Exxon Mobil was muscled out of the S&P 500 index’s top 10 stocks, but a potentially bullish scenario for oil could return the stock to its former glory. | AP Photo/Carolyn Kaster

Exxon Mobil has not been able to escape the wrath of the global economic slowdown and the U.S./China trade war. The company, whose stock has been among the S&P 500 index’s top 10 components for decades, was muscled out of position in the S&P 500 index’s top 10 stocks, a status it has held for nearly a century, by payments leader Visa. Adding insult to injury, Exxon Mobil, a dividend-paying stock that is relatively flat for the year, has since fallen to the No. 12 spot in the S&P 500 leaderboard, behind both Procter & Gamble and Visa.

A tweet from President Trump, however, reminds the world about how tensions with Iran are on the rise. He tweeted an image from an accident that occurred at an Iranian space site. Scientists are debating the high quality of the image the president posted, claiming it could be a classified picture, which if true an NPR report suggests could threaten U.S. national security. His tweet appears to exacerbate an already prickly situation with Iran, one in which a potentially fading U.S./China trade war would likely thrust the Iranian story back into the headlines, a geopolitical focus that could be bullish for the oil price and oil stocks including S&P 500 component Exxon Mobil.

The United States of America was not involved in the catastrophic accident during final launch preparations for the Safir SLV Launch at Semnan Launch Site One in Iran. I wish Iran best wishes and good luck in determining what happened at Site One. pic.twitter.com/z0iDj2L0Y3

— Donald J. Trump (@realDonaldTrump) August 30, 2019

Energy the S&P 500’s Biggest Losers

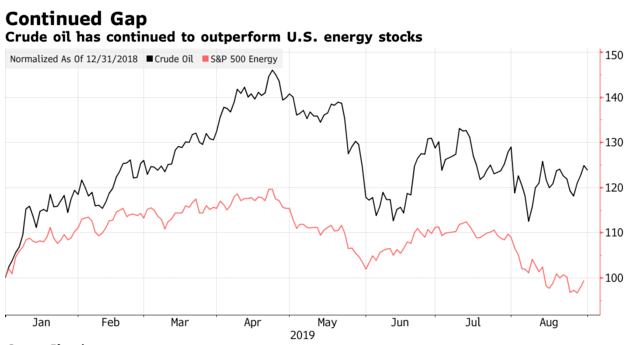

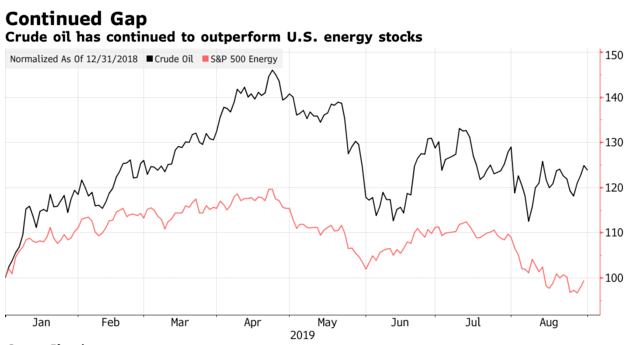

The energy sector is the S&P 500’s worst-performing group of 2019 so far while the oil price itself has advanced. Energy stocks have posted fractional declines vs. the S&P 500’s index’s double-digit percentage gains. But investors could decide to buy the dip now that the tide may be about to turn.

Source: Bloomberg

RBC Capital Markets’ Helima Croft is seeing the stars align for oil, telling CNBC:

“We’re getting green shoots that the physical market is starting to improve. We’ve had these big inventory draws… The combination of an improving physical market, if the trade war starts to off-ramp, I think that’s a catalyst to move higher.”

In focus are Iranian oil supplies, which hinge on the direction of geopolitics in the Middle Eastern region.

“There are a lot of Iranian barrels that are sitting off this market right now. Two million barrels. That will be a big story in terms of how this market shakes out for the rest of the year.”

The S&P 500 is no stranger to the influence of President Trump’s tweets. We’ll have to wait until after the holiday weekend to see if he worked his magic on oil stocks.

Disclaimer: This article is intended for informational purposes only and should not be taken as investment advice.

Source: CCNThe post appeared first on XBT.MONEY