(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Are you a patriot?

Do you pledge allegiance to the flag?

Are you a pinko commie?

Are you a capitalist pig who fights on the side of imperialism?

Are you a running dog for the enemy?

You’re part of the fifth column, aren’t you?

You are a bourgeois intellectual who is an enemy of the common person!

Do you dispute it, and if so, how shall you show your conviction to defeat the enemy?

What will you do For The War?

The sell-side gangsta Zoltan Pozar scribbled the following words in his 1 August 2022 piece entitled “War and Interest Rates”:

War is inflationary.

Wars come in many different shapes and forms. There are hot wars, cold wars, and what Pippa Malmgren calls hot wars in cold places – cyberspace, space, and deep underwater (see here). We would also add to the list of cold places “corridors of power” in Washington, Beijing, and Moscow, where great powers are waging hot wars involving the flow of technologies, goods, and commodities – hot economic wars – which have been major contributors to inflation recently.

And these words in his piece “War and Industrial Policy” on 24 August 2022:

War means industry.

Wars cannot be fought with supply chains that crisscross a globalized world,

where production happens on faraway, little islands in the South China Sea,

from where chips can be transported only if airspaces and straits remain open…

I highly recommend tracking down and reading these essays in their entirety. Zoltan succinctly describes the current global war the political power centres are engaged in. While the showdown between Ukraine and Russia may be the only direct, high-profile kinetic conflict currently taking place, make no mistake: there is a multifaceted economic war quietly being waged between the major flags of the world. Behind closed doors, the US / NATO (EU) alliance is squaring off against Russia / China.

(To be clear, there are other wars ongoing, and I don’t mean to discount the lives lost in those conflicts – but they don’t have the same global implications as the NATO vs. Russia / China entanglement. When nuclear powers square off in proxy wars and engage in alternative means of less visible warfare, the world at large has to take notice. The continued existence of the human race is on the line, after all.)

At The Brink

Just to hammer home the seriousness of this current conflict, my macro daddy Felix posted this distressing chart of the past major conflicts between the established hegemon(s) and up-and-coming challengers.

Out of the 16 instances listed, 75% of them resulted in war. History is not on humanity’s side if we hope to avoid a major kinetic conflict.

Before I continue, I have to share this quote that I read in Dale Copeland’s masterpiece “Economic Interdependence and War” (which I picked up a copy of after reading Zoltan’s most recent piece). Copland writes:

“Admitting that the economic stimulus provided by rearmament could never form the basis of a sound economy over the long term, Hitler further elaborated the supply dilemma:

‘There was a pronounced military weakness in those states which depend for their existence on foreign trade. As our foreign trade was carried on over the sea routes dominated by Britain it was a question rather of security of transport than of foreign exchange, which revealed in time of war the full weakness of our food situation. The only remedy, and on which might seem to us visionary, lay in the acquisition of great living space.’”

History never repeats itself, but it rhymes. I’m not saying the Chinese Communist Party bears a resemblance to the Nazis – but China has found itself facing a similar dilemma, whereby all of its seaborne trade is done with the tacit approval of America, which commands the most powerful blue-water navy globally. (It’s worth noting that China technically has the largest navy in the world, but it relies disproportionately on smaller classes of ships and does not have the same ability to wage war across open oceans and deep waters.) Should America wish it, she could easily cut off access to the Straits of Malacca, an important seaway through which a significant amount of Chinese trade travels. America could also cut off the Eastern Chinese seaboard – where all of China’s economic power is located – through her alliance with Japan. Japan’s navy is no slouch, either.

When viewed through this lens, the trade-war between America and China bears some similarities to the global trade situation of Germany and Britain almost a century ago.

The Power of the State

When war is waged, the State takes priority. Regardless of whatever the pre-war legal norms were, during wartime, whatever the State needs, the State takes. And because the State must have what it needs to wage war, the private sector is typically crowded out of a wide range of goods and services.

“But, that’s against the law!”, you might say. “My country can’t do that just because it’s expedient during wartime.” I would remind such readers that the COVID-19 pandemic was also a war – and who among us didn’t have our personal liberties curtailed in the righteous fight against an invisible virus? Wear a mask, inject your body with a hastily approved “vaccine”, stay in your house, don’t go to the funeral of a loved one, no visitors in the birthing room, etc. And while everyone bitched and moaned, they ultimately – for the most part – did what they were told by the State.

When the domestic economy cannot produce enough goods and services to support both the State and the private sector, the State resorts to paying people and for supplies in government fiat money, which becomes increasingly less valuable as the war goes on and goods are harder to come by. During previous total world wars, shortages of milk, bread, butter, sugar, and labour abounded, and there was nowhere to hide. During the current iteration of global economic war, we still have shortages – they just look a little bit different. We’ve run low on semiconductor chips, masks, baby formula, and weapons. There is no escape (or at least, there wasn’t in the past – but more on that later).

During wartime, you either have a loaf of bread, or you don’t. During wartime, the banks are either open, or they are not. During wartime, when you wish to travel, you either have the correct stamp in your passport, or you do not. During wartime, access is key and price is secondary. Therefore, all essential goods and services have an inelastic price curve.

And so as we enter World War III, fighting in non-traditional corridors, how can we – as private citizens – protect ourselves and our families from the “all or nothing” dichotomy that prevails during wartime? In the absence of traditional legal protections, how can we protect ourselves from the State that demands our resources because…war?

Previously, many thought the best way to do so was by saving money in “hard” precious metal currencies, like gold. But recognising the prevalence of this line of thinking and wanting to capitalise on it, the State (in this case, the US) outlawed private ownership of the shiny rock and forced gold owners to sell their nuggets to the government at depressed prices.

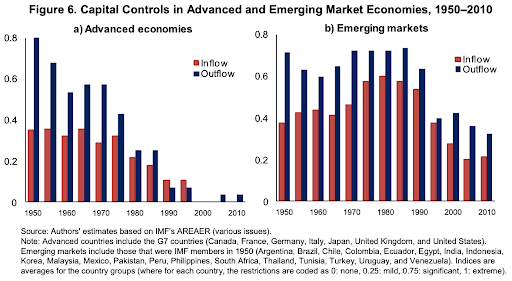

Not so easily discouraged, some of the more industrious plebs moved to convert their money into a “harder” fiat currency and store it abroad. But the government had an answer for that, too: capital controls (i.e., implementing laws restricting the flow of money out of the domestic economy).

So if the government has all of these levers to pull to keep its citizens from protecting themselves and their wealth, what options remain for us to steel ourselves from the devastation that is likely to follow WWIII?

There are many who understand the shift in the way markets function in peacetime vs. wartime, and will likely use that understanding to create, accelerate, and/or cement their wealth and power. Endeavour to be one of those actors in this sad thing we call global total warfare.

If you think I’m being a bit dramatic or that I sound like a stark raving Cassandra, let’s look at the recent trials and tribulations of Mr. Roman Abramovic.

Bloomberg recently published an excellent piece, “Roman Abramovich’s London Empire Unravels as Sanctions Bite”, which describes the effects of anti-Russian western sanctions on one of the world’s richest persons.

Mr. Abramovich is worth more than probably every single reader of this essay, apart from Baron CZ and Baron SBF. If you think wealth = power, then you would assume that laws just don’t apply to him. And you would probably largely be right – in peacetime, I’m sure wealth has afforded Mr. Abramovich many privileges in his current hometown of London.

However, the UK is at economic war with Russia. And you are either a patriot or a treasonous dog, regardless of your paper wealth. Unfortunately for Mr. Abramovich, he held a passport stamped with the wrong flag.

Bloomberg describes how the sanctions bit into his wealth:

Roman Abramovich’s cream-colored Kensington mansion has more than a dozen bedrooms and police vans posted at each end of its tree-lined street. Nearby neighbors include British royals, steel magnate Lakshmi Mittal and Warner Music Group owner Len Blavatnik.

It’s one of several London assets the Russian billionaire acquired in recent decades that have helped make the city the hub of his fortune. But that foothold has proven tenuous in recent months as his prize possessions in the English capital — from Chelsea Football Club to luxury homes to a stake in London-based steel group Evraz Plc — have been sold or frozen following Russia’s invasion of Ukraine.

One day the rule of law protected your assets, the next day they were frozen or forcibly sold.

I found this passage quite tickling:

“He’s not on the top of his game anymore,” said David Lingelbach, who headed Bank of America Corp.’s Russian operations in the 1990s and now teaches at the University of Baltimore. “It seems to me that he is on the defensive.”

No shit he’s on the defensive. The UK government arbitrarily abrogated his property rights without due process and in effect froze a third of his assets with the stroke of a pen. What does common law say about that? I think we would all be on the defensive in that scenario.

I’m not here to argue about whether what the UK did was justified. My intent is to simply point out that, no matter how wealthy or powerful you may be, any asset whose ownership is conferred by legal title is fair game for wartime confiscation. Your bank account, your stock portfolio, your house, your car – your ownership of these things is predicated upon the State upholding and protecting your exclusive right to use them. If that weren’t the case, anyone who had something coveted by their neighbour would have to be perpetually ready to inflict physical harm upon strangers who had that “lean and hungry” look.

The “woes” of Mr. Abramovich are a good modern-day example, but let’s go back in time to World War II and observe how different flags treated the property of their citizens. In this essay, I will explore how America, the United Kingdom (UK), Nazi Germany, and Imperial Japan dealt with wartime rationing and what that meant in terms of capital controls, access to food and its price, and ownership of “hard” currencies like gold – and then I’ll argue that, amidst these difficult conditions (which we are likely to see again in one form or another if WWIII begins to escalate into a larger conflict), Bitcoin is the best means for plebes to protect their wealth.

Before I jump in, a quick PSA – the time to buy Bitcoin is now, while you still can. Because once your fiat assets are frozen or fiat capital controls are erected, your wealth cannot be converted into a harder currency. At that point, you are at the whim of the State, and you better hope the flag printed on your passport wins. That is how the State gains the support of the masses – it takes away their modes of escape. The only way out is through!

Capital Controls

The flag that can marshal the most of its citizens’ resources and put them towards fighting the war is the flag that will win. The government must take control of these private resources in either physical form (i.e., food, machinery, labour) or in abstracted form (i.e., currency in circulation, financial assets like stocks, bonds, etc.). The physical route is more obvious and mentally disruptive. Imagine a government goon knocking on your door and demanding all the food in your kitchen to feed hungry soldiers, or that you work 8 hours each day in a converted factory building munitions for below market wages. That makes war very real to the average citizen.

So instead, we can expect the State to go the abstract route, targeting citizens’ funds and assets. The State always has very ingenious ways of forcing monetary patriotism upon its subjects.

Its most benign tactic is to sell its plebs low-yielding government bonds, appealing to their love of the flag and convincing them to patriotically invest their spare capital with the government. A common example of this is war bonds. War bonds convert citizens into “investors” in the war effort. Now, everyone’s interests are aligned. We win the war, and you get your money back.

These war bonds would not pay a yield greater than the rate of domestic inflation, because if they did, the government would slowly be bankrupting itself. But the government would not highlight the fact that they yield less than inflation – they would be counting on their citizen’s obliviousness to how bond maths work. (As an aside I believe it is partly intentional that financial literacy is not taught to children. It renders the population defenceless and malleable in the face of deceitful politicians painting monetary fairytales.)

No matter how hard the government tries to sell the public on the righteousness of these bonds, the average person is likely to understand that war means inflation (or at least realise it as the war drags on). As long as there has been settled human civilisation, there have been wars. And the State always uses inflation to “pay” for the war. Eventually, this is likely to send citizens scurrying to find ways to escape this pernicious vice.

From the State’s point of view, that is why capital controls – again, laws that forbid or limit the transfer of money and assets outside of the domestic economy – must be erected. Without them, the treasonous plebes would spirit their capital into hard money and remove oxygen from the flames of the war effort. Capital controls make it almost impossible to escape the flag’s financial system, as all options to either convert domestic currency into a harder equivalent or purchase a financial asset with a higher yield than the offered government bonds are essentially forbidden. Once the State’s citizens are financially trapped, they are likely to surrender to the circumstances – earning a paltry yield that does not beat inflation is better than earning no yield at all. That’s how you start the process of converting the prodigal sons and daughters of the land into financial patriots.

Let’s look at how the various flags implemented capital controls during WWII.

Overt Capital Controls

Overt capital controls directly restrict the movement of money between borders and currencies. The end result is a pool of vulnerable capital that can be easily channelled to “patriotic” purposes.

America

Movement of capital outside of America was largely unrestricted during WWII. America had the strongest economy and did not host actual fighting inside its borders; there was little reason for domestic capital to flee.

The one asset on which America did impose strict controls, however, was gold.

For decades, the Fed was required to hold 40% of its issued currency as gold, and redeem gold held by US citizens for $20.67 per ounce. But the 1933 Emergency Banking Act gave the President greater control over banking, international transfers, and gold, and it paved the way for Executive Order 6102 – which was enacted by President Franklin Delano Roosevelt (FDR) during WWII, and required Americans to immediately exchange their gold with the government or face penalties.

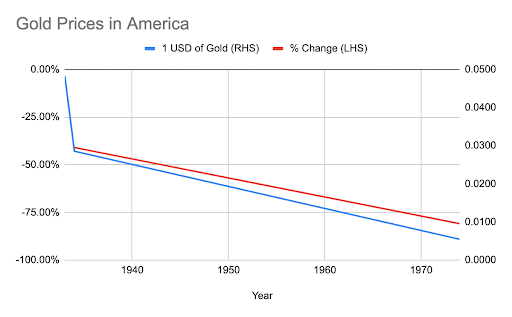

FDR’s gold confiscation meant that private owners were obliged to take their coins, bars, or gold certificates to a bank and exchange them for dollars at the prevailing rate of $20.67 per ounce. Over the next year, the President then raised his official gold price to $35 per ounce, effectively cutting 40% off the dollar in a bid to stoke inflation and spur the economy. It was part of FDR’s larger effort to move the US away from the gold standard. The prohibition on personal gold stayed in effect until December 1974, when President Ford legalised private ownership.

Let this chart sink in: gold capital controls lasted for 41 years, and over that time, the USD lost 80% of its purchasing power in terms of gold. Trapped capital is dead capital.

UK

The UK installed extensive capital controls – covering most imports and exports along with private portfolios and retail investments. The policies were implemented as part of the Emergency Powers Act of 1939; later updated to Exchange Control Act of 1947.

Sales of securities, the exchange of Sterling into any other currency, and the movement of funds abroad were all heavily controlled. Your capital was not really yours at all. You could only sell securities, conduct foreign exchange, or send funds out of the country if the government deemed your reasons for moving your finances abroad to be legitimate according to their rules.

Professor Daisuke Ikemoto wrote, “Exchange control was originally introduced in 1939 for wartime purposes, but it was maintained after the end of the conflict. This allowed successive British governments to reconcile the maintenance of a fixed exchange rate with their commitment to demand-management policy.”

Germany

During the war Germany enacted capital controls so that funds were available for “investment” into government bonds. I will give a more detailed account of these measures in the next section when I cover the yields on German government bonds during the war.

Post-war, in the early years of the Federal Republic, current account deficits and a dearth of foreign exchange reserves led to a strict prohibition on all exports of capital by residents. The legal basis for these controls was provided in the foreign exchange regulations of the Allied Occupation. By the early 1950s, however, West Germany’s current account turned to surplus and the country’s war-related external debts were finally settled. Restrictions on foreign direct investment abroad began to be liberalised in 1952, and residents were allowed to purchase foreign securities starting in 1956.

Japan

I don’t have a good document detailing the capital controls faced by Japanese citizens. However, I found this enlightening paper discussing the various ways in which Japan spirited away the essential commodities produced by the Southeast Asian countries it occupied during the war. Here is the abstract of the paper:

This article analyzes how Japan financed its World War II occupation of Southeast Asia, the transfer of resources to Japan, and the monetary and inflation consequences of Japanese policies. In Malaya, Burma, Indonesia and the Philippines, the issue of military scrip to pay for resources and occupying armies greatly increased money supply. Despite high inflation, hyperinflation hardly occurred because of a continued transactions demand for money, Japan’s strong enforcement of monetary monopoly, and because of declining Japanese military capability to ship resources home. In Thailand and Indochina, occupation costs and bilateral clearing arrangements created near open-ended Japanese purchasing power and allowed the transfer to Japan of as much as a third of Indochina’s annual GDP. Although the Thai and Indochinese governments financed Japanese demands mainly by printing large quantities of money, inflation rose only in line with monetary expansion due to money’s continued use as a store of value in rice-surplus areas.

If Japan, due to its lack of essential commodities, “transferred” as much as a third of Indochina’s annual GDP to fuel its war effort, do you think it let ordinary Japanese citizens shirk their patriotic financial responsibilities by allowing capital to flee abroad? If you believe they allowed the Japanese plebes to escape, are you bodoh or what?

Following the war, the focus on economic reconstruction meant that capital inflows and outflows were tightly controlled. The policy was put into place during the early days of the Allies’ occupation of the country and eventually drew its legal justification from the Foreign Exchange and Foreign Trade Control Law of 1949. In principle, all cross-border flows were forbidden unless specifically authorised by administrative decree. Only in the early 1960s did these restrictions begin to loosen, and even then, it was only for certain flows closely related to foreign trade transactions.

Global Situation Post-War

Below is a chart that shows how pervasive and long-lasting capital controls were post-war once the Bretton Woods agreement came into effect.

Today’s Conflict

Today’s Conflict

Let’s take a quick step forward to understand what overt capital controls look like in today’s world. With the Ukraine conflict raging, Russia has taken several steps to prop up the ruble. Most notably, Russia imposed a $10,000 withdrawal limit on consumers and required companies to convert their foreign currency reserves into rubles. The desired outcome of strengthening the ruble was achieved, and the government has justified the restrictions by arguing they were necessary to avoid financial pain and will be removed once risk subsides.

Financial Repression

Turning back to WWII, the flags have now implemented capital controls and their domestic capital is stuck inside the border, with limited investment options available to their plebes. What did they do next in order to capture its citizens’ landlocked capital and redirect it towards the war effort? They happily offered debt obligations to their patriots to help fund the fighting. Where I could, I tried to compile a numerical representation of the real yield of various “war bonds” or other government bonds that were issued during and after the war.

American War Bonds

Thankfully, the US Treasury wrote an excellent report on the history of WWII financing methods. While I don’t have similar reports for the other countries profiled, take note of how the money was raised and the justifications offered. What follows are snippets from that report, with added colour commentary from yours truly.

By early 1941 the public debt was expanding rapidly. The danger of price inflation was growing as defense spending poured money into the economy and diverted consumer goods from the market. There was an obvious need to take surplus funds out of the spending stream and store them for the future, thus helping to reduce inflationary pressures during this critical period.

This is economics 101 – government spending crowds out the private market. If the government needs a tank, you can’t have a washing machine.

The government created new bureaucracies to market the newly issued war bonds. Famous artists created art that helped convince the average citizen to part with their scarce capital.

America’s entry into the war had brought forth a host of new problems for the government, to be solved only with the help of the public. Rationing – conservation – manpower – allocation of scarce materials – these were just some of the critical programs (in addition to the buying of War Bonds) which required public cooperation.

Very clear – I couldn’t have said it better myself.

The realisation came even at a time when sales of small bonds to small investors were going very well, and it gave rise to a troublesome question: can the voluntary bond program really work, or must a system be devised for forced loans to the government (i.e. compulsory savings)?

…

Only Secretary of the Treasury Morgenthau, with the backing of President Roosevelt, held out in opposition to the plan [The plan to compel ordinary citizens to surrender their savings to the state]. His point was that the voluntary way was ‘the democratic way’ – but even he was forced to concede that if the upcoming war loan drives failed to produce the hoped for results, some form of compulsory savings might indeed have to be considered.

If the public won’t voluntarily give the State what it needs, the State must take it instead. Although the “compulsory” option was never taken, the US Treasury stood ready to do whatever it took to finance the war effort, even if that meant removing the property rights of its citizens.

America issued $186 billion worth of war bonds (E, F, G issues) between 1941 and 1945. Below is a picture of one.

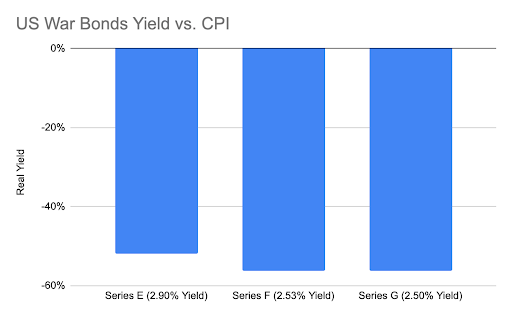

Were the war bonds a good investment? That depends on your definition of “good”. If by “good” you mean that bond holders received income that surpassed inflation, let the below chart refute any notion that these were “good” investments.

Please read the Appendix if you would like to understand a bit more about the calculations and the source of the data.

These bonds had 10- to 12-year maturities. Assuming you bought the bond at issue, and held until maturity, the above chart is the amount of money you lost in real terms. This is truly staggering.

But from the government’s perspective, the war bond drive was a resounding success. The public voluntarily handed over hundreds of billions in scarce capital during wartime. This capital was used to arm and feed the military instead of competing for limited consumer goods and contributing to domestic inflation.

UK

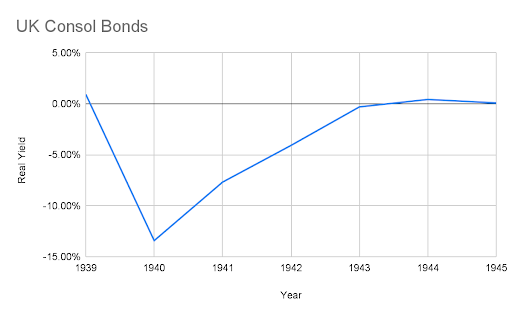

The UK Consol bonds are the longest standing bond issuance of any modern nation state, lasting from 1756 to 2015/16. But for our exercise here, we’ll focus on the real yield of these bonds during and shortly after the war.

Please read the Appendix if you would like to understand a bit more about the calculations and the source of the data.

Please read the Appendix if you would like to understand a bit more about the calculations and the source of the data.

Over the 1939 to 1945 wartime period, holders of Consol bonds lost a total of 24% in real terms. Thanks for playing!

Germany

In an insightful paper entitled “Financing the German Economy during the Second World War”, the author Zdenka Johnson said the following about measures to sequester capital and finance the war effort:

Businessmen trading with the Reich then had to accept that up to 40% of the payments for their goods and services was in the form of interest-free tax bills (Steuergutscheine). These were vouchers could have been used for payments of tax obligations to the state in the future and also provided tax advantages. This debt instrument solved several problems at once – the government received a very favourable loan, reduced its cash expenditures, and did not have to issue that many government bonds. After half a year of the regulation validity, private firms “lent” government almost 5 bln. RM.

Opportunities to invest in private securities were successfully limited. For the banks and private investors there was de facto no other option than to invest [in government securities]. In 1940, mainly savings banks provided 8 bln. RM to the state, the following year nearly 13 bln. RM. Towards the end of 1944, two-thirds of the savings were stored in securities, 95% of which were state bonds.

Both during and after the war Germany followed the standard prescription for how to finance a war. Lock the capital in, and then force it to lend at paltry rates to the State.

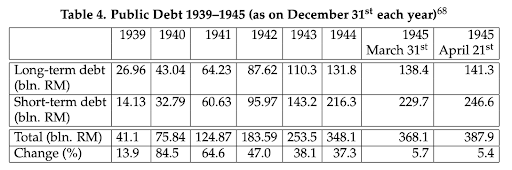

As mentioned above, the sequestered capital of individuals and businesses was forcibly lent to the State. While I couldn’t find a robust data series on bond yields and consumer price metrics, below is a chart detailing how the public debt ballooned during the war period. The one data point on yields I did find stated that yields in 1939 averaged 3.9% and declined to 3.5% in 1942. Yields dropped but the public debt grew by 4.5x. Usually, when the supply dramatically increases, absent a surge in demand, the price must fall. When bond prices fall, yields rise. Therefore, from even this scant amount of data we can observe how the government saved money, due to lower yields, by forcing the public to “invest” their spare capital with the State.

Source: “Financing the German Economy during the Second World War”

Japan

We have no bond or inflation data for the war-time period.

While none of the government bonds yielded above inflation, the winners at least got their principal plus interest back. Holders of German bonds faced outright default and serious legal challenges in collecting what was due to them post-war. It goes to show – it pays to be the winner.

Today’s Conflict

As of yet, no major power has started selling “war bonds”, mostly because technically US / Nato and Russia / China are not at war. However, in today’s age – where capital is more mobile – keep an eye on the rules and regulations surrounding how public and private pensions / retirement accounts must be invested. The global baby boomer generation that holds trillions of dollars worth of “savings” in these managed pools. Governments deliberately construct the rules so that this capital can only find its way into “approved” investments. Be on the lookout for more restrictions on how retirement savings can be invested that prioritises the State over all else.

I Gotta Eat

I will now walk through the last major form of economic control wielded by governments during wartime – food rationing – and the impact it had on prices and citizen’s wages during WWII. Before I jump in, I should note that the food rationing situation in a WWIII scenario likely won’t be apples to apples with what took place during WWII. I think we’re more likely to see food shortages than direct food rationing (and I’ll share more on why a bit later in this section). But, I expect the price impact and cultural effects of the food shortages will be similar – so it’s still useful to review what happened with food rationing during that period. Let’s take a look.

Japan

Official rationing was first implemented in 1938 and “expanded incrementally to include almost every basic necessity by 1942.” As Junko Baba notes, rationing took place under the slogans “Luxury is the enemy” and “Do not desire until victory is achieved.” Food rations were systematically controlled, monitored, and distributed in a limited amount to each household through the neighbourhood associations (tonari-gumi) that were in each community nationwide.

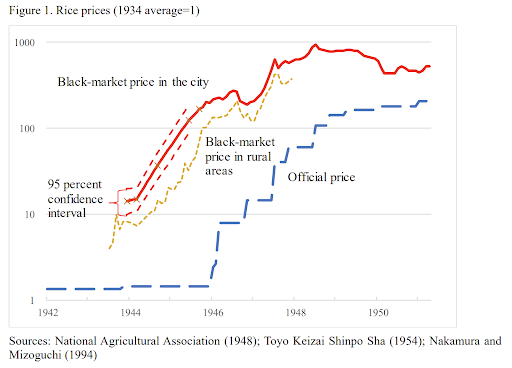

Rice supplies came under government control in 1939, while rationing of consumer goods began on a local basis in 1940. By 1942, rice, wheat, barley, and rye were monopolised by the government. Despite police efforts, a black market – or as I like to say, free market – thrived, facilitating the exchange and sale of a variety of consumer foodstuffs. (Obviously, the term “black market” has a negative connotation, but all you are trying to do is feed your family. And as a darkie, I take offense to the colour black not being beautiful – hence the rebrand.)

Below is an example of how large the price difference could be for one basic commodity.

If you have ever been to Japan (or Asia in general), you know how important rice is to the general diet. During the time of the Samurai, the warrior class was paid in rice (called koku).

As you can see on this log chart, the “real” price of rice was at times 10x higher than the official price. Given that the essential foodstuffs were heavily rationed, if you wanted to consume to your heart’s content or even at all, you had to pay exorbitant prices for rice.

Unless your income increased 10x after the onset of the war, you became 90% poorer in rice terms with the fiat paper you stashed in your mattress. I ask you rhetorically, what’s the value of fiat money when you can’t even afford a bowl of rice?

I don’t have charts such as these to illustrate the free-market price of essential foodstuffs for America, Great Britain, and Germany, but I will briefly describe each of the other combatants’ food rationing regimes.

America

America rationed extensively to assist in the war effort. Tyres, sugar, meats, milk, coffee, and more could only be purchased using government-granted ration points. As Laura Schumm notes, “On January 30, 1942, the Emergency Price Control Act granted the Office of Price Administration (OPA) the authority to set price limits and ration food and other commodities in order to discourage hoarding and ensure the equitable distribution of scarce resources.” Administering the rationing was a complicated bureaucratic system with over 8,000 local offices and monthly re-evaluations of point distributions. Different population segments received different benefits, and each individual was given a non-transferrable booklet of coupons. Homes were encouraged to grow “victory gardens” to provide their own sustenance where possible.

If you thought going to the Department of Motor Vehicles was bad (for non-Americans, just imagine your version of a frustrating visit to a government bureaucratic office), imagine wading through a swamp of bureaucracy to feed your hungry children.

UK

The UK began war rationing in 1939, administered by the Ministry of Food. Basic goods (meats, sugar, cheese, etc) and most products (cereal, biscuits, rice) were apportioned by coupons. While fruits and vegetables were never rationed, long lines and shortages made supplying a household a difficult task for most housewives. Allocations varied across the population, with workers receiving larger shares, children receiving more fats, mothers receiving more milk, etc. The government also encouraged the cultivation of crops at home in what they dubbed a “victory garden.”

Germany

German rationing began in 1939, soon after the commencement of hostilities. Individuals were given cards (refreshed every 4 weeks) with allotted points for foodstuffs. While strict rationing did not come into effect until 1942, shortages could be felt throughout the grocery aisle for the previous three years across meat, eggs, milk, bread, and more. Germany also differentiated rations by the individual (more for labourers, mothers, less for Jews, etc.). Unsurprisingly, the country also experienced a burgeoning free market of exchange.

Today’s Conflict

Fastforwarding ahead again, neither America, Europe, Russia, nor China have begun rationing food. But remember – history is an imperfect guide to the future. While food rationing previously helped feed hungry men in their quest for glory, today’s version of food rationing – for all nations that end up involved in WWIII, or all nations who depend on foodstuff exports from these major powers – will likely be different.

Consider that the reason most of us are able to earn a living staring at a computer screen is modern agriculture. We use fossil fuels to power mechanised farming equipment, and we use our knowledge of industrial chemistry to produce fertilisers at scale. This allows for very few people to be employed as farmers without any negative impact on our massive modern agricultural outputs. In short, industrialisation and urbanisation moved humans from the farm to the city.

Imagine a world in which the flags that produce a disproportionate amount of global fertilisers restrict exports to hostile flags. Imagine a world in which flags that are the “workshops of the world” refuse to export critical components needed to build and operate industrial mechanised farming equipment. Imagine a world in which energy flows are disrupted such that the fossil fuels needed to power agricultural machinery just aren’t there. The result would be a steep fall in farming yields, and subsequently famine for certain flags.

Given there aren’t millions of men fighting on the battlefield who must be fed, I expect the shortages resulting from restricted exports and low farming yields will replace the more direct shortages incurred to feed soldiers during WWII. At this point, as Logan Roy so eloquently asked, “what is the price of a pint of milk”?

Your domestic fiat currency will not be able to keep up with this food inflation. If you are experiencing food inflation, it means your flag is structurally short of the necessary ingredients for modern agriculture, and no amount of money printing is going to solve for that deficit. Governments always resort to quotas and subsidies in an attempt to alleviate the pressure – but they never work, and only exacerbate the issue. Why would a business take risk attempting to solve the problem when the government will ultimately just expropriate their property to provide food for the people?

At this point, free markets will spring up. The free market of the past was physical, but if physical cash is banned and only electronic forms of money are accepted (Central Bank Digital Currencies, anyone?), then free market goods will be priced in an electronic currency that cannot be confiscated by the State. I predict that the currency of the free market will be Bitcoin.

Get Out

If you took anything away from the preceding section, it should be that governments have a wide range of tools at their disposal to enforce financial loyalty and restrict your ability to invest – and history shows that such controls (coupled with the other effects of war) usually inflict pretty substantial harm on plebe’s personal finances.

With that in mind, the best time to escape the jaws of wartime capital controls is before they are enacted. Remember that currently, your fiat net worth is zero, you are allowed to access your bank account, stock portfolio, and real estate at the discretion of the State. But when the State says Nyet to capital freedom, then the game is over.

In this digital age, we must be extremely thoughtful about what digital financial assets are fiat and what are true decentralised cryptos. If you think you are escaping EU capital controls, by transferring your EUR bank balances into CHF bank balances, you missed the point. Any digital asset held inside the banking system, regardless of the currency, is fair game for confiscation. You must completely exit the system altogether. Remember Zoltan’s definition of “Inside Money” vs. “Outside Money”, you can read more about it in my essay “Energy Cancelled”.

Bitcoin’s value and transmission network is not predicated upon government-chartered banking institutions. Therefore, it is outside the system, and thus “Outside Money”. Of course, the government could shut off the internet and electricity grid. But at that point, your flag has already lost the war. Instead of worrying about your financial assets, you better hope you have another flag’s passport to escape to greener pastures.

The government can also easily ban the conversion of fiat money into Bitcoin, and it will likely do so to prevent capital from escaping its grasp. But, it likely won’t be able to confiscate Bitcoin from those who already hold it – and here’s why.

Bitcoin’s Intrinsic Value

At any point in time, there is no mathematical way to prove that a particular public Bitcoin address belongs to me, or that I’m able to spend the Bitcoin contained in that address. Only when I sign a message spending an output of Bitcoin can it be reasonably determined that I had access to that address at that specific date and time. This is revolutionary, and not fully appreciated by most.

With every other monetary asset, I can easily determine who owns it without a discrete action by the supposed owner. If you say you have a bar of gold, I can see the gold. If you say your bank balance is $1 million, I can ask the bank to confirm. If you say you own that house, I can ask the government whose name is on the deed. But with Bitcoin, just because I suspect a public address might belong to you, doesn’t mean you actually have access to the funds in that address.

Furthermore, Bitcoin has no physical manifestation, and I can commit my Bitcoin private key to memory and spend funds whenever I like without anyone knowing. There are no outwardly visible cues as to how much Bitcoin I own.

The point being, you can inconspicuously convert fiat assets into Bitcoin. Bitcoin has no mass. $1,000,000,000 converted into Bitcoin is just as weightless as $1 converted into Bitcoin, whereas $1,000,000,000 converted into gold weighs many metric tonnes. Protecting many tonnes of gold from the covetous eye of the State is extremely difficult. A bar of gold, fiat money in the bank, or your house can also be stolen from you without your consent.

For someone to take “your” Bitcoin, they either need to know your private key (i.e., your password), or they need you to sign a transaction for them. But what if you “forgot” the password to your Bitcoin wallet? Well, then the funds would be completely inaccessible. Therefore, while the State can implement laws that confer ownership of a particular group of public addresses to itself, enforcing those laws would be rather difficult – as the State could not take control of the Bitcoin contained in those wallets without your consent.

Of course, there is a very simple way they could gain your consent. An agent of the State armed with a blunt force object or gun could visit your residence and demand you sign a transaction transferring your Bitcoin to the State. You might protest that you “forgot your password”, causing the agent to apply truth serum in the form of “enhanced interrogation” techniques like breaking your knees or shooting you in a non-lethal manner. And you might remember your private key at that point – but you also might not. If not, you may become a permanent cripple or your life might be extinguished, depending on the depravity of your flag, but they still wouldn’t be able to get to your Bitcoin.

How Bitcoin Would Survive

Assumptions:

A Total World War

Capital Controls

With these two assumptions, how could Bitcoin be mined? Bear in mind that mining is necessary to keep the network up and running – because mining is really the act of verifying and confirming transactions.

Obviously, any flag that enacted modern versions of capital controls might prohibit Bitcoin mining in its territory. So how would the network function if the major economies are all fighting one another?

One side might decide to use Bitcoin as a financial weapon. If a group of flags believed the operation of the Bitcoin network would financially weaken their adversary, then game theory dictates that they would likely allow miners to exist. This would naturally be a tenuous relationship, however, and if the flags decide at any point that mining Bitcoin has served its purpose, then it might ban it and confiscate any related machinery. Butterfly labs redux anyone?

Alternatively, there are always neutral flags in any conflict – and these neutral flags earn significant economic rewards by allowing both sides of a war to coexist within its borders. Switzerland did not participate in either world war, even though it is smack dab in the middle of Europe. Switzerland is not naturally endowed with copious amounts of natural energy, but imagine another country with an abundant source of natural energy – such as hydro or geothermal – decides to take Switzerland’s neutrality approach. This would be the perfect place for Bitcoin miners to operate. The miners would be heavily taxed, but they would at least be allowed to exist. Bitcoin could go on, and the neutral country would become the birth of crypto capital havens.

Finally, remember that pre-2013 – when ASICs first became commercially available – Bitcoin mining could be done profitably by hobbyists using personal computers. It goes without saying that the network hashrate was much lower at that time, but the beauty of the Bitcoin network difficulty’s self-correcting nature is that it creates the potential for Bitcoin mining to revert back to an activity that can be profitably conducted by the average computer user and not just extremely well-capitalised mining businesses. Should commercial mining be outlawed (explicitly or implicitly), the network can still function if enterprising individuals still find value in supporting the network underpinning the digital people’s money.

The Price Switch

“Arthur, you are just trying to write some scary shit to justify your long bias during this current nuclear bear market.”

I expect to hear many variations of this retort in response to this essay. And if that is your opinion, you didn’t get my message.

Readers may also be dismayed that I offer no price prediction in the event the economic war escalates. The point at which war becomes “total” for both sides, is the point at which you lose all options to protect yourself financially. The fiat price of Bitcoin ceases to be a thing. Who cares how many USD / EUR / JPY / CNY / RUB etc. buys one Bitcoin when you are forbidden from converting fiat currencies into anything other than domestic government bonds?

At that point, I’d expect that the Bitcoin price would switch from a fiat exchange rate to one against oil. Oil is the source of energy that powers modern civilisation. The ownership goals of Bitcoin are to maintain constant purchasing power with respect to oil. “Bitcoin per barrel of oil” would become the new exchange rate.

Don’t get it twisted.

The goal is to remain financially flexible in the face of the vagaries of war. 100% of your financial capital should never be parked in just one monetary instrument, whether that be Bitcoin, domestic fiat currencies, bonds, stocks, real estate, commodities, or gold. But your opportunity to move your fiat assets into Bitcoin and other “real” assets only exists today, and may not tomorrow. Remember that.

Appendix

American War Bonds

Real bond yield calculated by comparing the notational yield to the change in CPI over the lifespan of the bond from purchase in 1941, the first year war bonds were issued.

UK Consols

Real yield calculated by summing the cumulative difference between annual yield and CPI change over the selected period.

Related

The post appeared first on Blog BitMex