(Any views expressed below are the personal views of the author and should not form the basis for making investment decisions nor be construed as a recommendation or advice to engage in investment transactions.)

Ping…Ping…Ping…

That is the sound of my phone alerting me to overnight snowfall at the various Hokkaido ski resorts I monitor. While this sound brings me immense joy in January and February, in March, it brings only FOMO.

I decamped from Hokkaido in early March for the past few ski seasons. My recent experience taught me that Mother Nature turns on the heat circa March 1st. I’m a primadonna skier who only likes the driest and deepest pow. However, this season, Gaia changed up big time. There was a brutal warm spell in February that rekt the snow back. The cold weather only returned towards the end of the month. But frigid temperatures came back in March, accompanied by 10 to 30cm dumps of freshie pow pow every night. Hence, the reason why my phone was blowing up.

Sitting in various South East Asian hot and humid countries throughout March, I kept foolishly checking the app and ruing my decision to leave the slopes. The April thaw finally occurred in earnest, and with it, the end to my FOMO.

As readers know, my ski experiences act as metaphors for my macro and crypto trading book. I previously wrote that the cessation of the US Bank Term Funding Program (BTFP) on March 12th would cause a global market rout. The BTFP was cancelled, but a vicious sell-off in crypto specifically did not occur. Bitcoin broke $70,000 decisively and topped out around $74,000. Solana kept pumping alongside various doggie and kitty meme coins. My timing was wrong, but like the ski season, the unexpected favourable March conditions will not be repeated in April.

While I love winter, summer brings joy as well. The onset of northern hemispheric summer brings sporting bliss as I reorient time towards playing tennis, surfing, and kiteboarding. Summer will usher in a renewed gusher of fiat liquidity due to the policies of the US Federal Reserve (Fed) and Treasury.

I will briefly outline my mental map on how and why April will experience extreme weakness in risky asset markets. For those intrepid enough to short crypto, the macro setup is favourable. While I will not outright short the market, I have closed in profit several shitcoin and memecoin trading positions. From now until May 1st, I will be in a no-trade zone. I hope to return in May with dry powder ready to deploy to position myself for the bull market to begin in earnest.

Tricksters

The Bank Term Funding Program (BTFP) ended a few weeks ago, but no US, non-Too-Big-to-Fail (TBTF) banks have subsequently faced any real stress. That is because high priests of fugazi finance have a bag of tricks they will use to surreptitiously print money in order to bail out the financial system. I will peek behind the curtain and explain how they are expanding the USD fiat money supply, which will underpin the general rise of crypto and stonks until the end of the year. While the end result is always money printing, the journey is not without periods where liquidity growth slows, providing a negative catalyst for risk markets. By going through the bag of tricks and estimating when the rabbit will be pulled from the hat, we can guestimate when there will be periods where the free market is allowed to operate.

The Discount Window

The Fed and most other central banks operate a facility known as the discount window. Banks and other covered financial institutions who are in need of funds can pledge eligible securities to the Fed in exchange for cash. By and large, the discount window, for now, only accepts US Treasuries (UST) and mortgage-backed securities (MBS).

Assume that a bank is fucked because a bunch of Pierce & Pierce boomer muppets runs it. The bank holds a UST that was worth $100 when purchased but is currently worth $80. The bank is in need of cash to satisfy deposit outflows. Rather than declaring bankruptcy, the dogshit insolvent bank can tap the discount window. The bank swaps the $80 UST for $80 of dolla dolla bills because under the current rules the bank receives the market value of pledged securities.

To deprecate the BTFP and remove the associated negative stigma without increasing the risk of bank failures, the Fed and US Treasury now encourage troubled banks to tap the discount window instead. However, under the current collateral terms, the discount window is not as attractive as the recently expired BTFP. Let’s go back to our example above to understand why.

Remember that the UST’s value declined from $100 to $80, which means the bank has an unrealised loss of $20. Initially the $100 of UST was funded with $100 of deposits. But now the UST is worth $80; therefore, the bank would be short $20 if all the depositors fled. Under the BTFP rules, the bank receives par for underwater USTs. That means a UST worth $80, when delivered to the Fed, is swapped for $100 of cash. This restores the solvency of the bank. But the discount window only gives $80 for a UST worth $80. The $20 loss is still there, and the bank remains insolvent.

Given that the Fed can unilaterally change the collateral rules to equalise the treatment of assets by the BTFP and discount window, by greenlighting the use of the discount window by the insolvent banking system, the Fed continued the stealth banking bailout. Therefore, the Fed has essentially solved the BTFP problem; the entire UST and MBS balance sheet of the insolvent US banking system (I estimate at $4 trillion) will be supported when needed by money printed to finance loans through the discount window. This is why I believe the markets haven’t forced any non-TBTF banks into bankruptcy post-March 12th, when the BTFP ended.

Bank Capital Requirements

Banks are often called upon to finance governments who offer bonds at yields less than nominal GDP. But why would private for-profit entities buy something that features a negative real yield? They do it because the banking regulators allow banks to purchase government bonds with little to no money down. When the banks, who hold an insufficient capital cushion against their government bond portfolio, inevitably blow up because inflation appears and bond prices fall as yields rise, the Fed allows them to use the discount window in the manner described above. As a result, banks would rather buy and hold government bonds than lend to businesses and individuals in need of capital.

When you or I buy anything using borrowed money, we must pledge collateral or equity against potential losses. That is prudent risk management. But the rules are different if you are a vampire squid zombie bank. After the 2008 Global Financial Crisis (GFC), the world’s banking regulators attempted to force banks globally to hold more capital, thus creating a more robust and resilient global banking system. The system of rules that codified these changes are called Basel III.

The problem with Basel III is that government bonds are not treated as riskless. Banks must put a small amount of capital behind their gargantuan portfolio of sovereign bonds. These capital requirements have proven problematic during times of stress. During the COVID March 2020 market crash, the Fed decreed that banks could hold USTs with no collateral backing. This allowed banks to step in and warehouse trillions of dollars worth of USTs in a riskless fashion … at least in terms of their accounting treatment.

When the crisis abated, the supplemental leverage ratio (SLR) exemption for USTs was reinstated. Predictably, as UST prices fell due to inflation, banks went bust due to an insufficient capital cushion. The Fed rode to the rescue with the BTFP and now the discount window, but that only covers losses from the last crisis. How can banks step up and slurp down more bonds at the current unattractively high prices?

The US banking system loudly proclaimed in November 2023 that due to Basel III forcing them to hold more capital against their government bond portfolios, Bad Gurl Yellen could not stuff them with more bonds. Therefore, something had to give because the US government has no other natural buyers of its debt at these negative real yields. Below is the polite way the banks phrased their precarious situation.

Demand for US Treasuries may have softened among several traditional buyers. Bank security portfolio assets have been declining since last year, with bank holdings of Treasuries down $154 billion compared to one year ago.

Source: Report to the Secretary of the Treasury from the Treasury Borrowing Advisory Committee

Again, the Fed – led by Powell – saved the day. Out of nowhere, at a recent US Senate Banking hearing, Powell proclaimed that banks would not be subject to higher capital requirements. Remember that many politicians called for banks to hold more capital so that the regional banking crisis of 2023 would not repeat itself. Obviously, the banks lobbied hard to nullify these higher capital requirements. They had a good argument – if you, Bad Gurl Yellen, want us to buy dogshit government bonds, then we can only do it profitably with infinite leverage. Banks around the world run every flavour of government; the US is no different.

The icing on the cake was a recent letter from the International Swaps Dealer Association (ISDA) advocating for an exemption of USTs from the SLR I spoke about earlier. In essence, banks can only hold USTs in the trillions of dollars needed to finance the US government deficit on a go-forward basis if they are required to put no money down. I expect as the US Treasury ramps up debt issuance, the ISDA proposal will be accepted.

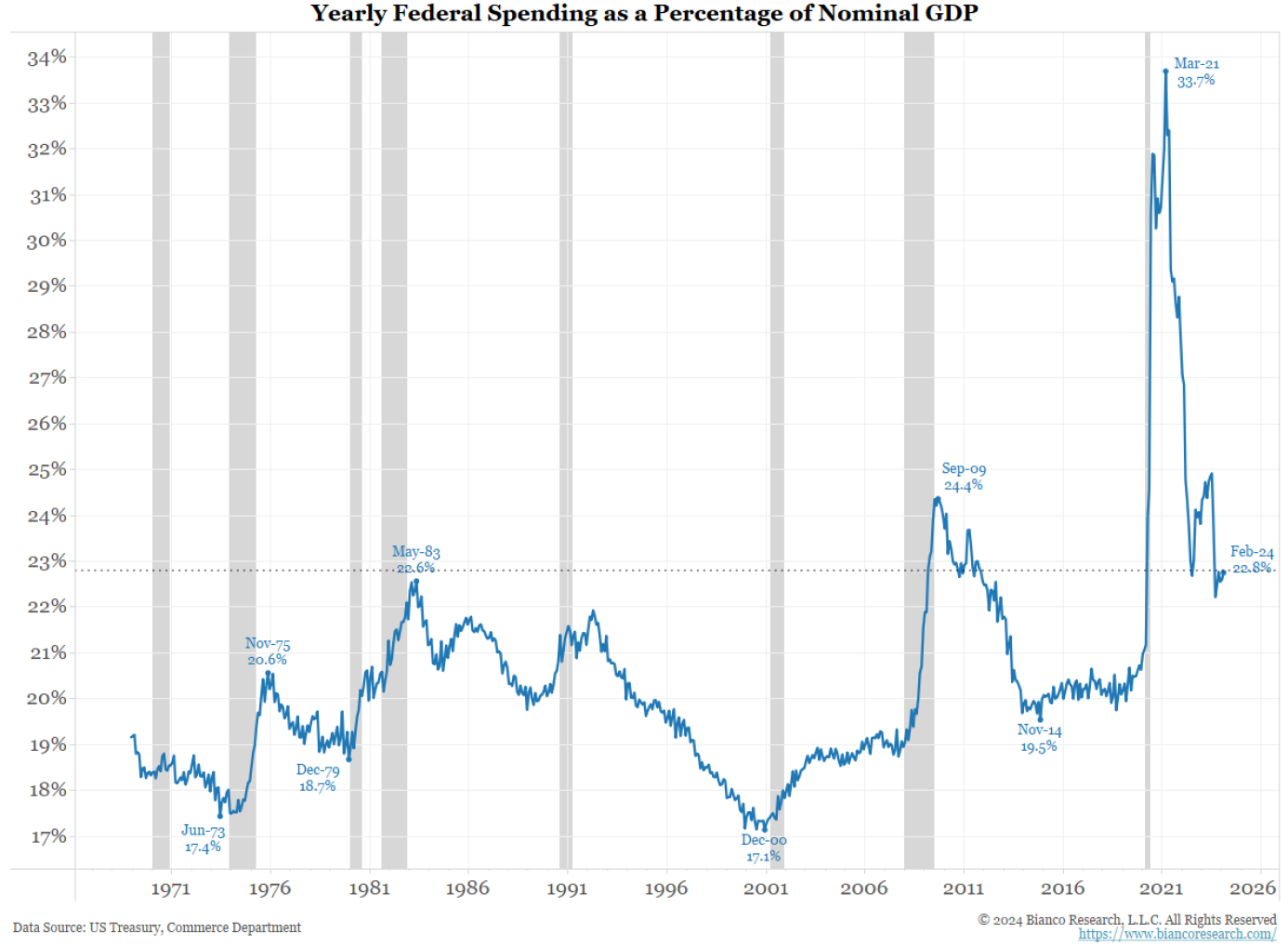

This excellent chart from Bianco Research clearly shows how wasteful the US Government is, as evidenced by the record-high deficit. The two recent periods where deficit spending was higher were due to the 2008 GFC and the boomer-led COVID lockdowns. The US economy is growing, but the government is spending money like it’s an economic depression.

Taken together, the relaxation of capital requirements and a likely future exemption of USTs from the SLR are a covert way of money printing. The Fed doesn’t print the money, rather the banking system creates the credit money out of thin air and purchases the bonds which then appear on their balance sheet. As always, the goal is to ensure that government bond yields do not rise to a level above the nominal GDP growth rate. As long as real rates remain negative, stonks, crypto, gold, etc., will continue advancing in fiat currency terms.

Bad Gurl Yellen

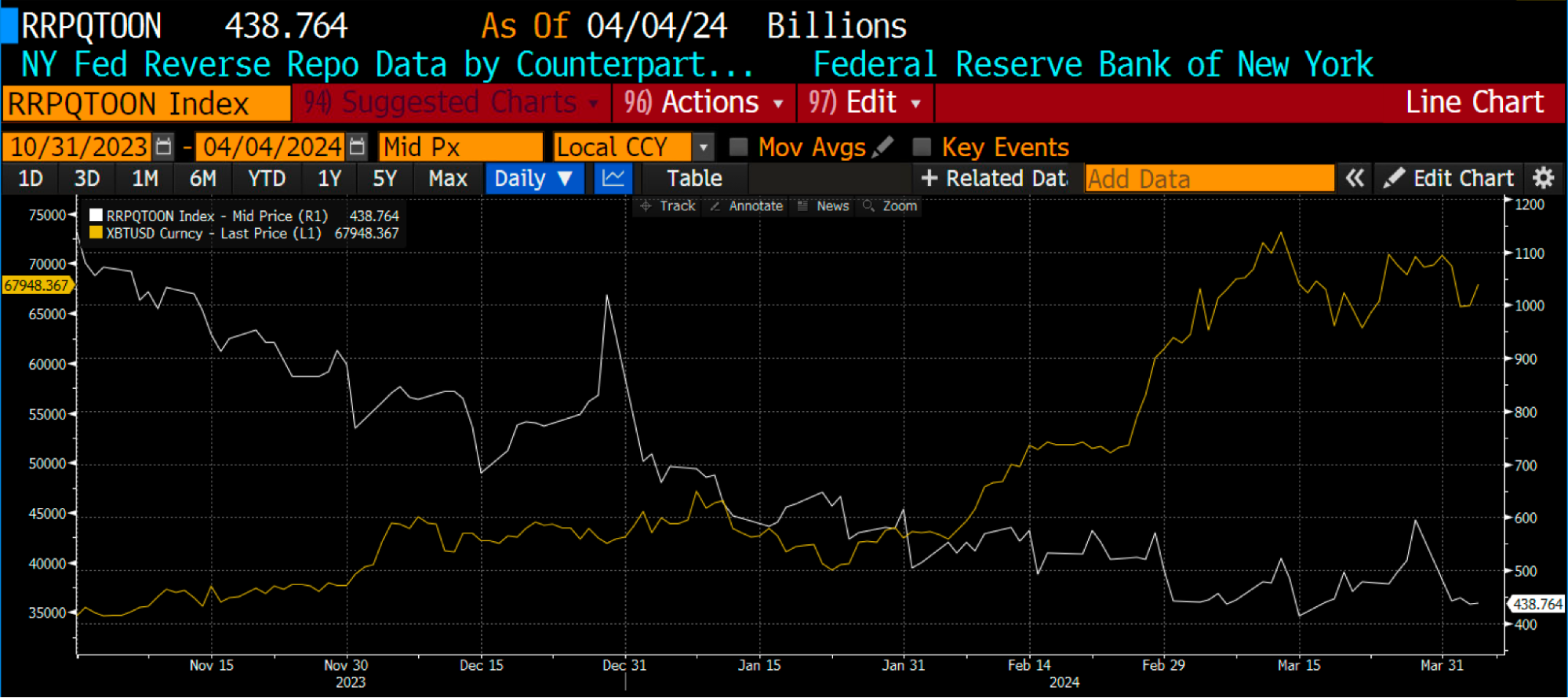

My essay “Bad Gurl” spoke in depth about how the US Treasury, led by Bad Gurl Yellen, increased the issuance of short-term Treasury bills (T-bills) in an effort to drain the trillions of dollars locked in the Fed’s Reverse Repo Program (RRP). As expected, the RRP decline coincided with a rip higher in stonks, bonds, and crypto. But now that the RRP is down to $400 billion, the market is wondering what the next source of fiat liquidity will be that bolsters asset prices. Don’t you worry, Yellen ain’t done yet, shout ‘bout to booty drop.

RRP Balance (white) vs. Bitcoin (yellow)

The flow of fiat funds I will discuss focuses on US tax payments, the Fed’s Quantitative Tightening (QT) program, and the Treasury General Account (TGA). The timeline in question is from April 15th (the day tax payments are due for the 2023 tax year) to May 1st.

Let me provide a quick guide on their positive or negative impact on liquidity to help you understand the implications of these three things.

Tax Payments remove liquidity from the system. That is because payers must remove cash from the financial system by selling securities for example, in order to pay their taxes. Analysts expect tax payments for the 2023 tax year to be on the high side because of the large amounts of interest income received and a solid performance in the stock market.

QT removes liquidity from the system. As of March 2022, the Fed allows roughly $95 billion worth of UST and MBS to mature without reinvesting the proceeds. This causes the Fed’s balance sheet to fall, which we all know reduces dollar liquidity. However, we are not concerned about the absolute level of the Fed’s balance sheet but the pace at which it declines. Analysts, like Joe Kalish of Ned Davis Research, expect the Fed to reduce the pace of QT by $30 billion per month at its May 1st meeting. The reduction in the pace of QT is positive for dollar liquidity as the Fed’s balance sheet rate of decline slows.

When the TGA balance rises, it removes liquidity from the system, but when it falls, it adds liquidity to the system. When the Treasury receives tax payments, the TGA balance rises. I expect the TGA balance to swell well above the current ~$750 billion level as tax payments are processed on April 15th. This is dollar liquidity negative. Don’t forget it’s an election year. Yellen’s job is to get her boss, US President Jeo Boden, reelected. That means she must do all she can to juice the stock market to make voters feel rich and ascribe this great outcome to the slow “genius” of Bidenomics. When the RRP balances finally go to zero, Yellen will spend down the TGA, releasing, most likely, an additional $1 trillion of liquidity into the system, which will pump markets.

The precarious period for risky assets is April 15th to May 1st. This is when tax payments remove liquidity from the system, QT rumbles on at the current elevated pace, and Yellen has yet to start running down the TGA. After May 1st, the pace of QT declines, and Yellen gets busy cashing checks to jack up asset prices. If you are a trader looking for an opportune time to put on a cheeky short position, the month of April is the perfect time to do so. After May 1st, it’s back to regular programming … asset inflation sponsored by Fed and US Treasury financial shenanigans.

Bitcoin Halving

The Bitcoin block reward is forecast to halve on April 20th. This is seen as a bullish catalyst for crypto markets. I agree that it will pump prices in the medium term; however, the price action directly before and after could be negative. The narrative of the halving being positive for crypto prices is well entrenched. When most market participants agree on a certain outcome, the opposite usually occurs. That is why I believe Bitcoin and crypto prices in general will slump around the halving.

Given that the halving occurs at a time when dollar liquidity is tighter than usual, it will add propellant to a raging firesale of crypto assets. The timing of the halving adds further weight to my decision to abstain from trading until May.

To date I took full profit on these positions, MEW, SOL, and NMT. The proceeds were placed into Ethena’s USDe and staked to earn that phat yield. Before Ethena, I would have held USDT or USDC and earned nothing while Tether and Circle captured the entire T-bill yield.

Could the market defy my bearish inclinations and continue higher? Fuck yeah. I’m perennially long as fuck crypto, so I welcome being wrong.

Do I really want to babysit my most speculative shitcoin positions while I’m two-stepping at Token2049 Dubai? Hell no.

Therefore, I dump.

There is no need to be upset.

If the dollar liquidity scenarios I discussed above come true, I will have that much more confidence to ape into all manner of dogshit. If I miss a few percentage points of gains but definitely avoid losses for my portfolio and lifestyle, that is an acceptable outcome. With that, I bid you adieu. Please remember to put your dancing shoes on, and I will see you in Dubai for a celebration of the crypto bull market.

Related

The post appeared first on Blog BitMex