According to Gemini, off-exchange or OTC trades on the new Gemini Clearing platform can be carried out both between two parties or through third-party brokers.

Cryptocurrency exchange Gemini has come up with a new digital clearing and settlement solution. Named Gemini Clearing, the new service allows traders to negotiate off-exchange or over-the-counter (OTC) crypto trades using Gemini accounts.

.@Gemini is continuing to expand its institutional offering with Gemini Clearing™, a fully-electronic clearing and settlement solution for off-exchange or over-the-counter (OTC) crypto trades. https://t.co/iR7bP8qk2f

— Tyler Winklevoss (@tylerwinklevoss) September 5, 2019

According to the company’s blog post, off-exchange or OTC trades on the Gemini Clearing platform can be carried out both between two parties or through third-party brokers.

Jeanine Hightower-Sellitto, Managing Director of Operations at Gemini, said:

“Such trades can either be arranged bilaterally between two parties or brokered via a third party. Gemini Clearing provides regulated clearing and settlement services for such pre-arranged trades, which helps to ensure timely settlement and mitigate counterparty risk.”

It is notable that Gemini does not have an OTC desk, but with the new product, it supports OTC desk trades. Among other benefits of Gemini Clearing are privacy (trade details are known only to the parties involved and are not published via Gemini’s market data feed), counterparty risk (transfer of funds between Gemini accounts takes place only after both parties of the trade are fully funded), and regulatory/compliance (as each party is subject to Gemini’s robust KYC and BSA/AML program).

As the company has noted, the new service will be available to anyone, including both institutional and retail traders, which makes it different from other exchanges including Huobi and Coinbase that have launched their OTC services exclusively for professional and institutional clients.

Gemini Pushes Further Adoption of Digital Money

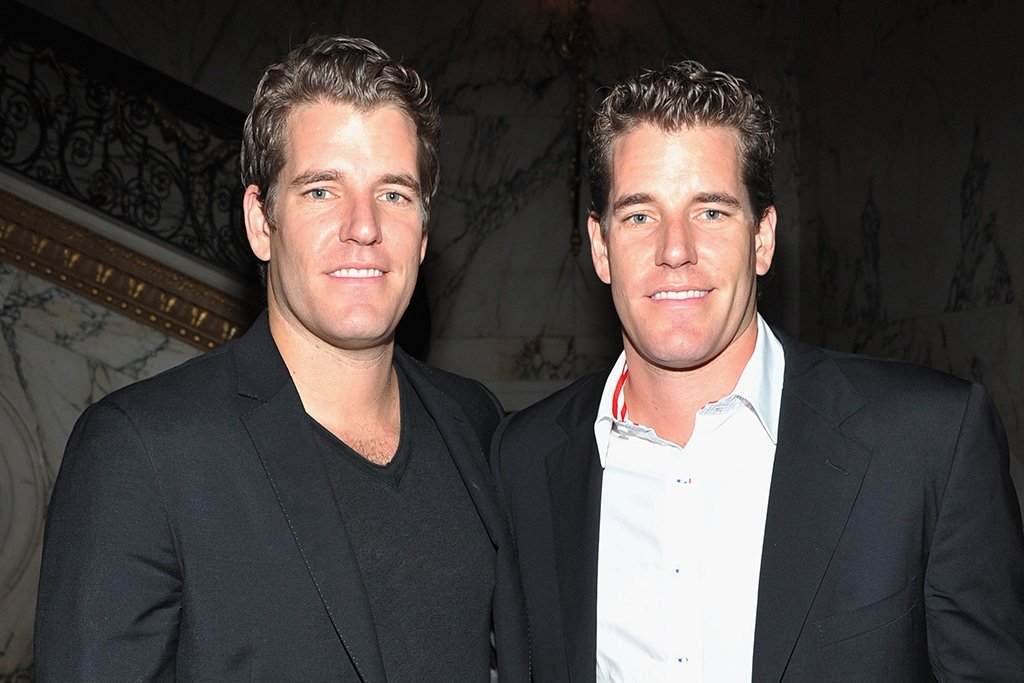

Gemini is a licensed digital asset exchange and custodian built for both individuals and institutions and regulated by the New York State Department of Financial Services (NYSDFS). Founded in 2014 by Cameron and Tyler Winklevoss, Gemini operates in the United States, Canada, the United Kingdom, South Korea, Hong Kong, and Singapore.

In July this year, Gemini founders were considering joining the Libra Association, the consortium behind Facebook’s cryptocurrency project Libra. The news surprised the crypto community, as previously Winklevoss brothers had disagreements with Mark Zuckerberg about the idea behind Facebook.

In August, Gemini announced its partnership with Silvergate Exchange Network (SEN), a USD payments platform. Within the agreement, SEN allowed Gemini’s institutional customers to deposit and withdraw U.S. Dollars from their accounts in real-time. With such an integration, the Gemini exchange can also establish counterplay relationships with other members on the network thereby making instantaneous transfers.

Recently, Gemini welcomed a new member to its team. The company hired Noah Perlman, the former Global Head of Financial Crimes at Morgan Stanley, as its new Chief Compliance Officer.

#TeamGemini Update – Noah Perlman will be joining us as Chief Compliance Officer!

Compliance is one of Gemini’s four pillars and we are excited for Noah to continue to build on this tradition.

Read more about Noah on our blog: https://t.co/Y6iANzERno

— Gemini (@Gemini) September 4, 2019

Moreover, the company has expanded to Australia and allowed its citizens download the Gemini Mobile App and use it to buy, sell, and store cryptocurrencies as are Bitcoin (BCH), Ether (ETH), Bitcoin Cash (BCH), Litecoin (LTC) and Zcash (ZEC). However, their own stable coin Gemini dollar (GUSD) will not be supported in Australia.

The Gemini team believes that cryptocurrencies will definitely replace traditional money, changing the sphere of finance. And the company will do its best to facilitate this process of transfer from fiat to digital money and introduce benefits of blockchain to the entire world.

The post appeared first on CoinSpeaker