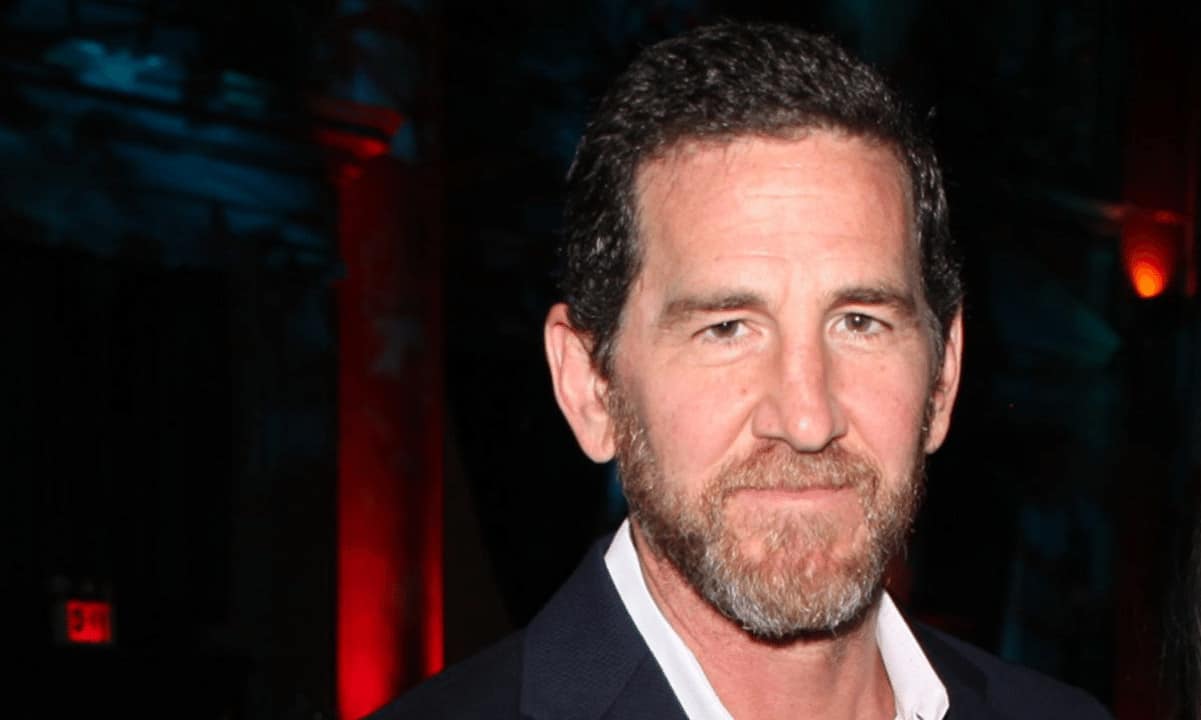

Adam Dell – former Head of Product at Marcus by Goldman Sachs – launched a new wealth-building platform focused on both cryptocurrencies and stocks. The project is called Domain Money and aims to grant investors opportunities such as more control and access to their assets, real-time intelligence, and live customer agents.

The Birth of Domain Money

Ahead of going live, the new investment platform, which targets retail users, raised $33 million from investors, including Bessemer Ventures, SV Angel, RRE Ventures, Maveron, and others. Its developers are Adam Dell and other team members behind Marcus by Goldman Sachs.

Adam Dell – whose brother is Michael Dell (CEO of Dell Technologies) – revealed that Domain Money’s mission is to “build consumer’s wealth.” He said the team behind the project “utilizes time-tested investment strategies” to create the best environment for new and experienced investors.

The American added that users seek security, transparency, and power to control their finances when investing. As such, his platform will aim at those features and more:

“We developed Domain Money to provide investors a sophisticated, intuitive, and holistic platform to invest in crypto, not as a novelty, but as a core component of their portfolios.”

The company will have prominent advisors behind it. These include Christopher Giancarlo – former Chairman of the Commodities Futures Trading Commission (CFTC), Do Kwan – Founder of Terra Network, and Niall Ferguson – Senior Fellow at the Hoover Institution.

ADVERTISEMENT

Investment App Betterment Wanted to Provide Crypto Services

The New York-based investment application with over 650,000 customers and nearly $30 billion of assets under management – Betterment – revealed last year plans to add cryptocurrency services for its clients.

Back then, the Chief Executive Officer at the company – Sarah Levy – spoke about the notorious volatile nature of the asset class. However, she asserted that her company could reduce the risks of dealing with digital currencies by educating its users on the matter:

“We know investors increasingly have an interest in crypto, so what we’re doing is really trying to figure out: Is there a way that we can offer crypto with a guided wrapper so that we can help educate along the way?”

She labeled bitcoin and the alternative coins as “countercyclical,” meaning they perform well even when the economy passes through harsh times. Speaking on a personal level, she said she is a “big fan of crypto” and advised investors to adopt the popular HODLing strategy to benefit the most from the asset class.

According to the official site of Betterment, though, the organization has not added cryptocurrency options for its customers yet.

Featured Image Courtesy of Bloomberg

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to get 25% off trading fees.

The post appeared first on CryptoPotato