Dow Jones stock Goldman Sachs is trading below book value, suggesting it could be a buying opportunity for patient long-term investors. | Source: Shutterstock

By CCN Markets: Apple may be getting all the attention about its new credit card, but there is another company involved whose stock might be the real buying opportunity. Goldman Sachs, which is a component in the Dow Jones, is partnering with Apple for the card and in doing so is making a push into the consumer market.

The Wall Street bank is typically associated with institutions but has been making attempts at reaching the consumer market as well. While Goldman may be taking a narrow approach by targeting the high-end consumer with the card, it’s a start, and the firm’s timing couldn’t be better. The strong consumer is currently getting credit for holding up the U.S. economy. Does this make Dow Jones stock Goldman Sachs an attractive bet? Let’s just say it makes the stock more interesting, but there is one indicator that suggests that the stock could be cheap.

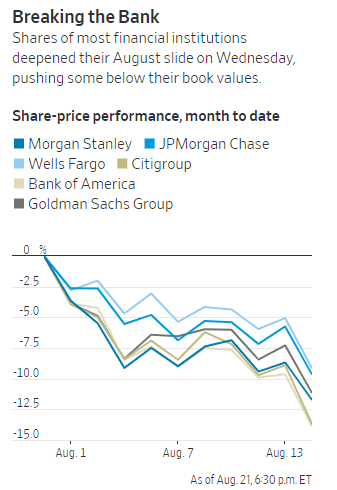

Goldman Sachs’ stock, which counts billionaire Warren Buffett as an investor, is trading below book value, which reflects what the firm would be worth if it were to divest all of its assets. The stock has basically gotten beat up along with most bank stocks as their earning power weakens in the low interest rate environment. But rates won’t remain at rock-bottom levels forever because the economy will eventually emerge from the recession danger zone. This suggests it could be a buying opportunity for long-term investors who are willing to wait for the economy to favor financial stocks once again.

Goldman Sachs is trading below book value. | Source: FactSet and The Wall Street Journal

A Bumpy Ride for Financials Including Dow Jones Stock Goldman Sachs

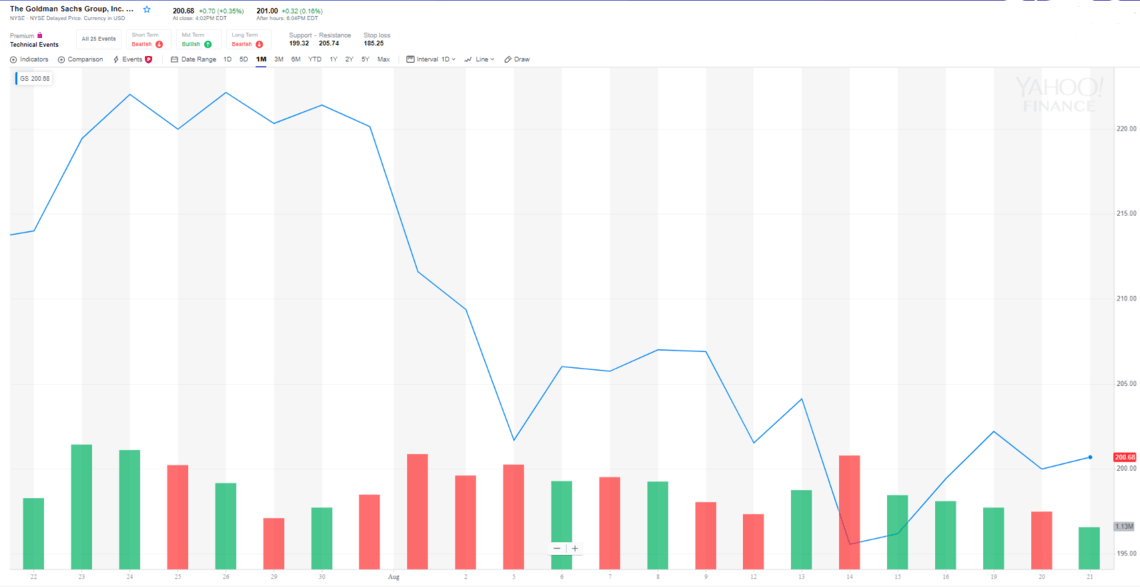

Goldman Sachs has been beaten up lately with the rest of an ailing financials sector and is down 18 percent from its 52-week high.

Goldman’s stock is down nearly 20 percent from its 52-week high.| Source: Yahoo Finance

Of course, not all traders are fans of Goldman Sachs stock, as it has dragged on the Dow Jones index. Stock market trader Guy Adami on CNBC compares Goldman’s stock to the worse-off Citi, the latter of which he points out is trading at 75 percent of book and is where Goldman is headed. Adami expects Goldman’s stock to fall to “$185 before it goes back to recent highs.”

After a dizzying week, our traders go Dow dumpster diving for bargains at the bottom of the bin. $BA $PFE $XOM $GS pic.twitter.com/u8xQzLntfW

— CNBC’s Fast Money (@CNBCFastMoney) August 16, 2019

Apple may be getting all of the attention for the new credit card, but it would never be possible without a bank such as Goldman Sachs. Love or hate the card, it’s hard not to appreciate a Wall Street bank that is looking to innovate and capture a piece of the consumer market share.

Disclaimer: This article is intended for informational purposes only and should not be taken as investment advice.

This article is protected by copyright laws and is owned by CCN Markets.

Source: CCNThe post appeared first on XBT.MONEY