Bitcoin’s 2020 rally is stalled, for now. However, throw some liquidity and bullish trading sentiment in the mix and you have a winner. In fact, an in-depth look at Bitcoin Futures’ charts suggests that the cryptocurrency’s price may bounce back soon.

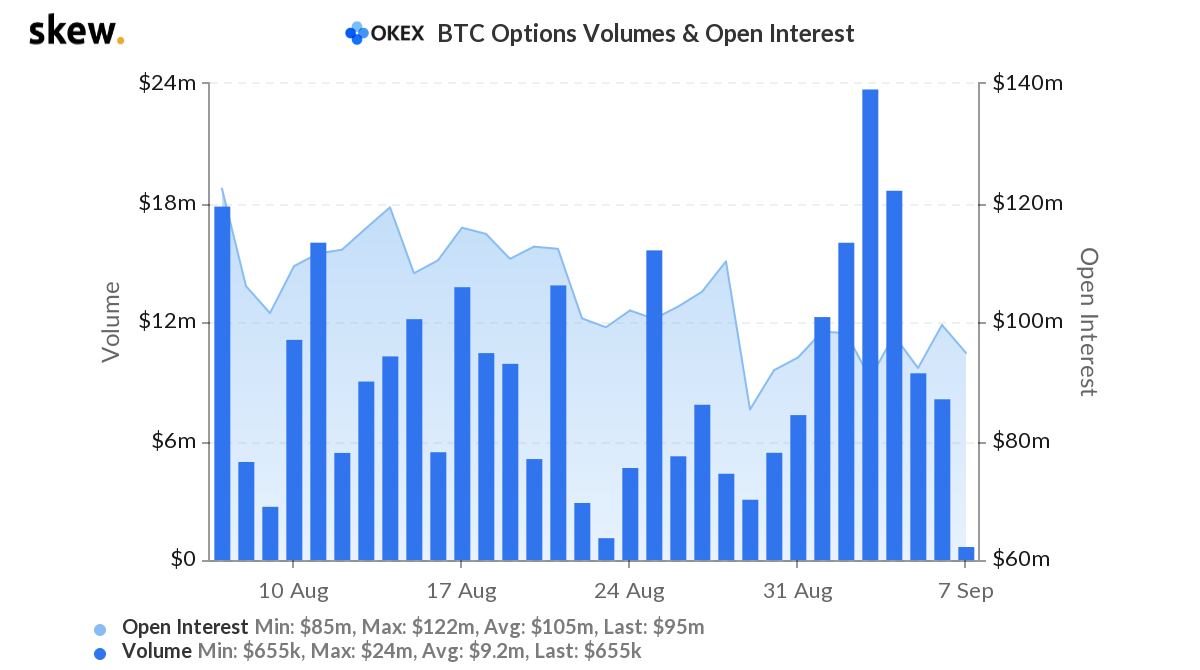

A reason why this may be the case is that Open Interest and daily volume on OKEx, an exchange that enjoys a 33% market share in Bitcoin Futures, are not aligned with the current traders’ sentiment.

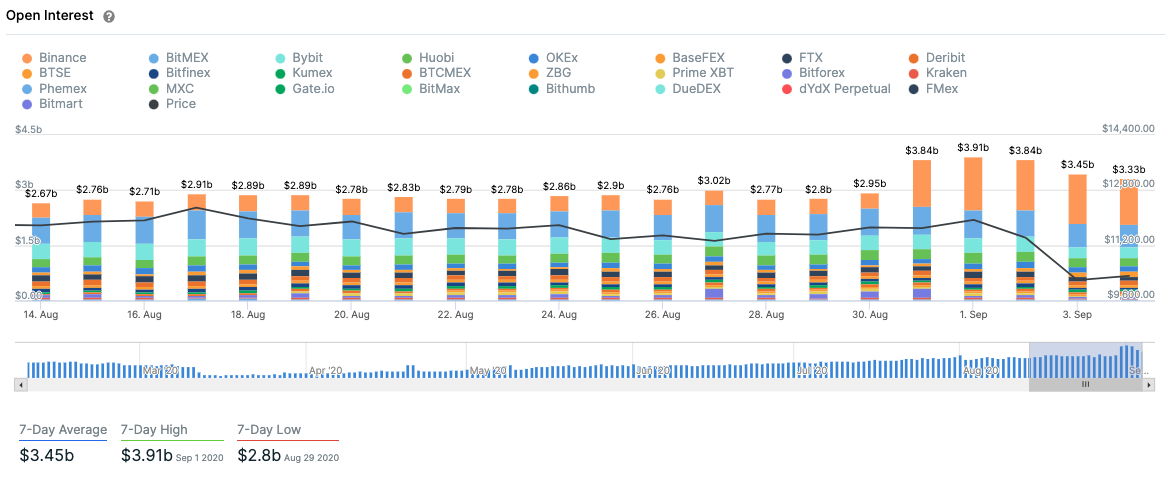

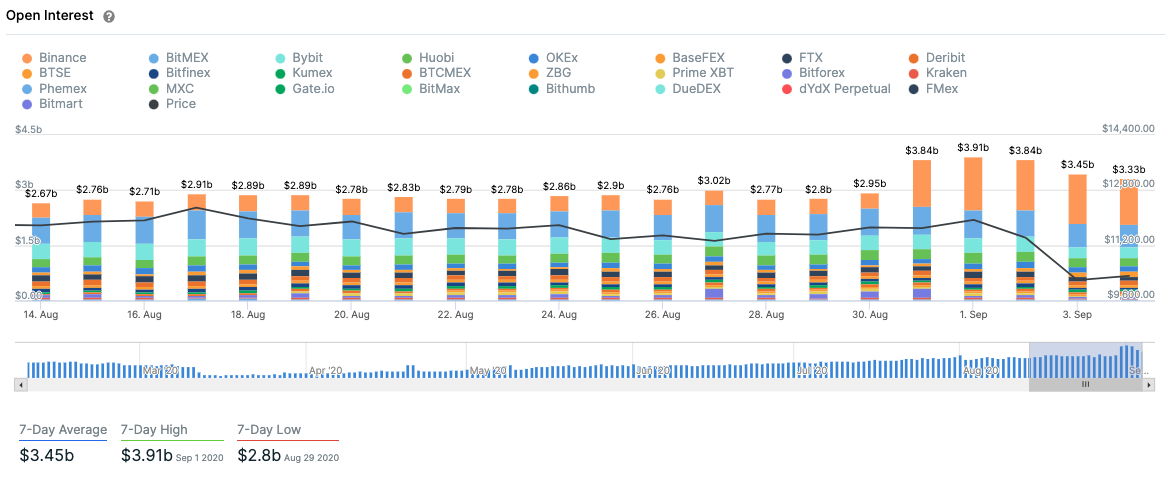

Source: Skew

In fact, despite a drop below $11,500, Open Interest and BTC Options volume has not dropped considerably. Daily BTC Options volume on OKEx has sustained itself well above $90M, with the Open Interest around $100M with occasional drops to $95 M. Interestingly, the level of Open Interest and volume was 60% lower in June and July 2020. However, at the time of writing, there were no signs of a drop to this level. Instead, there may be some recovery later this month, one based on traders’ sentiments.

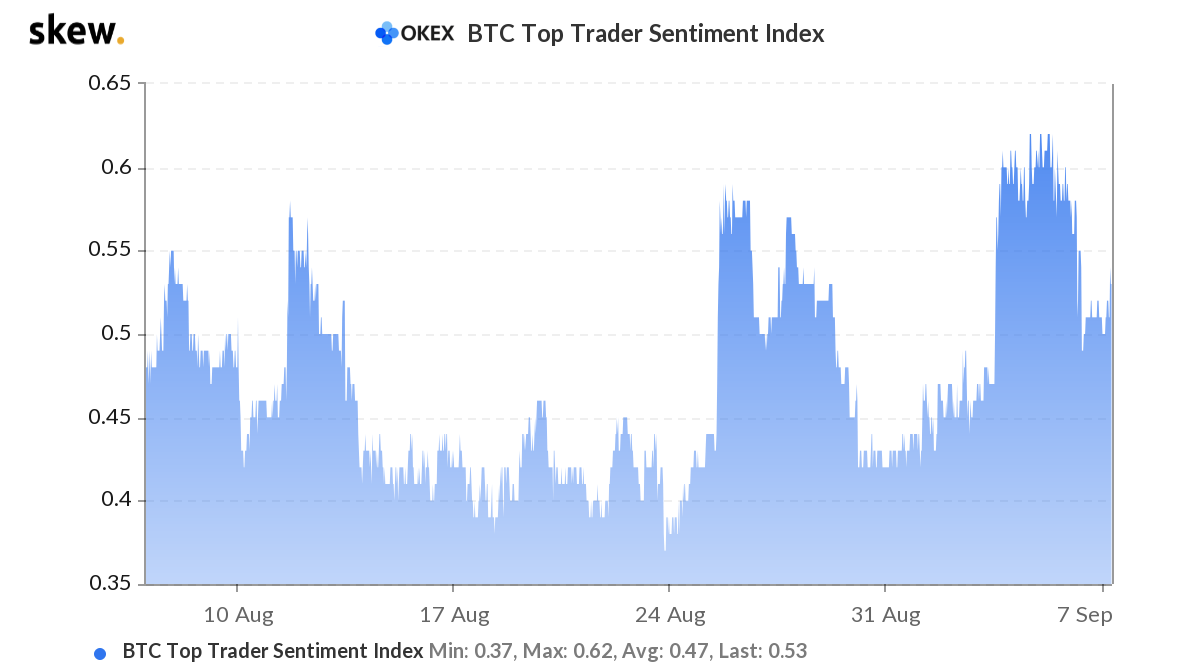

Traders’ sentiment has remained near 0.5 mostly. And despite the drop in price and a brief drop in sentiment, the larger sentiment remains bullish. In fact, one can argue that traders on derivatives exchanges are largely undeterred by the price drop.

Source: Skew

Another chart that points towards upcoming recovery on the charts is Open Interest across exchanges. A deep dive into perpetual swap metrics suggests that a drop in price would lead to a drop in Open Interest too. However, akin to Open Interest on OKEx, across exchanges, positions are being closed and positions are getting liquidated. Ergo, an increase in volatility has pushed the Open Interest higher and weakened the bearish momentum across exchanges.

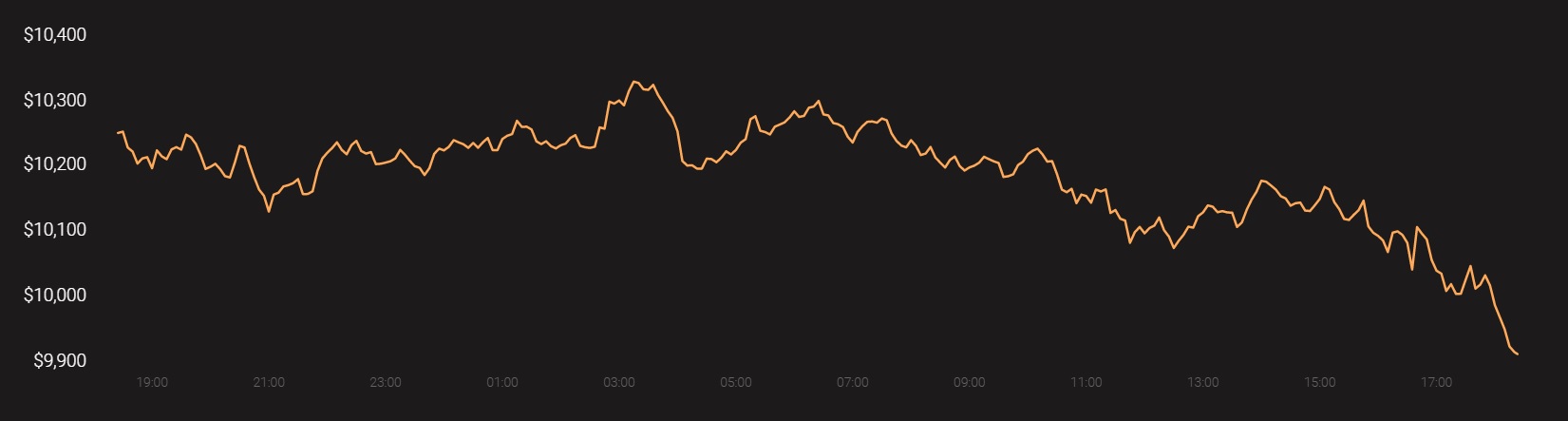

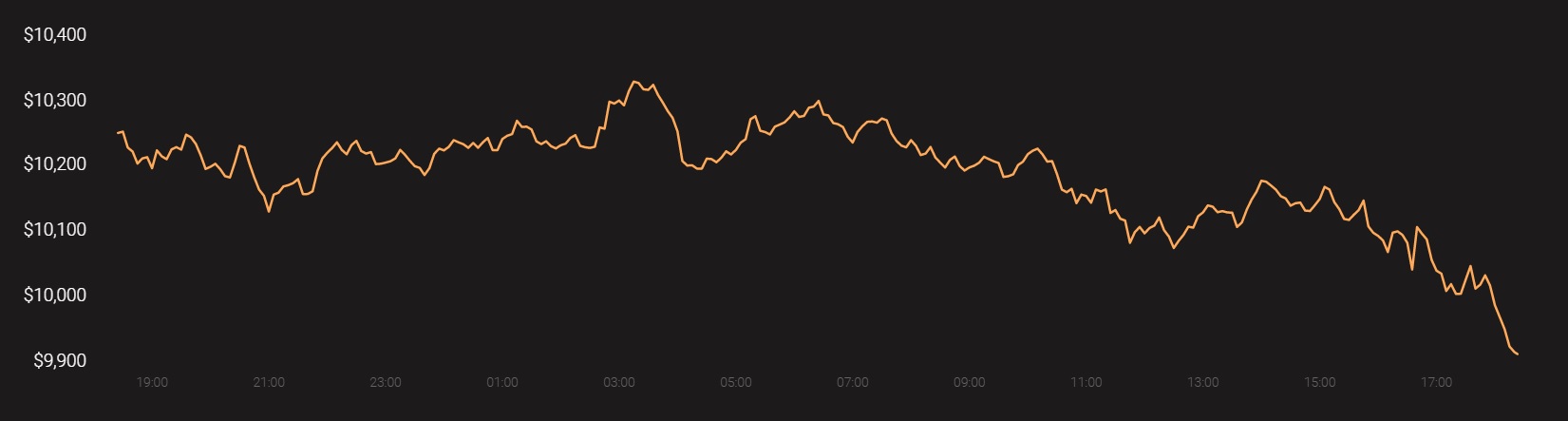

Source: Onchainsights

Further, as a recent Bloomberg report noted, “After 2014’s 60% decline, by the end of 2016, the crypto about matched the 2013 peak. Fast forward four years and the second year after the almost 75% decline in 2018, Bitcoin will approach the record high of about $20,000 this year, in our view, if it follows 2016’s trend.”

Bitcoin’s price, at press time, was 30% above its January levels. It was hovering around $10,000 and may multiply and rise to $20,000 before the end of the year, returning to its 2017 all-time high, according to another analyst.

Source: Coinstats

Analysts would agree that traders’ sentiment plays an important role in the price. This is especially the case in the present market cycle. There are no standard numbers that help determine sentiment and when to buy or sell. However, once you see spikes/trenches on sentiment charts, you may want to enter/exit new positions to ride the rally.

The post appeared first on AMBCrypto