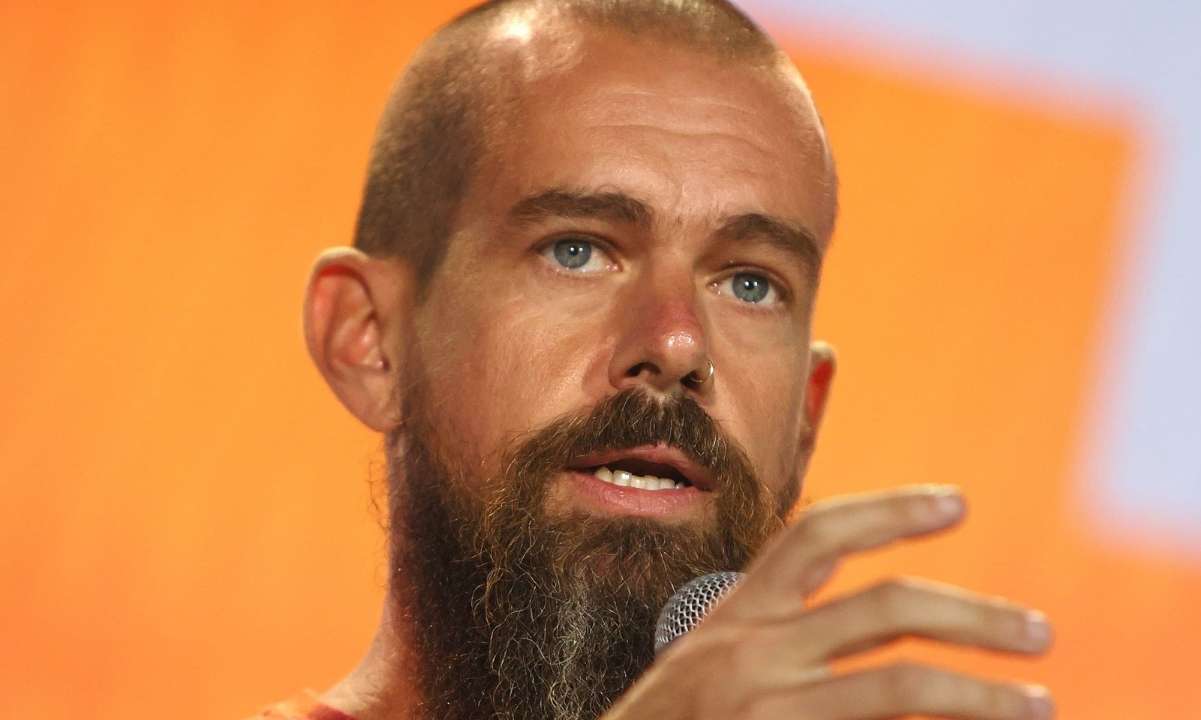

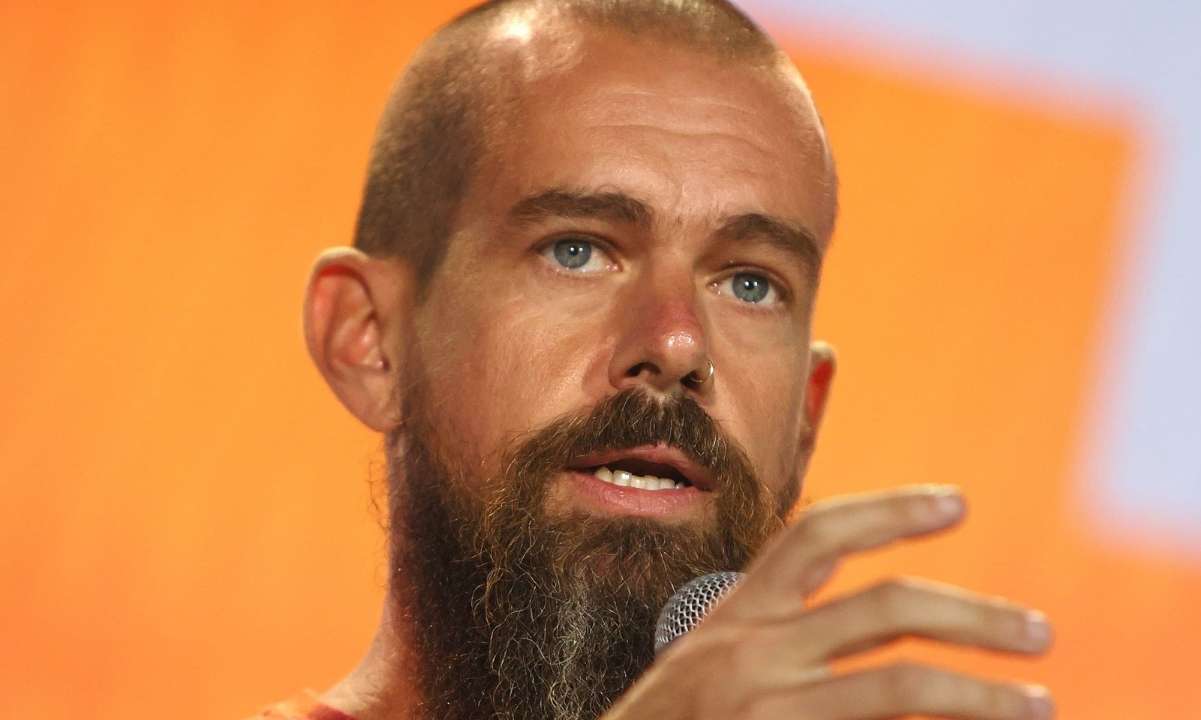

Financial technology conglomerate Block, owned by X co-founder Jack Dorsey, has decided to invest 10% of all profits made from bitcoin-related products in monthly BTC purchases.

Speaking to shareholders in a Q1 2024 earnings report, Dorsey outlined several reasons for the decision, addressing investors’ concerns about why Block is so focused on the largest cryptocurrency.

Block to Invest in Bitcoin Monthly

Dorsey explained that bitcoin is the best and only candidate for a decentralized open protocol for money, which the world needs. BTC would eventually become the native currency of the internet and help serve users worldwide faster without the need to customize hundreds of payment schemes and intermediaries.

Block also intends to make BTC more usable for everyday transactions, utilizing the cryptocurrency as a medium of exchange for the internet and solving the original problem pseudonymous creator Satoshi Nakamoto stated in the project’s white paper.

The problem Nakamoto mentioned in the white paper is the lack of an electronic payment system based on cryptographic proof instead of trust that would allow two willing parties to transact directly across the Internet without needing a third party.

Dorsey believes it was just a matter of time before the internet, including artificial intelligence systems and agents, had a native currency, and the most efficient protocol for that was Bitcoin.

“Historically and moving forward, our investment in bitcoin transcends technology; it is an investment in a future where economic empowerment is the norm. This commitment drives our business into new territories, unlocking novel opportunities for our customers, and securing enduring value for you, our shareholders,” Dorsey said.

Block’s Q1 Revenue Beats Estimate

In addition to conducting monthly BTC purchases, Block is building Bitcoin mining hardware, including a mining rig system and a three-nanometer ASIC mining chip.

So far, Block has allocated $220 million into BTC, and by the end of Q1 2024, the investment had grown by approximately 160% to $537 million.

Meanwhile, Block’s Q1 2024 revenue of $5.96 billion beat the $5.75 billion estimate from Wall Street analysts by 3.54%. The firm’s gross profit grew 22% year-over-year (YOY) to $2.09 billion, and its mobile payments and crypto platform Cash App reported a 25% YOY increase in gross profits to $1.26 billion.

LIMITED OFFER 2024 for CryptoPotato readers at Bybit: Use this link to register and open a $500 BTC-USDT position on Bybit Exchange for free!

The post appeared first on CryptoPotato