SushiSwap is one of the ‘forgotten’ DeFi projects in the space today, one that everyone certainly remembers. And, not for all the right reasons wither. In fact, in light of the aftermath of the Nomi/Sushi ordeal, SushiSwap has been passed up by many as an ‘investable project.’

However, it would now seem that the protocol has been constantly working behind the scenes under new management to possibly reinvent itself. The new management under 0xmaki has introduced some new products on top of its main exchange product – BentoBox.

The SIMP1 proposal, which stands for Sushi Improvement or Modification to the Protocol, aims to improve upon rewards too. It will include Vesting and Boosting for rewards in the new Sushibar v2, rewards in DAI, and Keep3rs integration.

Sushiswap had a really shitty autumn, as the glow of DeFi summer wore off and the memory of NomiGate lingered.

And during that…. it just kept on building.

I’m not really involved in what Sushi is doing, but I’m happy to see it keep pushing the industry forward. https://t.co/WZQfGJMdBZ

— SBF (@SBF_Alameda) November 15, 2020

In fact, of late, Sushi has managed to generate some interest among certain members of the crypto-community, including FTX CEO Sam Bankman-Fried, who tweeted,

“I’m not really involved in what Sushi is doing, but I’m happy to see it keep pushing the industry forward.”

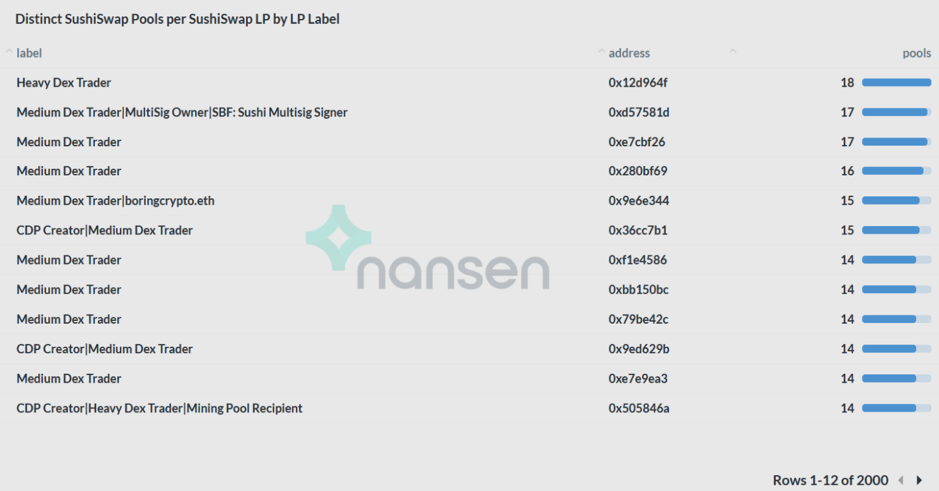

However, although SBF tweeted that he is not really involved in what Sushi is doing, a Nansen report found that he has 17 pools, making him the second-highest Liquidity Provider (LP).

It should also be noted that 66.2% of LPs provide liquidity to only 1 pool and only 4.2% provide liquidity to 5 pools or more.

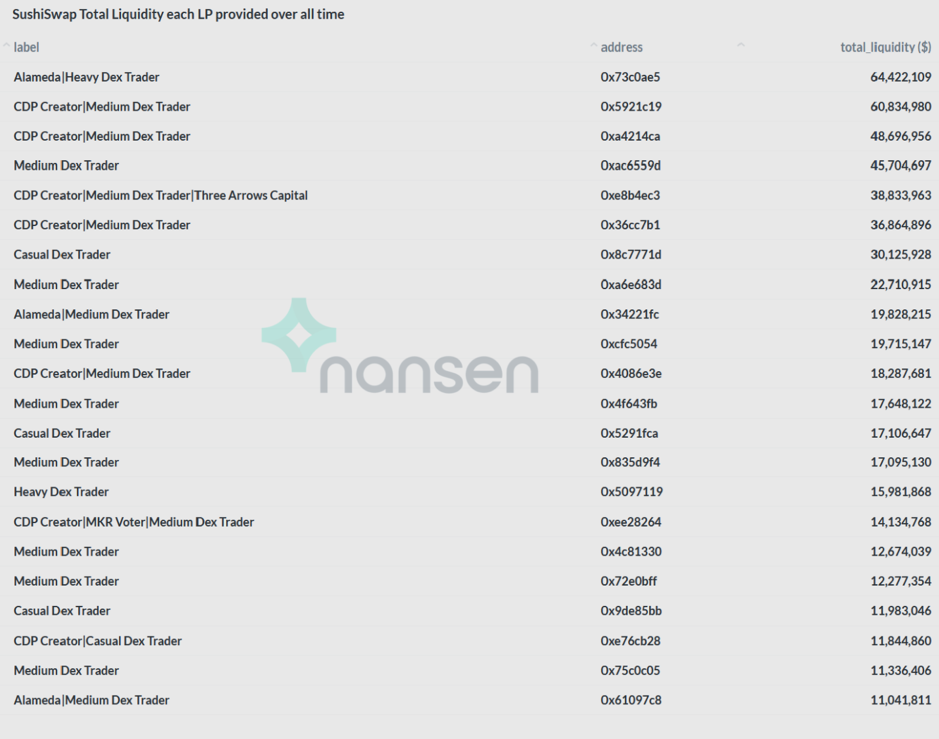

Further, when examining the Total Liquidity of each LP provided over time, it was found that Alameda and Three Arrows Capital have provided a significant amount, with Alameda providing over $64 million.

This is not the same SBF MultiSigner address from Alameda that was noted down in the previous section, which probably means Alameda seems to be using multiple wallets to interact with SushiSwap.

The report also revealed that Alameda is one of the top farmers, ranking 5th on the list of top farmers with $201,104 in master chef farming.

The post appeared first on AMBCrypto