Stocks, US Dollar, and yields crashed Friday after President Donal Trump ordered the US manufacturers to find alternatives to China, in a series of Tweets.

Trump’s tweets came after China announced new tariffs on another $75 million worth of US goods including autos. These tariffs that range between 5% and 10% will be implemented in two batches on September 1st and December 15.

Trump also announced additional tariff increase of 5% on imports from China.

….Sadly, past Administrations have allowed China to get so far ahead of Fair and Balanced Trade that it has become a great burden to the American Taxpayer. As President, I can no longer allow this to happen! In the spirit of achieving Fair Trade, we must Balance this very….

— Donald J. Trump (@realDonaldTrump) August 23, 2019

…Additionally, the remaining 300 BILLION DOLLARS of goods and products from China, that was being taxed from September 1st at 10%, will now be taxed at 15%. Thank you for your attention to this matter!

— Donald J. Trump (@realDonaldTrump) August 23, 2019

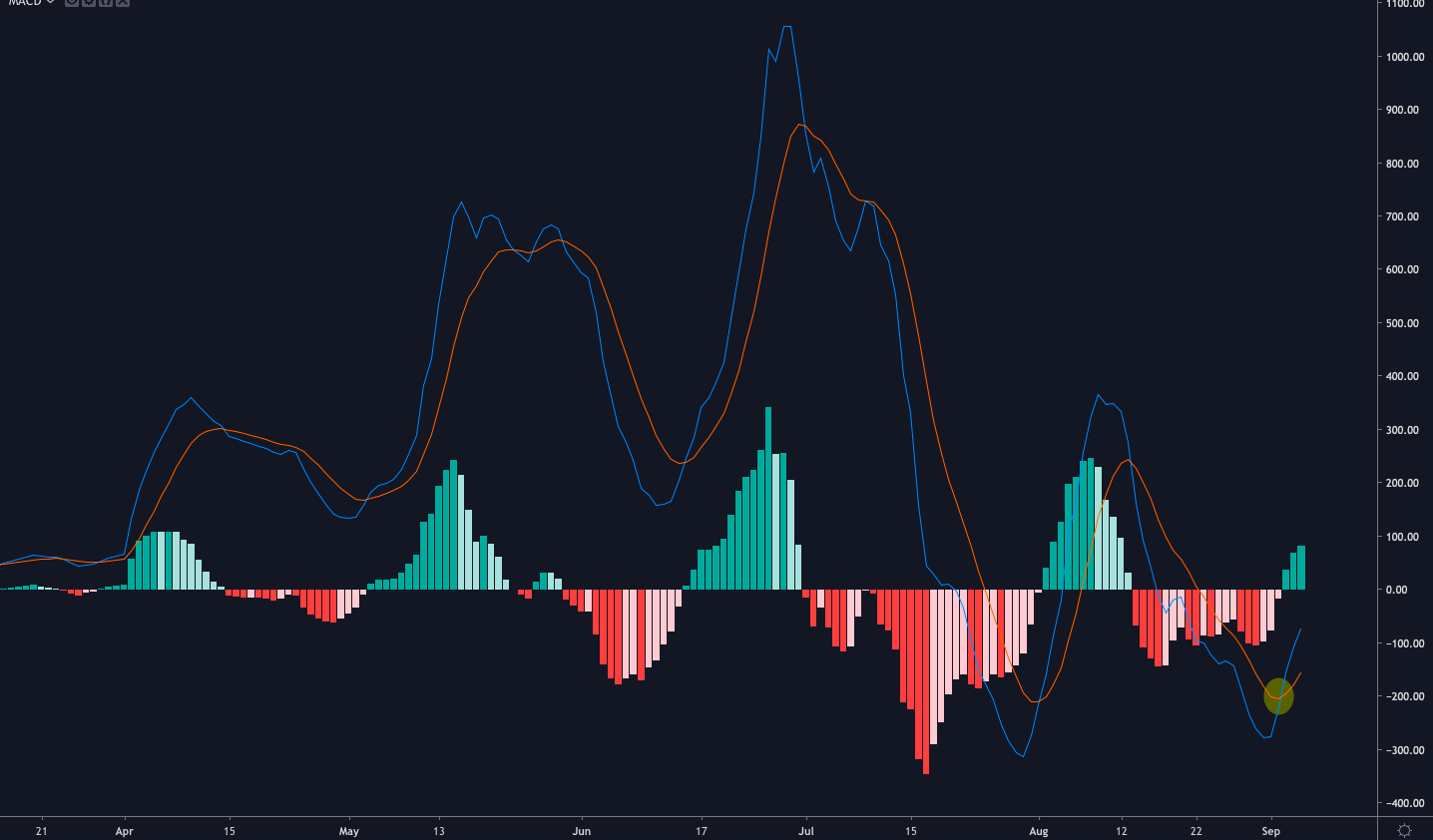

The market reacted badly, with red spilling all over.

The Dow Jones Industrial Average closed over 623 points lower, dropping 2.4%. The S&P 500 fell 2.6% while Nasdaq composite slid 3%.

The yield curves also inverted briefly on Friday but then fall flat. It has been a reliable recession indicator in the past.

Surprisingly, US Dollar plunged as traders feared that Trump might announce an outright currency war. The dollar index suffered its biggest one day drop in more than a month.

Meanwhile, gold scored gains of more than $24 an ounce, hitting a six and a half year high of $1,530.

#Gold is the #Bitcoin for those that haven’t found Bitcoin

— Brendan Blumer (@BrendanBlumer) August 23, 2019

Bitcoin also jumped above $10,400 on this news as economist and trader Alex Kruger commented, “first time BTC reacted sharply in *real-time* to a Trade War breaking headline or USDCNY fix,” an event outside of crypto.

But since then, we have dropped back down to the level before the spike.

Source: TradingView

Altcoins went red, following bitcoin. Total market cap lost about $10 billion with BTC dominance at 70.6%, as per TradingView.

Source: Coin360.com

About Trump’s move, Art Hogan chief market strategist at National Securities said,

“The threats have always been out there but there’s been no need to provoke that. It’s almost like the administration was expecting the Fed to announce a rate cut at the Jackson Hole meeting.”

“Hereby ordered to start taking your business out of China”. Really? Did we bestow dictator status on @realDonaldTrump Like I tweeted earlier, the slide has started. Trump is nervous and panicky and impulsive. Take the field vs Trump. And buy $btc. It’s gonna get messy

— Michael Novogratz (@novogratz) August 23, 2019

Trump further Tweeted, “As usual, the Fed did NOTHING!” after Fed Chairman Jerome Powell’s speech in Jackson Hole, Wyoming.

In his speech, Powelll said that “after a decade of progress toward maximum employment and price stability, the economy is close to both goals.”

These comments didn’t alleviate traders hoping for an aggressive easing cycle.

“He’s walking a tightrope,” said Michael Arone, chief investment strategist at State Street Global Advisors. “He’s balancing so many things that no other Fed chairman has had to do.”

Elsewhere, Bank of England governor, Mark Carney challenged dollar’s position as a world’ digital reserve currency, arguing that USD could be replaced by a global digital alternative.

BREAKING: Bank of England says that central banks should join forces and create a cryptocurrency to take the spot as the new world reserve currency.

A “Libra-like” currency to end the US Dollar’s dominance.

— Rhythm (@Rhythmtrader) August 23, 2019

Gold Explodes & Global Market Shook After President Donald Trump’s Tweet; Where is Bitcoin?

The post appeared first on Crypto Asset Home