The last few weeks were quite stagnant for Bitcoin in terms of price movement, considering the cryptocurrency is famed for its price action. However, while BTC price is looking pretty unexciting in recent times, Bitcoin is fundamentally strong as the network activities continue to record new highs.

Positive On-Chain Market Activities

According to insight first shared by Glassnode CTO Rafael Schultze-Kraft, on-chain market metrics including transaction counts, new addresses, active addresses, and spent outputs had positive performances yesterday.

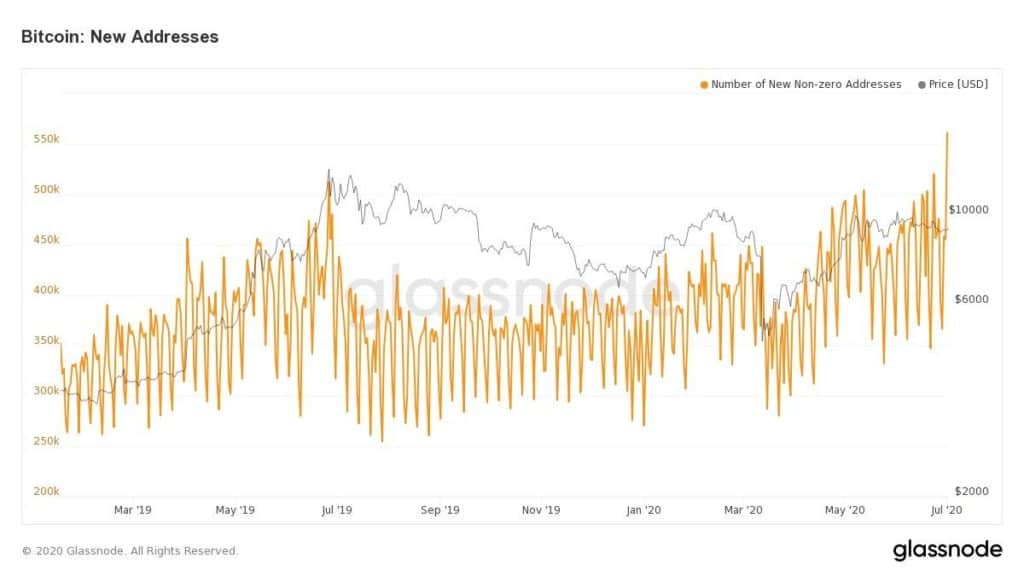

The number of daily new addresses reached a 2-year high of 560k. The last time a similar figure was recorded was during the bull run in late 2017 and early 2018. During that period, the number of new addresses created daily was between 800k and 600k. Since then, the number has never surpassed 550k until July 1, 2020, data on Glassnode reveals.

The total number of addresses on the network is now above 670 million. However, there are only 2,135 whale addresses with a balance of at least 1,000 BTC and less than 110 addresses with at least 10,000 BTC.

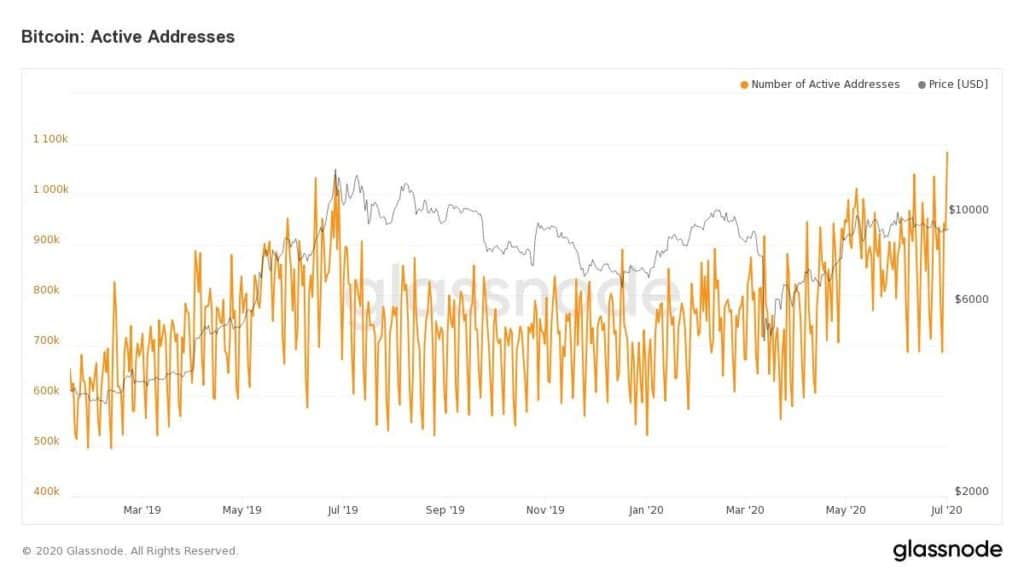

Glassnode further revealed that the daily active addresses saw a spike and reached above the 1.08 million mark for the first time since January 2018 when the total recorded was 1.24 million. Active addresses are unique addresses on the network that either send or receive coins.

The surge in the number of new and active addresses caused led to an increase in hourly on-chain transactions. The daily transaction count is now at 382k. The last time Bitcoin’s daily transaction count was this high was about ten months ago. Also, the number of hourly spent outputs with a lifespan of 24 hours is at its highest level.

Hash Rate Recovering Well

Despite the recent halving, the amount of transactions processed per second has reached a one-year high. Following the third halving event, the transaction rate dropped to as low as 2.48 transactions per second. However, on July 1, the transaction rate was at 4.42 transactions per second.

The network’s computing power has also recovered from the post-halving crash. On May 15, just a few days after the halving event, Bitcoin’s hash rate recorded a massive 32% drop to 91.265 TH/s. However, as of July 1, the hash rate was solidly above 125 TH/s, making the network more secure.

Meanwhile, Bitcoin is currently hovering around $9,200, with a total market cap of $170 billion.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato