The feud between Bitcoin and Ethereum is a long-standing one. ‘Feud’ isn’t exactly the right word for it. Perhaps, the communities have fought over which is the superior coin for quite some time. However, comparing BTC and ETH is like comparing apples to oranges, while both may be fruits, both are different and alike in their own way.

Here are a few examples:

- Bitcoin is more ‘money’ than Ethereum. Bitcoin’s major focus was to be an alternative payment system to the US dollar. Hence, payment/value transfer is the main focus of Bitcoin, while with Ethereum, there are a plethora of use cases that range from smart contracts, building dapps, the world computer, etc.

- Bitcoin is an asset that has higher s2f which is its main attraction/selling point to the global audience. Bitcoin can hold value [aka store of value] and is digital gold, hence, this narrative is quite alluring to the investors. As for ETH, people may find it hard to grasp Ethereum as a blockchain.

While fundamental differences are many and can be elaborate, here are comparisons of an on-chain metric that tries to show the differences between the two.

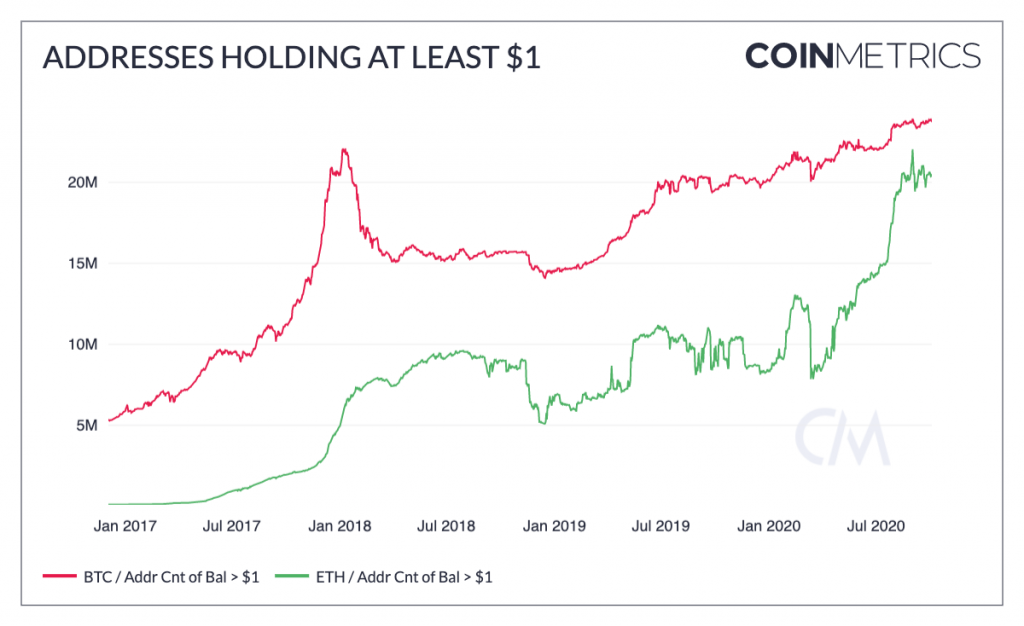

- Bitcoin addresses worth $1 hit a new high of 24 million, and so is the same with ETH addresses holding $1 ETH at 21.4 million.

Source: Coinmetrics

While ETH isn’t far away it still needs to catch up with BTC.

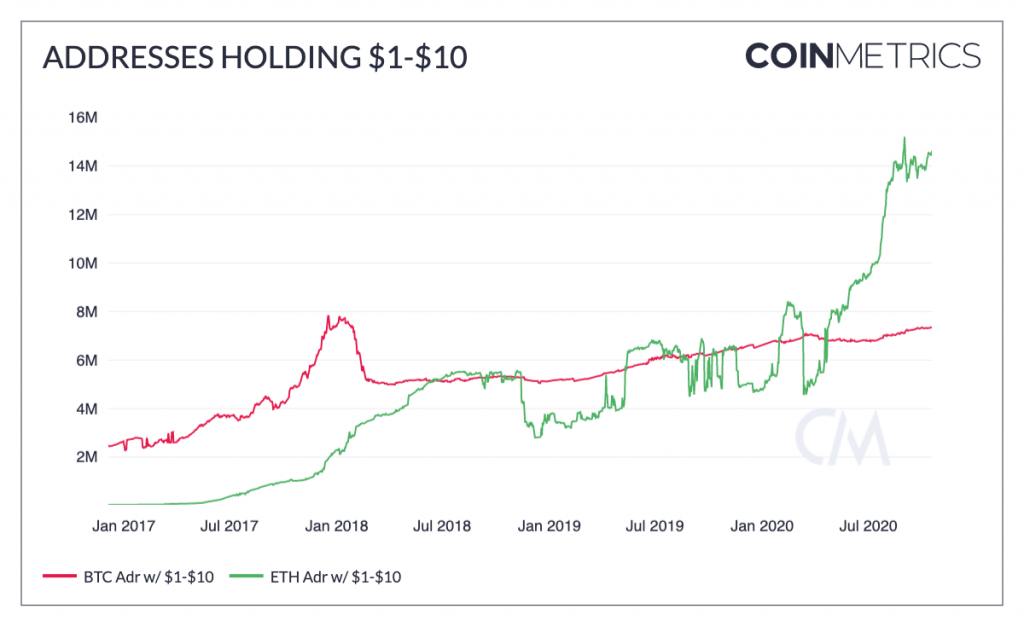

2. BTC addresses that hold less than $10 is at a whopping 16.45 million whereas, for ETH, this number is at 6.51 million. The gap is huge but is not out of the purview of Ethereum.

Source: Coinmetrics

Conclusion

This is both good and bad, depending on how one views it.

On the bright side, Bitcoin has had the 1st mover advantage, however, ETH has almost caught up with bitcoin even though it was launched in 2015, 2016. Considering ETH’s much-awaited and much-delayed ETH 2.0, these numbers could easily be overpassed, should ETH successfully move to ETH 2.0.

To conclude, comparing these coins is counter-cyclical. Bitcoin’s goal is much different than what Ethereum intends to do, so comparing them would be a wasted effort. While the two, as mentioned, are different from each other, trying to build a gateway between the two would benefit both the ecosystem better.

The post appeared first on AMBCrypto