The crypto market has seen an uptick in Institutional Investment of late and following the announcement of these large purchases by more firms, the market has rallied as anticipated.

There is much speculation as to which firm will be the next to buy Bitcoin, but the real question is how many institutions are now accumulating it?

As seen, public announcements of just an intent to purchase can send prices rallying, so an investor’s best strategy would be to buy in at the best available price.

MicroStrategy and Square’s purchase used the TWAP (Time Weighted Average Price) method and made a successful purchase without moving the market until after news announced.

In their Bitcoin Investment Whitepaper, Square stated,

“We negotiated a spread on top of a public bitcoin index and executed trades using a Time-Weighted Average Price (TWAP) over a predetermined 24-hour period with low expected price volatility and high market liquidity, in order to reduce risks associated with cost and pricing.”

There is reason to believe that more institutions are silently accumulating Bitcoin by examining a few things.

On-chain data

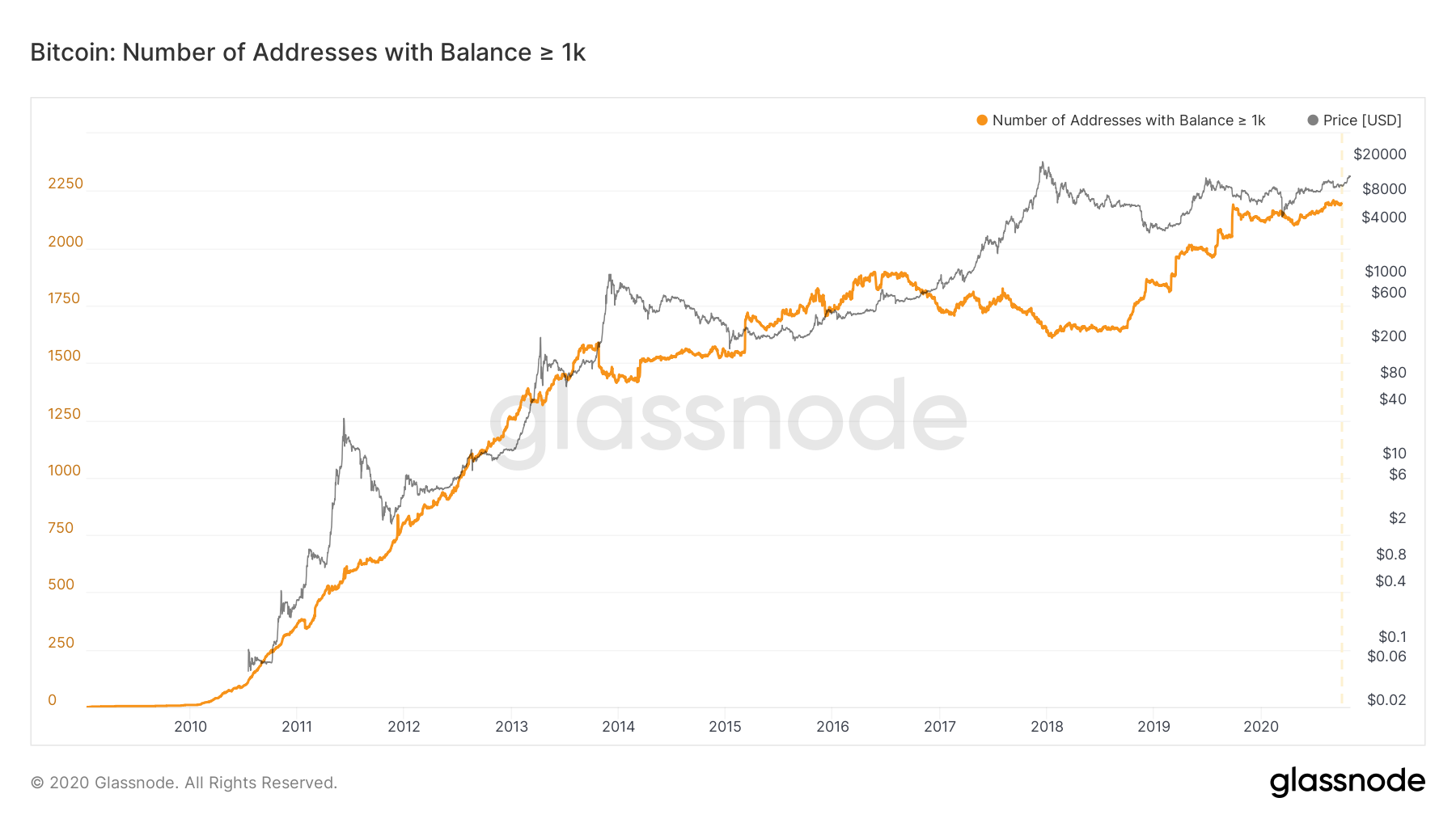

Source: Glassnode

The number of addresses holding over 1000 Bitcoins has been steadily increasing showing potential evidence of gradual accumulation. Even addresses holding above 10,000 Bitcoins increased considerably in the last month alone.

This coupled with the falling balances on exchanges suggests that Whales and larger investors are choosing to hodl Bitcoin at this stage.

Futures market

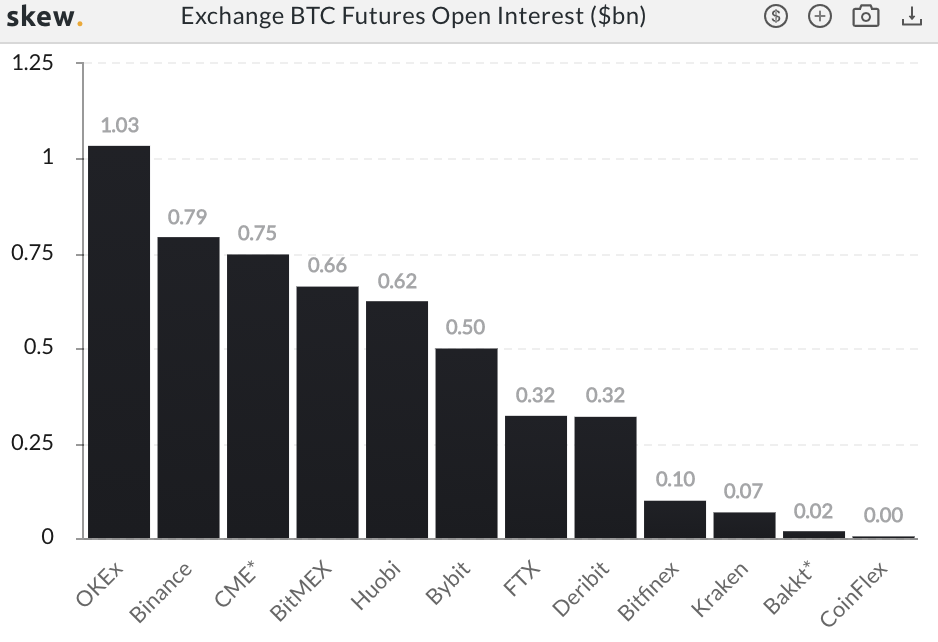

Source: Skew

The graph above depicts CME with the third-largest amount of Open Interest in BTC Futures, overtaking a number of crypto exchanges. If institutional investors were taking a more active part in the BTC Futures market, the CME would be their exchange of choice. This gives reason to believe the growth in OI on CME is driven by institutions.

Custodian Balances and Private Funds

A report by KPMG found that major banks, asset managers, and qualified custodians are launching a new wave of institutional-grade crypto products and services. Coinbase Custody, one of the largest crypto custodians reported $7 billion worth of assets under custody.

Platforms such as Bitwise, a provider of crypto asset index funds to professional investors, reported $100 million in AUM. The CEO, Hunter Horsley stated,

“Today, we see the greatest demand from RIAs, financial advisors, multifamily offices, and hedge funds. The recent entrance of firms like PayPal, Square, Fidelity, CME, Nomura, Facebook, and others has convinced many who were previously cautious that it’s time to reevaluate.”

The post appeared first on AMBCrypto