Bank of America (BofA) has a bullish view on gold and expects the prices of the precious metal to hit the $3,000 mark per ounce within the next 18 months, according to the bank’s latest report titled “The Fed can’t print gold.”

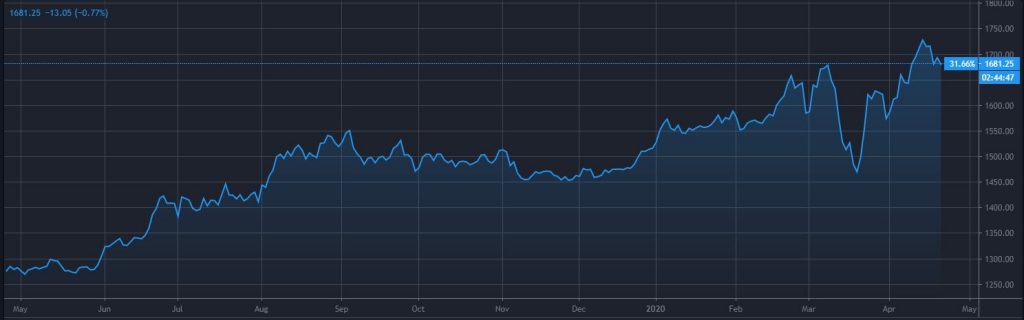

Per the report, gold is the “ultimate store of value,” and the prices have performed well over the last 15 months against other asset classes, even though the bullion recorded a hard sell-off in March. The asset traded around $1,678 today, representing 11% growth this year.

Investors Will Aim For Gold

BofA had earlier placed its 18-month gold-price target at $2,000; the benchmark price is also VanEck’s most recent forecast. However, the bank increased its target to $3,000 as governments around the world continue to print more money to stimulate the economy due to the COVID-19 pandemic.

“As central banks & governments double their balance sheets & fiscal deficits, we up our 18m gold target from $2000 to $3000/oz. The Fed can’t print gold, unlike every other asset,” as reported by the bank.

As policymakers continue to release more fiscal and monetary stimulus plans, Bank of America believes it could put fiat currencies under pressure, thus forcing investors to consider buying gold.

Gold Faces Barriers

For the rest of the year, BofA thinks the average price per oz would be $1,695, and in 2021, the prices would surge by 22% to $2,063, even though the asset has never traded up to that level. The prices hit an all-time high of $1,921.17 in September 2011.

Despite the bullish views, BofA was sure to add in its report that factors like a strong dollar, reduced financial market volatility, and lower jewelry demand in countries like India and China could continue to deter gold from breaking new records.

Meanwhile, famous gold bug, Peter Schiff, recently shared what he thinks is the reason why gold has not surged beyond its current price. According to him, investors are “clueless” about the consequences of the present monetary & fiscal policy mistakes being made by governments. Once they are able to figure it out, the prices of gold will hit new records, he said.

The post Fed Can’t Print Gold: Bank of America Predicts Gold Price To Hit $3,000 In 2021 appeared first on CryptoPotato.

The post appeared first on CryptoPotato