The outbreak of the novel coronavirus (COVID19) caused serious turmoil in the global financial markets. According to a report by VanEck Global, an ETF and Mutual Fund Manager, during this crisis so far, gold correlates with Bitcoin increasingly in the short-term.

Gold Correlates With Bitcoin Amid Coronavirus Outbreak

Gold and Bitcoin are two assets that have nothing to do with each other on the surface and yet they are oftentimes compared. A closer look reveals many similarities, such as scarcity, finite supply, and so forth.

According to a new report by the fund manager VanEck Global, gold and Bitcoin are increasingly correlated amid the current coronavirus crisis.

“Short-term, the market sell-off induced by the COVID-19 pandemic increased bitcoin correlations with traditional asset classes – particularly gold, potentially hinting at bitcoin’s increasing safe-haven status.” – The document reads.

The report goes on to explain that a small allocation of bitcoin to a 60% equity/40% bond blended portfolio has significantly reduced the volatility of set portfolio throughout the recent market sell-off.

VanEck also makes the case that a product such as a Bitcoin ETF “may have significantly reduced volatility for 60% equity/40% bond blended portfolios.”

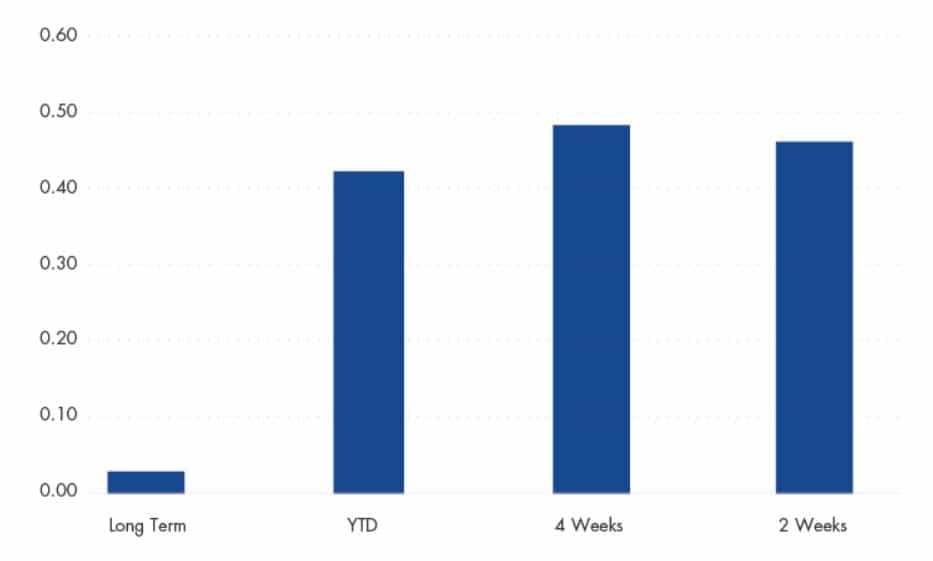

Yet, the company also concludes that the long-term correlation between bitcoin and gold remains low but increases during the COVID-19 induced broad market sell-off.

A Good Or Bad Thing For Bitcoin?

Bitcoin has been touted as a safe-haven asset by many in the cryptocurrency field. Even though it charted a 40% loss during the sell-off on March 12th-13th, a case could be made that bitcoin’s price recovered despite it being completely unregulated and with no safety nets such as government bailouts.

This notion brought on many comparisons between Bitcoin and gold as the latter is well-known as a powerful hedge against the price of stocks, currencies, and even other commodities.

As CryptoPotato recently reported, back in 2008, gold had its turning point, and at a certain time, it began increasing in value, unlike stocks that continued to decrease. Popular cryptocurrency analyst Willy Woo suggested that the decoupling of gold and bitcoin from the legacy markets during this crisis might have already started.

On the other hand, there are experts who believe that to shine, Bitcoin needs to be entirely uncorrelated from traditional markets, including gold.

The post Gold Correlates With Bitcoin Amid Coronavirus Outbreak, VanEck Report Says appeared first on CryptoPotato.

The post appeared first on CryptoPotato