Even though the past week was positive for Bitcoin, the recent price action could raise some question marks for the Bulls.

After starting the week below $10,500, Bitcoin was able to break above the old tough resistance and reach back to the $11,000 are.

However, while Bitcoin gained 5% over the past week, most of the leading cryptocurrencies lost market cap. LINK -18% and even Ethereum -2% are only two examples. The trending defi tokens suffered even harder.

This tells us that some or major reason for the BTC price gains was coming from the altcoins sell-off, and not from funds entering crypto. Just like in a healthy bull market.

Double-Top On the 4-Hour?

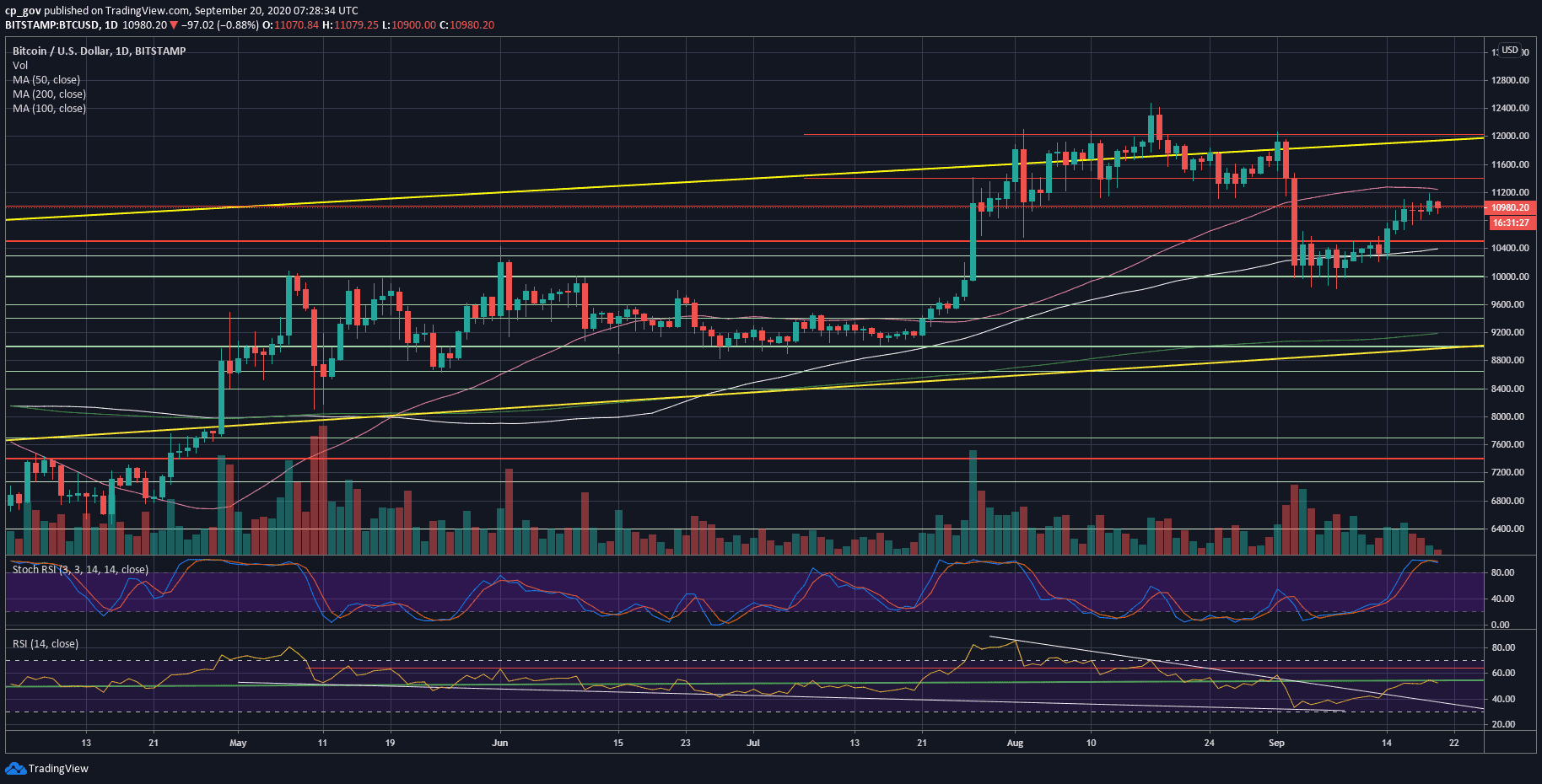

Looking at the following 4-hour chart, we can see a double top formation around $11,100, which is textbook bearish.

Moreover, there is bearish divergence on the RSI, which is also bearish. This happens when the asset’s price is increasing, while the RSI is decreasing.

Another issue to consider is the decreasing amount of volume over the past week, which shows that the buyers are losing their power.

Despite the above, and just as in crypto, the momentum might change very quickly. Keep in mind that Bitcoin is also waiting for the equity markets of Monday, including Gold, both had a significant effect on the price recently.

The level to watch is, of course, the recent high from yesterday around $11,100. In case Bitcoin breaks above it (further above lies the 50-days MA at around $11,250), the momentum could change quickly.

However, as long as Bitcoin having trouble at that price area, the price can easily drop from here.

From below, the first level of support lies around $10,800; followed by $10,500 and $10,400 – where lies the 100-days moving average line (the white line).

Total Market Cap: $357 billion

Bitcoin Market Cap: $202 billion

BTC Dominance Index: 56.8%

*Data by CoinGecko

BTC/USD BitStamp 1-Day Chart

BTC/USD BitStamp 4-Hour Chart

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited – first 200 sign-ups & exclusive to CryptoPotato).

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato