Facebook stock suffered a devastating investor exodus last year, but FB shares held the line and are now poised for a 25% surge. | Source: REUTERS / Dado Ruvic

By CCN Markets: Facebook (FB) stock suffered a devastating 2018 amidst controversies that led to a mass investor exodus. In one particularly painful trading session, Facebook rewrote the history books with a $126 billion plunge.

The social media giant weathered the storm, and FB shares are up almost 38 percent this year amid a broad stock market recovery. And as major stock indices succumb to trade war panic, Facebook is poised to offer investors massive upside.

FB stock’s technical picture suggests that the company could be on the verge of rallying more than 25 percent, a move that would enable it to set a new all-time high.

Facebook Recovered a Key Support to Regain Its Bullish Momentum

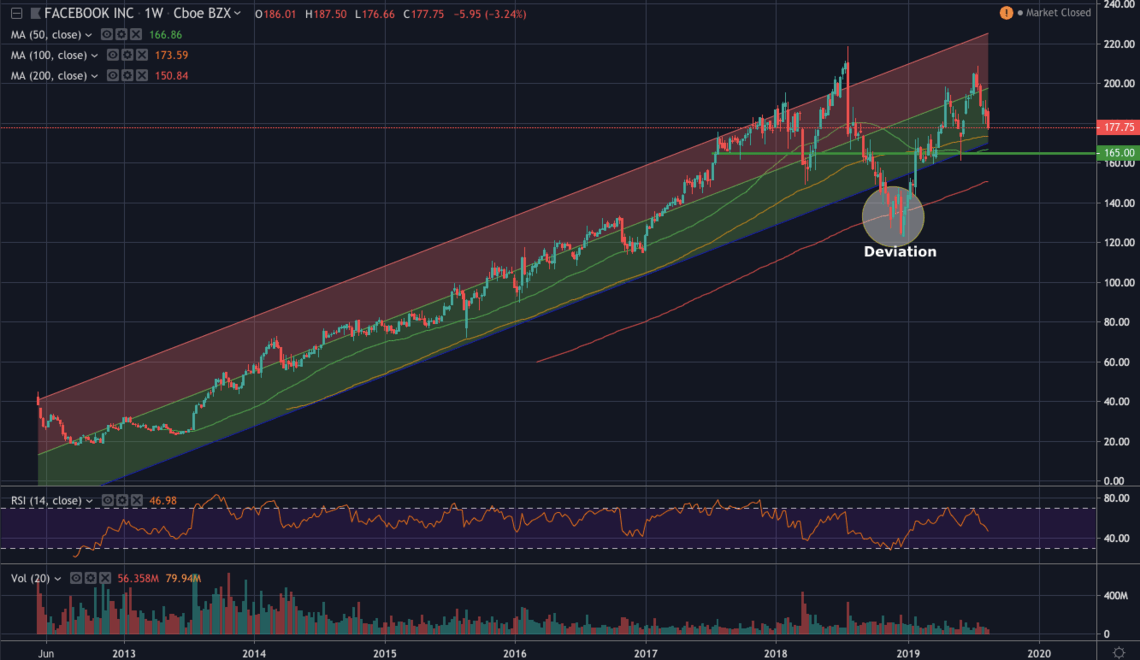

A look at the weekly chart reveals that FB shares have been trading within a large ascending channel for over seven years.

The support of the channel was briefly broken in October 2018, which ignited a waterfall event that drove the equity to as low as $123.02 in December 2018.

Facebook stock has been moving within an ascending channel since its IPO | Source: TradingView

However, the move below the support of the channel appears to be a deviation. Bulls bought the dip and lifted the stock back above the diagonal support in January 2019. The recovery of the support catapulted Facebook to a 2019 high of $208.66.

The stock is currently correcting, but it is still inside the ascending channel. Thus, as long as it trades within the structure, we can see Facebook tapping the resistance of the channel at $225.

Facebook’s Fundamentals Remains Strong

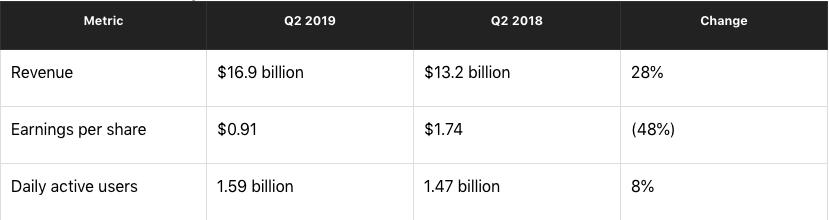

The tech titan’s recovery comes on the heels of a strong second-quarter earnings report. For Q2 of 2019, the company’s revenues rose by 28 percent year-over-year.

On top of that, daily active users climbed to 1.59 billion from 1.47 billion during the same period last year.

Robust fundamentals driving FB share price growth | Source: Motley Fool

Hatem Diab, Managing Partner at Gerber Kawasaki, spoke to CCN and shared his bullish view on Facebook. He said:

“Facebook seems to continue growing revenues and has additional levers to pull should they decide to further monetize Instagram and WhatsApp. While the regulatory environment looks murky from a strictly investment standpoint, they seem, with Google, the only game in town for digital advertising. So for the short term, I would think FB will keep performing well.”

So even though Mark Zuckerberg continues to unload his FB shares, fundamentals remain strong for Facebook stock.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.

This article is protected by copyright laws and is owned by CCN Markets.

Source: CCNThe post appeared first on XBT.MONEY