After the Supreme Court’s ruling to quash the ban on cryptocurrencies in India, activity in the crypto space has grown significantly, however, some rumors have still emerged about the uncertainty regarding the legal status for Bitcoin and cryptocurrencies in the country.

However, as Sathvik Vishwanath, CEO of Unocoin stated in a recent interview spoke about the legislation around crypto in the country, he said,

“In all likelihood, it will be a ‘no’ as of this time because of our influence. The industry has done this influence and the media has done this influence on why it should be there in India — to not lose the opportunities.”

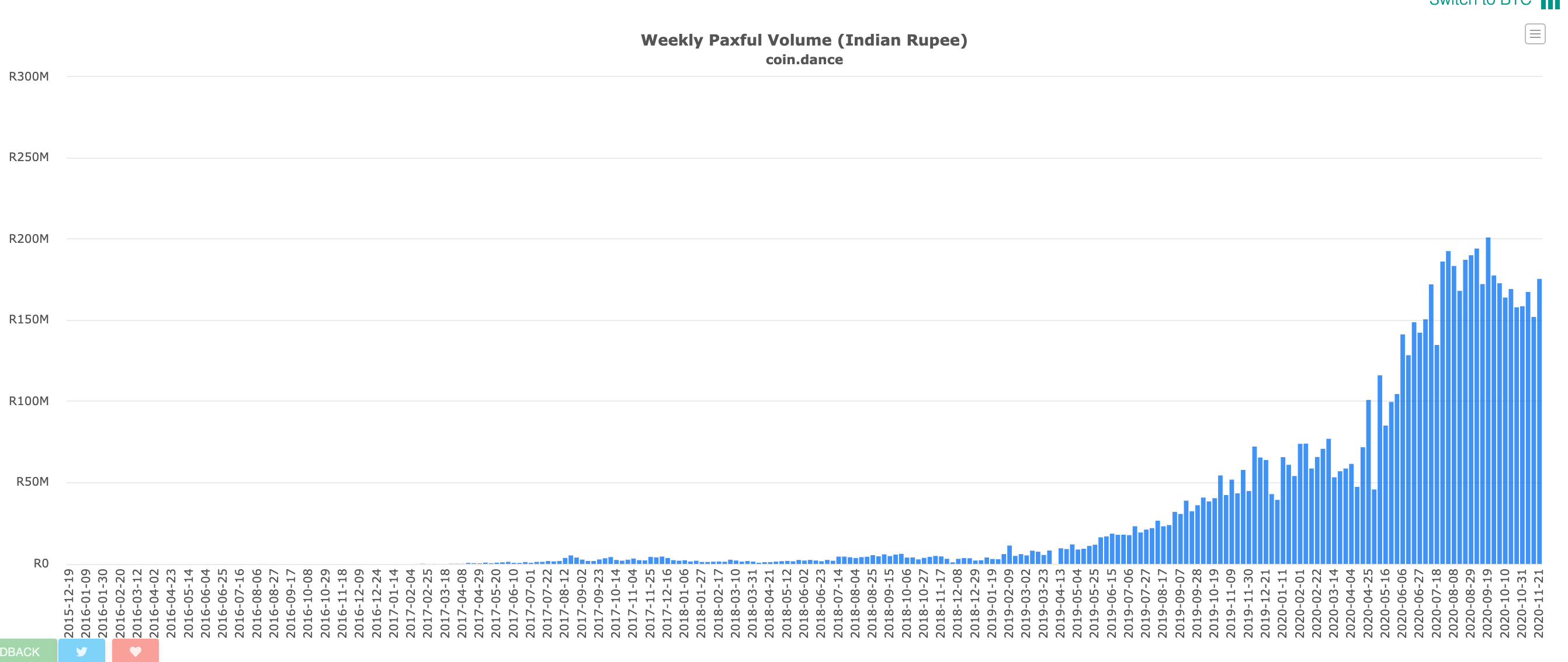

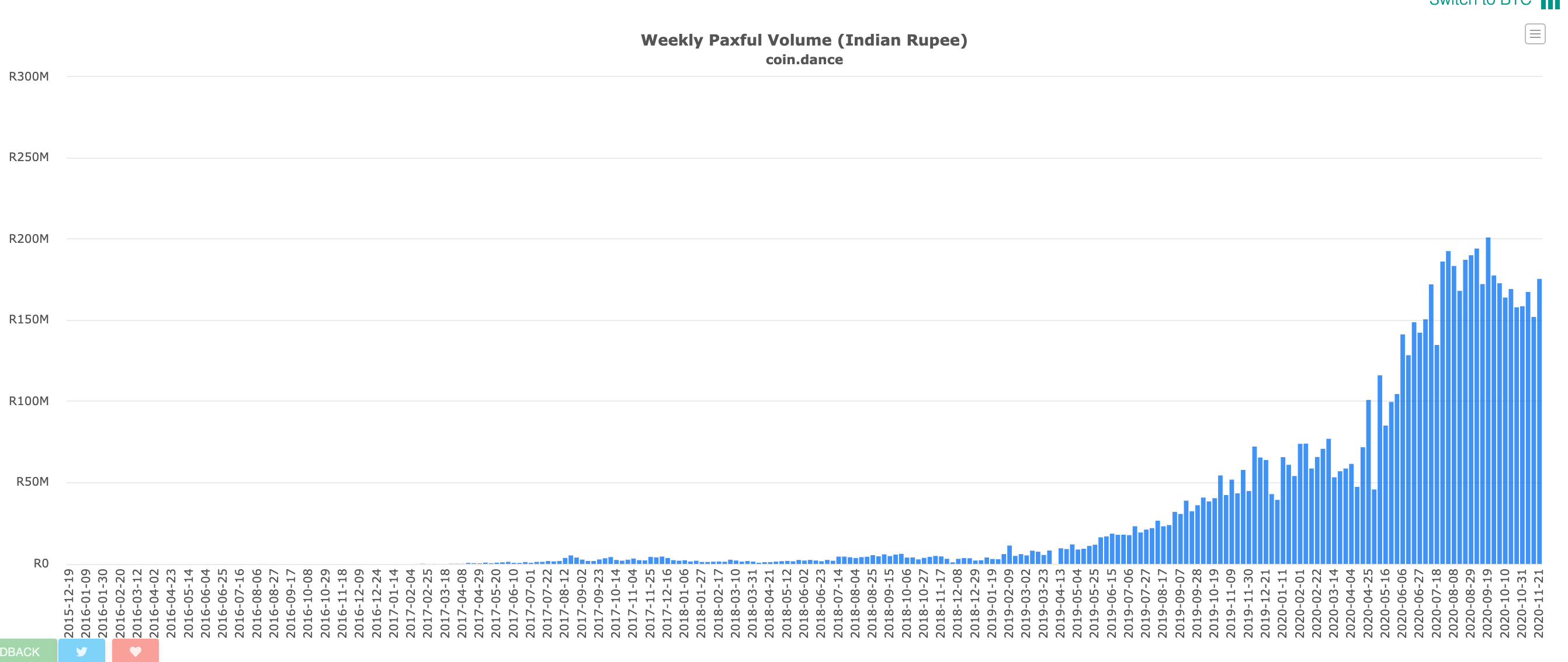

Interestingly, the crypto industry has flourished in India after the ban was revoked in March, as data from Coin Dance confirms.

Source: Coin Dance

Weekly trading volumes surged as more players entered the crypto space. As crypto businesses continue to thrive, there will be a need to carefully consider the effects that a lasting ban on crypto could have on the country.

In line with this thought, Vishwanath stated that once this legislation becomes annulled, there will be a need for a new committee to be formed again to determine how the present law of the land will apply to crypto and offer a more balanced view.

Regulatory sandboxes are being increasingly considered by many countries, in order to determine how best to regulate cryptocurrencies.

In Hong Kong, for instance, the SFC (Securities and Futures Commission) has established a sandbox that allows an opportunity for both regulators and the industry to see how transactions work in concert with each other.

Even countries such as Kyrgyzstan and South Africa have recently issued draft laws on crypto regulation, that invite the public to submit their own recommendations towards regulatory proposals.

However, there are no specific guidelines on this in India just yet, and as such, many retail investors are reluctant to enter this space because of the ongoing rumors of an impending ban.

Regulatory clarity could provide much-needed legitimacy, safety, and security for the average retail investor.

The post appeared first on AMBCrypto