The odds of Joe Biden winning the upcoming Presidential election and significant progress being made on the coronavirus vaccine front are unnaturally high, as per Goldman Sachs. Also, what is extremely possible is the US Dollar’s drastic drop to its 2018 lows because of these two probable events, according to the global banking giant. Will this cause bitcoin (BTC) price to break new highs?

The Time For The USD’s Drop To A 2-Year Low Is Nigh: Goldman Strategists

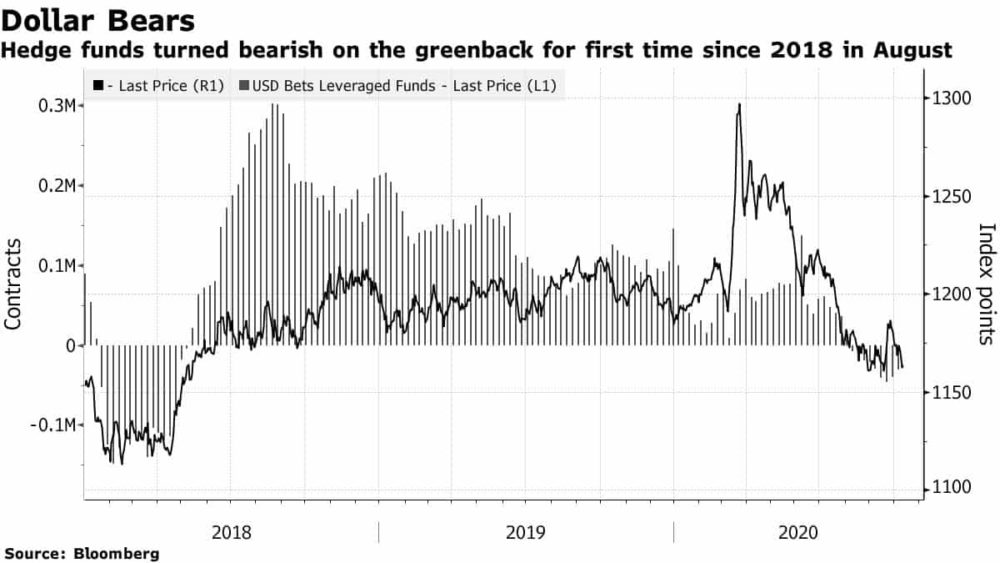

In one of the latest Bloomberg reports, analysts at Goldman Sachs Group Inc. have predicted a near doom for the greenback. This, they say, will happen on the back of ‘Joe Biden winning the U.S. election and progress on a coronavirus vaccine.’

Zach Pandl, along with other Goldman Sachs strategists, noted on Friday:

“The risks are skewed toward dollar weakness, and we see relatively low odds of the most dollar-positive outcome — a win by Mr. Trump combined with a meaningful vaccine delay. A ‘blue wave’ U.S. election and favorable news on the vaccine timeline could return the trade-weighted dollar and DXY index to their 2018 lows.”

Biden is clearly in the lead for becoming the next US President. Swiss banking heavyweight UBS, and asset management company Invesco had already used this as a yardstick to paint a bleak picture for the US Dollar.

Now Goldman Sachs has become the latest firm to second their opinion and has recommended ‘investors short the dollar against a volatility-weighted basket consisting of the Mexican peso, South African rand and Indian rupee.’

Time For Another ‘Face-Melting Bitcoin (BTC) Price Rally’?

As per a Twitter-based bitcoin analyst, “Mr. Anderson,” BTC’s RSI (Relative Strength Index) numbers are brewing up an extremely bullish scenario for the cryptocurrency.

#BTC Weekly RSI

A few wks ago I explained that the Bulls would defend $10.1k b/c they had too

Now BTC has given us a wkly RSI pivot that is extremely common w/ Ultra Bullish #BTC moves

A wkly RSI close of 63+ has always provided another LEG up & a 70+ close gives you $16k+ pic.twitter.com/9w8tWgeJpW

— Mr. Anderson (@TrueCrypto28) October 11, 2020

According to the technical setup posted by Mr. Anderson (not necessarily the antagonist from the popular Matrix film franchise), bitcoin’s weekly RSI close clocked a little above 60. This the ‘long-term TA trader’ opines is quite common and precedes ‘face-melting’ BTC price rallies.

Bitcoin bulls have already strongly prevented BTC from dipping below the $10,100 mark. If bitcoin were to register a weekly RSI close of 63+, it would signal the beginning of another rally, with a $16,000 BTC very much possible if RSI tops and surpasses 70.

Also, Mike McGlone, a senior Bloomberg market analyst, predicted bitcoin attaining a $100,000 price by 2025. But for this year, BTC would have to make do with $14,000, he said. It is still quite an impressive growth because the cryptocurrency crashed to near $3,600 lows in March.

The post appeared first on CryptoPotato