According to a former Chairman of the US Federal Reserve, Alan Greenspan, it won’t be long before the spread of negative interest rates reaches the US. He also added that gold prices have been on a positive uptrend as investors are looking for a hedge. Can Bitcoin thrive under tumultuous economic conditions of the kind?

Negative Interest Rates Headed To The US

Alan Greenspan was the Chair of the US Federal Reserve from 1987 to 2006. Commenting on the current economic situation, he outlined that it’s only a matter of time before negative interest rates come to the US.

You’re seeing it pretty much throughout the world. It’s only a matter of time before it’s more in the United States. – Greenspan told CNBC’s Squawk On The Street.

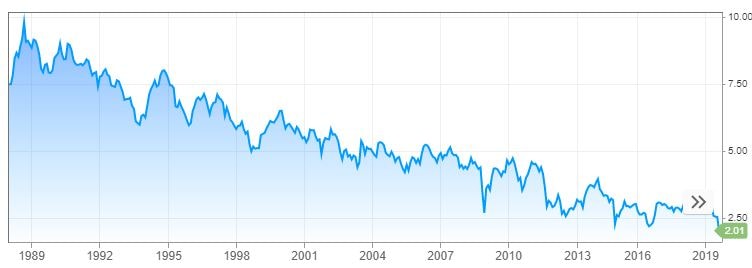

Indeed, looking at the US 30Y Treasury rate, we can see that it traded at around 1.93% on Wednesday, reaching an all-time low.

US30Y. Source: CNBC

By definition, with negative interest rates, cash deposits placed at banks bring a storage charge rather than the opportunity to receive an interest income.

Further adding to his point, Greenspan outlined:

We’re so used to the idea that we don’t have negative interest rates, but if you get a significant change in the attitude of the population, they look for a coupon. […] As a result of that, there’s a tendency to disregard the fact that that has an effect on the net interest rate that they receive.

Bullish For Bitcoin?

The veteran also outlined that gold prices have been surging recently as investors are looking for hard assets such as gold as their value tends to hold strong or increase down the road.

Gold prices have been performing splendidly in 2019. Gold CFDs are up more than 25 percent year-to-date and it appears that the international economic uncertainty is only fueling the growth.

But amid market conditions of the kind, it’s also reasonable to look at Bitcoin. As Cryptopotato reported yesterday, Bitcoin has consistently been marking higher lows every single month since February 2019.

The fact that it’s not correlated to traditional financial markets is something that makes it attractive to investors in times like these. At the beginning of August, when US President Donald Trump slammed yet another 10 percent tariff on $300 billion worth of Chinese goods, traditional markets tumbled. Bitcoin, on the other hand, gained more than $700 in less than 24 hours, potentially signaling that investors could be looking at it as a store of value and a hedge in critical economic conditions.

More news for you:

The post appeared first on CryptoPotato