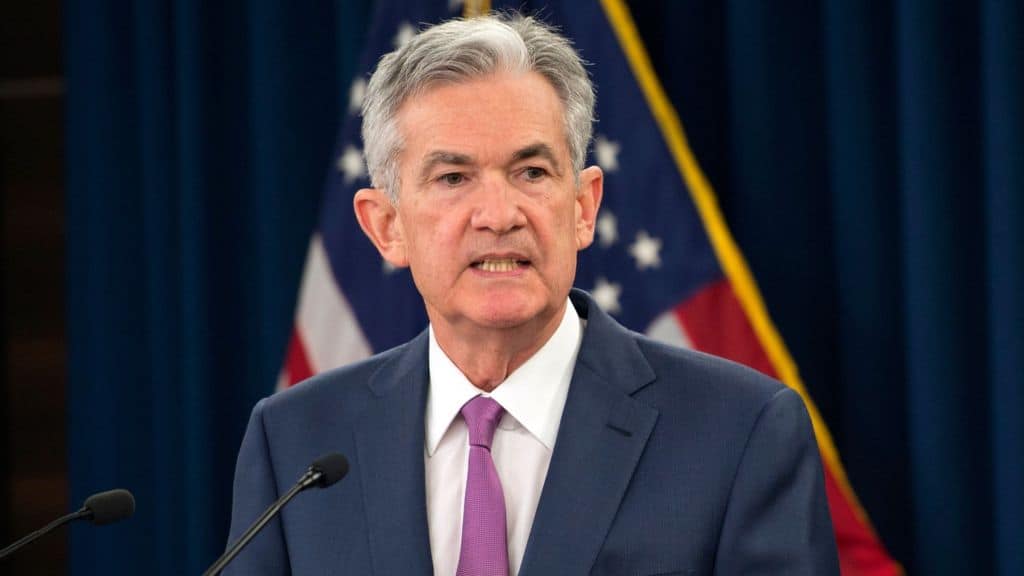

Jerome Powell – Chairman of the Federal Reserve – recently testified in front of the House Financial Services Committee on the state of the economy, and future monetary policy. Given the various sanctions placed on Russia during its conflict with Ukraine, he said the conflict “underscores” the need for crypto regulation that he’s advocated for months.

Maintaining Effective Sanctions

Following his testimony on Wednesday, Powell was asked whether Russia could potentially use cryptocurrencies to bypass the slew of sanctions recently placed on the nation.

Following its announcement of “special military operations” in Ukraine, Western nations have taken major measures to damage Russia’s economy through a trade war. These include “export blocks on technology” from the US to Russia, alongside a massive cutoff of Russian banks from SWIFT.

“[The Ukraine-Russia conflict] underscored the need for Congressional action on digital finance including cryptocurrencies,” Powell responded. “We have this burgeoning industry which has many parts to it, and there isn’t in place the kind of regulatory framework that needs to be there.”

Since cryptocurrencies like Bitcoin allow for peer-to-peer cross-border transactions, they are difficult for governments to enforce trade restrictions on. Western allies are already raising concerns over how Russians may take advantage of them during the conflict, including European Central Bank President Christine Lagarde.

ADVERTISEMENT

Powell also mentioned how crypto could be exploited by nefarious actors like terrorists, further underscoring the need for adequate regulation. Though he has no intention to ban cryptocurrency like China, he and lawmakers have long acknowledged the money laundering risks presented by digital assets – especially stablecoins.

The Role of Exchanges

Regulators effectively have one major chokepoint to block or hinder crypto transactions: exchanges.

To better enforce sanctions, Ukraine officials have called on crypto exchanges to blacklist Russian addresses, in order to “sabotage ordinary users”. However, some exchanges like Kraken and Binance are not on board, citing the libertarian values that cryptocurrencies are supposed to represent.

Hillary Clinton – former first lady and US presidential candidate – expressed displeasure with their decision, showing dismissiveness of their philosophy. She wishes that all parties would do as much as possible to damage Russia’s economy at this time.

That said, cryptocurrencies are proving beneficial to Ukrainians as well, with tens of millions of dollars being sent to the country through Bitcoin, Ethereum, and others assets.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to receive up to $7,000 on your deposits.

The post appeared first on CryptoPotato