From Microstrategy’s $500 Million investment in Bitcoin to PayPal’s integration of crypto, in the past three months, we have seen it all. November 2020 is unlike any month since 2018. Bitcoin is trading above $13k and the top 10 altcoins have gained 10-12% in the past week. Additionally, BTC, ETH, and USDT reserves are the lowest since 2019 and they are dropping further closer to November 2020.

How a retail trader would invest a $1000 in crypto winter is way different from how they possibly invest/ trade in November 2020. In a hotter market in July or August this year, you could divide $1000 in Bitcoin and Altcoins ranking 1 to 25 on CoinMarketCap. October was so unique that traders with Bitcoin and Ethereum in their portfolio have made over 50% in profits. However, with an Altcoin rally retail needs to change strategy. Portfolios that list cryptocurrencies ranking in the top 20 have given over 20% returns in July and August 2020.

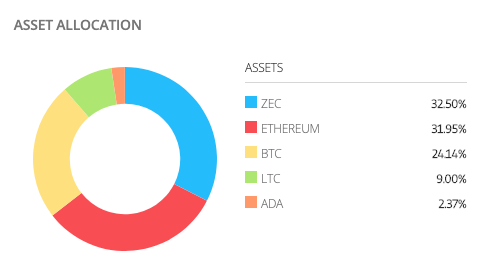

Portfolio with assets from top 25 || Source: eToro

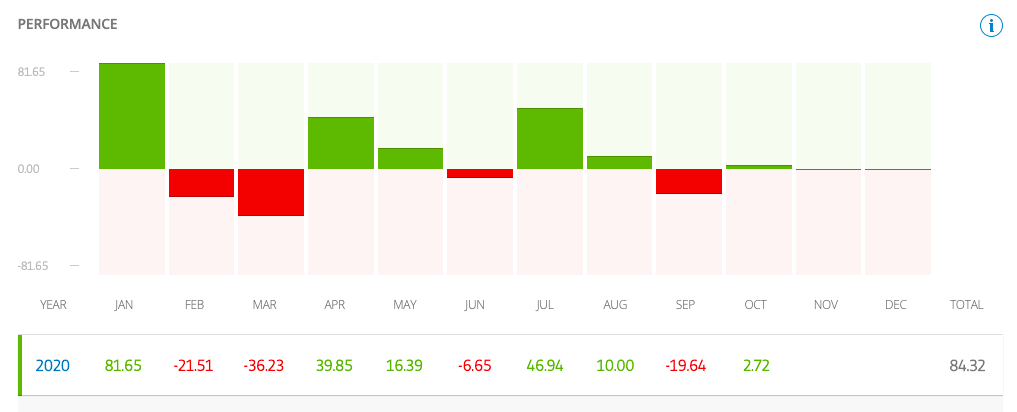

With nearly 25% in Bitcoin, 30% in Ethereum, and 32% in ZEC, this portfolio gave over 46% profits in July 2020, and 10% in August 2020. This portfolio offered barely 2.72% returns in October 2020.

Portfolio Performance || Source: eToro

A portfolio with a similar allocation to The TIE-Long Only, from eToro with a difference in allocation and choice of assets could possibly close November at over 30% in profits. Limiting exposure to top 25 altcoins based on their market capitalization and limiting Bitcoin to 50% or less for November 2020, may turn out to be a strategically wise move. Bitcoin is 12.5% up in the past 7 days, however, if you bought around the $8.5-$9k level, you are still relatively profitable. If you bought before, in mid-2019 or early 2019, you’d be sitting on 18-20% profit and that is fairly profitable for a balanced portfolio.

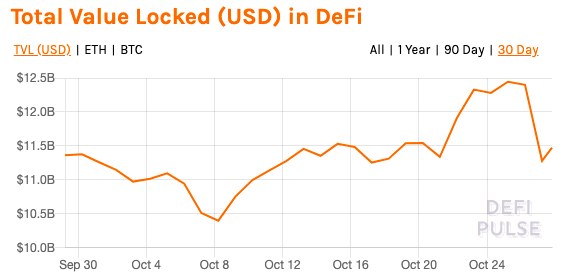

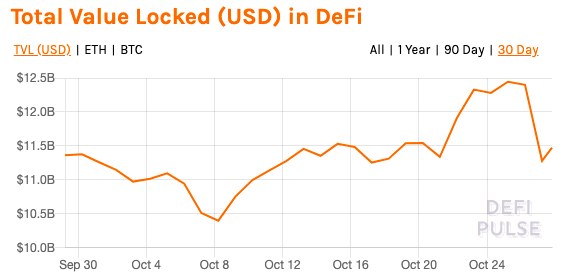

DeFi has survived the winter phase and is making a comeback with top projects like Synthetix and AAVE. The uptick in the TVL chart is from October 27, 2020, and with increasing returns on Lending projects and DEXES, DeFi may possibly regain $12.3 Billion in TVL.

TVL in DeFi || Source: DeFiPulse

High-velocity coins, projects that are on track with their development phases and roll-outs, are next, with 20% allocated to them. Algorand, Brave, and Polkadot would fit this classification. Another 15-20% is for small-cap coins based on their weekly performance, from coinmarketcap.com.

Rebalancing of portfolios has made a come back on Twitter with crypto Twitterati like @TripDawg sharing their portfolio allocation.

Source: Twitter

$1000 spent on crypto in November 2020, could possibly return 30% or higher returns with proven portfolio allocation and time tested strategies. Keep an eye out for portfolio secrets being spilled on Twitter threads!

The post appeared first on AMBCrypto