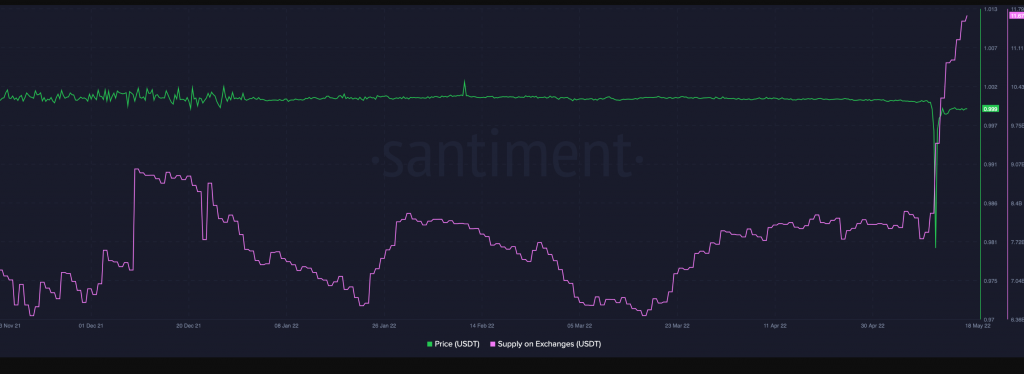

Tether’s USDT market valuation has decreased by nearly $9 billion after Terra’s UST meltdown. The market saw a dramatic sell-off last week as a result of the collapse of Terra’s UST stablecoin, with USDT trading as low as $0.95.

Tether’s “implosion” was approaching, according to the crypto analyst known for his opposing viewpoints. This is perhaps not surprising coming from an expert who has already criticized Tether’s ethics. What was more concerning was a graph depicting Tether’s declining market cap.

Indeed, as of press time, USDT’s market capitalization had plummeted to levels last seen in December 2021. Even though USDT’s market value ranking did not change, this is a worrying warning for investors. Tether, meanwhile, was trading at $0.999 at the time of publication.

As if that weren’t enough, Tether supply on exchanges has increased by more than two billion in recent days, with a particularly sharp increase of stablecoins returning to the markets since early May.

Which is the New Go-To Stablecoin?

While much of this happened around the time Tether was briefly de-pegged, the trend has continued, and Tether supply on exchanges has reached new highs.

Another interpretation is that investors are taking their USDT to the exchanges to buy the dip and leave with shiny new alts. Glassnode noted that,

“If we look to the supply of USDT, we can see that indeed, over $7.485 Billion worth of USDT has been redeemed with week. The total USDT supply declined from near the $81.237B ATH to $75.75B.”

Meanwhile, according to Glassnode’s study, crypto investors may be reconsidering their preferred stablecoin.

“Given the dominant growth of USDC over the last 2yrs, this may be an indicator of changing market preference away from USDT and towards USDC as the preferred stablecoin.”

The post appeared first on Coinpedia