The cryptocurrency community is usually divided into three major camps when it comes down to potential ways to earn money.

The first is inhabited by traders, believing that the best way to make profits is to take advantage of the volatility in the market by trading.

The second comes in the form of long-term investors, also known as Hodlers. They believe in a cryptocurrency’s (usually Bitcoin’s) value and that it will increase notably over the years, so they don’t trade it – just hold it.

The third option – enter miners. Those are people who have invested a large amount of money in hardware so that they can mine a particular cryptocurrency. Today we will take a more in-depth look into mining as a whole and will try to answer the question of whether or not it’s still profitable in 2020 or miners should use that money to invest directly.

What is Bitcoin Mining?

Even though plenty of different coins are “mined,” we will provide the examples and explanations using Bitcoin, as it introduced the term “mining” in the industry, being the first-ever cryptocurrency working on this principle.

Bitcoin miners use high-powered computed to solve complex computational math problems, and the whole process is called the “Proof-of-Work” consensus algorithm. The result of this endeavor is two folded – miners “create” new bitcoins, and they also help verify each transaction, keeping the payment network secure and trustworthy.

The latter happens when the miners clump transactions together in “blocks” and then add them to a public record, called “blockchain.” By doing this, they are making sure the transactions are accurate, and that double-spending cannot occur.

In return, miners receive bitcoins as rewards for completing each transaction, and the amount of new coins released with each mined block is called “block reward.” It decreases in half every four years in a process called…

The Bitcoin Halving Event

Every four years, the Bitcoin halving slashes in half the rewards that miners receive for their efforts. So far, there have been two previous cases – in 2012 and 2016. The former cut the rewards for a solved block from 50 BTC to 25 BTC and the latter from 25 BTC to 12.5 BTC.

It happens after every 210,000 blocks, and the next one will take place next year, further decreasing the rewards to 6.25 BTC. This brings us to our initial question – would Bitcoin mining be still profitable in 2020 but more on that later.

Bitcoin Mining Throughout the Years

Back in the day when Bitcoin was initially introduced to the public, mining was usually done on personal computers. At that point, profitability was pretty easy, because miners already had the needed equipment, so they didn’t need to invest any money to start. Additionally, the biggest competition they had was other miners using the same type of equipment.

Quickly though, this changed with the induction of application-specific integrated circuit chips (ASIC) that offered extremely higher capabilities than the regular personal machine, thus making them obsolete. The bar was notably raised, and adding the high expenses; individuals could no longer compete properly with the new standard. Moreover, this was the time when large Bitcoin mining centers started to emerge with severely powerful machines.

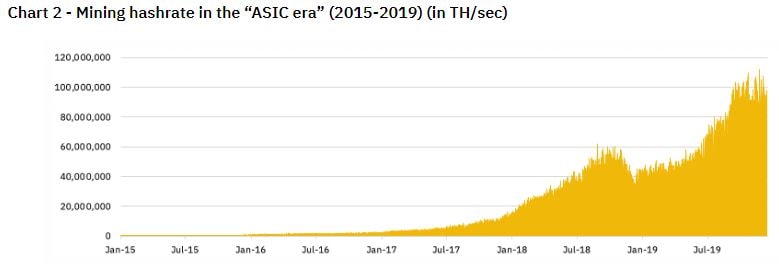

It’s worth noting that after ASIC-powered computers started operating, the hash rate of the largest crypto increased dramatically, as well, ultimately making the network much healthier.

BTCHashrate. Source: Binance Research

Bitcoin Mining Allocation

With the entry of the new and powerful technology and the creation of large mining centers, it became clear that those establishments will be in control of Bitcoin mining. China grew into the most prominent player in this game by controlling 66% of all the hash rate, as Cryptopotato recently reported.

Such a large percentage operated within the borders of the same country could be regarded as a potential issue for Bitcoin. One thing that remains positive, though, is that no single entity has more than 25% of the total control, let alone over 50%.

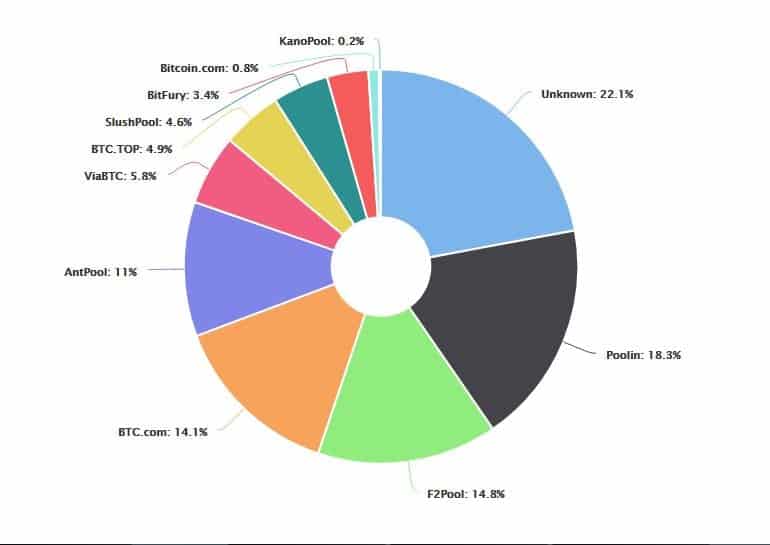

Bitcoin Hashrate Distribution. Source: blockchain.com

As we can see in the picture above, Poolin controls around 18.3%, followed by F2Pool – 14.8% – both based in China.

We can also notice that the largest part indicates that it’s unknown, which could raise concerns that it may be under a potential attack. However, the report quickly disproves it by clarifying that it appears this way only because they were unable to establish the origin yet.

Is Bitcoin Mining Still Worth It Today?

Here comes the big question, but it doesn’t have a straightforward answer. It consists more of complex issues that have to be explained before we can determine the outcome. Let’s begin with the four major factors that we need to acknowledge.

- The cost of electricity to power the computer systems.

- Mining difficulty

- The availability and price of computer systems

- Competition

The first one is somewhat subjective and depends mainly on the location, as the electricity costs differ depending on where the mining machine is stationed. Also, the bills change with the different seasons, and in most places, the price is lower at night.

The difficulty factor is strongly related to the hash rate of Bitcoin as it measures the transaction validation in hashes per second. The network is designed to produce a certain number of bitcoins per second, and when there are more active miners, the difficulty increases to ensure that the level is of distribution is static.

Even though the availability of computing power sounds like it wouldn’t provide any issues, that’s not always the case. During the parabolic price increase of 2017 and the increased media attention, Bitcoin mining became extremely popular and lots of people were trying to get in. Rapidly, the hardware became scarce, which also exploded the prices, leaving lots of potential miners “on the street.” Nowadays, though, similar equipment can be found more easily and usually cheaper.

The competition could be the most significant factor, as mentioned above. As we can see from the previous paragraph, large mining companies have entered the field, leaving less grinding materials for the individual.

Now we can see why the question doesn’t have just a “yes” or “no” answer. In fact, by looking at all of those factors, each future miner should ask himself whether or not it’s worth it for him. But before heading to the hardware store to make large purchases with the idea of Bitcoin mining, make sure that you have made all of the needed calculations.

Final Words

Mining has become a billion-dollar industry in recent years, with so many large players trying to establish further control. However, those changes are generally excluding individual miners, yet many continue to do it and manage to make profits. Next year Bitcoin will go through its third halving, cutting the rewards that miners receive in half to 6.25 BTC.

On the surface, this might repel potential newcomers who are asking the question if it’s not more profitable just to invest in the largest crypto and wait for it to grow over the years. Yet, the growth is not guaranteed; however, by mining, people not only receive BTC as rewards but also keep the network safe and validate the transactions, making them one of the most critical pieces of the Bitcoin puzzle.

You might also like:

The post appeared first on CryptoPotato