Bitcoin’s halving is behind us, and its price is nothing but soaring. Moreover, BTC is surging while legacy markets continue their downturn, strengthening the narrative that the cryptocurrency keeps on decoupling.

Bitcoin Price Soars 9% in Less Than Three Days

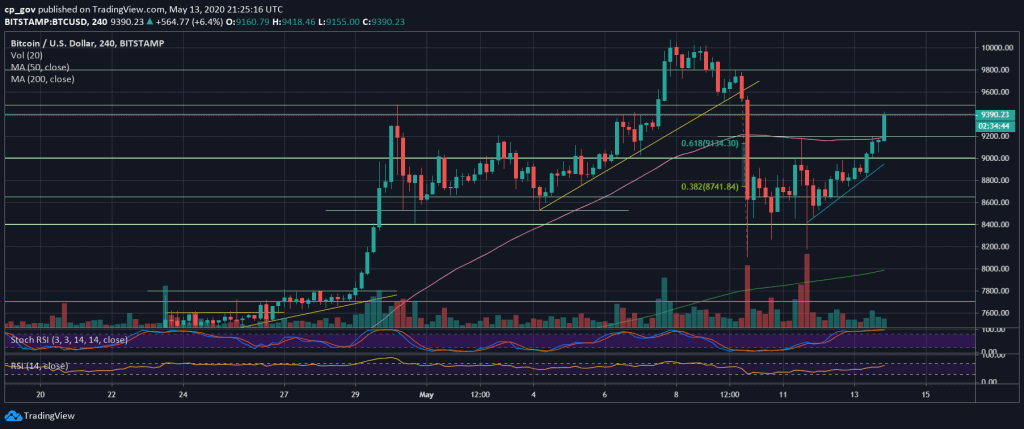

Bitcoin’s halving took place a little more than 48 hours ago. At the time, BTC was trading at around $8,550, and it currently changes hands at over $9,300, while the current daily high touched $9400 on Bitstamp. This marks an increase of more than 9% in less than three days.

From a technical perspective, Bitcoin broke above the range between $9,130 – $9,200 that contains the Golden Fib level 61.8% and represents a strong resistance area. This now becomes the first major support from below, followed by $8900.

Should BTC be able to make a definitive close above it, the next area to watch out for lies between $9,400 and $9,500, the current daily high as of writing these lines. Following that, strong resistance lies between $9,800 and $10,000. The latter is the high from a week ago, and the highest level since mid-February.

It’s worth noting that, as it stands, Bitcoin defies a lot of the doom-and-gloom predictions that factored in selling pressure from miners that are no longer profitable.

BTC Continues To Decoupe From Legacy Markets

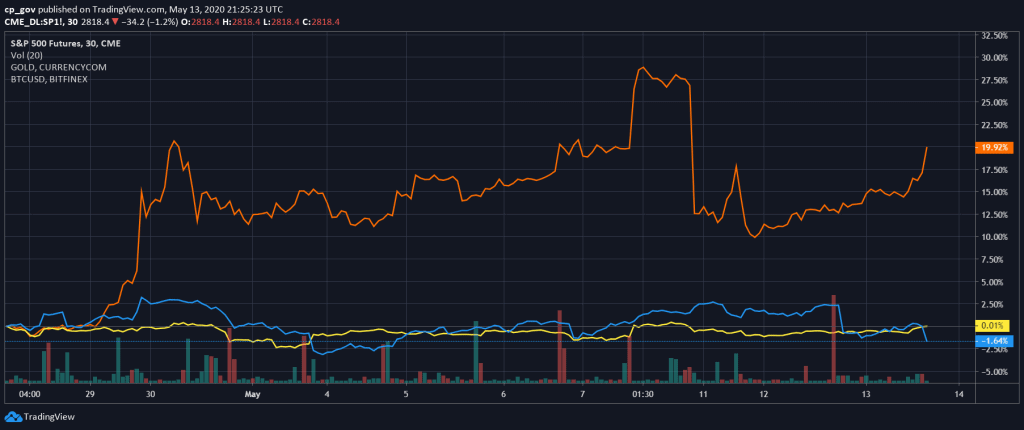

Another interesting thing to note is that the cryptocurrency continues to detach from traditional markets. In the same period, the S&P 500 lost about 5% off its value while gold is more or at the same price, it was at the time of the halving.

BTC vs S&P500 vs Gold. Source: TradingViewAs seen in the above chart, this is not a two-day trend. Bitcoin’s price has failed to follow that of legacy markets since the beginning of May.

Many experts have previously stated that Bitcoin needs to be in a league of its own and that the only way to do this is to be completely disconnected from traditional finance. This would allow it to establish itself as a viable alternative and enable it to fulfill the purpose it was created for.

In any case, the latest development in Bitcoin’s price could probably be considered as somewhat positive. The coronavirus-induced financial crisis continues to take its toll even though some countries lifted some of the limitations in an attempt to get their economies back to normal. However, major indices are still far from recovered as the S&P 500, for once, is about 15% below its numbers from mid-February.

The post Halving Decoupling: Bitcoin Price Soars 9% While The S&P 500 Losses 5% appeared first on CryptoPotato.

The post appeared first on CryptoPotato