(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Every

Summer

Is

The

Fucking

Same

!

When crypto hits the northern hemispheric summer, people lose their bearings.

Price Volatility: Rekt

Price Performance: Rekt to sideways

Exchange Trading Volumes: Abysmal

Crypto Trader Sentiment: Despondent

Staying focused on what matters becomes increasingly difficult as we are bombarded with data through our internet connected devices. There is always some piece of information that can cloud our minds. But those who are focused care not for the vicissitudes of the 24/7 social media dopamine-distributing news cycle. They only analyse what they believe is the key driver of financial returns.

Zooming out, I am only focused on one piece of macro data, and that is the pace of central bank balance sheet expansion. If the quantum of money increases, it must go somewhere. Crypto alongside stonks, commodities, housing, and bonds etc. will all receive the manna from unelected bureaucrats. Let’s take stock of what our monetary masters cooked up for our financial wellbeing in the first half of 2021.

The three central banks that matter are The US Federal Reserve, The People’s Bank of China, and the European Central Bank. Combined, these three entities pump the lion’s share of fiat wampum into the arteries of the global economy. These central banks also represent the largest economies in the world.

Here is my simple checklist, for my simple investor brain:

Is the money supply – as defined by the central bank balance sheet or gross credit issuance – increasing or decreasing, and at what rate?

-

-

- Whatever financial assets I own need to outperform the growth of credit.

-

Is the reference government bond rate below or above nominal GDP growth?

-

-

- If (bond yields < nominal GDP growth) :

- Then I must speculate in financial assets in hopes of not suffering a negative real interest rate.

- Or else:

- I should own nothing else besides government bonds – because why would I take that risk if my savings grow at a positive real interest rate?

- If (bond yields < nominal GDP growth) :

-

These two questions are reflexive because the pace of credit growth affects government bond yields. And the government bond yields affect the growth of credit. Aiyah! So we must consider both questions and make a nuanced decision regarding what asset(s) will help us retain real purchasing power.

Get comfortable with the philosophical and quantum theoretical problem that the act of observing or participating affects the outcome. Nothing objectively exists, existence is a relative phenomenon. Reflexivity is the most powerful concept I have learned to appreciate recently.

The Fed

The talk of the town is, when will the Fed begin to taper their bond purchases?And the meta narrative is, what piece(s) of economic data would force the Fed to broadcast a slowdown of its balance sheet growth? We are told that the Fed has a dual mandate – prices and unemployment. Therefore, the Consumer Price Index (CPI) and unemployment numbers are believed to be extremely important.

The unfortunate thing is that the Fed’s policy responses do not correlate at all with changes in these variables. If the Fed wants to print, all inflation is “transitory” and all jobs are not enough. If the Fed wants to tighten then all inflation will “unanchor expectations” and we are at the magical but numerically undefined “full employment”. The data can be twisted to meet whatever the a priori policy response is.

In my piece FARB<L>AST OFF, I argued that the Fed (and every other major central bank, for that matter), has been tasked to monetise its domestic governments’ debt issues to pump up the economy in the wake of COVID. Until “growth” is achieved, they will continue to print whatever is necessary.

The Fed cannot directly admit this, as it would exacerbate the already astronomical “Fed Put”. That is, if the market defined by stonks (The S&P 500) declines, then the Fed must rescue the market with more printed money.

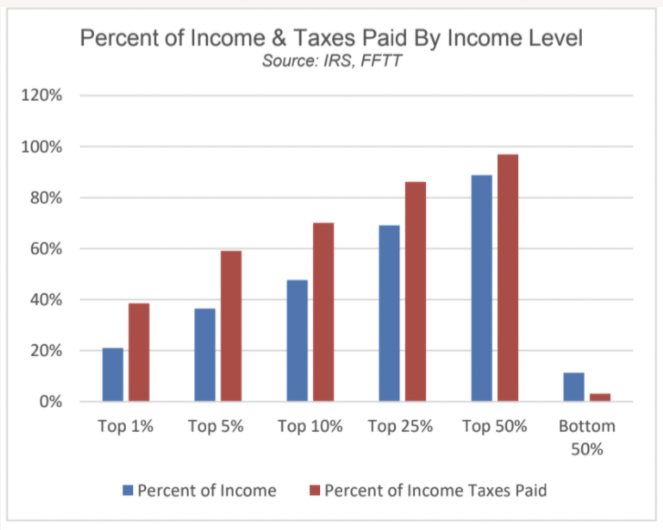

This is an excellent chart from Luke Gromen, and it is startling. The top 5% of American households pay 60% of income taxes. He argues these people don’t make most of their income from wages, but through some sort of stock-based compensation. Therefore, if the Fed refuses to goose the stock market by continuously expanding its balance sheet, it directly harms the net income of the US Government.

Look at what the Fed does rather than what they say. Every week features some Fed governor talking some nonsense about how the Fed will respond to certain economic outcomes. I decided to delve into the Fed’s SOMA account, where all their bond purchases are warehoused.

Over the past 12 months, the Fed’s SOMA account grew by $1.4 trillion – which is 97% of target. Good job, print dat money. The Fed has removed $1.4 trillion of the highest quality collateral from the system. Ponder that for a moment. Whatever anyone says about a taper in the future, in the present, asset managers must replace this collateral with higher risk stuff. Dog money anyone?

Why is the US 10-year yield so important? Investors are trained to value stocks based on the present value of future cash flows. We discount future cash flows based on the domestic risk-free rate plus some risk premia. Therefore, investors will buy more stonks if the 10-year yield is low based on its relative yield to nominal GDP growth and dividend yields. Investors get the heebie jeebies if inflation, defined by CPI in America, is above the 10-year yield. They believe the Fed will then raise rates and allow the 10-year yield to rise above CPI. Rates go up, stonks go down – it’s just that easy. CFA Level III obtained, now you young Loro Piana wearing PM gets to charge 2 and 20 while sippin’ on sizzurp in the Hamptons.

We know that the Fed has a history of Yield Curve Control from the post WWII period. We also know that the governor at the time was uncomfortable ceding control of the balance sheet growth over to the US Treasury in order to cap long term yields at 2.5%. He did it, because that’s what the USG needed, but he didn’t like it. His concern was valid, though – the Fed’s balance sheet expanded exponentially during the 1939 to 1951 period.

The current crop of central bankers posted up at the Eccles building are also deathly afraid of uncontrolled expansion of the Fed’s balance sheet. That is why they fight at all costs not to explicitly engage in Yield Curve Control. If you set a red line, the market will test you. Better to be like Teddy Roosevelt, speak softly and carry a big stick.

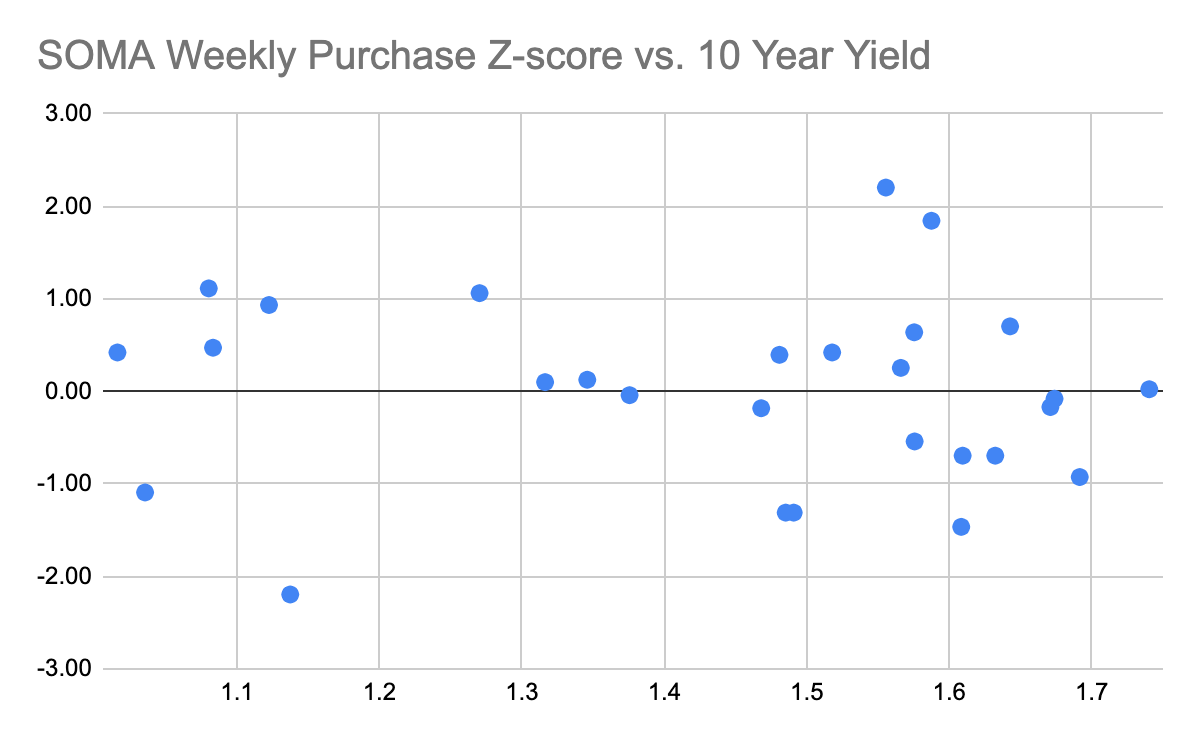

I looked at the 2021 week-on-week changes in the Fed’s SOMA account. I thought that I would find a relationship between the degree of weekly purchases and the 10-year yield. I thought I would catch the Fed engaged in stealth YCC. I was wrong.

The sample consists of the weekly change in the SOMA Treasury Notes and Bonds holdings. I calculated the Z-score of the weekly change because I’m interested in the change in behaviour – not the amount purchased week-on-week. I plotted the Z-score against the weekly 10-year yield (Bloomie: USSG10YR INDEX). There is no visible relationship between the deviation of one week’s purchases and the 10-year yield. I don’t have an explanation for why the Fed buys more or less each week, but they are not secretly pinning 10-year yields via their purchases … yet.

If you thought a Z-score was the swish of Zoro’s sword, take a gander at this.

The next question is, how significant is the Fed’s participation in monetising new government bond issuance? I looked at the SIFMA tables up to June of this year to determine how much the Fed is helping the Treasury. The Fed purchased 20% of newly issued notes and bonds. It’s not egregious, but it also isn’t benign.

It is plainly obvious that most investors do not do math. Because if they did, it would be crystal clear to them that owning government bonds at the zero bound is pure insanity. The convexity on a long bond is completely lost as you approach zero. The 60 / 40 equities vs. bond split should be revised to 100% equities plus a long interest rate trail hedge. The tail hedge can be crudely established by purchasing puts on TLT US and rolling them. For those who have the funds and connections to park money with a good volatility hedge fund, hedging equity beta downside is paramount.

The Treasury TIC report contained a golden nugget. Year-to-date in 2021, foreigners did some bond math and net dumped $39.39 billion of notes and bonds, and purchased $42.67 billion of equities. Boom shaka laka. The rich Americans hold equities, and the foreigners who finance the USG also hold equities. Money printer go brrrr not only helps wealthy Americans, it also helps wealthy foreigners. The political setup for the Fed to continue printing $120 billion per month is perfect. And guess what – the data clearly shows they are staying on message.

Let’s answer a question about the status of the US monetary system: the Fed’s balance sheet has expanded at a YoY pace of +22.74%, YTD at a pace of +13.21%. Have you outperformed?

|

YoY |

YTD |

|

|

Bitcoin |

+229% |

-6.44% |

|

Ether |

+663% |

+156% |

The current Bloomberg forecast of 2021 US GDP is +6.60%, vs. the US 10-Year that yields . 1.20%. That equates to a rough negative real yield of -5.40%. Savvy investors are instead turning to “long duration” equities – that’s a fancy way of saying tech stocks.

Remember Chyna?

Gotta love WWF. I watched that shit every day in middle school.

Gotta love WWF. I watched that shit every day in middle school.

Back to economics.

It is quite funny that the current narrative is that China is making light use of the money printer. Don’t be fooled, the PBOC definitely bought a DuoLingo subscription and translated “Money Printer Go Brrr” into Mandarin. 加油!

Estimating the growth of credit in China is an art rather than a science. There are so many conflicting statistics that a euphemism called “Total Social Financing” (TSF) was created to encapsulate all the various ways credit is pumped through the economy. Every sell-side research house has their approximation for credit growth in China. I’ll defer to Beijing for the “official” tally. The PBOC calls it the China All-System Financial Aggregate. As of June, this metric expanded 11% YoY.

Given that China has the largest debt stock in the world, that is an absolutely stupendous amount of Renminbi. To be exact, in 2021 China expanded its credit stock by $2.74 trillion.

The PBOC officially has only expanded its organisation’s balance sheet by 0.20% YoY. This is why some believe China has shown restraint in the face of COVID compared to its US and European counterparts. Beijing has many ways to skin a hog, and credit is most often created through commercial banks on and off-balance sheet lending. Even though the $2.74 trillion figure is not a central bank figure, the PBOC is at the table when it’s decided who receives credit and how much. Rather than list a bunch of acronyms for the various government bodies involved in rationshing credit I use the PBOC as a familiar placeholder.

All credit in China is de facto state-controlled. The banks that create credit and the companies that receive it by and large are all state-owned. That is why I used the total credit figure in China and not a similar metric in the US or Europe where bank credit creation is administered by private companies to earn a private profit. The Fed and ECB stand ready to finance their respective domestic fiscal spending, but they must wait for the federal governments to spend and issue bonds before buying them. Chinese GDP growth as I will show in the next paragraph is a political outcome dependent on the amount of gross credit Beijing deems is acceptable.

In China, Beijing uses credit to achieve a desired GDP growth rate. The most recent 2Q21 YoY GDP print was +7.9%. They used an 11% growth in credit to achieve a 7.9% increase in economic activity. A healthier ratio would be a 1:1 ratio rather than 1 Yuan of debt creating only 0.72 Yuan of economic activity.

If you hold RMB, has your financial portfolio generated at least 11% YoY growth?

Real yields in China are about the same as in America, which is decidedly negative.

Many macro pundits extol the virtues of adding China sovereign bonds to one’s portfolio. They are the best yielding govvies of all the major economies. However, given the breakneck growth inside China, you still are getting the stick. A negative 5% real yield is 不好意思.

While the China story of outbound capital escaping financial repression is currently dead, be on the lookout for policy changes that unleash the hordes of China retail investors onto the global capital markets. China must do something with all the dollars it accumulates selling knick knacks to the Americans.

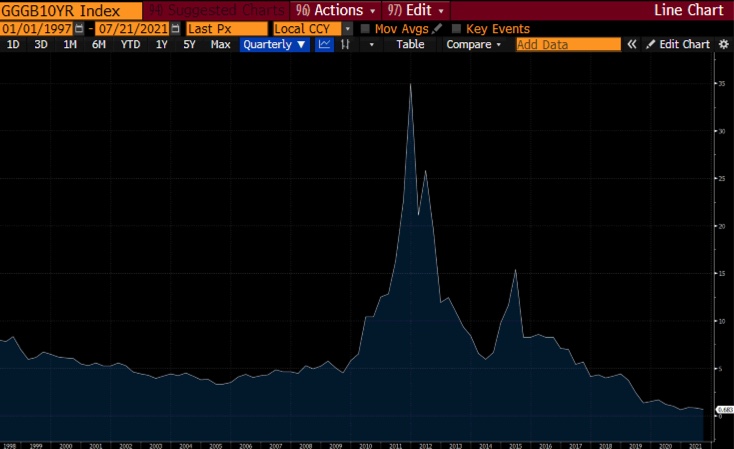

The Med

Do you know how you know a central bank is printing money? When Greek bonds yield 0.68%. It’s roll-on-the-acropolis laughable that the Greek government can fund itself cheaper than America. Don’t you dare doubt Super Mario when he takes a bite out of the magic money mushroom.

Do you know how you know a central bank is printing money? When Greek bonds yield 0.68%. It’s roll-on-the-acropolis laughable that the Greek government can fund itself cheaper than America. Don’t you dare doubt Super Mario when he takes a bite out of the magic money mushroom.

The ECB prints money to hoover up these reputable sovereign credits. In 2021, the ECB expanded its balance sheet by $1.10 trillion, YoY +25.18%, YTD +13.34%. How many penalty kicks did you miss in your portfolio this year?

To get a flavour of the negative real yields hoisted upon the backs of savers, let’s take a gander at ze Germans. The 10-year Bund yields -0.41% and German 2021 GDP is expected to print at 4.5%. Real yields in the strongest Eurozone economy approach negative 5%. I love investments that are mathematically guaranteed to lose money if held to maturity.

In Total

The three strongest economic countries / regions globally all engage in rampant money printing. All real yields are negative. While people focus on the month-on-month rhetoric regarding when the printer will stop brrr’ing, the central bankers continue to expand their balance sheets. Don’t let the noise fool you. If your investment thesis in crypto, equities, property, etc. is based on a fear that your financial assets must keep pace with the expansion of central bank balance sheets, continue being fearful and accumulate.

|

2021 |

Central Bank Balance Sheet Expansion, USD Billions |

|

USA |

$883 |

|

China |

$2,737 |

|

Europe |

$1,100 |

|

Total |

$4,720 |

$4.72 trillion of money created out of thin air. It must go somewhere. The challenge is to procure the assets that will receive a slice of these funds. Investors who come out on top will be the ones that do not fall prey to the economic sophistry of believing long government bonds owned at the zero bound will save their portfolio from the ravages of negative real interest rates.

Don’t Cry for Me Satoshi

I know it’s hard to stomach 50% drawdowns from the all-time highs in Bitcoin and Ether. If you owned various DeFi coins your portfolio is in various stages of rekt. However, sell when you want to, not when you have to. That comes down to position sizing and judicious use of leverage.

Channel your inner Soros – observe, don’t predict. The data is clear – central banks continue to print money. When / if that changes, the data will show us. There is no need to predict when it stops if you own scarce assets that appreciate in fiat terms at least at the same pace of balance sheet expansion. On the past 6-month horizon crypto underperformed, but from the onset of the COVID pandemic till today, crypto markedly outperformed as central bankers stepped on the gas. Don’t get shook.

Related

The post appeared first on Blog BitMex