In times of pandemic, uncertainty, and risk, exposure to new of investments is more a necessity rather than a recommendation. According to Fidelity, one of the largest brokers in the U.S., Bitcoin is an excellent investment for those considering to exit banks and enter the markets.

In October 2020, Fidelity Digital Assets, a branch of Fidelity focused on the crypto markets, released a report named “Bitcoin Investment Thesis: Bitcoin’s Role As An Alternative Investment.” In it, they analyze Bitcoin’s role as an investment and what the future could bring for the world’s first cryptocurrency.

And things look quite good —for those willing to take risks.

How Fidelity Sees Bitcoin Today

For Fidelity, Bitcoin offers significant advantages over traditional financial instruments. In fact, they claim that the strength of the original cryptocurrency lies in its low correlation with any other asset within an investment portfolio.

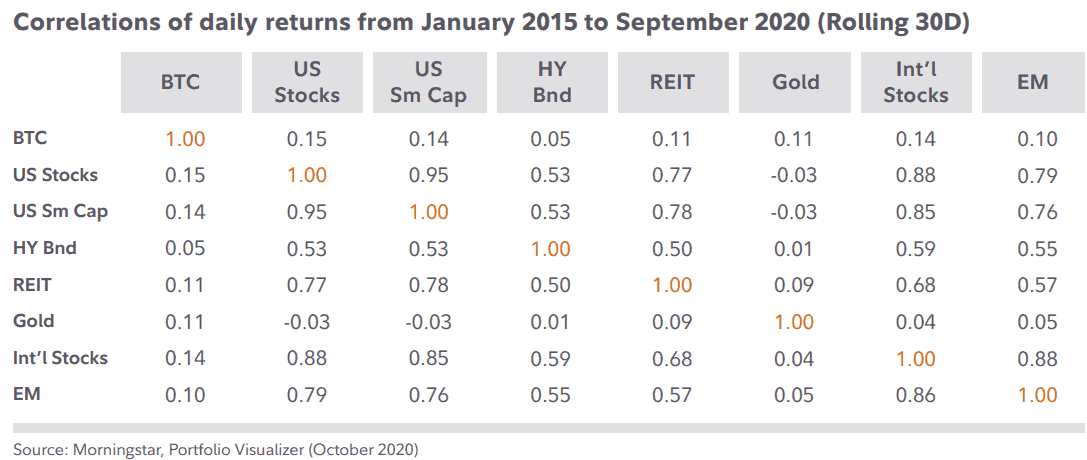

Fidelity compared Bitcoin’s performance against several investments and found that the correlation between them is minimal. This suggests that Bitcoin actually acts as an independent player and has its own particular dynamics.

This is good for investors. According to Fidelity, Bitcoin could be classified as an alternative asset that allows hodlers to protect their wealth by exposing themselves to a commodity for which the risk doesn’t depend on what happens to other markets.

In other words, it’s a kind of cushion for a portfolio with diversified investments.

Fidelity recommended an investment strategy of up to 5% of total assets in Bitcoin. People should buy or sell it when the proportion decreases or increases. This creates discipline in investors and ensures Bitcoin’s role as a wealth booster:

“Consider a portfolio with a target allocation of 5% bitcoin. If bitcoin’s allocation rises to 10% of the portfolio due to its outperformance relative to other assets, a disciplined rebalancing strategy would dictate selling bitcoin to bring its allocation back to the 5% target and using the funds to increase the allocation to other asset classes, which have drifted below their target allocation. If bitcoin underperforms and declines to 1% of the portfolio, investors would buy bitcoin and sell their position in other asset classes that are above their target allocation. An advantage of rebalancing is that it forces investors to have the discipline to buy low and sell high.”

What the Future of Bitcoin Looks Like

The future looks even more promising in the eyes of those who might read the report. Money flows from traditional investments into Bitcoin could boost its price and turn BTC into mainstream investment instead of being just a niche market.

Fidelity explains that current circumstances can catalyze this massive capital migration:

“If bitcoin were to capture 5% of the alternatives market as measured by CAIA, that would equate to an incremental $670 billion growth in its market size. If it were to capture 10%, that would expand its market size by $1.3 trillion.”

Considering that BTC’s supply is limited, and its inflation rate is predetermined, a trillion-dollar capitalization would imply an exponential price increase.

Fidelity just published a report showing how TRILLIONS of dollars could flow into #Bitcoin over the next few years.

It’s worth reading the full report: https://t.co/PEO31aE90q

h/t @DigitalAssets pic.twitter.com/xvwC9IvRcJ

— Chris Dunn (@ChrisDunnTV) October 13, 2020

Another critical factor to consider is that more and more institutional investors are getting involved with Bitcoin as time passes on. This would be good for the markets, as it would eliminate some preconceived ideas, giving the average user greater security when investing in more something more profitable than the fixed-income securities and low-volatility products that exist today.

And considering that this company has more than 3.3 billion dollars under management, it might be good to listen to what they have to say.

The post appeared first on CryptoPotato