The leading crypto-asset management firm, Grayscale Investments registered a total of $2.2 billion in Assets Under Management [AUM] on 10th January 2019.

Its official tweet read,

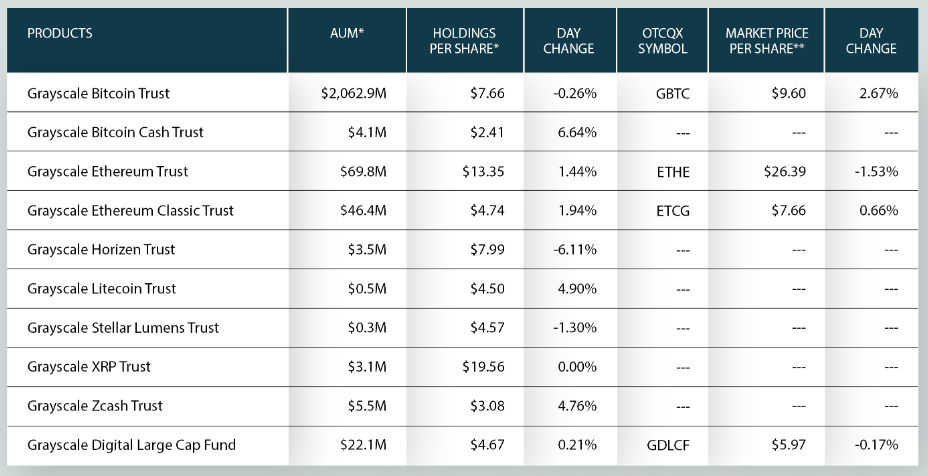

“01/10/20 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Products. Total AUM: $2.2 billion”

According to the investment firm’s latest update, Grayscale Bitcoin Trust exhibited a decline of 0.26% despite a positive price action of its underlying cryptocurrency in the first week of 2020. Additionally, GBTC held $2,062.9 million AUM with $7.66 holdings per share.

Source: Grayscale Investment

The digital currency asset manager had previously registered $2.3 billion in Assets Under Management [AUM] on 8th January, highest in this year. Following which it declined and held its mark at $2.2 billion AUM, on 9th and 10th January.

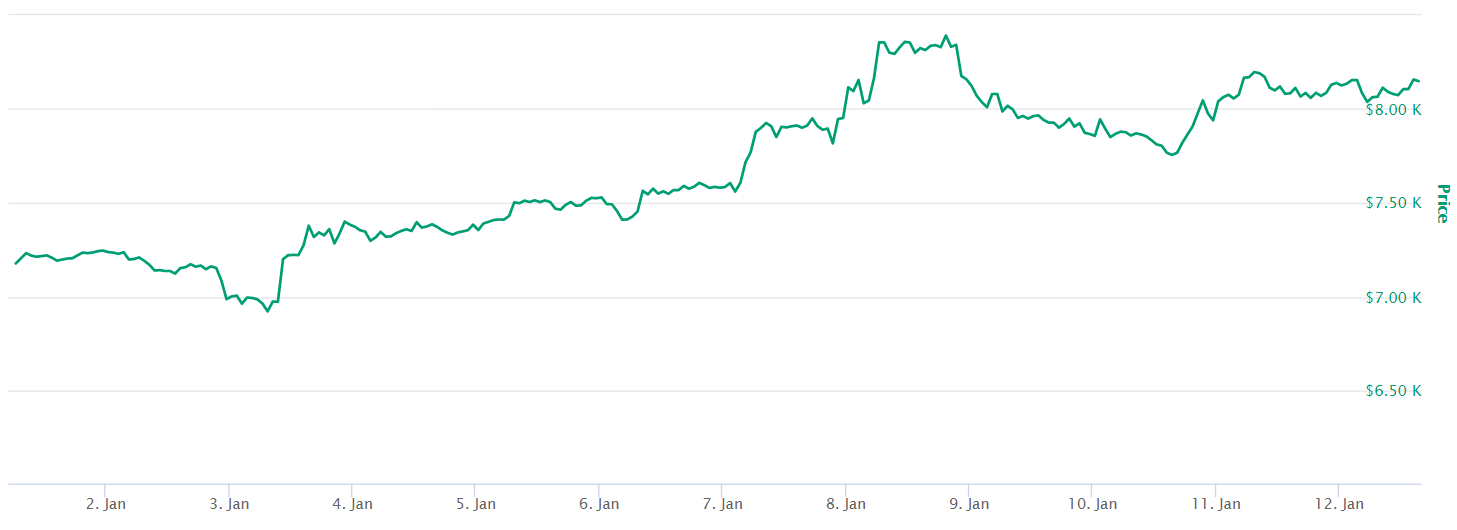

Source: CoinMarketCap | Bitcoin

This coincided with Bitcoin’s price movement. According to CoinMarketCap’s data, BTC was trading near the $7,200-region on 1st January. Eight days later, the coin climbed to a year-high of $8,391 before sustaining a brief fall below $7,800 on 10th January. The price recovered and at press time, Bitcoin was trading at $8,162 with a market cap of $148 billion after a surge of 8.92% over the past week.

Interestingly, Grayscale Bitcoin Trust climbed to a year-high of $2,144.1 million AUM on 8th January before falling to $2,069.9 million AUM the very next day

Besides, Grayscale Bitcoin Cash Trust noted an uptick of 6.64% in its day change and registered $4.1 million AUM and holdings per share of $2.41. Grayscale’s Ethereum investing product held $69.8 million AUM after a positive day change of 1.44% and $13.35 holdings per share. The investment firm’s Litecoin Trust held its mark at $0.5 million AUM and $4.50 holdings per share after a surge of 4.9%.

Overall Grayscale Digital Large Cap Fund held $22.1 million AUM after recording a positive change of 0.21% and holdings per share of $4.57.

The post appeared first on AMBCrypto