According to a recent report, the majority of all mined bitcoins are held by long-term investors, while only 19% is utilized for trading.

Although professional traders are roughly only 4% of the market, they are largely responsible for significant price developments, the research added.

BTC HODLers On The Rise

The cryptocurrency monitoring company Chainalysis recently posted its latest report exploring the behavior of Bitcoin investors. More specifically, it examined their approach to “what are people using Bitcoin for?”

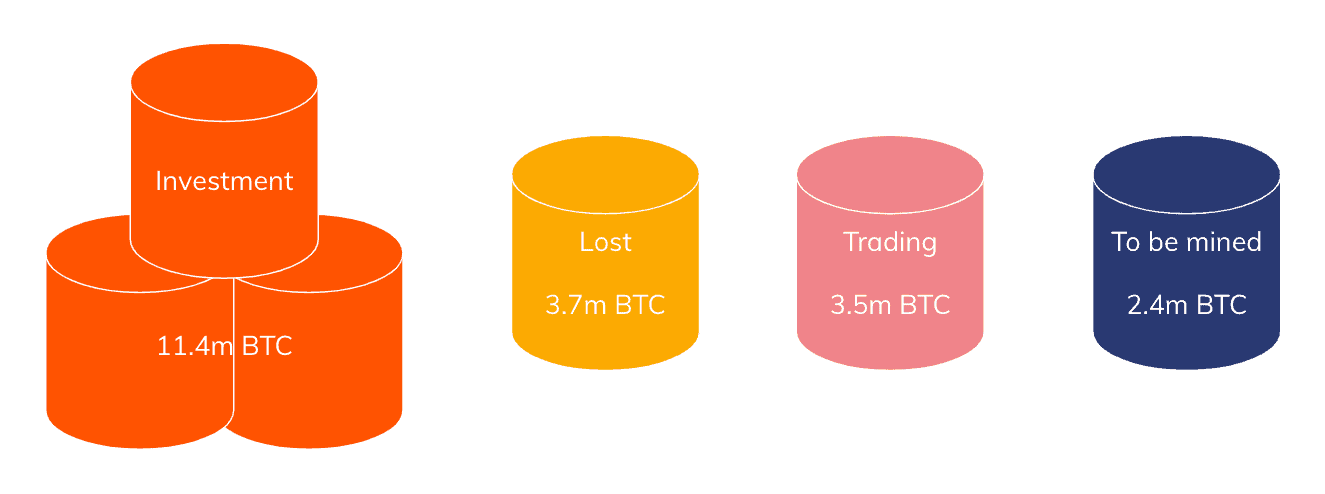

In the eleven years of its existence, Bitcoin has seen roughly 18.6 million coins mined. Approximately 60% of that quantity “is held by entities – either people or businesses – that have never sold more than 25% of Bitcoin they’ve ever received, and have often held on to that Bitcoin for many years, which we label as Bitcoin held for long-term investment.”

The company also classified as lost bitcoins another 20%, which hasn’t moved from its current set of addresses in five or more years. By estimating this, Chainalysis said, “that leaves just 3.5 million Bitcoin – or 19% of all mined Bitcoin – that moves frequently, primarily between exchanges, which we label as Bitcoin used for trading.”

The above data showcases a substantial HODLers mentality from BTC investors, and the majority of them “treat it as digital gold.” However, it’s supported by an active trading market, and the estimated 3.5 million “used for trading supplies the market, and, in interaction with the level of demand, determines the price.”

Retail Vs. Professional Traders

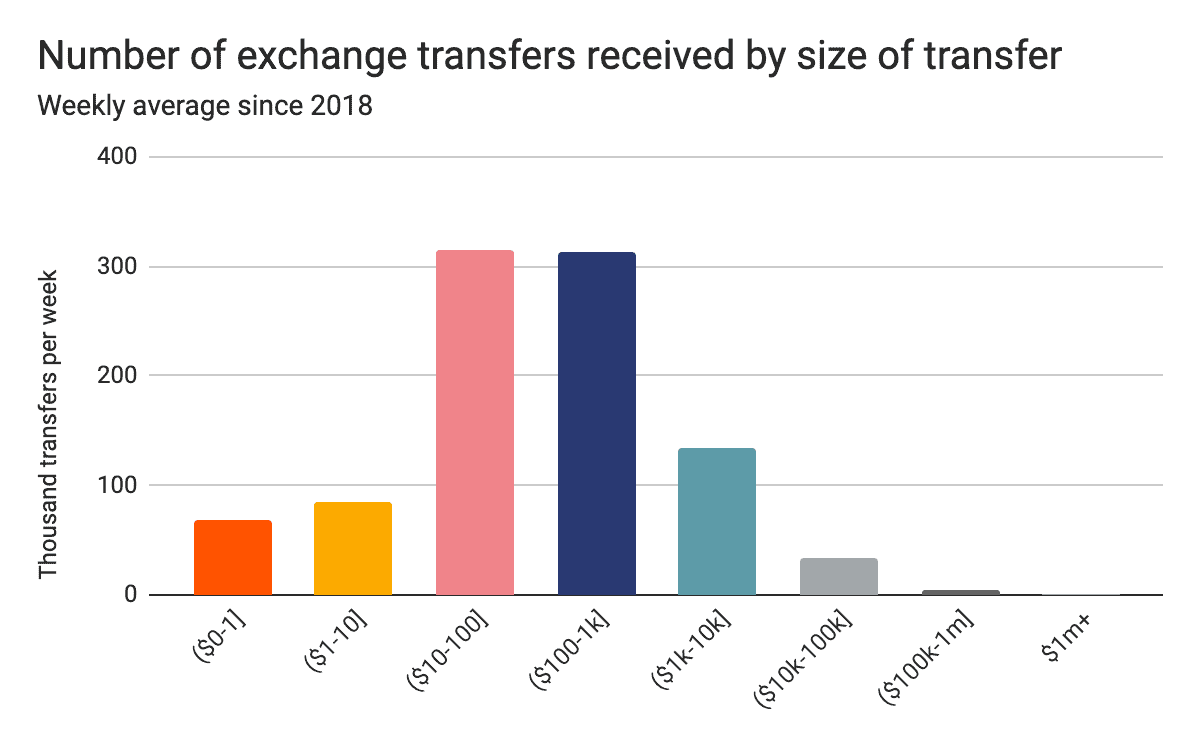

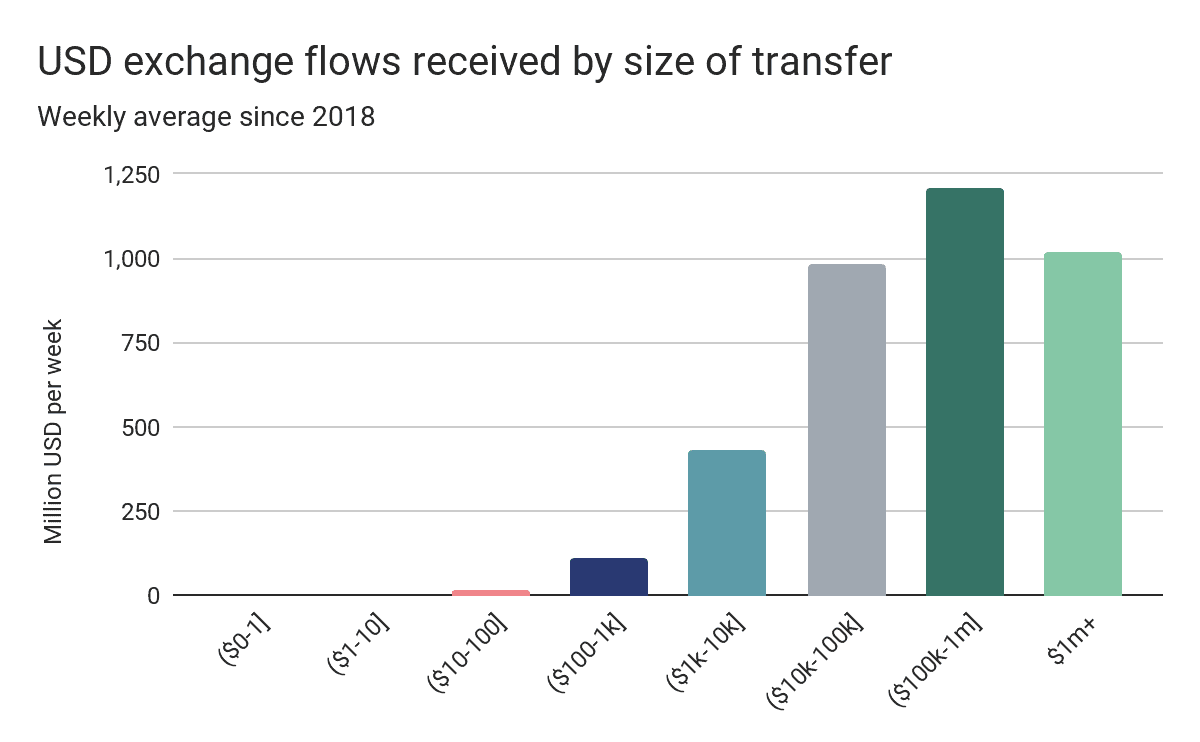

The report further investigated the background of traders. While it determined that “tens of millions of people hold Bitcoin,” the number of people actively trading the asset weekly is no higher than 340,000. By calculating the USD size of transfers traders made, Chainalysis classified them into two groups – retail and professional.

By assuming that retail traders are depositing less than $10,000 worth of BTC on platforms at a time, the report concluded that they are the “large majority, accounting for 96% of all transfers sent to exchanges on an average weekly basis.”

However, despite professional traders being responsible for only 4% of the number of BTC transfers to platforms, they actually “control the liquidity of the market, accounting for 85% of all the USD value of Bitcoin sent to exchanges.” Naturally, this means that professional traders are “the most significant contributors to large market movements.”

Bitcoin’s Current Homes

Chainalysis also studied the current locations of the most substantial portions of BTC.

“Roughly 60% of Bitcoin that is not lost is held by a licensed custodial service, or as FATF would refer to it, a Virtual Asset Service Provider (VASP). Most cryptocurrency exchanges would fall into this category, along with hosted wallets.

This share has risen steadily over time, reflecting the growth of custodial cryptocurrency businesses as Bitcoin has gone more mainstream.”

The report outlined that the four largest cryptocurrency exchanges since 2018, namely Binance, Huobi, Coinbase, and Bitfinex, are responsible for nearly 40% of all BTC received in 2020. The next ten platforms have collectively received 36% of the transfer volume, and hundreds of other small exchanges got the remaining 24%.

The post HODLers Prevail: Nearly 60% Of Mined Bitcoin Is Held By Long-Term Investors, Report Says appeared first on CryptoPotato.

The post appeared first on CryptoPotato