If building and scaling a world-class crypto derivatives exchange is like assembling an aeroplane in flight, then strengthening exchange parameters would be the vital work of the pilot, ensuring the ride is as smooth as possible.

If building and scaling a world-class crypto derivatives exchange is like assembling an aeroplane in flight, then strengthening exchange parameters would be the vital work of the pilot, ensuring the ride is as smooth as possible.

Over the years, we’ve developed BitMEX from the ground up, using our unique Fair Price Marking System to ensure users aren’t unfairly affected by erroneous price movements.

This effort never stops, and in November and December 2020, we made some important updates – the introduction of the Hybrid Composite Index and parameter changes to our existing controls – to help reduce unnecessary Mark Price swings for a better trading experience.

These changes have allowed us to more closely track the ‘true market price’ of the underlying instruments, differentiating the BitMEX platform from competitors with less sophisticated safeguards.

The trading period since these changes were introduced has been among the most active in recent memory, and the platform has performed exceptionally well. A few weeks on, it’s worth examining how the improvements we’ve made during this time are protecting our users and maintaining fair and orderly markets.

Hybrid Composite Index – Increasing Diversity

Generally speaking, the more reliable price sources we can add, the more accurately our index will track the true market price of an asset. But what happens when we would like to add more sources (index constituents) to make our index more robust? And what happens when there’s a shortage of price sources – for example, with the recent delisting of XRP/USD pairs by some exchanges? The introduction of Hybrid Composite functionality is the answer.

This provided a solution to the challenge of maintaining our XRP product, enabling us to identify XRP/USDT constituents to replace the XRP/USD sources lost to delisting. Using the composite, we can now convert and combine prices from USDT underliers with the remaining USD underliers. It’s a complex process with a simple result – allowing us to continue offering the XRP/USD perpetual swap product when many of our competitors could not.

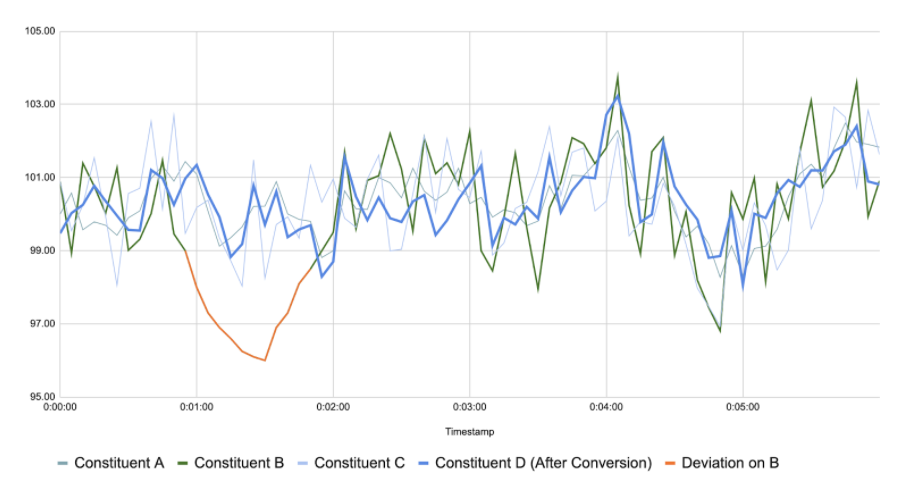

We are also using the Hybrid Composite Index to diversify our index constituents for other products, reducing dependency on individual price sources and making the indices more robust and more resilient to outlier prices on an index constituent. The below graphs show how this helps in a theoretical situation where we’re able to add a fourth price source (Constituent D) to help smooth out the effects of extreme price moves on individual venues.

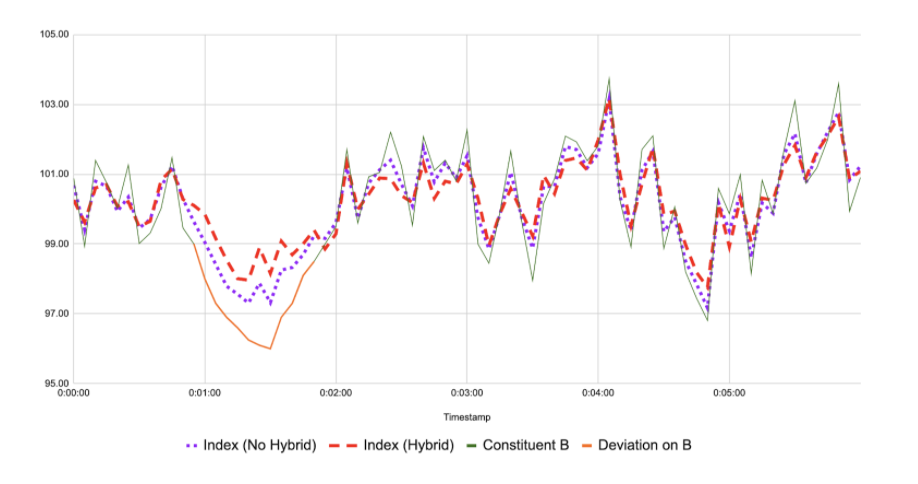

In our new hybrid composite index, where Constituent B is subject to a sudden deviation…

…the impact of the deviation on the index price is reduced.

…the impact of the deviation on the index price is reduced.

The Hybrid Composite Index has many applications and makes our indices more robust through diversity. But the price can still move unnecessarily on the constituents themselves. That’s where the next change comes in.

The Hybrid Composite Index has many applications and makes our indices more robust through diversity. But the price can still move unnecessarily on the constituents themselves. That’s where the next change comes in.

Index Protection Parameter – Filtering Outliers

The exchanges whose feeds we use to calculate our Mark Price aren’t immune to price deviation, so we’ve made a significant change to our Index Protection parameter to help protect our users from sudden, unrepresentative price swings on them. The parameter works by filtering out extreme price movements where the price on a single venue deviates from the median by more than a set percentage.

We’ve reduced the parameter from 25 to 10 percent, giving the platform greater sensitivity to detect erroneous price information while retaining information from genuine large price moves that can begin on one exchange and follow on others.

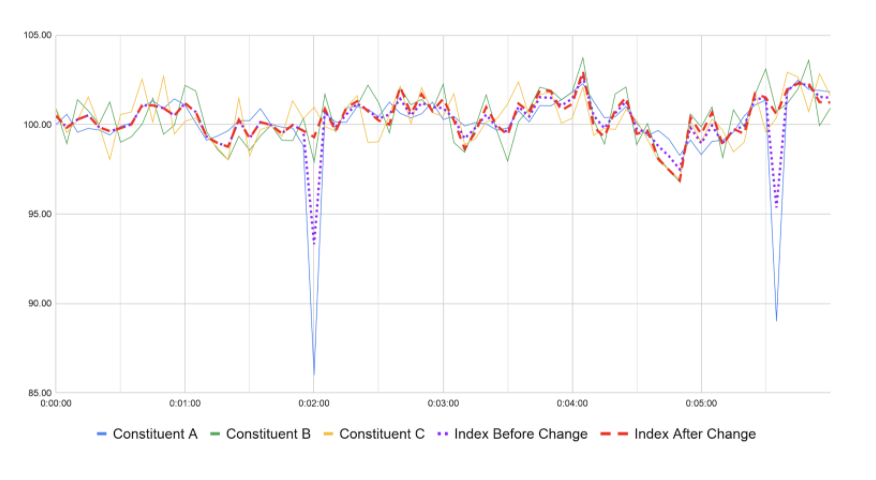

This means that, in the event of a deviation on a constituent exchange in excess of 10 percent, the Mark Price on BitMEX will track the correct price trend, reducing unnecessary liquidations. Here’s a theoretical example of this using sample constituents:

A sudden, erroneous price drop in Constituent A would previously have caused the Mark Price on BitMEX to fall. But after the change in index protection parameter from 25 to 10 percent, the Mark Price is resilient…

…while keeping the correct price trend.

…while keeping the correct price trend.

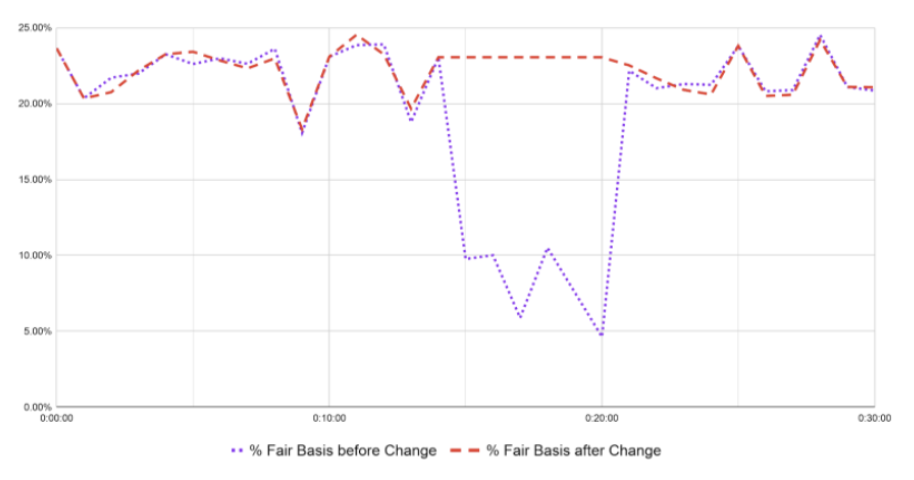

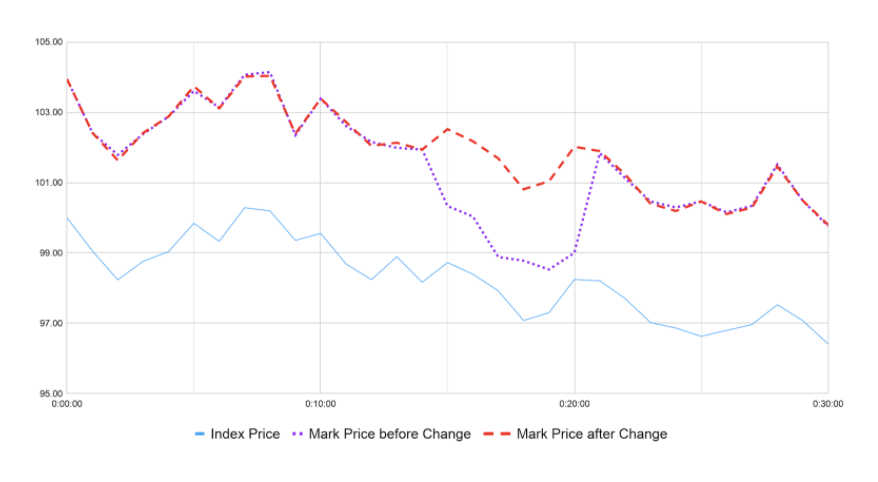

Impact Notional – Only Reacting to Genuine Market Moves

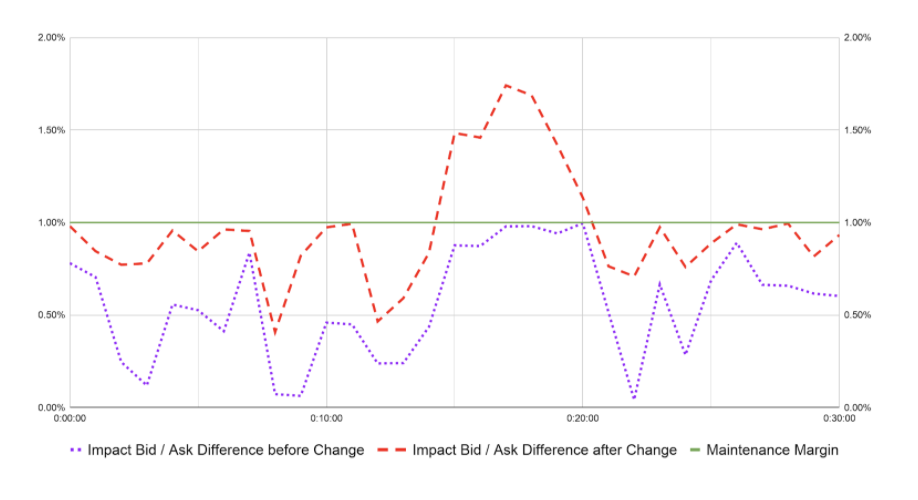

The final change, an increase in the Impact Notional, makes futures contracts on BitMEX more insulated against market shocks caused by, for example, attempted market manipulation or temporary drops in liquidity. In illiquid markets, it’s important to look at metrics other than just Last Price. Our Impact Notional filter takes into account the depth of the order book and reduces the impact a rapid, low volume move may have. By essentially doubling the scope of the orderbook used to determine the % Fair Basis, we’ve made it much harder for an outlying order to change the price and trigger liquidations.

A theoretical example for this is also shown below.

When a sudden drop in liquidity widens the spread…

…the % Fair Basis is not updated under the new parameter…

…the % Fair Basis is not updated under the new parameter…

…preventing unnecessary Mark Price moves.

…preventing unnecessary Mark Price moves.

The Bottom Line

These changes ultimately provide a fair and orderly trading environment for BitMEX users, building upon the protections inherent to our unique Fair Price Marking system, and reflect valued feedback from the BitMEX community. We’re committed to continuously improving our platform, and we will roll out additional measures as they are developed by our team. Until then, happy trading.

For any questions or to provide any feedback, please contact Support.

Related

The post appeared first on Blog BitMex