The number of US-based investors interested in Bitcoin continues to increase according to Grayscale’s Investment 2020 report on the cryptocurrency.

The leading digital asset manager also noted that the COVID-19 pandemic has exemplified Bitcoin’s merits and made it even more captivating to investors.

US Investors’ Growing Interest In Bitcoin

Titled “Bitcoin Investor Study,” Grayscale’s 2020 research aimed at shedding some light on US investors’ perception of Bitcoin and how it has changed in a year. The expanding interest is among the most notable highlights. Grayscale noted that 36% of all surveyed participants in 2019 expressed an interest in BTC, while the percentage has grown to 55% this year.

83% of those who answered that they have previously bought Bitcoin have made their purchase in the past year. The most significant percentage here was in the past four months – 38%.

Nearly two-thirds of those particular Bitcoin investors reported that “the ramifications of COVID-19 were a factor in their decision to do so.” Furthermore, three times as many investors indicated that the pandemic had increased Bitcoin’s appeal as those reporting that it had decreased their interest in the asset.

The data also suggested that “Bitcoin is moving toward mainstream acceptance,” as 62% of the 1,000 participants said they were familiar with the primary cryptocurrency. For reference, the percentage last year was slightly over 50%.

Bitcoin To The Moon Attracts Investors

Apart from listing the COVID-19 as a motivating factor to purchase Bitcoin, the participants listed two other reasons. Being the best-performing asset of the previous decade, BTC’s potential price growth has become even more alluring to new investors. Nearly 80% named this as their most enticing aspect.

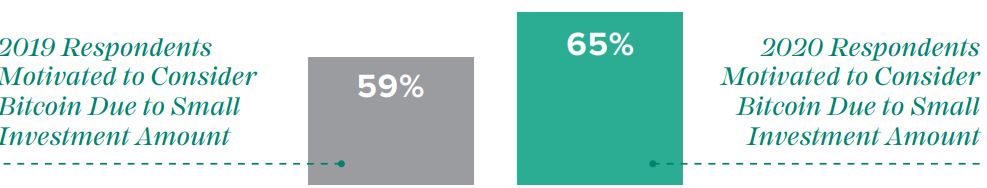

The other reason why most people have become attracted to the asset is the ability to start small. Although many investors outside of the cryptocurrency industry believe that they need to purchase at least one bitcoin to start, that’s far from the trust. As any BTC proponent will assert, people can buy even a small fraction.

65% have answered that having the option to buy less than one bitcoin has made them feel safer towards entering the space. The percentage has grown by 6 points since last year.

Despite all the rising data from above, most people still believe that they need more comprehensive educational materials before investing. They explained that the regular investor couldn’t find trustworthy information on the cryptocurrency space. However, there’s a significant number of reports covering crypto scams.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

The post appeared first on CryptoPotato