The end of 2019 marked yet another volatile and, in most cases, profitable, year in the cryptocurrency community. The field continues to evolve with new developments while governments are starting to pay further attention, ultimately leading to a more mature market place.

A recent report has compiled interesting data regarding the performance of Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Bitcoin SV, and Ethereum Classic. To do so, SFOX has examined several factors, including price, volume, correlations, and volatility from eight major exchanges and liquidity providers.

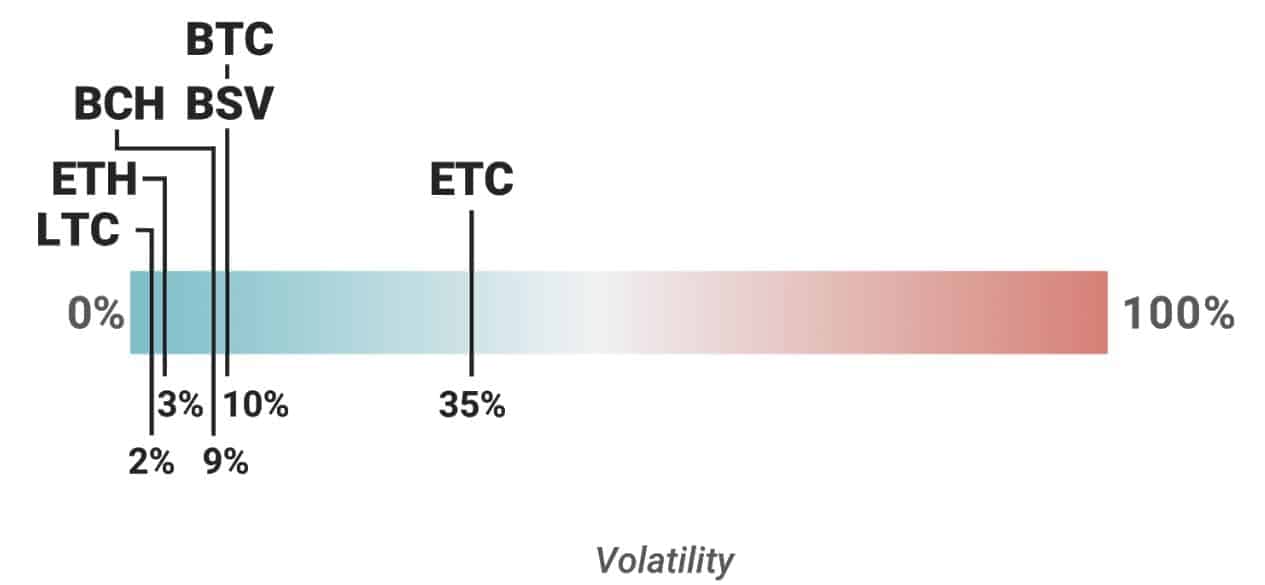

Volatility

The report firmly concludes that five out of the six mentioned above cryptocurrencies have declined in terms of volatility. The only one that has recorded more substantial volatility rates is Ethereum Classic, as its percentage is 35.

Bitcoin, for example, is at 10%, similarly to Bitcoin SV. Bitcoin Cash is lower at 9%, while Ethereum and Litecoin are at the lowest point of the chart – 3% and 2%, respectively.

VolatilityCryptocurrencies. Source: SFOX Report

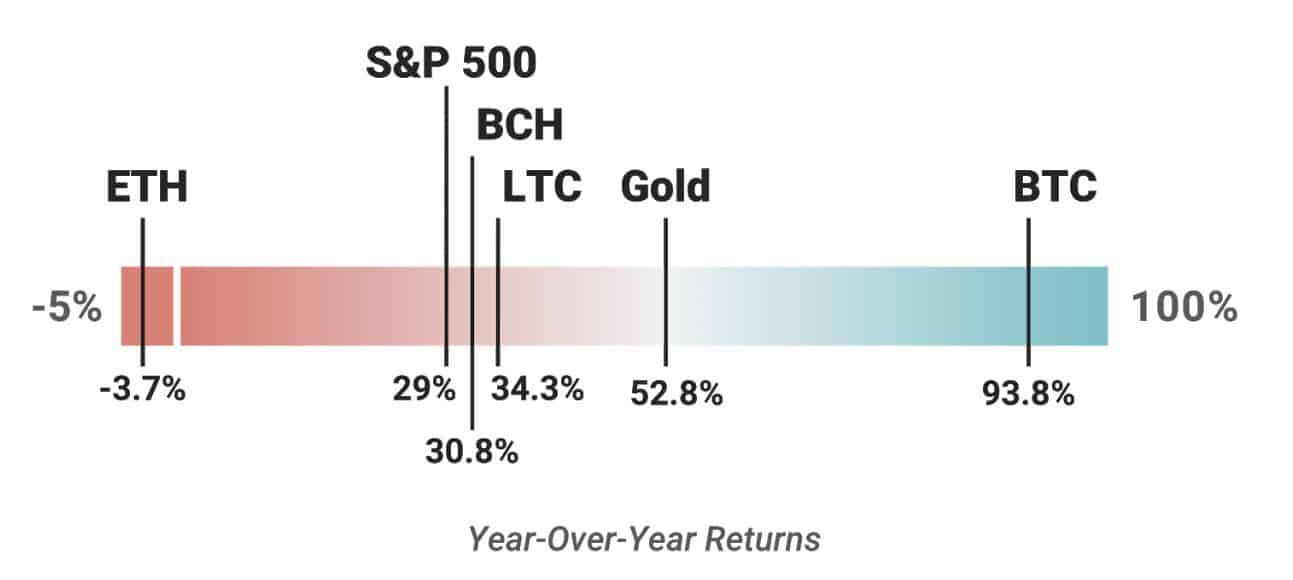

Yearly Returns

As far as annual returns go, Bitcoin is in a class of its own for 2019. The largest cryptocurrency has outperformed all other examined assets by a country mile with almost 94% ROI. Moreover, BTC has also proven itself as the best investment in the whole past decade, delivering 8,900,000% returns.

The other listed digital assets provide the following numbers: LTC (34.3%), BCH (30.8%), and ETH is at -3.7%.

2019Returns. Source: SFOX Report

The report also includes assets outside of the cryptocurrency world. Gold provided the second-best ROI last year with 52.8%, and the popular stock index fund S&P 500 delivers 29%.

Correlations

SFOX’s document also notes that BTC is not correlating with Gold and S&P 500.

However, as the latter seems to be valid with previous examples indicating the same, the community has recently presented numerous theories that Gold and Bitcoin actually display similarities. As Cryptopotato reported a few days ago, both assets (and oil) noted very similar price movements during Iran’s missile attack on two U.S. airbases in Iraq. Additionally, the largest crypto has been previously named as a commodity – the same category as the precious metal.

While the debate if Bitcoin correlates with Gold or the traditional stock market is left open, the report shows data regarding the lack of such correlation among the cryptocurrencies. It reads that “BTC has a much lower positive correlation with BCH, BSV, and ETC than typical.” From previous highs of 0.8 and 0.9 in the past, these numbers have dropped to 0.4 and 0.6.

Looking Ahead

When it comes to the near future and 2020 in particular, the report touches upon one of the most anticipated upcoming events – the Bitcoin halving. It’s about to occur somewhere in April or in May, and it will slash in half the amount of BTC that miners receive as a reward for successfully adding a new block on the blockchain. So far, there have been two similar events in history, both resulting in price surges shortly after, and most of the community speculate that this time will be no different.

The report urges for caution when it comes down to those expectations, mentioning that BTC’s price has dropped with over 45% since June 2019. Moreover, investors should be aware that history is not a price indicator, and such an increase might not happen.

Several cryptocurrency prominent proponents, including the Chief Strategy Officer of CoinShares, Meltem Demirors, have also supported the same idea. According to her, the Bitcoin derivatives market is growing, which causes more speculation rather than actual ownership and transfer of bitcoins.

Final Words

The evolution of the cryptocurrency market continued throughout 2019 as well. The volatility has dropped when compared to previous years, showing signs of maturity, and at the same time, Bitcoin’s ROI is unmatched. SFOX concludes that this has made BTC a compelling tool for portfolio management. Still, investors should be aware that even though the volatility has declined, it doesn’t mean that it has disappeared.

You might also like:

The post appeared first on CryptoPotato