Despite high price turbulence and trend concerns, Bitcoin noted a major milestone over the past 24-hours. According to data released by Messari, Bitcoin completed its longest-ever period above $10,000, crossing its previous record of 62 days that spanned over 1 December 2017 and 31 January 2018.

While comparisons with Bitcoin’s most bullish period are good news, the differences between both timelines are very perceptible.

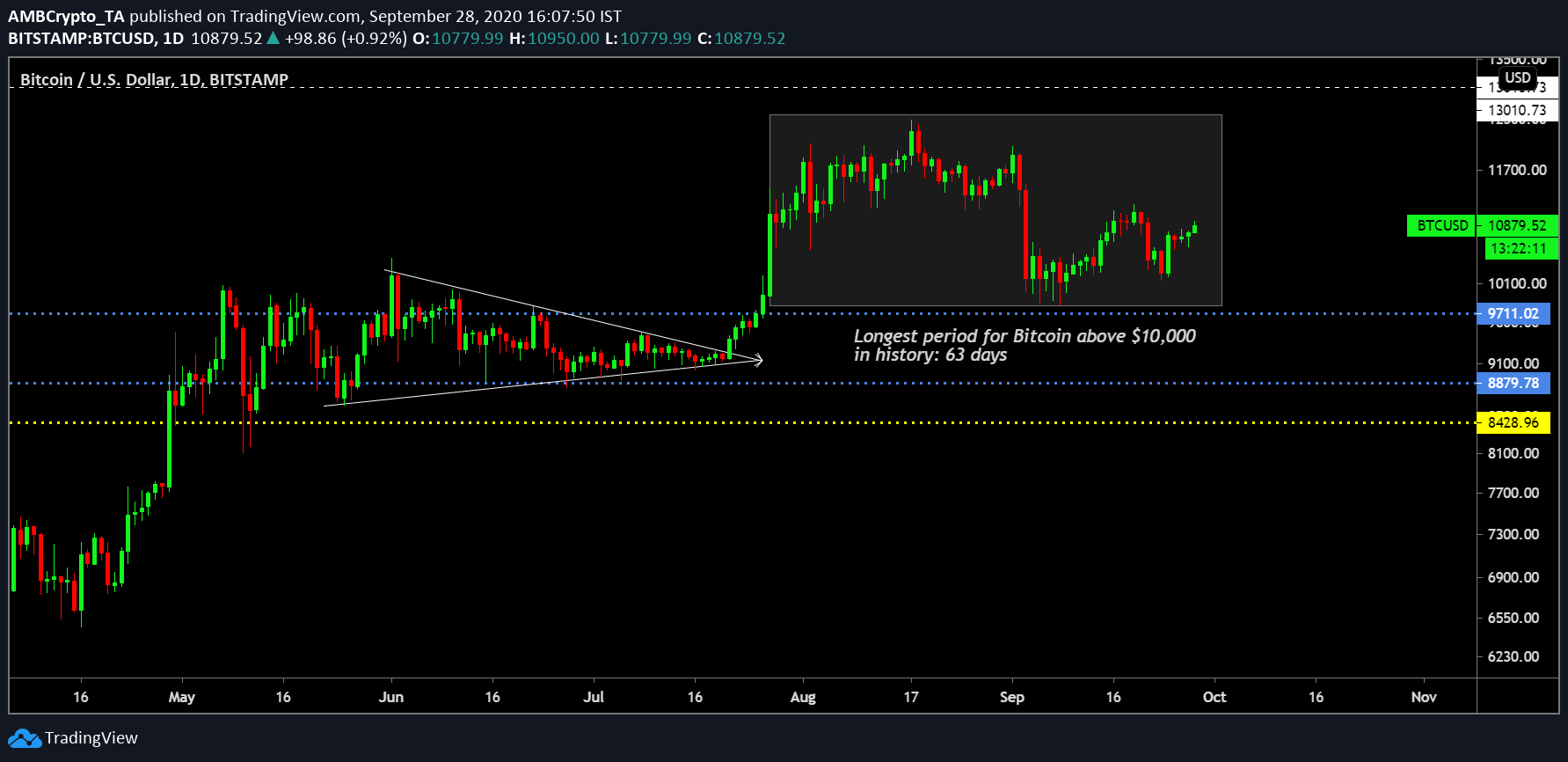

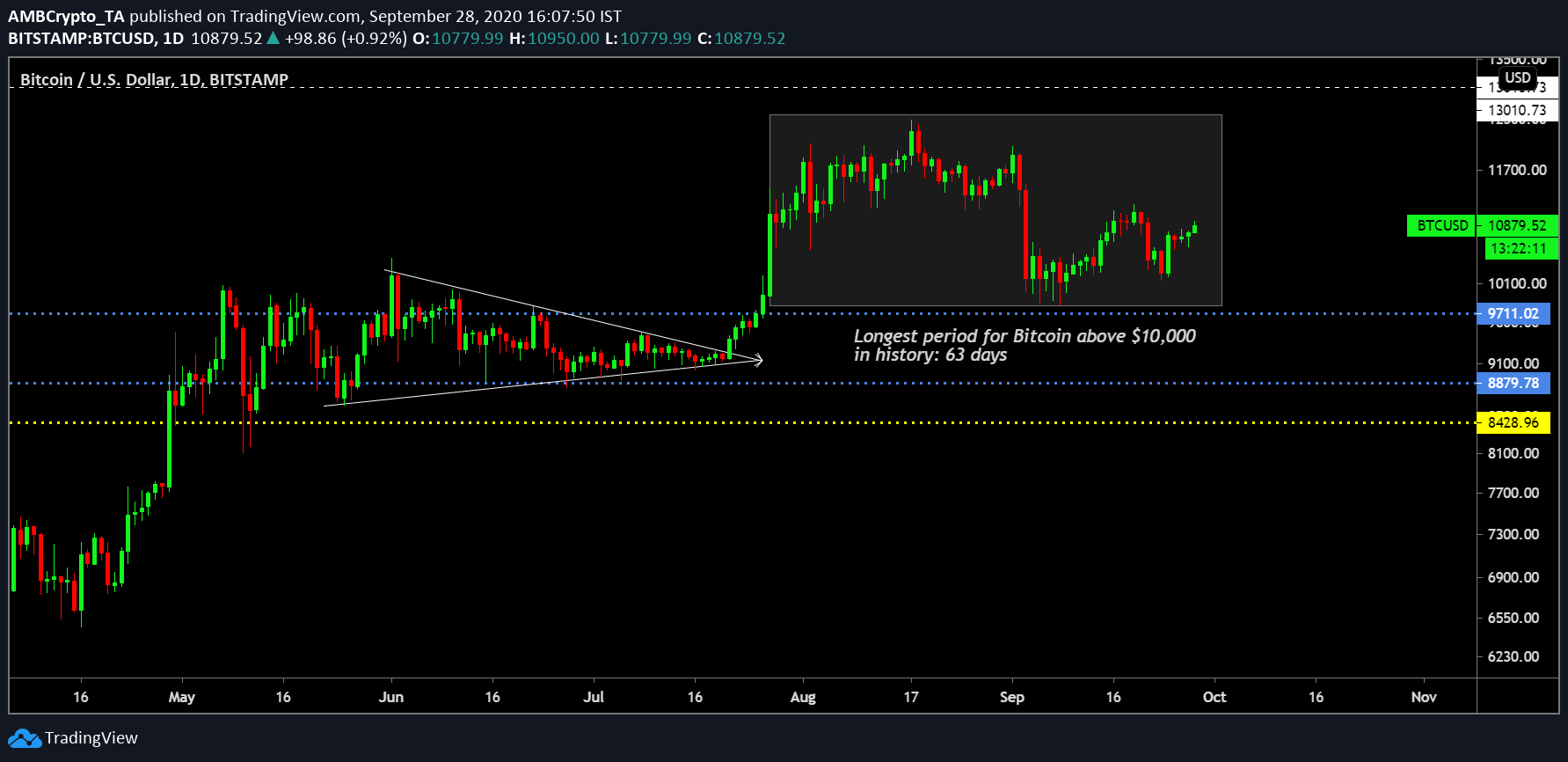

Source: Trading View

For starters, Bitcoin’s position back then came on the back of its strongest rally ever, at a time when the price reached an all-time high of $20,000. The period of correction from December to January was counted as its phase above $10,000. Right now, Bitcoin has spent 63 days above $10,000, but at a very restrictive range. The trend is neither heavily bullish or bearish at the moment, and the price has stayed between $10,000-$12,500 since 27 July.

Further, other fundamentals reported by CoinMetrics stated that BTC’s 180-day returns volatility had declined by 41% in September. So, what exactly has changed for Bitcoin over the past two months?

Limited Trade Range, so Lower Leveraged Bitcoin?

As discussed above, the limited trading range of Bitcoin over the past couple of months has completely blown the short-term Futures Open Interest. While the market does implement a funding rate to prevent major market swings, over the past few weeks, Bitcoin’s funding rate has either remained negative or neutral, in spite of the falling price. Ergo, this was leading to overcrowded short-selling traders.

Keeping this in mind, and the drop in Open Interest, now, fewer traders are trading with additional leverage because of the lack of clarity. While shorts might or might not pan out, the fact that high leverage is reducing will in turn avoid massive price swings. So now, in the medium-term trend for Bitcoin, considering Bitcoin has still maintained a higher consolidation range at $10,000, a drastic correction is slowly becoming a declining possibility.

The aforementioned narrative can also be supported by the fact that Bitcoin Whales are presently accumulating at a higher range. Between 24 September and 27 September, 150,000 BTC was bought between $10.4k and $10.7, with the price moving up by $450, at press time.

How long will it last?

In fairness, notwithstanding another unexpected turmoil in the financial market, if the price solely depended on Bitcoin, a closing position below $10,000 might not be recorded for a long period, especially if the bullish rally took off from this point.

However, with many expecting a potential drop to $8500-$9500, the present streak will get snapped again, until it is improved upon by the next bull rally. That is, if the present streak ends in the next few weeks.

The post appeared first on AMBCrypto