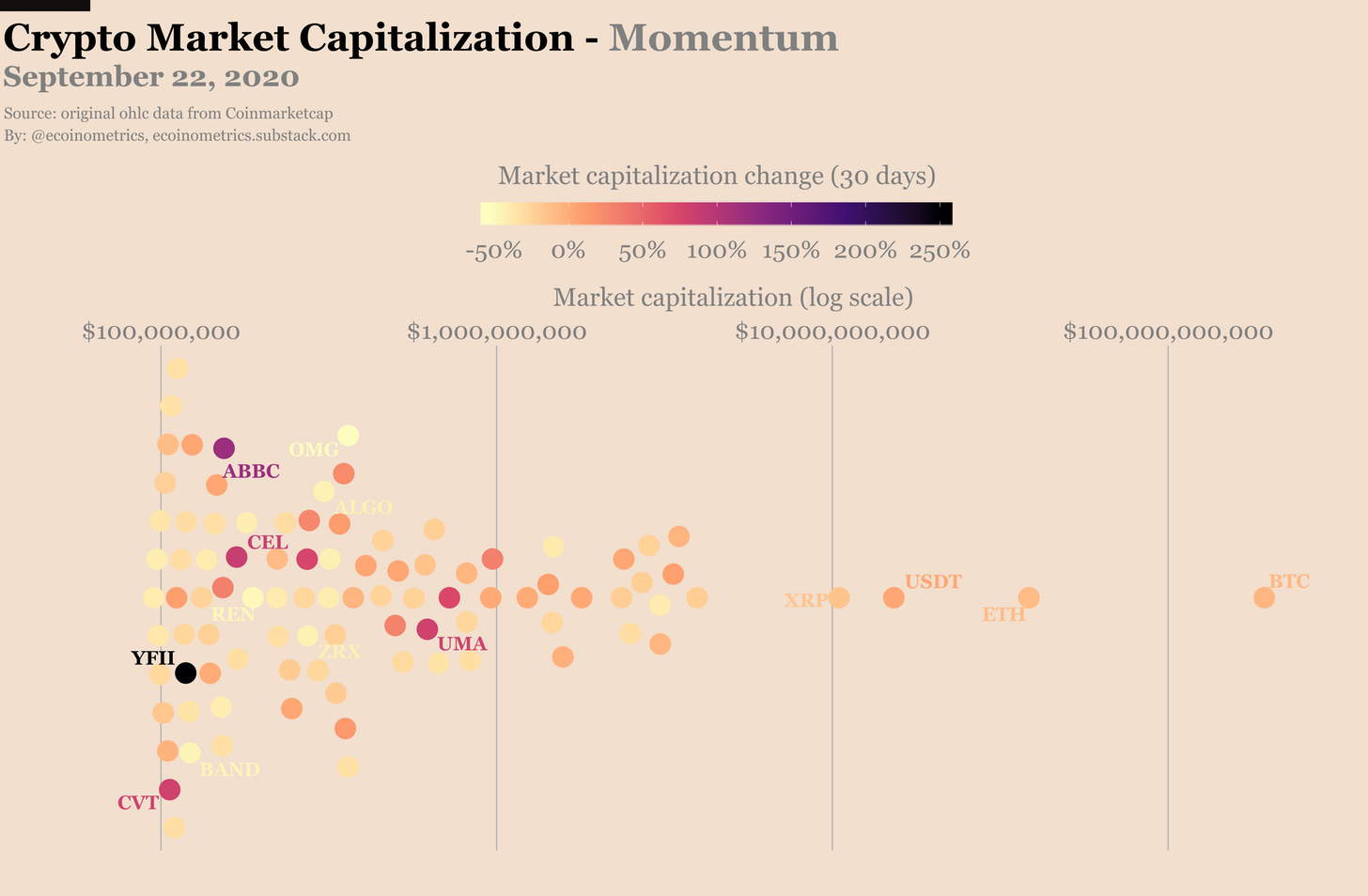

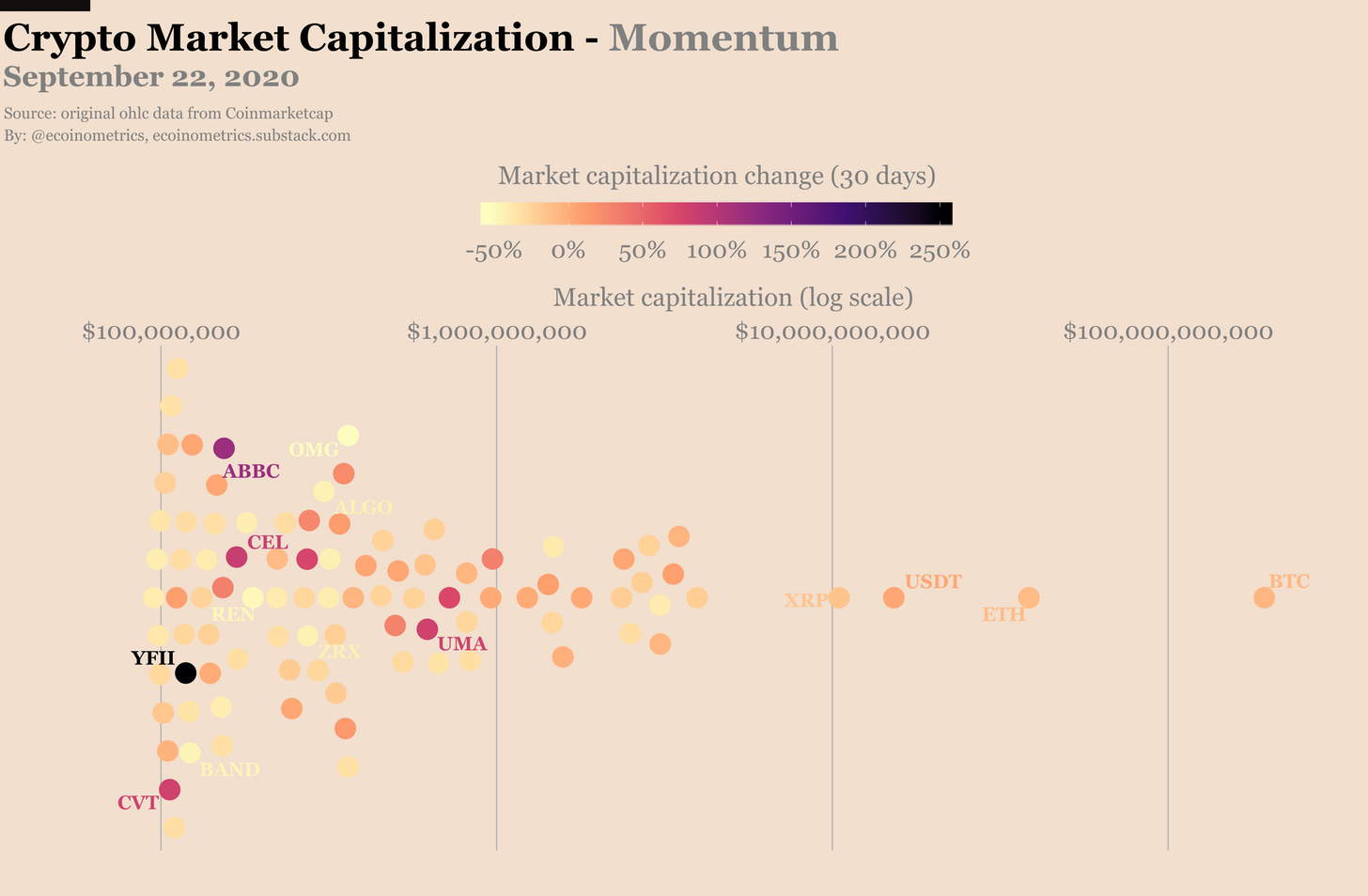

Source: Ecoinometrics

In fact, according to a recent Ecoinometrics report, during this period of price consolidation for Bitcoin, there are use cases that are driving more new users such as its long-term store of value status. The report added,

“Even when BTC is pretty quiet you can find opportunities to trade momentum in small market cap assets (below $1 billion).”

At press time, the price of Bitcoin continued to remain between $10k and $11k, and this period of consolidation can be considered to be a tremendous buying opportunity for new users. The fact that the realized cap of Bitcoin continues on its growth trajectory, despite registering some dips along its way, shows that new investors are making use of this low price point Bitcoin finds itself in.

The post appeared first on AMBCrypto