(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Sometimes you just want to experience pain to remind yourself that you still exist. Maybe that is why I thought walking on to the University of Pennsylvania rowing team was a good idea my freshman year. I was not good, and I only lasted a semester– and this is mostly because I did not appreciate that being a good rower requires six days a week of self-inflicted corporal punishment.

The Penn boathouse sits on the picturesque banks of the Schuylkill River. When practice was on the water, I rode my dilapidated bike 2.5 miles each morning or afternoon to practice (we were advised to purchase inexpensive bikes, as theft was quite common in and around campus).

To me, the highlights of my short-lived experience on the crew team were the rare moments on the water when my boat of novices “got it”. Whenever we were harmoniously gliding across the placid waters with the sun rising over downtown Philadelphia, I sincerely appreciated the beauty that rowing brings to the human experience.

But it was a dichotomous experience, as the life-affirming serenity of human bodies exerting themselves in a rhythmic fashion sometimes gave way to the other side of the coin… death. Periodically, decomposed human bodies – which we affectionately referred to as “floaters” — surfaced next to us intrepid athletes. Some had likely gone to their watery grave voluntarily, and others were wearing the latest fashion of concrete foot apparel. But regardless of how they got there, after these individuals had spent sufficient time submerged under the cloudy depths, some unfortunate rowers would discover a silent water logged companion floating next to them.

Just like on the Schuylkill, there are floaters lurking just below the surface of the capital markets. These are companies or hedge funds that seem to be getting along fine, until some calamitous volatility event fatally compromises their ability to remain a going concern. To the untrained eye, these zombies might have appeared to be alive and well– but they got deaded a long time ago by unsustainable business models and trading strategies. This past week witnessed the lightspeed bankruptcy / insolvency of a few high profile business and hedge funds that previously were thought to be masters of the metaverse.

Unlike the human dead, the living dead of capital markets carry their possessions with them into the river Styx, bobbing just out of sight underneath opaque waters. It is only once their souls finally succumb to their macabre reality, and market conditions force their carcasses to the surface, that these companies’ worldly possessions are unearthed – and ultimately auctioned off in a fire sale. For those intrepid living capital markets explorers who possess the resources to harvest the fruits of the dead, the capital markets zombie apocalypse is welcomed.

During the fire sale of the dead, pristine assets with solid fundamentals suddenly become inexpensive. But beware, not all assets are made equal. Many of the zombies’ possessions deserve to travel with their hosts down to the underworld. It requires the utmost discipline to separate what is irrationally cheap from what fundamentally deserves to perish. The key determining factor is always cash flow.

I know that in this new era of life-changing technology, such pedestrian concepts of cash flows seem banal. However, when we enter the sepulchre, we must be like Indiana Jones and the Holy Grail, eschewing obvious beauty for the plain value of projects or businesses with real cash flows driven by strong usage.

The time is upon the faithful to sow seeds for the next bull harvest. The time is now to re-discover the merits of category-defining DeFi projects and decentralised applications (dApps) that are being dumped indiscriminately alongside copypasta trash. There exists a universe of projects that are category leaders in the substrate that will allow the faithful to construct an entirely new decentralised financial system.

These projects have the following characteristics:

- They are down 75% – 99% from their late 2021 all-time highs.

- They have actual users that spend real capital to access their services.

- They are the first projects defining how key DeFi services should be offered.

Let us walk through the valley of darkness and scoop up the discarded baubles of the funds that are no longer with us or are not long for this world. These zombies are in the process of liquidating a significant number of assets so that they can meet margin calls and investor redemptions.

Duration Mismatch

What happens when you borrow short-term money, but lend / lock up funds over the long term? This is the cause of just about every banking-led financial crisis. Prior to the 2008 Global Financial Crisis, Goldman Sachs, Morgan Stanley, Merrill Lynch, Bear Stearns, and Lehman Brothers were true investment banks. They did not accept retail deposits, which meant they had a freer hand to pursue riskier and more lucrative business lines.

During my stint at undergrad business school, landing a gig at one of the true investment banks was the dream. Commercial banks like JP Morgan and Citigroup were thought of as one rung below. Fast forward to September 2008, and every single investment bank who borrowed in the wholesale short-term debt markets but effectively lent long term either took a government bailout, was bought by a commercial bank, or went out of business.

The crypto flavour of this in 2022 features firms that borrowed short-term money at high rates from retail hodlers, and locked it up long term into DeFi yield farming strategies. Howooo, calling the Luna wolf pack!!!

When retail recently demanded their capital back, the duration mismatch destroyed these companies’ business models. BlockFi sold equity first, and therefore sold it best. They procured additional financing at a 66% discount to their previous round … ouchie … but at least they did not have to halt withdrawals.

While Celsius is the highest profile “floater”, there are other cadavers that will wash up on the shores of the crypto river Styx. Every morning my Telegram is lit up with so-and-so telling tales that such-and-such company engaged in crypto lending is fini. Those who do not study history are doomed to repeat it. There is nothing special about this business model, except that somehow these companies were able to trade at astronomical price-to-book ratios. Thank you VC money, keep pumping the market full of that fee-adjusted beta!

As this cohort of firms is forced to puke out any asset that is not locked in some long-term yield strategy, look out below. More indiscriminate selling of all liquid assets on their loan books will occur so these lending firms may return assets to their retail depositors.

The Calendar

In “Shut It Down!” I laid out my thesis for why I believed the market bottomed shortly after the TerraUSD-led crypto market implosion. I also described my view that while I believed a bottom was in, that didn’t mean the market wouldn’t retest those levels in the short term as the high clergy of finance wields their flaming sword of rate hikes to cool rampant inflation.

The universe, the earth, nature, and ultimately humanity moves in cycles. For money managers, the quarter-end cycle is extremely important. Due to the way in which results are reported and redemptions are processed, quarter ends take on extreme importance. It is obvious to all that for many crypto asset managers, the second quarter was disastrous. As the weeks drag on, the market will continue to see investor letters and regulatory filings describing the magnitude of losses incurred by funds and businesses on the back of the crypto capital markets shedding close to 50% of its value over the second quarter.

Humans react poorly when presented with losses. The majority responds by demanding their capital back, regardless of how it diminishes long-term prospects for profit. I can only imagine the flood of redemption requests many funds are processing as the quarter draws to a close. Compounding the issue is that unlike many alternative assets, crypto trades 24/7. There is always a price, which means investors can watch their capital evaporate in real time, all the time. There is no excuse for a fund manager to delay exiting any positions that still have value.

A Short Primer on Hedge Fund Maths

I also must add that hedge fund maths will exacerbate the closure of funds. Given that most crypto hedge funds are below their high water mark, it makes financial sense for the manager to close fund A but then raise a new fund B. This simple example will illustrate why.

Imagine investors gave you $100 in January, and you put all your money into the TerraUSD carry trade. You were able to exit the trade and only lose 50% of your money. Your capital is now $50, but you cannot charge any performance fees. You can only charge performance fees once you return your capital base back to $100, which means you must double your assets. That is hard work, which pays you NOTHING!

Vs.

After you lose the $50, you close the fund and liquidate all remaining assets. You then raise another fund. If you turn $50 into $100, you get to charge performance fees on the $50 of profit. This is hard work, which pays you well.

The yearly linear return payout structure of hedge funds means that investors are always short volatility at the discretion of the hedge fund manager. The path dependency does not favour the investor. Bringing it back to the current market situation, it makes more sense for a manager to close their current fund, liquidate all assets, then raise another fund and purchase the same assets at bargain prices in a few weeks / months time. This allows them to actually profit from the revival of the crypto market. However, it does bring more sell pressure to the market in the short term.

During this last bull market cycle, capital flooded into institutional money managers who offered some flavour of a DeFi fund. Most times, these beta-chasing outfits just bought the market leaders in various categories. That includes lending, proto-crypto banking, both spot and derivatives decentralised exchanges, NFT marketplaces, and decentralised domain name service protocols, just to name a few. To bolster returns, many of these funds engaged in the mother of all carry trades, powered by TerraUSD.

The weekend after TerraUSD imploded, I pulled up my screens and was shocked at how many of what I consider to be the best DeFi projects were down 50% from a few days earlier. These projects were not analogous to TerraUSD. My conclusion was that many DeFi funds had such large exposures to UST (via earning 20% on Anchor) and LUNA that they had to sell everything in their books to meet capital class stemming from losses on Terra ecosystem coins and projects.

As the lotus takes nutrients from the swap and creates beauty, I knew it was time to strap on risk in the face of this TerraUSD calamity. My mental model is simple – I want to own the things that power the basic financial services of DeFi. These services previously traded at nose-bleed price-to-earnings ratios and were now deeply discounted. If I fundamentally believe that the usage of DeFi will grow over time, then I must get long all the key financial service providers at these levels.

Just because something is cheap on day one, doesn’t mean it can’t get cheaper as time drags on. As I row through the river Styx, I fully expect to encounter more floaters. These floaters will puke tokens as their portfolios are forcibly unwound. In light of this, I tempered my initial excitement, and revisited the macro. The Fed just started the reduction of its balance sheet this month. The ECB will shortly enact its first rate hike. (Side note: Maybe Lagarde should take a break from thumping the merits of crypto and focus on alleviating the inflation-induced poverty in the EU that her august body is responsible for).

Given the likely fallout of these events, and as I look at the northern hemispheric summer calendar, there is one particular weekend that strikes me as a likely candidate to host the final showdown between panic sellers and a bidless market – the weekend of July 4.

By June 30 (second quarter end), the Fed will have enacted a 75bps rate hike and begun shrinking its balance sheet. July 4 falls on a Monday, and is a federal and banking holiday. This is the perfect setup for yet another mega crypto dump. There are three ingredients to this humble pie:

- Risk assets will again rediscover their dislike for tightening USD liquidity conditions sponsored by the Fed.

- Crypto funds must raise fiat to satisfy redemption requirements by continuing to sell any liquid crypto asset.

- No fiat can be deployed until Tuesday, July 5.

June 30 to July 5 is going to be a wild ride to the downside. My $25,000 to $27,000 Bitcoin and $1,700 to $1,800 Ether bottom levels lay in tatters. How low can we go? I believe we’ll find out on this fateful weekend. This week Bitcoin and Ether bounced off of $20,000 and $1,000 respectively in an impressive fashion. Can they hold a renewed attack on these levels during a weekend where no fresh filthy fiat can be deposited on crypto exchanges?

While Bitcoin and Ether hopefully won’t get much cheaper, it will be goblin town for the rest of the shitcoin complex. The rest of this essay is a study in why I have faith in a small subset of protocols that actually have real use cases and users willing to pay real money for DeFi financial services.

Caution

Just as I own Bitcoin and Ether, I own every shitcoin featured below. Do not take this as financial advice. Rather, I implore you to critique my thought process and challenge yourself to find value during these trying times.

C.R.E.A.M.

Cash

Rules

Everything

Around

Me

WuTang 4 life!

When in doubt, return to basics. In its end state, every business must generate cash flow. Even when tech investors focus on user growth at all costs, they are expecting that these acquired users can eventually be monetised in some fashion.

Successful DeFi protocols offer a service to users, and in return users conduct some activity that nets money for the DAO controlling it. Paying users to participate by issuing tokens works to an extent, but users must be willing to part with scarce capital for the service – otherwise, it is just an exercise in ponzinomics.

There are a few marquee projects that rose to prominence in their respective verticals during the DeFi summer of 2020. As of today, these projects actually have users and robust protocol revenues that, at the direction of governance token holders, are distributed in various ways. A plethora of projects followed and attracted large sums of investor money by imitating the successful business models of pioneering projects, but many have failed to attract actual users and usage.

Unfortunately, financial services lend themselves to natural monopolies quite easily. In most of these major DeFi verticals, there are only three to five that are regularly used by actual users and are generating real revenues. Because of this, the protocol value of challengers will likely quickly trend to zero as this bear market drags on.

Underpinning this analysis is a critical assumption. As every one of the projects analysed is built on Ethereum, I assume that over time, the number of Ethereum wallets will continue to expand exponentially. Therefore, I expect that the Total Addressable Market that can use these DeFi services will continue to grow. This gives me confidence that DeFi will not wither away and die, and I can apply mean reversion thought processes that guide me to determine which projects look attractive relative to their past performance. It also allows me to assume that the total fees generated by these projects will continue to expand even if there is a short time period where activity and revenues fall or stagnate due to this current bear market.

I will make use of the Token Terminal service to chart Price-to-Earnings (P/E) multiples for all the projects discussed.

Price = Fully Diluted Market cap

Earnings = Last 30 days of onchain fees that accrued to the protocol, annualised. E.g., if the shitcoin protocol earned $100 of fees in the last 30 days, that would annualise to $100 * 365/30 = $1,267.

Sales = Last 30 days of total onchain fees charged for the service, annualised. This in some cases will be higher than Earnings, as some protocols distribute a portion of fees directly back to liquidity providers.

The Decentralised Exchange (DEX)

Uniswap is the largest DEX by average daily trading volume. The design of this protocol is the most beautiful piece of decentralised financial technology ever created. Of course, Uniswap was not the first decentralised asset swapping service launched on Ethereum. EtherDelta and a few other projects came before. However, the team at Uniswap took the proto spot DEX and transformed it into the most game-changing DeFi primitive created thus far.

Uniswap at its core offers a service that allows for the creation of user-directed liquidity pools to swap one ERC-20 asset for another. The protocol charges a fee that is split between the liquidity providers and the protocol itself. The Automated Market Maker (AMM) uses a constant product curve to determine the clearing exchange rate based on the intended trade size and the amount of total liquidity. All interactions with the protocol are fully transparent because they are on-chain. This completely changes the microstructure of the market.

I believe that DEXs are the future of trading when it comes to non-professional trading houses. I say that because the evolution of centralised exchanges (CEXs) tends towards a market where flows are dominated by a few large high-frequency trading (HFT) firms. Due to their outsized trading volumes, these firms dictate the policies of CEXs. As time passes, crypto CEXs will resemble their TradFi counterparts more and more. The market becomes not a race for price discovery based on the disparate views of profit-seeking human traders, but a race for supremacy in technology infrastructure spending.

For the first time ever, retail traders have at least a choice in the type of platform they choose to trade on. The CEXs will adopt policies that favour HFT firms at the expense of retail traders, and I predict that the DEXs will cater towards policies that better engage retail traders due to their community ownership model enabled by governance tokens and DAOs.

Both crypto CEXs and DEXs will continue to grow their trading volumes, but I believe they are not competing for the same type of order flow – which leads me to believe that both can grow together as the crypto capital markets reach a wider audience of traders.

Sushiswap is a fork of Uniswap (remember, the code for all these projects is open-sourced) with a different token distribution model. I chose to analyse these two dominant spot DEXs. Uniswap commands far and away the most market share, regardless of layer-1 chain. I excluded a few large projects for various reasons from my analysis.

Curve – While this is a dominant platform, it is focused on the trading of stablecoins, and I am more bullish on the trading of shitcoin vs. shitcoin. Also, even at these depressed prices, Curve trades at a 108x P/E – it’s hardly cheap.

PancakeSwap – There is nothing inherently wrong with Binance Smart Chain, but it is not decentralised nor does it pretend to be. It also isn’t super duper cheap, its current P/E hovers around 25x.

There are other large spot DEX projects on Avalanche and Solana which I also did not evaluate. I’m a bit of an Ethereum maxi when it comes to smart contract layer-1’s. Soz.

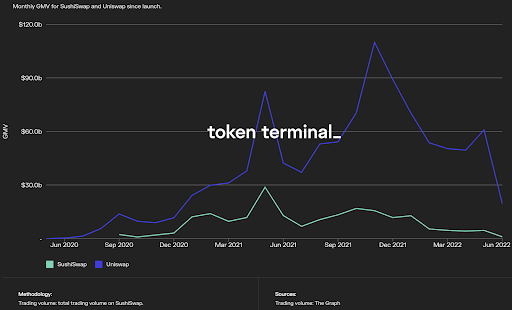

Both Uniswap and SushiSwap charge trading fees. The key metric to determine their value is the total fees that accrue to the protocol (earnings), which has a direct relationship with average daily trading volumes.

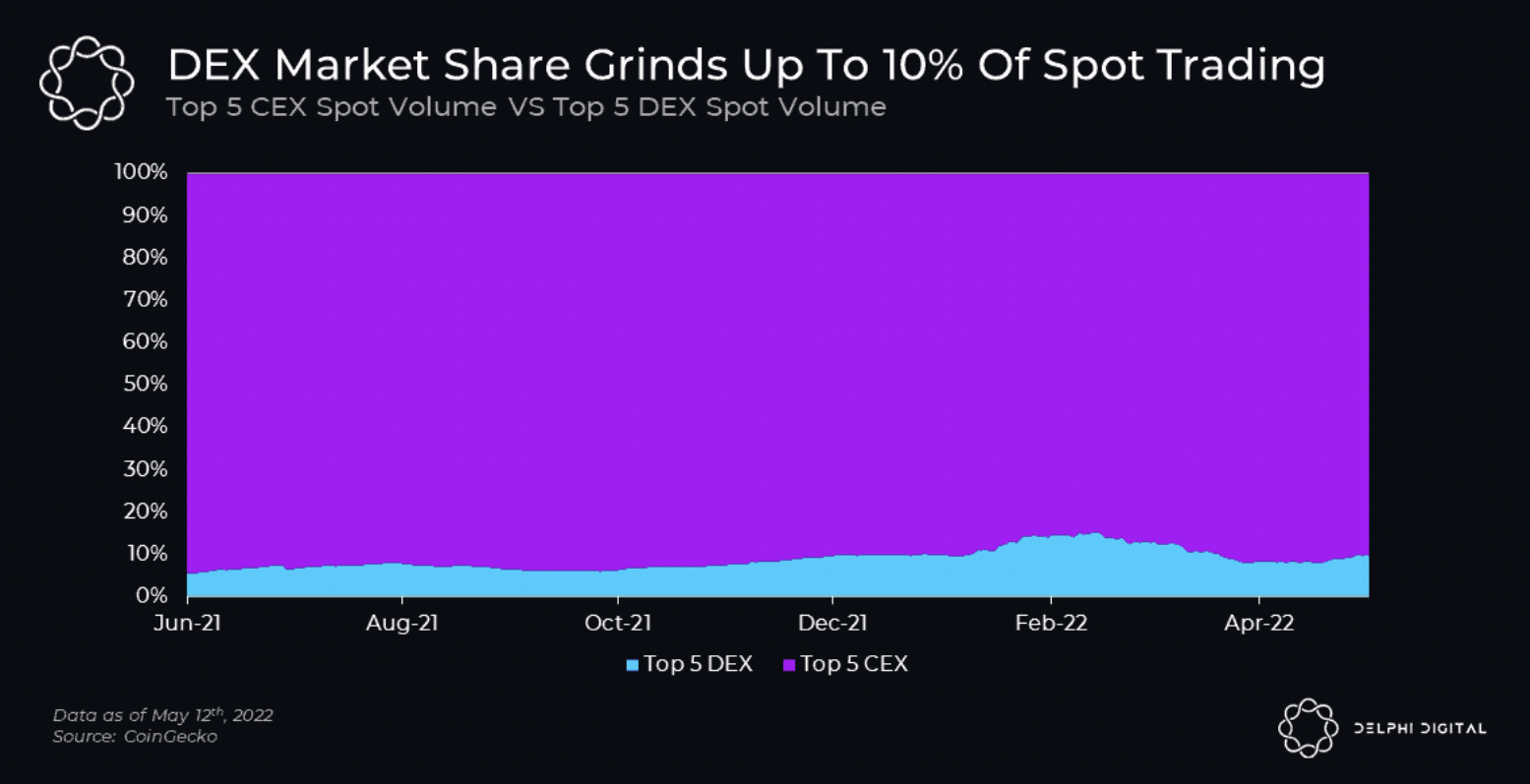

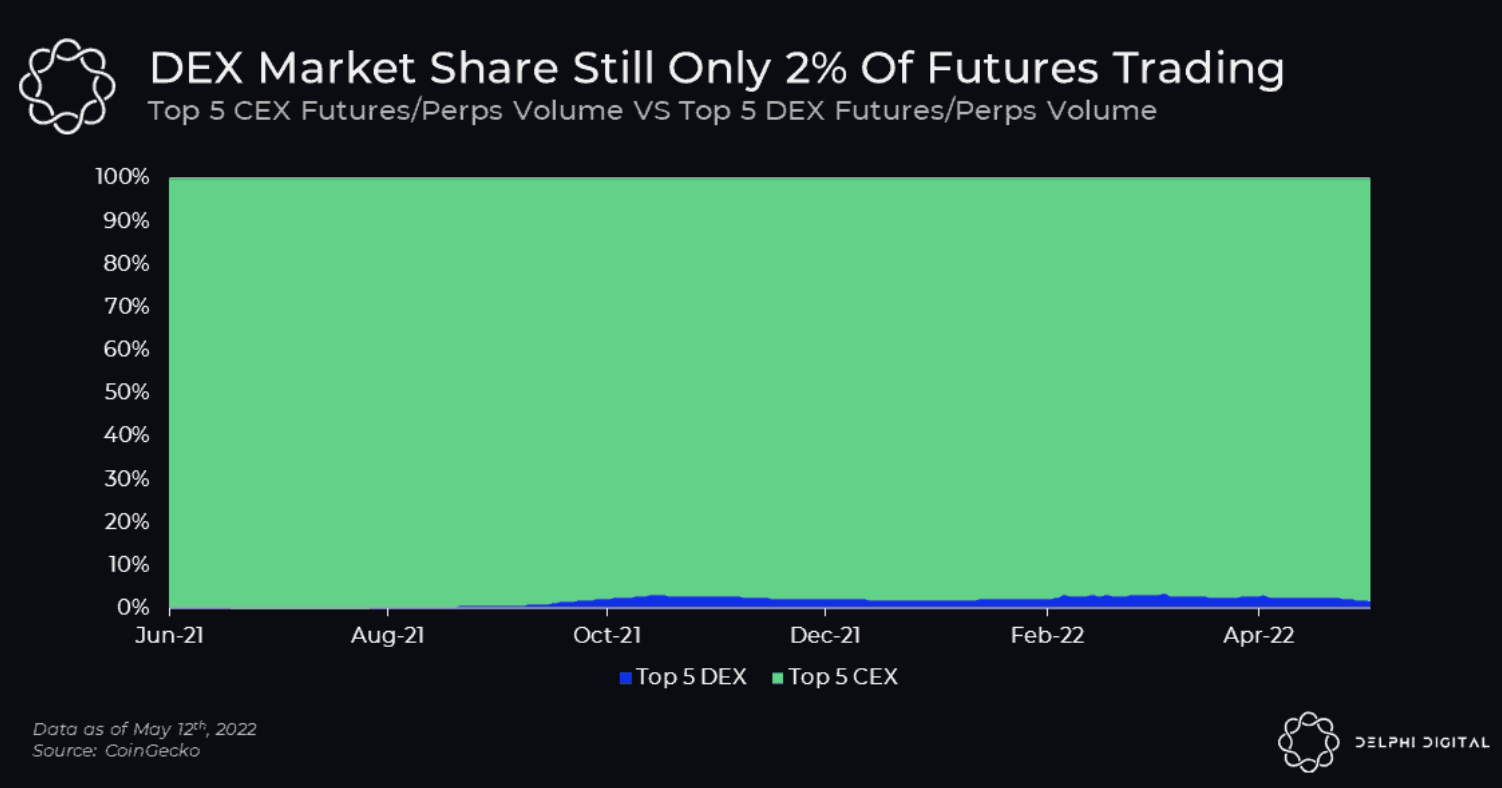

The above chart from Delphi Digital tells a compelling story that the DEX spot market share is not insignificant. It has grown YoY, and I believe it will continue to do so in the near future for the reasons laid out above. The key takeaway is that the dominant spot DEXs are useful to a small but growing cohort of traders. Irrespective of a nuclear bear market, traders will still trade, and thus the future is one filled with more and more trading fees.

The above chart from Delphi Digital tells a compelling story that the DEX spot market share is not insignificant. It has grown YoY, and I believe it will continue to do so in the near future for the reasons laid out above. The key takeaway is that the dominant spot DEXs are useful to a small but growing cohort of traders. Irrespective of a nuclear bear market, traders will still trade, and thus the future is one filled with more and more trading fees.

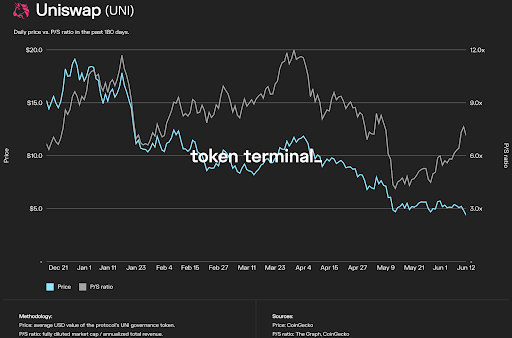

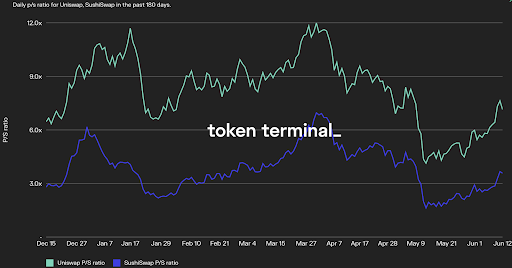

Uniswap P/S Ratio

As of right now, Uniswap fully distributes fees to liquidity providers. My assumption is that in the near future, token holders will vote for a portion of the fees earned to be distributed to themselves. This is why the graph features a Price to Sales (P/S) ratio instead of a P/E ratio.

As of right now, Uniswap fully distributes fees to liquidity providers. My assumption is that in the near future, token holders will vote for a portion of the fees earned to be distributed to themselves. This is why the graph features a Price to Sales (P/S) ratio instead of a P/E ratio.

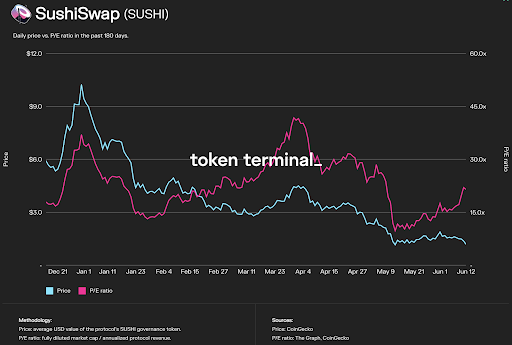

SushiSwap P/E Ratio

Uniswap vs. SushiSwap P/S Ratio

Uniswap vs. SushiSwap P/S Ratio

Here is Uniswap’s and SushiSwap’s P/S ratio, compared side-by-side. Sushi is definitely behind Uni from a valuation standpoint. However, as I will illustrate below, when contextualised against a leading TradFi exchange, these are bargain basement valuations.

Here is Uniswap’s and SushiSwap’s P/S ratio, compared side-by-side. Sushi is definitely behind Uni from a valuation standpoint. However, as I will illustrate below, when contextualised against a leading TradFi exchange, these are bargain basement valuations.

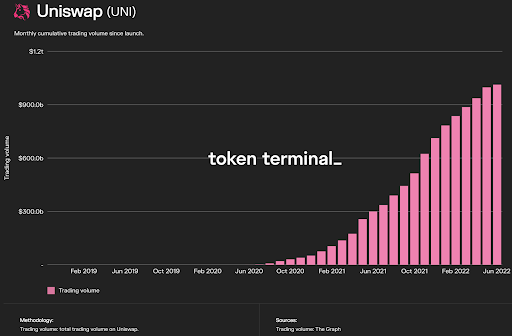

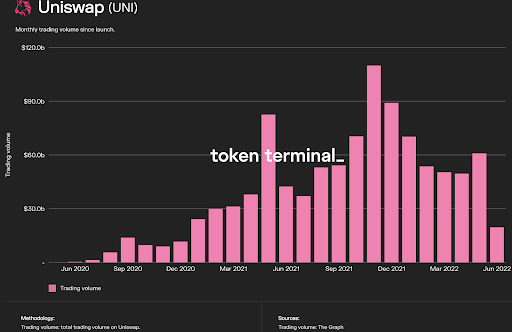

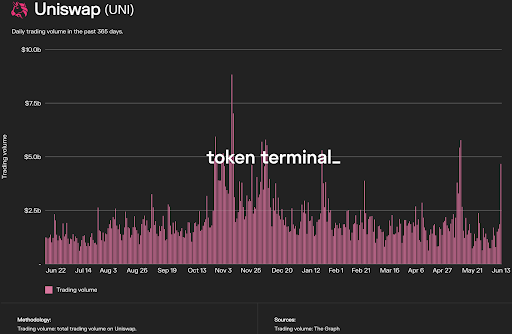

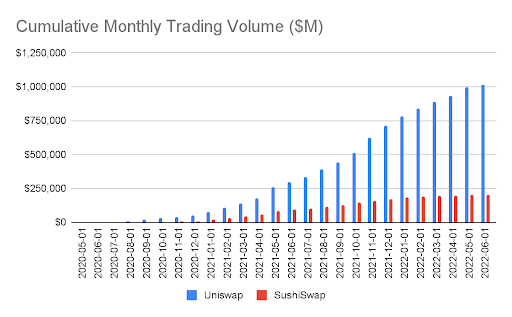

Uniswap Trading Volume Graphs

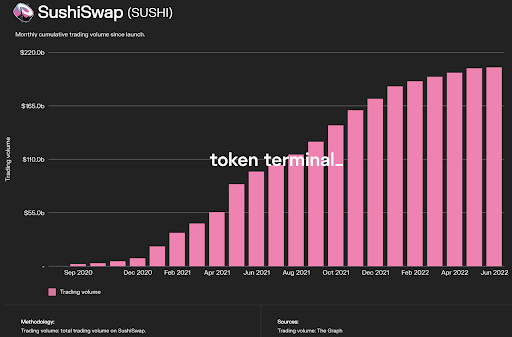

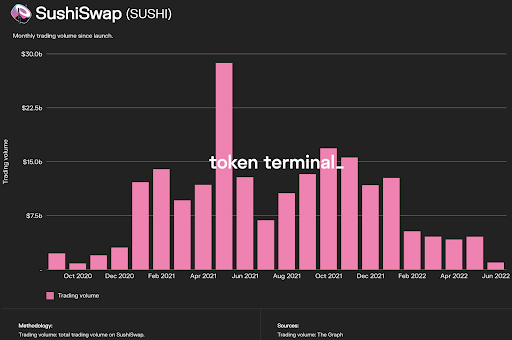

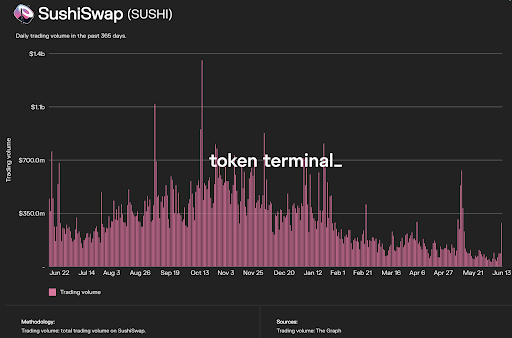

SushiSwap Trading Volume Graphs

SushiSwap Trading Volume Graphs

Here is a graph showing Uniswap and SushiSwap trading volumes referred to here as GMV.

Here is a graph showing Uniswap and SushiSwap trading volumes referred to here as GMV.

The moral of the story for the preceding charts is that trading volumes are healthy and growing.

The moral of the story for the preceding charts is that trading volumes are healthy and growing.

Chicago Mercantile Exchange (CME) P/E Chart

Intercontinental Exchange (ICE) P/E Chart

Intercontinental Exchange (ICE) P/E Chart

The CME and ICE are the number one and two largest exchanges of any type globally by average daily trading volume. These are great businesses. Focus your attention on the 2008 time period. As you can see, the P/E of these businesses traded in the 10x area during the onset of the GFC, before the market recovered due to the massive amount of Fed money printing.

The CME and ICE are the number one and two largest exchanges of any type globally by average daily trading volume. These are great businesses. Focus your attention on the 2008 time period. As you can see, the P/E of these businesses traded in the 10x area during the onset of the GFC, before the market recovered due to the massive amount of Fed money printing.

The current P/E values for Uni and Sushi are below or close to these levels currently. Now, obviously, neither of these two DEXs are as battle tested and well developed as their TradFi counterparts– but these DEXs offer a new way of trading to anyone with an internet connection. The TAM of what is possible starting from such a low base with Uni and Sushi is truly stupendous. However, both of these DEXs trade at similar valuations to the CME or ICE during the depths of the last major financial crisis since the Great Depression.

Thank you very much for such value.

Derivative DEXs

Y’all know I love me some derivatives. The complexities of creating a simple offering that allows for leveraged trading on-chain is the holy grail. I do not believe any protocol to date has achieved such sublime beauty in the derivatives space as Uni and Sushi have in the spot arena. However, there are good offerings at attractive valuations that are already throwing up decent numbers.

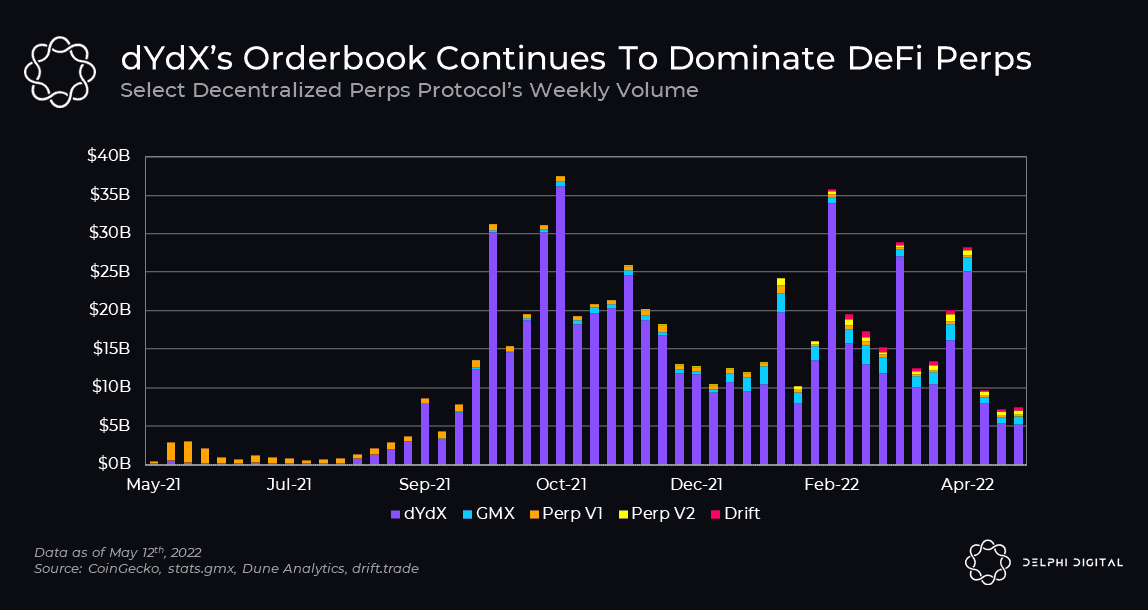

Compared with the CEX behemoths, the derivative DEX average daily trading volume numbers are quite low. But that only gives more upside to the faithful. Just to match the market share that spot DEXs possess vs. their CEX counterparts at 10% would be a 5x improvement in trading volumes. I’ll take that.

Compared with the CEX behemoths, the derivative DEX average daily trading volume numbers are quite low. But that only gives more upside to the faithful. Just to match the market share that spot DEXs possess vs. their CEX counterparts at 10% would be a 5x improvement in trading volumes. I’ll take that.

In the derivative DEX space, dYdX dominates the field. That said, I have a very puritanical objection to the dYdX model, which is that dYdX is not truly a DEX. It is a centralised orderbook hosted on a dYdX machine, and only settled trades are posted on chain for finality. But more importantly, when it comes to its P/E ratio, it is markedly higher than the protocol I’m most impressed by, GMX.

In the derivative DEX space, dYdX dominates the field. That said, I have a very puritanical objection to the dYdX model, which is that dYdX is not truly a DEX. It is a centralised orderbook hosted on a dYdX machine, and only settled trades are posted on chain for finality. But more importantly, when it comes to its P/E ratio, it is markedly higher than the protocol I’m most impressed by, GMX.

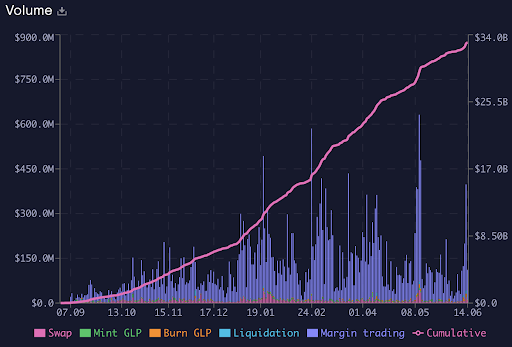

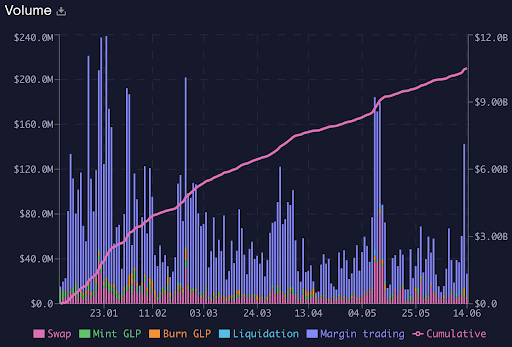

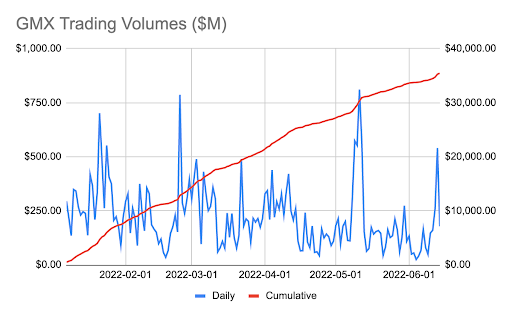

GMX offers pseudo levered total return swaps (TRS) on a few crypto vs. fiat stablecoin pairs. As I write this at 1am GMT on 14 June 2022, GMX has traded $33 billion worth of derivatives since 1 September 2021.

GMX charges fees to trade that are split between liquidity providers and the DAO running the protocol. To date, a total $44 million of fees have been collected.

GMX Trading Volumes on Arbitrum

GMX Trading Volumes on Avalanche

GMX Trading Volumes on Avalanche

GMX Total Trading Volumes

GMX Total Trading Volumes

GMX P/E Ratios

GMX P/E Ratios

Source: GMX Stats

As we know, derivatives trading volumes should be orders of magnitude higher than spot volumes. Whichever few DEXs comprise the natural monopoly will earn beaucoup fees. That is the future bull case for the category itself, and from what I have seen so far, GMX is the best out there. However, I don’t believe it is elegant enough … yet … to truly capture the fee wallet of DeFi leveraged traders en masse and catapult volumes over spot DEXs such as Uni and Sushi.

Decentralised Internet

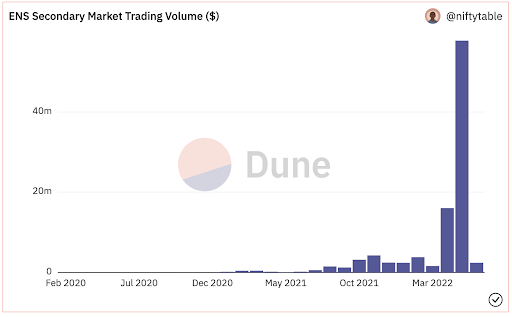

Shouldn’t the world’s decentralised computer help host the decentralised internet? That is the essential ethos of Ethereum Name Service (ENS). You can purchase a “.eth” top level domain from ENS, and fees are paid in ETH.

Your domains then become not only usable websites but tradable assets. ENS domains are traded on large NFT trading platforms like OpenSea and LooksRare. In fact, secondary market trading of ENS domains is healthy. According to Non Fungible, over the last 7 days ENS was the 15th most traded project, and 27th most traded project of all time.

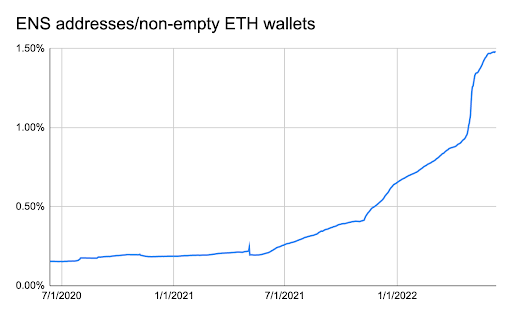

The number of ENS domains created to-date has grown exponentially, but still scratches the surface of possible market penetration. Every Ether wallet with a non-zero balance is eligible to purchase one or more ENS domains. The below chart displays the market penetration of ENS.

The number of ENS domains created to-date has grown exponentially, but still scratches the surface of possible market penetration. Every Ether wallet with a non-zero balance is eligible to purchase one or more ENS domains. The below chart displays the market penetration of ENS.

As you can see, ENS has tremendous upside in terms of people with ETH addresses that could decide to purchase domains. One reason why more people with ETH addresses would decide to create their own “.eth” domain is that this domain might become their identity. It is way easier to send money to “arthur.eth” as opposed to “0x….”. A variety of online services (e.g. Twitter) might also enable tipping and other payments using the “.eth” domain as your online identity.

As you can see, ENS has tremendous upside in terms of people with ETH addresses that could decide to purchase domains. One reason why more people with ETH addresses would decide to create their own “.eth” domain is that this domain might become their identity. It is way easier to send money to “arthur.eth” as opposed to “0x….”. A variety of online services (e.g. Twitter) might also enable tipping and other payments using the “.eth” domain as your online identity.

The cost to register a “.eth” domain varies depending on how many characters, but these are annual fees. That means this protocol has that sweet sweet thang we call annual recurring revenue (ARR). Of course, subscribers could choose not to renew, but the first purchase is always the hardest to secure. A portion of those who created these domains will renew year after year.

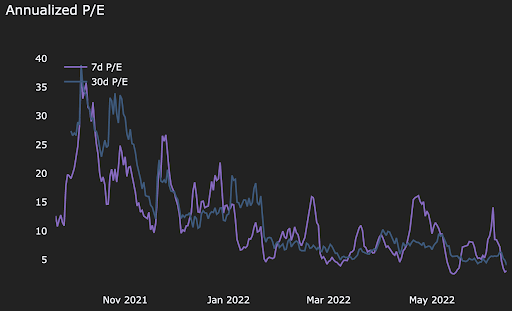

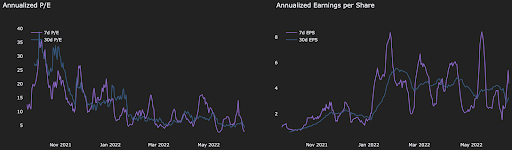

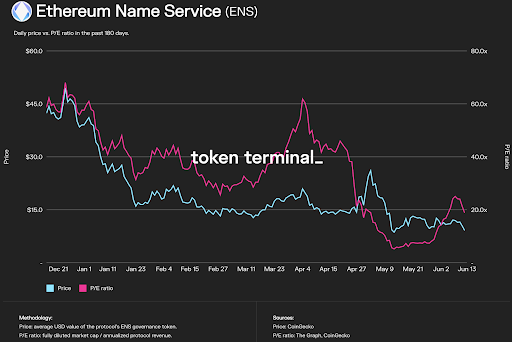

ENS P/E Ratio

ENS’ Web2 counterpart is Verisign. Verisign is one of the major DNS providers for classic websites. It has been around since the 2000 dot.com bubble and has traded at some pretty astronomical P/E ratios. Internet penetration two decades after the insane initial burst of enthusiasm is much higher, and so is the number of domains.

ENS’ Web2 counterpart is Verisign. Verisign is one of the major DNS providers for classic websites. It has been around since the 2000 dot.com bubble and has traded at some pretty astronomical P/E ratios. Internet penetration two decades after the insane initial burst of enthusiasm is much higher, and so is the number of domains.

Verisign P/E Ratio

As a more immature company, Verisign traded at P/E ratios in the hundreds to low thousands. But currently, as a more mature company, it trades at a P/E in the low 20’s. ENS trades at essentially the same valuation as Verisign. However, ENS could capture the potential of Web3 / public blockchains, and participate in decentralising the internet. Shouldn’t ENS trade at a much higher multiple, similar to Verisign back in the day, due to the vast growth potential it enjoys?

As a more immature company, Verisign traded at P/E ratios in the hundreds to low thousands. But currently, as a more mature company, it trades at a P/E in the low 20’s. ENS trades at essentially the same valuation as Verisign. However, ENS could capture the potential of Web3 / public blockchains, and participate in decentralising the internet. Shouldn’t ENS trade at a much higher multiple, similar to Verisign back in the day, due to the vast growth potential it enjoys?

Time will tell if ENS can support more and more “.eth” domains, and if their tradability as NFTs creates an entirely new asset class. The potential is there, and the market does not value ENS’ bright future appropriately.

Slinging JPEGs

Art and culture is an expression of human civilization’s abundance. Art at its core ingests scarce resources and produces objects and experiences whose only purpose is to provide enjoyment. The surplus of our society’s labour is used to purchase and consume paintings, sculptures, music, film, theatrical performances, television, sporting events, delicious epicurean delights, etc. Apart from fueling our bodies and reproducing, what’s the point of existence if we can’t enjoy the art that the creatives amongst us produce?

The arts consume a vast amount of resources, and many a billionaire has been created providing culture to the masses. Contrary to popular belief, NFTs – Non Fungible Tokens – are not art. What they really are is a public blockchain enabled object / data structure that allows for the digitisation of culture. While popular culture synonymises NFTs with digital art, NFTs are just the object that allows culture to be digitised, made scarce, and traded.

The unfortunate (but also fortunate) fact that NFTs are derided by mainstream financial institutions as people trading easily copied JPEGs illustrates a fundamental misunderstanding of what NFTs are and what activity they enable. The first popular expressions using this new technology, which some consider vulgar, are ugly pixelated profile pictures produced by algorithms and traded as discrete digital objects. Where the NFT asset class ends up in five or ten years is completely unknown, and will look nothing like today.

Since the summer of 2021, when trading volumes first exploded higher on OpenSea, billions of dollars worth of these digital objects pinged back and forth between digital wallets. OpenSea is a centralised company that operates an exchange that allows the non-custodial trading of NFTs. In exchange for fostering a market, OpenSea charges a healthy commission.

Due to its first mover advantage, OpenSea commands anywhere between 80% to 90% of the entire trading volume of NFTs. It’s a great business, but one which is privately owned.

The technology that underpins how NFTs are traded does not require a centralised operator such as OpenSea. LooksRare appeared and offered a community-owned decentralised marketplace for NFT trading. The trading and royalty fees went to the LOOKS DAO. LOOKS governance token holders could then vote on how best to distribute them. Therefore, holders of LOOKS can directly participate and benefit from the explosion of the digitisation of culture, whereas previously users were just customers of a centralised entity.

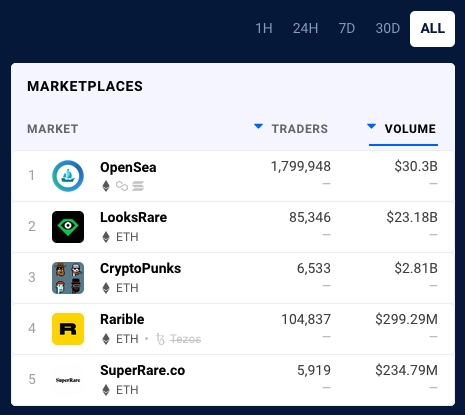

NFT Trading Volume League Table

Source DappRadar

One note about this table, there are concerns about volumes being misrepresented across all platforms due to trades between addresses controlled by the same entity. Rather than take these numbers as gospel, just observe the relative distance between the second and third ranked platform by volume. That is the point of this table.

Looking at this chart, LooksRare is the solid number two behind OpenSea. Long live the duopoly.

The tightening of global liquidity inspired by central banks bludgeoned the “value” of the NFT complex as well. Prices for various NFTs cratered alongside trading volumes. Many mainstream financial pundits essentially laughed at us for thinking these JPEGs would be immune from rising interest rates. I suspect that those who gazed into the starry night and tried their hand “investing” in NFTs got third-degree burns and now feel embarrassed that in their search for alpha they resorted to slinging JPEGs. As these masters of the universe must face the quarter-end crescendo of losses, they want no remaining evidence in their portfolios that they too engaged in this madness.

That is amazing news, because it has led to LOOKS getting absolutely slaughtered in the recent downturn.

This is a life-to-date chart of the LOOKS/USD price on FTX, courtesy of Cryptowat.ch.

This is a life-to-date chart of the LOOKS/USD price on FTX, courtesy of Cryptowat.ch.

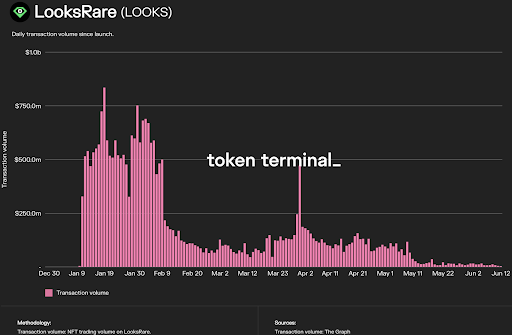

LOOKS listed in January 2022 at $2.6 and now hovers around $0.17, which is a decline of about 95%; the ATH was $6.87, meaning it is down 98% from its top. Wowzers! What a return in only six months.

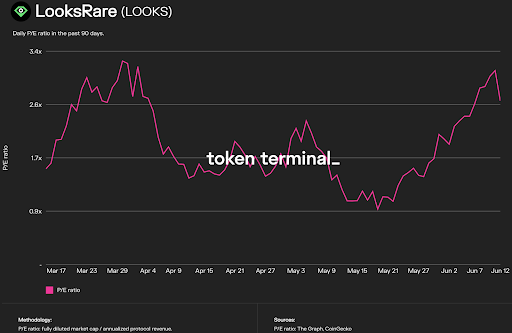

While the price performance is disastrous so far, LOOKS’ fundamentals are STRONK! It is the number two NFT trading platform by trading volume. Remember, protocol revenues are available to token holders. Therefore, its P/E ratio is dirt cheap.

LOOKS P/E Ratio

2x to 3x earnings is an amazing valuation for a protocol that could be one of the dominant exchanges of human culture on the internet. This is the first real market cycle for tradable NFTs. It is completely rational for the businesses connected to this sector to experience 98% drawdowns from their recent all-time highs.

2x to 3x earnings is an amazing valuation for a protocol that could be one of the dominant exchanges of human culture on the internet. This is the first real market cycle for tradable NFTs. It is completely rational for the businesses connected to this sector to experience 98% drawdowns from their recent all-time highs.

The issue of the worthiness of one form or culture vs. another is deeply personal. People get mega triggered when something they consider worthless is ascribed high values by others. How many people scoff at how some scribbles on a canvas are “worth” millions of dollars? This pathos will continue to drive insane volatility in any protocols related to the intersection of human culture and public blockchains. As LOOKS is just a call option on an uncertain future, the bigger the volatility, the larger the intrinsic value of the option.

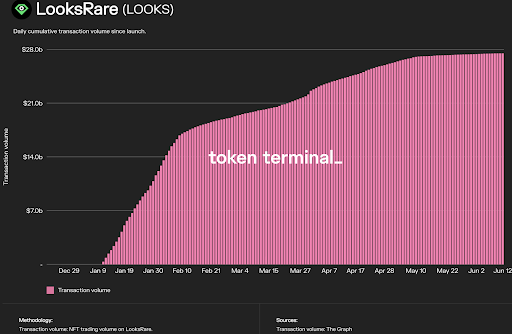

LOOKS Cumulative Trading Volume

LOOKS Daily Trading Volume

LOOKS Daily Trading Volume The fact that trading volumes and prices are down has not dented the enthusiasm of those in the business of selling culture from appreciating how impactful NFTs will be to human society. Anyone directly involved or adjacent to the arts is desperately trying to figure out what NFT technology means for their practice or business model. NFTs will not perish, and their disruption to the economics of culture will be profound.

The fact that trading volumes and prices are down has not dented the enthusiasm of those in the business of selling culture from appreciating how impactful NFTs will be to human society. Anyone directly involved or adjacent to the arts is desperately trying to figure out what NFT technology means for their practice or business model. NFTs will not perish, and their disruption to the economics of culture will be profound.

All the while, the press is focused on those silly individuals and businesses that thought they could get rich quick flipping JPEGs. If that is denting investor enthusiasm for an exchange that is the number two place where digital culture is traded, please keep spewing that nonsense. I will be there with my ape diamond paws scooping up cheap LOOKS for a long time. When the market narrative shifts down the line, these top platforms will be the pinnacle of how culture is traded and the P/E multiple expansion will be glorious.

I’m sure that many readers can point to areas of improvement in the business model or technology. But as natural monopolies go, the game is basically over for global NFT marketplaces. It will be very difficult to supplant OpenSea or LooksRare. Liquidity begets liquidity. And if the community owns the platform on which the majority of assets they ascribe value to trade, then why would the community have any reason to try out a new competitor?

As anyone who has actually tried to sell an NFT knows, the liquidity on the exit is severely lacking. As a result, it is better to sell on the number one or two platform than on some upstart that claims to have lower fees or some other shiny technological bauble. Again, liquidity begets liquidity.

Out of all the tokens analysed in this essay, I am most excited about LOOKS. It is part of a small cadre of platforms that are creating the market for the tradability of human culture. Many will look back at this summer and rue their insistence on allowing the filth of mainstream financial pundits to infect their token selection process.

Oops I Did It Again

Oops, I did it again

Oops, I did it again

I played with TA, got lost in the game

Oh baby, baby

Oops, you think I’m in love

That I’m sent from above

I’m not that PRESCIENT

When it comes to calling the market, I get it wrong more than I get it right. That’s the difference between writing essays and investing. My Bitcoin $25,000 to $27,000 and Ether $1,700 to $,1800 bottom range proved to be extremely optimistic. Oh well…

As I wrote this piece over the last fortnight, I became a little less convinced that my Ether call would hold up in the face of my theory that hedge funds will continue puking anything DeFi related. While I am not going to outright sell Ether for filthy fiat, given that I continue to carry a large implicit (through ownership of ERC-20 tokens) or explicit Ether exposure, I dabbled in more out-of-the-money puts. I started with a purchase of Ether puts with a September 2022 expiration and $1,500 strike price. Just for completeness, I also purchased some Bitcoin puts with the same expiration and a $25,000 strike price. I closed these a bit early, and didn’t fully participate in this week’s dumpfest. But that is why I keep my sizes relatively small. Babysitting my Bitcoin … I ain’t about dat life no more.

The US CPI for May hit a fresh 40-year high of 8.6% YoY. The politics dictate that the Fed must go larger and longer with rate hikes. We saw that yesterday with a historic 75bps hike by the Fed. I suspect that the political pressure for the Fed to be perceived as fighting inflation won’t let up until after the November US midterm elections. At which point, it becomes a fight for the 2024 presidential election. The democrats will most likely lose the House of Representatives and the Senate, which creates a lame duck 2-year stint for the Biden administration. Nothing will get passed, and all political energy will be focused on what narratives play well to voters in 2024.

The number one thing that American voters care about is their personal finances. Juicy the markets, both employment and financial, will win votes. The easiest way to accomplish both of these goals is printing money. While the long term effects are deleterious, that’s the next administration’s problem. Therefore watch how quickly the Biden administration pivots in its messaging. From “the Fed must tackle inflation” to “the Fed must ease financial conditions so that American jobs can be created”. With POTUS at his back, the Fed can get back to business as usual … money printing.

Crypto Valuation = Technology + Fiat Liquidity

The fiat liquidity situation will be brutal for the next 6 to 12 months. It is during this period that we shall discover what multiple the market ascribes to what the faithful believe is game-changing tech. This game-changing tech previously commanded a very high price-to-metrics ratio. For the foreseeable future, that ratio will be sliced and diced to unimaginably low levels.

As I hope the preceding analysis highlighted, there are critical DeFi verticals that are on sale right now. If you believe in the fundamental premise that the number of addresses will continue growing, then certain projects with revenue-accretive models at the protocol level will still exist and even grow during this nuclear bear market.

These tokens will likely continue getting smacked as hedge funds and other crypto businesses liquidate positions amidst being wound down or severely curtailing their activities. For a real asset allocator, this is planting season. Once the rainy season, filled with phat droplets of central bank liquidity, begins, then it becomes difficult again to procure desirable projects at reasonable valuations.

The rewards to the intrepid investor will sooth the market-to-market pain experienced from now until the beginning of the next bull cycle. Please internalise this statement if you believe I somehow can attempt again to call a bottom in any of the shitcoins I just analysed. These tokens could fall another 50% or more, and I would be even more excited to own the premier DEXs, exchanges that enable the tradability of human culture, and one of the backbones of a decentralised internet. And as the market marches lower and lower, as long as I believe usage of these services will continue and grow in the future, then my average entry price gets lower and lower, and my effective yield (Protocol Revenue / Fully Diluted Market Cap) goes higher and higher.

Related

The post appeared first on Blog BitMex