While Ethereum was trading above $450 at press time, the ETH-BTC correlation remained tight at around 0.76, based on data from CoinMetrics. In fact, Ethereum’s price has gained by 3.69% over the past week and considering the progress of ETH 2.0’s validator nodes, it may seem obvious that many traders are long on ETH.

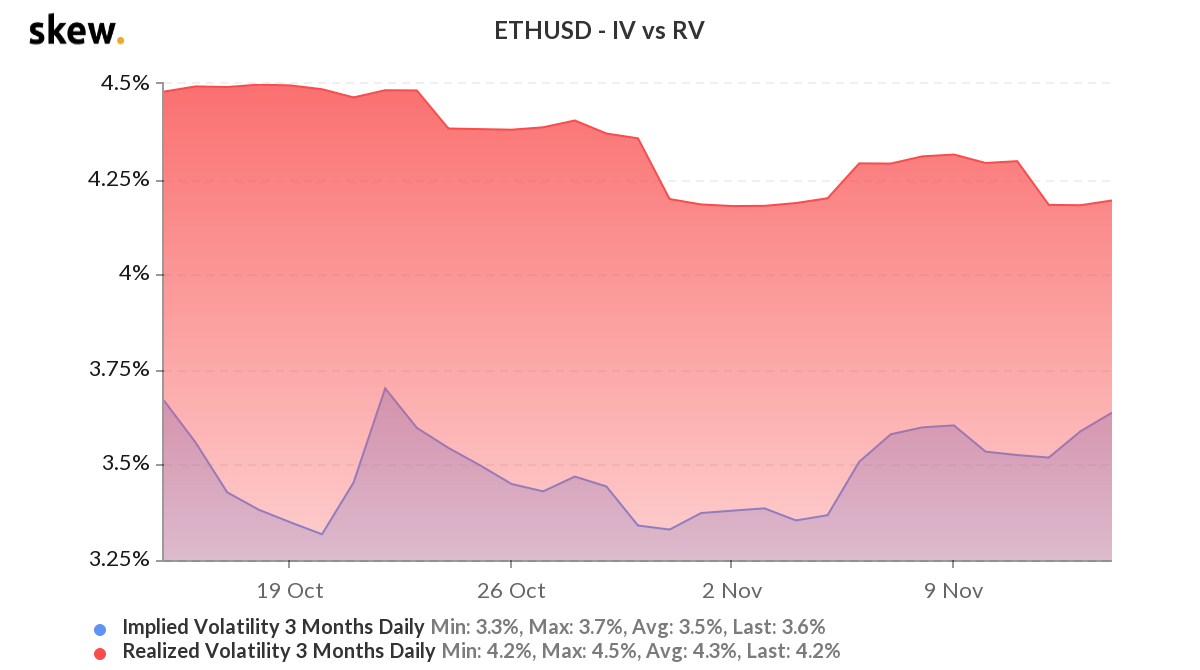

High volatility may be a contributing factor to Ethereum’s price rise and growing Open Interest on exchanges. However, a contrarian view on the same emerges when examining the Implied Volatility v. Realized Volatility charts on Skew.

The spread on the Implied and Realized volatility charts has ranged between 0.8% to 1.2% over the past 30 days. In fact, data from the attached chart suggested that the Implied Volatility has been much lower, when compared to the Realized Volatility, and the spread has been high for nearly a month now.

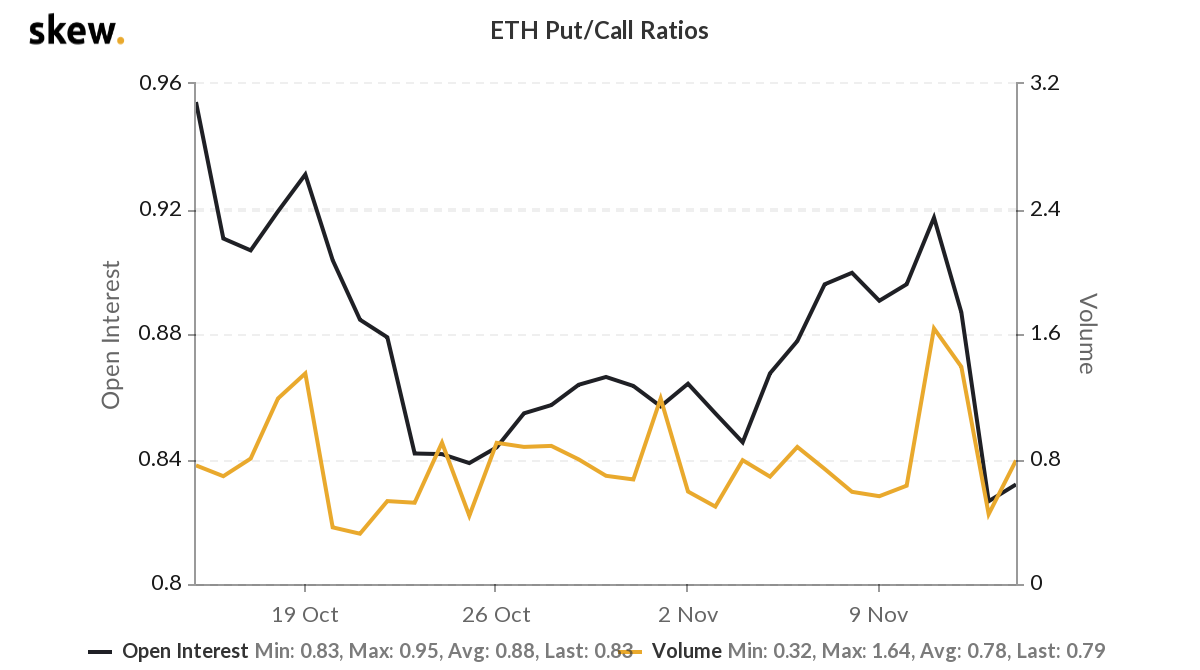

This means the market expects an underlying drop in volatility and prices soon. This can be considered as a signal that ETH may be due for a correction. Supporting this signal was the Put/Call ratio from ByBit. The Put/Call ratio for Open Interest in ETH Options stood at 0.83, well above 0.7, signaling that traders are ” buying more ” puts than calls and this may be a signal for a rise in bearish sentiment.

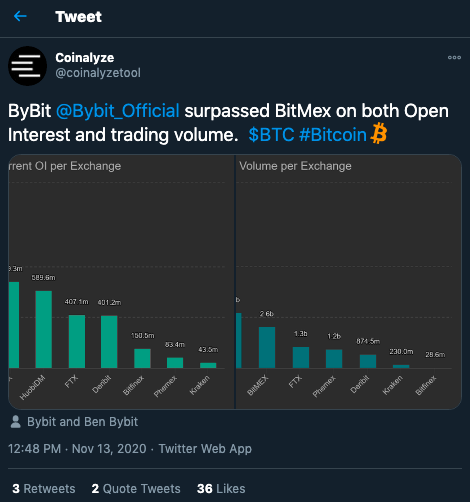

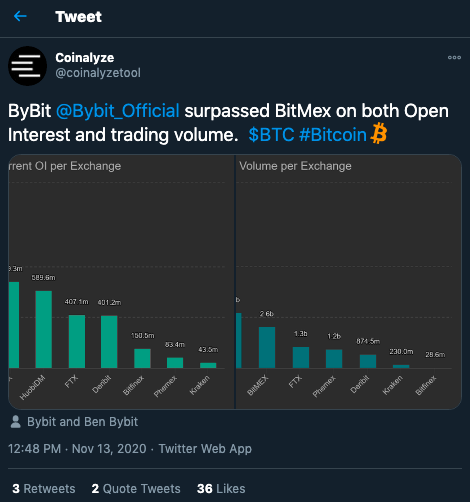

Further, data from top derivatives exchange ByBit suggested that Open Interest in ETH was up by nearly 113%. This data may predict an upcoming change in price trend for Ethereum as ByBit now accounts for higher Open Interest and trade volume than BitMEX.

Source: Twitter

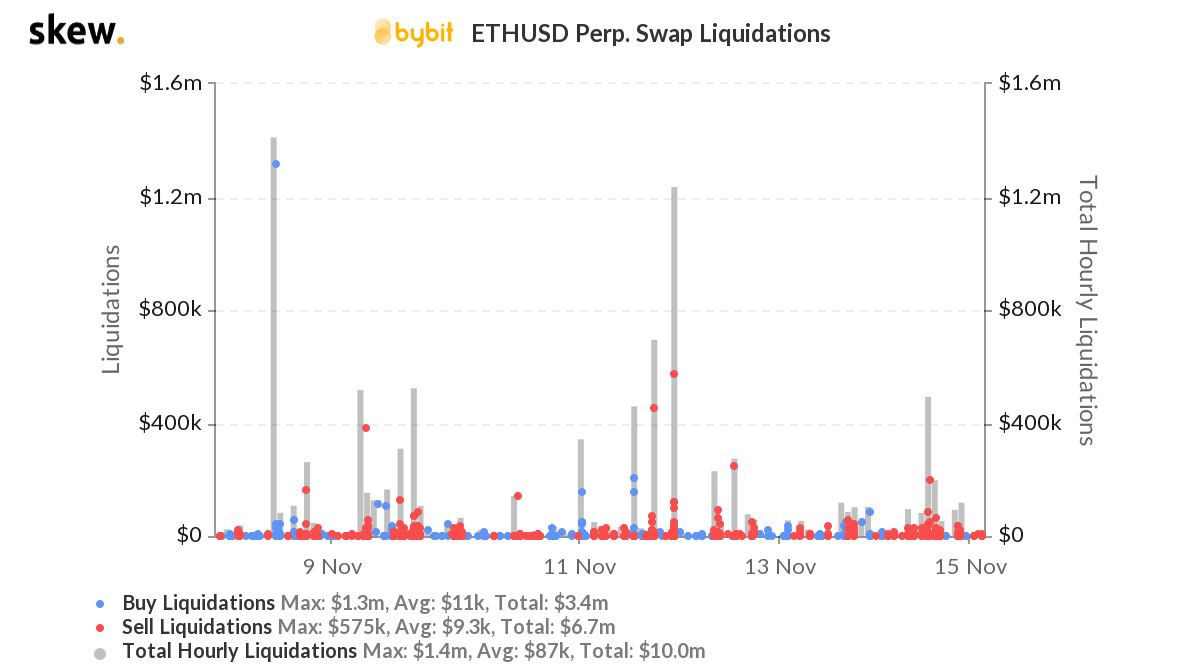

On ByBit, most traders are long on ETH. In fact, the ETH-USD Perpetual Swap Liquidations chart for ByBit suggested that sell liquidations were two times buy liquidations over the past 15 days. Further, the average hourly liquidations stood at an average of $87k, with the total liquidations at $10M.

The aforementioned data seemed to signal the opposite of what price charts from spot exchanges have been signaling. However, based on the prominent liquidations that are taking place in bursts, going long on ETH may not be the best strategy as a lot of traders’ positions are being liquidated and selling has been triggered.

If you’re long on ETH, you may be running with the tide, however, that may also push you to face an eventual liquidation. With the price now volatile, this may be the case until the launch event of ETH 2.0.

The post appeared first on AMBCrypto