Grayscale Investments has been loading up on digital assets for a while now, more so when prices have been depressed.

Its Bitcoin Trust enables investors to gain exposure to the price movement of BTC through a traditional investment vehicle. This is a bonus for institutional investors seeking to expand their portfolios but not wanting to dabble in crypto exchanges or trading directly.

In addition to Bitcoin, Grayscale also offers trust funds in Ethereum, Bitcoin Cash, XRP, Litecoin, Stellar Lumens, Ethereum Classic, Zcash, and Horizen. The total assets under management (AUM) have just hit another milestone.

$5.5 Billion AUM

According to a recent tweet, Grayscale now has $5.5 billion worth of digital assets under management, spread across its various funds. Compared to last week, that fund has grown by $700 million as crypto prices hit new highs for the year.

08/05/20 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Products.

Total AUM: $5.5 billion$BTC $BCH $ETH $ETC $ZEN $LTC $XLM $XRP $ZEC pic.twitter.com/daUhirxzte

— Grayscale (@Grayscale) August 5, 2020

The BTC trust holds the lion’s share, or over 80%, of the investments at $4.5 billion with the ETH trust coming second with $746 million. Crypto friendly cash app Square has also seen quarterly revenues surge to record levels on the back of Bitcoin.

Acknowledging this rising trend, Grayscale has also launched a Digital Currency Toolkit for financial advisors, stating;

“Over one third of U.S. investors are interested in investing in crypto like #Bitcoin. For financial advisors, it’s time to get up to speed on the asset class.”

The package does appear to be very Bitcoin heavy, though, just like the fund itself. Bitcoin may be the digital gold, but it is not the best performing crypto asset at the moment.

Crypto Cap at One Year High

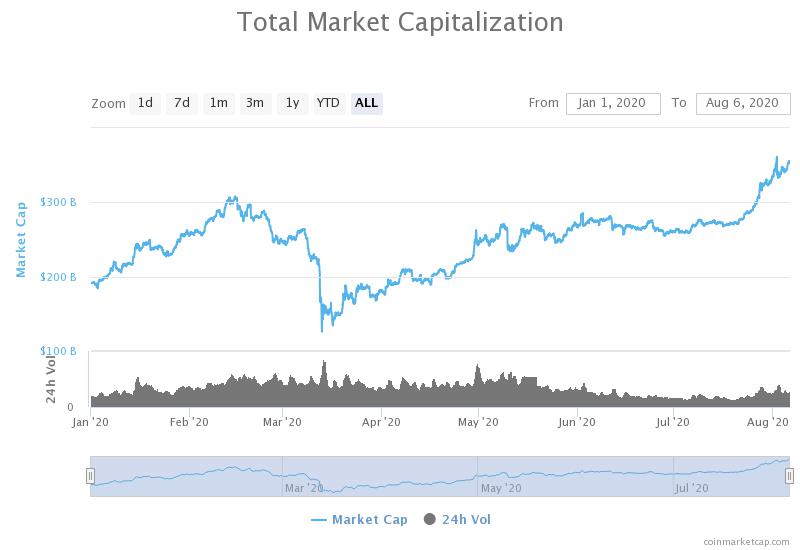

The momentum is all clearly bullish at the moment as crypto markets are hovering at their highest levels for over a year in terms of total market capitalization, which is just over $350 billion at the time of writing.

Since the beginning of 2020, crypto markets have collectively gained 84%, but they have yet the break above their 2019 highs. Ethereum and DeFi tokens have been driving momentum with ETH tapping a two year high of $400 twice this week. Some of the DeFi tokens, meanwhile, have gone parabolic with four-figure gains over the past six months.

The confirmation of the uptrend is likely to bring in more institutional investors to funds such as Grayscale’s, which can only be bullish for the industry.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato